Risk Management Strategies Guide: Embark on a thrilling journey through the often-treacherous landscape of risk! This guide isn’t your grandpappy’s dusty manual; we’re talking about dodging metaphorical (and sometimes literal) landmines with the grace of a seasoned ninja. Prepare to learn how to identify, assess, and conquer those pesky risks that threaten to derail your grand plans, all while maintaining a healthy dose of amusement. We’ll explore everything from identifying potential hazards to devising ingenious escape routes – because sometimes, the best defense is a really good offense (with a backup plan, naturally).

We’ll delve into the fascinating world of risk assessment, exploring both the quantitative (think spreadsheets and calculations) and qualitative (think gut feelings and expert opinions) approaches. Discover the secrets of effective risk response strategies – from mitigation (the art of softening the blow) to avoidance (running away screaming, sometimes the best option!), transfer (passing the buck), and acceptance (a philosophical approach to risk, involving a healthy dose of fatalism). We’ll even uncover the magic behind risk monitoring and control, ensuring your carefully constructed risk management fortress remains impregnable.

Introduction to Risk Management: Risk Management Strategies Guide

Risk management: it’s not just for daredevils anymore! In today’s increasingly complex world, understanding and mitigating risk is crucial for survival, whether you’re running a lemonade stand or a multinational corporation. This section will unravel the mysteries of effective risk management, revealing its core principles and showcasing its practical applications.

Effective risk management hinges on a few key principles. Firstly, it’s all about proactive identification – spotting potential problems before they become full-blown disasters. Think of it as a preemptive strike against impending doom. Secondly, a thorough analysis of each risk is vital. We need to understand the likelihood of something happening and the potential impact if it does. This helps prioritize our efforts. Finally, and perhaps most importantly, we need a robust plan of action. This isn’t about hoping for the best; it’s about having a well-defined strategy to deal with whatever life throws at us.

Risk Definition and Types

Risk, in its simplest form, is the possibility of something bad happening. It’s the uncertainty that accompanies any endeavor, a shadowy figure lurking in the background of every decision. However, not all risks are created equal. We can categorize risks based on their source and impact. For example, strategic risks stem from high-level business decisions, operational risks arise from day-to-day activities, and financial risks relate to monetary losses. Then there are compliance risks, which deal with regulations and laws, and reputational risks, which can be devastating. Finally, we have external risks, such as natural disasters or economic downturns, which are beyond our immediate control. Ignoring these categories is like playing Russian roulette with a fully loaded revolver – not advisable.

Risk Scenarios Across Industries

Let’s examine some real-world risk scenarios. Imagine a pharmaceutical company facing the risk of a product recall due to manufacturing defects. The potential impact: massive financial losses, damaged reputation, and potential legal battles. Or consider a tech startup struggling with cybersecurity risks. A data breach could lead to loss of customer trust, hefty fines, and significant operational disruption. In the airline industry, operational risks like mechanical failures or severe weather pose constant threats, potentially leading to accidents and massive financial losses. These are just a few examples of how risks vary across different sectors, each requiring a unique approach to management. Ignoring these realities is akin to driving a car without brakes – a recipe for disaster.

Identifying and Assessing Risks

Embarking on the thrilling journey of risk management requires a keen eye for potential peril – a sort of corporate Indiana Jones, if you will. Ignoring risks is like going on a treasure hunt without a map; you might stumble upon gold, but you’re more likely to end up face-to-face with a rather grumpy, venomous snake. This section unveils the art of identifying and assessing those potential hazards before they turn your carefully laid plans into a chaotic mess.

Identifying potential risks within an organization isn’t about predicting the apocalypse; it’s about proactively pinpointing areas of vulnerability. Think of it as a preemptive strike against potential problems, rather than a frantic scramble to fix them after they’ve already caused havoc. Several methods exist to achieve this, each with its own unique charm (and effectiveness).

Methods for Identifying Potential Risks

A multi-pronged approach is usually the most effective. Brainstorming sessions, where employees from various departments contribute their insights, can unearth hidden risks that might otherwise go unnoticed. Checklists, tailored to specific industries or organizational functions, provide a structured framework for identifying common hazards. Surveys and interviews can tap into the collective wisdom of the workforce, revealing vulnerabilities that might not be apparent to management. Finally, analyzing past incidents and near misses provides invaluable lessons learned, acting as a crystal ball for potential future problems. This approach allows for a comprehensive risk identification process, transforming potential catastrophes into manageable challenges.

Risk Assessment Matrix

A well-structured risk assessment matrix provides a clear, concise overview of potential risks and their associated levels of impact and likelihood. Imagine it as a risk-themed spreadsheet, but far more exciting.

| Risk | Likelihood | Impact | Overall Risk Score |

|---|---|---|---|

| Data breach | Medium (potential for human error, external attacks) | High (financial loss, reputational damage, legal penalties) | High |

| Supplier failure | Low (reliable suppliers, contingency plans in place) | Medium (disruption to operations, increased costs) | Medium |

| New competitor entering the market | High (aggressive marketing campaigns by new competitor) | Medium (loss of market share, price wars) | High |

The “Overall Risk Score” is often calculated by multiplying the likelihood and impact scores (after assigning numerical values to each). For instance, if likelihood is rated 1-5 (1 being low, 5 being high) and impact is rated similarly, a risk with likelihood 3 and impact 4 would have an overall score of 12. This simple calculation helps prioritize which risks require immediate attention.

Qualitative and Quantitative Risk Assessment Techniques

Qualitative risk assessment focuses on descriptive measures of likelihood and impact (e.g., low, medium, high). Think of it as a more artistic approach, relying on judgment and experience. Quantitative risk assessment, on the other hand, assigns numerical values to likelihood and impact, allowing for more precise calculations and comparisons. It’s the scientific method applied to risk, resulting in more precise risk scoring. A combination of both methods often provides the most comprehensive assessment. For example, a qualitative assessment might identify a risk as “high,” while a quantitative assessment provides a numerical score to quantify that risk relative to others.

Comparison of Risk Assessment Methodologies

Various methodologies exist for risk assessment, each with its own strengths and weaknesses. FMEA (Failure Mode and Effects Analysis) is a proactive method, identifying potential failures before they occur. HAZOP (Hazard and Operability Study) is particularly useful for complex processes, systematically examining potential hazards. Bow-Tie analysis provides a visual representation of risks, their causes, and consequences, while Monte Carlo simulation uses statistical modeling to estimate the probability of various outcomes. The choice of methodology depends heavily on the specific context and resources available. Each approach offers a unique lens through which to view and analyze risk.

Risk Response Strategies

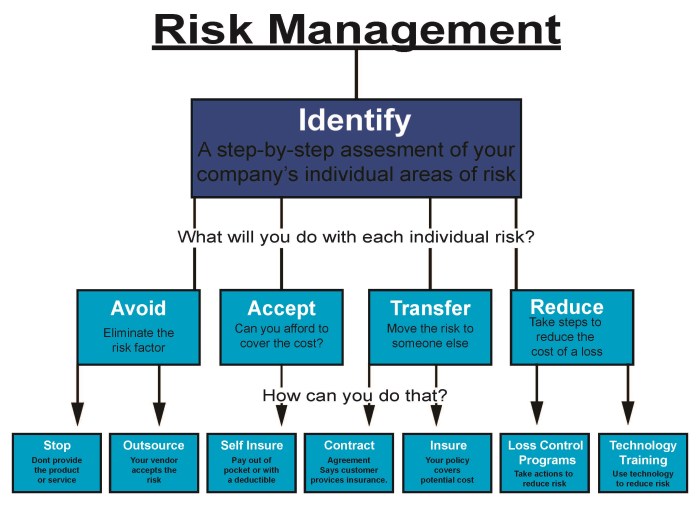

Now that we’ve identified and assessed those pesky risks (phew!), it’s time to get strategic. This section delves into the exciting world of risk response strategies – the proactive (and sometimes reactive) measures we take to manage those potential problems before they morph into full-blown catastrophes. Think of it as a preemptive strike against the forces of chaos, a carefully orchestrated dance with destiny (or at least, a well-considered spreadsheet).

Risk response strategies aren’t a one-size-fits-all solution; the best approach depends entirely on the specific risk, its likelihood, and its potential impact. We’ll explore four primary strategies: mitigation, avoidance, transfer, and acceptance. Buckle up, it’s going to be a wild ride!

Risk Mitigation Strategies

Mitigation involves reducing the likelihood or impact of a risk. It’s like putting out a small fire before it becomes a raging inferno. Instead of completely avoiding the risk, we aim to lessen its severity. For example, if a company identifies a risk of data breaches, a mitigation strategy might involve implementing stronger cybersecurity measures, such as two-factor authentication and regular security audits. Another example would be installing fire sprinklers to mitigate the risk of a building fire – less dramatic than a total evacuation, but still highly effective.

Risk Avoidance Strategies

Avoidance is the nuclear option – completely eliminating the risk by not engaging in the activity that creates it. This is best used for risks with high likelihood and high impact, where the potential damage far outweighs the benefits. Imagine a company deciding not to invest in a risky new market due to political instability – a calculated avoidance of a potentially huge loss. Or consider a hiker deciding against a treacherous mountain climb due to a severe weather forecast – avoiding the risk of injury or death.

Risk Transfer Strategies

Transferring risk means shifting the burden of the risk to a third party. This often involves insurance policies, contracts, or outsourcing. Think of it as paying someone else to worry about it for you. For example, a construction company might transfer the risk of worker injuries by purchasing liability insurance. Similarly, a business might outsource its IT infrastructure to a managed service provider, transferring the risk of system failures.

Risk Acceptance Strategies, Risk Management Strategies Guide

Sometimes, the best approach is simply to accept the risk. This is usually appropriate for risks with low likelihood and low impact – the potential consequences are minimal, and the cost of mitigation might outweigh the benefits. For example, a small business might accept the risk of minor equipment malfunctions, deciding that the cost of preventative maintenance is too high compared to the potential loss from a minor breakdown. Or, a company might accept the risk of a small drop in sales during a slow season, understanding that this is a normal fluctuation.

Comparison of Risk Response Strategies

The following table summarizes the pros and cons of each strategy and suggests ideal use cases.

| Strategy | Pros | Cons | Best Use Case |

|---|---|---|---|

| Mitigation | Reduces likelihood and/or impact; often cost-effective | May not eliminate risk entirely; requires ongoing effort | Risks with moderate likelihood and impact |

| Avoidance | Eliminates risk entirely | May miss opportunities; can be impractical | High likelihood, high impact risks |

| Transfer | Shifts risk to another party; can be cost-effective | May be expensive; loss of control | Risks that are difficult or expensive to mitigate |

| Acceptance | Simple and cost-effective for low-impact risks | Potential for significant losses if the risk materializes | Low likelihood, low impact risks |

Selecting the Appropriate Response

The selection of the most appropriate risk response strategy is heavily influenced by the risk assessment. A thorough risk assessment, which quantifies the likelihood and impact of each risk, provides the crucial information needed to make an informed decision. For example, a high-likelihood, high-impact risk would typically warrant a mitigation or avoidance strategy, while a low-likelihood, low-impact risk might be more suitable for acceptance. The cost-benefit analysis of each strategy must also be considered. Choosing the right strategy is about finding the sweet spot between minimizing risk and maximizing opportunities, a delicate balance that requires careful consideration and a dash of strategic brilliance.

Risk Monitoring and Control

Risk management isn’t a “set it and forget it” kind of deal. Think of it more like herding cats – chaotic, unpredictable, and requiring constant vigilance. Ongoing monitoring is crucial to ensure your carefully constructed risk mitigation strategies aren’t being outsmarted by the ever-shifting sands of reality. Without it, your brilliant plan could crumble faster than a stale biscuit.

The importance of ongoing risk monitoring stems from the simple fact that risks are dynamic. They evolve, morph, and sometimes even spontaneously combust (metaphorically speaking, of course, unless you’re dealing with particularly volatile chemicals). Regular monitoring allows you to detect emerging risks, track the effectiveness of your response strategies, and adjust your approach as needed, preventing minor inconveniences from snowballing into catastrophic meltdowns.

Tracking and Reporting Risk Events

Effective tracking and reporting of risk events requires a structured approach. This isn’t about creating an overly complex system that resembles the internal workings of a Swiss watch (though that would be impressive). Instead, focus on simplicity and clarity. A well-designed system should facilitate easy identification, recording, and analysis of risk events. This could involve a simple spreadsheet, a dedicated risk management software, or even a well-maintained notebook (if you’re feeling particularly old-school and enjoy the satisfying scratch of pen on paper). Regardless of the method, the key is consistency.

Regular Review and Update of Risk Assessment

Regularly reviewing and updating your risk assessment is akin to giving your risk management plan a much-needed spa day. It’s a chance to identify areas for improvement, remove outdated information, and ensure your strategies remain relevant and effective. Ideally, this review should be scheduled at regular intervals (e.g., monthly, quarterly, or annually), depending on the nature and volatility of your risks. The frequency should be determined by a careful consideration of the potential impact and likelihood of various risks. For instance, a company launching a new product might require more frequent reviews than a well-established, stable business. The review process should include a thorough analysis of past risk events, comparing actual outcomes with predicted ones, and making necessary adjustments to your risk mitigation strategies.

The Role of Key Performance Indicators (KPIs) in Risk Management

KPIs are your risk management superheroes, providing quantifiable measures of your risk management effectiveness. They transform abstract risk concepts into concrete, measurable data points, allowing you to track progress and identify areas needing attention. Examples include the number of risk events identified, the number of incidents avoided, the cost of risk mitigation, and the time taken to resolve risk events. By regularly monitoring these KPIs, you can gain valuable insights into the effectiveness of your risk management program, allowing for continuous improvement and optimization. A significant increase in the number of incidents avoided, for instance, indicates a successful risk mitigation strategy. Conversely, a persistent increase in the cost of risk mitigation might signal a need to re-evaluate your approach and explore more cost-effective solutions. Remember, choosing the right KPIs is critical. They should align with your organization’s strategic objectives and provide meaningful insights into your risk profile.

Risk Management Frameworks and Standards

Navigating the treacherous waters of risk is no easy feat, akin to captaining a ship through a hurricane while simultaneously juggling flaming bowling pins. Fortunately, we don’t have to chart our course blindly. Established risk management frameworks provide a much-needed map and compass, guiding us towards safer shores (or at least, less stormy seas). These frameworks offer structured approaches, helping organizations identify, assess, and respond to risks effectively.

Risk management frameworks offer a standardized approach, promoting consistency and efficiency in risk management processes. Think of them as the instruction manuals for avoiding corporate catastrophes. Without them, your risk management efforts might resemble a chaotic game of pin the tail on the donkey – blindfolded, and with a very grumpy donkey.

Examples of Established Risk Management Frameworks

Several frameworks provide a structured approach to managing risk. Each offers a unique perspective and methodology, catering to different organizational needs and contexts. Choosing the right framework depends on factors such as industry, size, and risk appetite. A small bakery might not need the same level of rigour as a multinational corporation launching rockets into space (though both should definitely have some form of risk management!). Among the most prominent are ISO 31000, COSO ERM, and NIST Cybersecurity Framework. ISO 31000, for instance, provides a principles-based approach applicable across all sectors, emphasizing context-specific risk management. COSO ERM focuses on enterprise-wide risk management, offering a detailed framework for integrating risk management into an organization’s strategy and operations. The NIST Cybersecurity Framework is tailored specifically for addressing cybersecurity risks, offering a robust structure for protecting sensitive information and systems.

Comparison of Risk Management Frameworks

The following table compares several prominent risk management frameworks, highlighting their key similarities and differences. Remember, this is not an exhaustive list, and the nuances of each framework extend far beyond this simplified comparison.

| Framework | Key Principles | Strengths | Weaknesses |

|---|---|---|---|

| ISO 31000 | Principles-based approach; context-specific; integration with other management systems; continuous improvement | Widely applicable; flexible; adaptable to various contexts; promotes a holistic approach | Can be quite broad, requiring significant interpretation and adaptation for specific organizations; lacks prescriptive guidance in some areas |

| COSO ERM | Enterprise-wide approach; integrates risk management into strategy and operations; focuses on governance and culture | Comprehensive; provides a detailed framework; strong emphasis on governance and internal controls | Can be complex and challenging to implement, particularly in smaller organizations; requires significant resources and expertise |

| NIST Cybersecurity Framework | Focuses on cybersecurity risks; utilizes a five-function framework (Identify, Protect, Detect, Respond, Recover) | Specifically tailored for cybersecurity; provides a structured approach to managing cybersecurity risks; widely adopted and recognized | Primarily focused on cybersecurity; not applicable to all types of risks; requires technical expertise |

Benefits of Adopting a Standardized Approach to Risk Management

Adopting a standardized approach to risk management, such as implementing a recognized framework, offers numerous benefits. It’s like having a well-organized toolbox instead of a jumbled mess of tools scattered across the floor – you know where everything is, and you can find what you need when you need it. These benefits include improved risk identification and assessment, enhanced communication and collaboration, increased efficiency and consistency, better decision-making, stronger compliance and regulatory adherence, and ultimately, a reduction in the likelihood and impact of negative events. A standardized approach allows for a more proactive and strategic approach to risk management, moving away from reactive firefighting and towards a more sophisticated and preventative strategy. It fosters a culture of risk awareness and responsibility, making risk management an integral part of the organizational DNA.

Communication and Reporting

Effective communication is the lifeblood of any successful risk management program. Think of it as the nervous system – if the signals aren’t clear and timely, the whole body (your organization) can seize up. Without proper communication, even the most meticulously crafted risk mitigation strategies will crumble like a poorly-constructed sandcastle at high tide. This section will explore how to effectively disseminate risk information, ensuring everyone from the CEO to the newest intern understands their role in navigating potential hazards.

Effective communication of risk information requires tailoring the message to the audience. A highly technical risk assessment report isn’t going to enthrall the board of directors, who are more interested in the bottom line and potential impact on profits. Conversely, a simplified summary lacking crucial detail would leave your risk management team feeling as useful as a chocolate teapot. Therefore, clear and concise communication, adjusted to the audience’s level of understanding and interest, is paramount.

Communicating Risk Information to Different Stakeholders

Tailoring risk communication involves understanding your audience’s needs and priorities. Executive summaries for senior management should highlight the most significant risks and their potential financial impact, presented in a visually appealing manner. For example, a bar chart comparing the likelihood and impact of various risks could provide a clear overview. This chart would use colors to represent the severity level, with darker shades indicating higher risk. The chart’s x-axis would represent likelihood, and the y-axis would represent impact, each with clear labels and numerical scales. Technical teams, on the other hand, require detailed reports with specific risk analyses, including root cause analyses and mitigation strategies. Finally, all stakeholders should receive regular updates on the status of identified risks and the effectiveness of implemented controls.

Risk Report Templates and Visual Aids

A well-structured risk report template provides consistency and clarity. One effective template might begin with an executive summary outlining key risks and their potential impact. This would be followed by a detailed section listing each risk, its likelihood, impact, and assigned owner. A simple table summarizing this information, using a color-coded system to represent risk severity (green for low, yellow for medium, red for high) would be extremely helpful. A further section could detail risk mitigation strategies and their associated costs and benefits. Finally, a section on monitoring and control measures, including key performance indicators (KPIs) and reporting frequency, should be included. A visual aid, such as a Gantt chart illustrating the timeline for implementing mitigation strategies, would provide a clear visual representation of the project’s progress. The Gantt chart would show tasks on the y-axis and time on the x-axis, with task durations represented by bars, clearly highlighting dependencies and milestones.

Tailoring Communication to Specific Audiences

The language and level of detail used should vary significantly depending on the audience. Senior management needs concise, high-level summaries focused on financial implications and strategic risks. Technical teams need detailed information, including data and analyses. Project managers need updates on risks impacting their projects, with clear actions and responsibilities. Employees need to understand their roles in managing risks and the procedures to follow if a risk event occurs. Using simple, non-technical language, avoiding jargon, and providing clear visuals is key for wider employee understanding. Regular communication keeps everyone informed and fosters a culture of proactive risk management. Consider using infographics or short videos to enhance communication for less technically-inclined audiences. For instance, an infographic could illustrate the potential impact of a specific risk using simple icons and easily digestible text, rather than complex technical data.

Case Studies of Effective Risk Management

Risk management isn’t just about avoiding disasters; it’s about proactively shaping a brighter, more profitable future. These case studies showcase how organizations, across various sectors, have successfully navigated turbulent waters, transforming potential pitfalls into opportunities for growth. By analyzing these examples, we can glean valuable insights and adapt successful strategies to our own contexts.

Successful Risk Mitigation in the Airline Industry: Southwest Airlines’ Weather Contingency Planning

Southwest Airlines, renowned for its operational efficiency, has a robust weather contingency plan that minimizes disruption caused by adverse weather conditions. The airline faces significant risks related to weather-related delays and cancellations, which can lead to substantial financial losses and reputational damage. Their strategy involves advanced weather forecasting, proactive communication with passengers, flexible scheduling, and a highly trained crew capable of making quick decisions. This comprehensive approach has resulted in significantly reduced operational disruptions compared to competitors, minimizing financial losses and maintaining a positive brand image. Key to their success is their commitment to continuous improvement and regular review of their contingency plans, adapting them based on past experiences and emerging technologies.

Cybersecurity Triumph: The Case of a Major Financial Institution’s Proactive Defense

A large international bank, facing escalating cyber threats, implemented a multi-layered cybersecurity strategy. This involved investing heavily in advanced threat detection systems, employee training programs focusing on phishing awareness, and rigorous penetration testing to identify vulnerabilities in their systems. The bank also established a dedicated cybersecurity incident response team capable of swiftly containing and mitigating any breaches. This proactive approach proved highly effective, significantly reducing the number and impact of successful cyberattacks. The bank’s commitment to continuous monitoring and adaptation to the ever-evolving threat landscape was crucial to its success. Their investment in cybersecurity, while significant, proved far less costly than the potential financial and reputational damage of a major breach.

Supply Chain Resilience: A Pharmaceutical Company’s Diversification Strategy

A global pharmaceutical company faced significant supply chain disruptions during a period of global instability. Their initial reliance on a single supplier for a critical ingredient proved disastrous. In response, they implemented a diversification strategy, sourcing the ingredient from multiple geographically diverse suppliers. This reduced their dependence on any single supplier and minimized the impact of future disruptions. Furthermore, they developed robust inventory management systems to ensure sufficient stock levels to withstand unexpected delays. This proactive approach proved crucial in ensuring the continued supply of essential medicines, safeguarding both the company’s reputation and the health of patients. The key takeaway is the understanding that resilience in supply chains isn’t just about efficiency; it’s about managing vulnerabilities proactively.

Strategic Risk Management in the Construction Industry: Mitigation of Project Delays

A major construction firm significantly reduced project delays by implementing a robust risk management plan. This involved detailed risk assessments at the beginning of each project, identifying potential delays caused by factors such as weather, material shortages, and regulatory changes. They then developed mitigation strategies for each identified risk, including contingency planning and proactive communication with stakeholders. This meticulous approach resulted in significantly fewer project delays, leading to improved project profitability and enhanced client satisfaction. The consistent application of a structured risk management process, coupled with transparent communication, proved instrumental in their success.

Emerging Risks and Future Trends

The future, much like a particularly spicy jalapeno, is simultaneously exciting and potentially excruciating. For organizations, this translates to a landscape of emerging risks that demand proactive and innovative risk management strategies. Failing to anticipate these challenges is akin to attending a chili cook-off without a fire extinguisher – a recipe for disaster.

Predicting the future is, admittedly, a fool’s errand (unless you’re a time-traveling squirrel, in which case, please share your secrets). However, by analyzing current trends and technological advancements, we can identify potential future threats and develop robust mitigation plans. This involves not only identifying the risks themselves, but also understanding how these risks will interact and evolve over time. Think of it as a complex game of risk-Jenga – one wrong move, and the whole tower crumbles.

Technological Advancements and Their Impact on Risk Management

Technological advancements, while offering incredible opportunities, also introduce a whole new batch of potential problems. Cybersecurity threats, for instance, are becoming increasingly sophisticated, moving beyond simple phishing scams to encompass AI-powered attacks that can bypass traditional security measures. The rise of automation also presents risks related to job displacement and algorithmic bias, requiring organizations to develop strategies for managing these societal impacts. Furthermore, the increasing reliance on interconnected systems creates vulnerabilities; a single point of failure can trigger a cascade of problems across an entire organization, much like a domino effect, but with far less satisfying visuals. Consider the impact of a major software glitch on a global financial institution – the potential losses are staggering.

The Role of Data Analytics and Artificial Intelligence in Risk Management

Data analytics and artificial intelligence (AI) are not just buzzwords; they are powerful tools that can revolutionize risk management. AI-powered systems can analyze vast datasets to identify patterns and anomalies that might indicate emerging risks, providing early warning signals that humans might miss. For example, an AI system might detect unusual transaction patterns in a financial institution, flagging potential fraud before it escalates. Furthermore, AI can automate many aspects of risk management, such as risk assessment and reporting, freeing up human resources to focus on more strategic tasks. However, it’s crucial to remember that AI is only as good as the data it’s trained on. Biased data can lead to biased results, creating new risks. Think of it as a sophisticated chef using spoiled ingredients – the outcome won’t be pretty.

Potential Future Risks and Challenges

Organizations face a multitude of potential future risks, ranging from climate change and geopolitical instability to pandemics and supply chain disruptions. These risks are interconnected and can exacerbate each other, creating complex and unpredictable challenges. For example, climate change can lead to more frequent and severe extreme weather events, disrupting supply chains and causing significant economic losses. Geopolitical instability can further complicate matters, leading to trade wars and resource scarcity. The COVID-19 pandemic serves as a stark reminder of the potential impact of unforeseen global events. Organizations need to develop robust contingency plans to address these challenges, and regularly review and update these plans to reflect changing circumstances. Failing to do so is akin to navigating a minefield blindfolded – not recommended.

Concluding Remarks

So, there you have it: a comprehensive guide to navigating the wild west of risk management. While we can’t guarantee a risk-free existence (sorry, not even we can control the unpredictable whims of fate), this guide provides the tools and strategies to help you confidently stride into the future, ready to tackle whatever challenges – or opportunities – may arise. Remember, a little bit of fear is healthy; it’s the excessive fear that you’ll learn to manage. Now go forth and conquer (responsibly, of course!).

Expert Answers

What if my risk assessment reveals an unavoidable catastrophic risk?

Accept it gracefully, secure adequate insurance, and perhaps invest in a really good therapist. Sometimes, acceptance is the most sensible option.

Can I use this guide to manage personal risks, like choosing a life partner?

While we don’t recommend using a risk matrix to evaluate potential spouses (unless you’re a particularly analytical individual), the principles of identifying, assessing, and managing risks apply to all areas of life. Proceed with caution.

Are there any legal implications I should be aware of regarding risk management?

Absolutely! Consult with legal professionals to ensure your risk management strategies comply with all applicable laws and regulations. Disclaimer: We are not lawyers (and we are certainly not your therapist).