Navigating the complex world of finance necessitates a robust understanding of risk management. From market fluctuations to credit defaults and operational failures, financial institutions face a myriad of potential threats. This exploration delves into the core principles and practical techniques employed to identify, assess, and mitigate these risks, ensuring financial stability and long-term success.

Effective risk management isn’t merely about avoiding losses; it’s about strategically navigating uncertainty to maximize opportunities. This involves a multifaceted approach, encompassing quantitative analysis, qualitative judgment, and a deep understanding of regulatory frameworks. We will examine various strategies, from diversification and hedging to the implementation of comprehensive internal controls, and explore how technological advancements are reshaping the landscape of financial risk management.

Introduction to Risk Management in Finance

Financial risk management is the process of identifying, analyzing, and mitigating potential financial risks to an organization. Its core principles revolve around understanding the potential for loss, quantifying that loss, and implementing strategies to reduce or eliminate the likelihood and impact of negative events. Effective risk management is crucial for the survival and success of any financial institution, ensuring stability and long-term profitability.

The goal of financial risk management is not to eliminate all risk – that’s often impossible and sometimes undesirable, as risk-taking is inherent in generating returns. Instead, the aim is to manage risk effectively, balancing the potential for reward with the potential for loss in a way that aligns with the organization’s risk appetite and overall objectives. This involves a continuous cycle of identifying new risks, assessing their impact, and adapting strategies as circumstances change.

Types of Financial Risks

Financial risks are broadly categorized into several types, each requiring specific management strategies. Understanding these different risk categories is fundamental to building a robust risk management framework.

- Market Risk: This encompasses risks stemming from fluctuations in market prices, such as interest rates, exchange rates, and equity prices. A sudden drop in interest rates could negatively impact the value of bond holdings, for example, while currency fluctuations can significantly impact international trade and investment.

- Credit Risk: This is the risk that a borrower will fail to meet its obligations, resulting in a loss for the lender. This risk applies to various financial instruments, including loans, bonds, and derivatives. The failure of a major borrower to repay its debt can have cascading effects throughout the financial system.

- Operational Risk: This refers to the risk of losses arising from inadequate or failed internal processes, people, and systems. This includes risks related to technology failures, fraud, human error, and regulatory breaches. A large-scale data breach, for example, could lead to significant financial and reputational damage.

- Liquidity Risk: This is the risk that an organization will not be able to meet its short-term obligations as they come due. This can arise from a sudden inability to access funds or a mismatch between the timing of assets and liabilities. A bank run, where depositors simultaneously withdraw their funds, is a classic example of liquidity risk.

- Legal and Regulatory Risk: This encompasses the risk of losses arising from non-compliance with laws and regulations. Changes in regulations, lawsuits, and penalties can all lead to significant financial consequences.

Examples of Financial Crises Caused by Inadequate Risk Management

The consequences of poor risk management can be catastrophic, as illustrated by several historical financial crises.

The 2008 global financial crisis serves as a prime example. Inadequate risk management, particularly concerning subprime mortgages and the complex securitization of these mortgages, led to widespread defaults and a collapse in the housing market. The lack of transparency and understanding of the risks associated with these complex financial instruments contributed significantly to the severity of the crisis. The crisis highlighted the interconnectedness of financial markets and the systemic risk that can arise from inadequate risk management practices across the industry. Similarly, the Asian financial crisis of 1997-98 demonstrated the dangers of excessive leverage and currency mismatches, leading to widespread currency devaluation and economic instability. In both cases, a failure to adequately assess and manage risks contributed significantly to the severity and duration of the economic downturn.

Risk Identification and Assessment

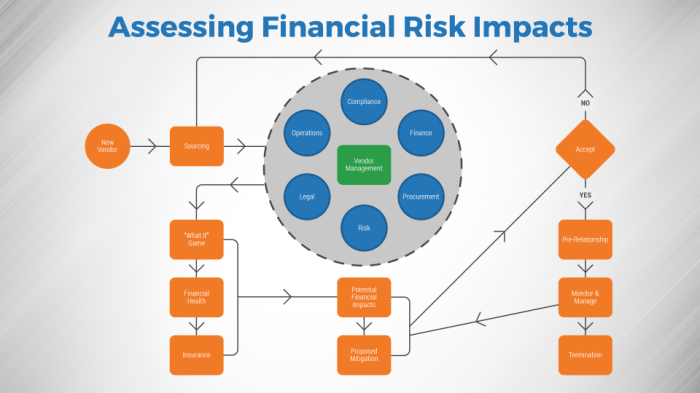

Effective risk identification and assessment are crucial for proactive financial management. A systematic approach allows companies to understand their vulnerability to potential financial losses and develop appropriate mitigation strategies. This process involves identifying potential risks, evaluating their likelihood and impact, and prioritizing them based on their severity.

Identifying potential financial risks requires a multi-faceted approach. It’s not enough to rely solely on intuition or past experiences. A robust system combines various methods to ensure comprehensive coverage.

Methods for Identifying Financial Risks

Several methods contribute to a comprehensive identification of financial risks. These methods are often used in conjunction to ensure no potential risk is overlooked. A combination of quantitative and qualitative techniques yields the most robust results.

- Financial Statement Analysis: Examining balance sheets, income statements, and cash flow statements can reveal vulnerabilities such as high debt levels, declining profitability, or insufficient liquidity. For example, a consistently declining current ratio could signal a growing risk of short-term insolvency.

- Internal Audits: Regular internal audits provide an independent assessment of the company’s financial controls and processes, identifying weaknesses that could expose the company to financial risks. Auditors may highlight issues like inadequate segregation of duties or weaknesses in internal controls over financial reporting.

- Scenario Planning: This involves developing hypothetical scenarios, such as economic downturns or changes in regulations, to assess their potential impact on the company’s finances. For example, a scenario might explore the impact of a sudden increase in interest rates on a company with high levels of variable-rate debt.

- SWOT Analysis: A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis helps identify both internal weaknesses and external threats that could negatively affect the company’s financial performance. Weaknesses might include outdated technology or a lack of skilled personnel, while threats might include increased competition or changes in consumer preferences.

- Expert Interviews: Engaging with key personnel across various departments can provide valuable insights into potential risks that might not be apparent through other methods. These interviews can uncover operational risks that could translate into financial losses.

Risk Assessment Framework

Once potential risks are identified, a framework is needed to evaluate their likelihood and potential impact. A common approach involves a qualitative assessment matrix.

| Likelihood | Low | Medium | High |

|---|---|---|---|

| Impact (Financial Loss) | |||

| Low | Low | Medium | High |

| Medium | Medium | High | Very High |

| High | High | Very High | Critical |

Each identified risk is then placed within this matrix based on assessments of its likelihood and potential impact. For example, a risk with a medium likelihood and high impact would be categorized as “High” severity. This provides a clear visualization of the relative severity of different risks. Quantitative methods, such as Monte Carlo simulations, can be used to supplement this qualitative assessment, providing a more precise estimation of potential financial losses.

Documenting and Prioritizing Risks

A comprehensive risk register is essential for documenting and prioritizing identified risks. This register should include details such as the risk description, likelihood, impact, potential financial consequences, assigned owner, and mitigation strategies.

Prioritization is typically based on the risk severity, as determined by the risk assessment matrix. Risks categorized as “High” or “Critical” require immediate attention and the development of mitigation strategies. A risk scoring system can be implemented to provide a numerical ranking for prioritization. For example, a simple scoring system could assign numerical values to likelihood and impact (e.g., Low=1, Medium=2, High=3), then multiply these values to obtain a risk score. A higher risk score indicates a higher priority.

Risk Response Strategies

Once risks have been identified and assessed, the next crucial step in risk management is developing and implementing appropriate response strategies. These strategies aim to modify the likelihood and/or impact of identified risks, ultimately aligning them with an organization’s risk appetite. A proactive and well-defined approach to risk response is essential for maintaining financial stability and achieving organizational objectives.

Risk Avoidance

Risk avoidance involves eliminating the risk entirely by not engaging in the activity that generates the risk. This is a straightforward strategy, but it may not always be feasible or desirable, particularly if the activity offers significant potential returns. For instance, a bank might avoid lending to a specific sector deemed too risky due to high default probabilities. This avoids the potential losses from loan defaults, but it also means forgoing the potential profits from lending in that sector. The effectiveness of avoidance depends heavily on the availability of alternatives and the potential opportunity cost.

Risk Mitigation

Risk mitigation aims to reduce the likelihood or impact of a risk event. This involves implementing controls to lessen the severity of the consequences should the risk materialize. A financial institution might mitigate credit risk by diversifying its loan portfolio, thus reducing its exposure to any single borrower or industry. Another example could be implementing robust cybersecurity measures to reduce the likelihood and impact of a data breach, a significant risk for any financial institution. Mitigation is generally preferred over avoidance when the risk cannot be entirely eliminated and the potential benefits outweigh the costs of implementing controls.

Risk Transfer

Risk transfer involves shifting the risk to a third party. This is often achieved through insurance, hedging, or outsourcing. For example, a company might purchase insurance to cover potential losses from property damage or liability claims. Hedging involves using financial instruments to offset potential losses from price fluctuations; a company might use futures contracts to hedge against changes in commodity prices. Outsourcing certain operations to specialized firms can transfer operational risks. The effectiveness of transfer relies on the availability of appropriate mechanisms and the reliability of the third party.

Risk Acceptance

Risk acceptance means acknowledging the risk and deciding to bear the potential consequences. This is often the case for low-probability, low-impact risks where the cost of mitigating the risk outweighs the potential loss. A small investment firm might accept the risk of a small loss on a single investment if the overall portfolio is well-diversified. Acceptance is often a passive strategy but should be a conscious decision based on a thorough risk assessment.

Comparison of Risk Response Strategies

The choice of risk response strategy depends heavily on the specific circumstances, including the likelihood and impact of the risk, the cost of implementing different strategies, and the organization’s risk appetite.

| Strategy | Likelihood of Risk | Impact of Risk | Cost of Implementation |

|---|---|---|---|

| Avoidance | Eliminated | Eliminated | Potentially high (opportunity cost) |

| Mitigation | Reduced | Reduced | Moderate to high (depending on controls) |

| Transfer | Variable (depends on the mechanism) | Variable (depends on the mechanism) | Moderate (premiums, fees) |

| Acceptance | Unchanged | Unchanged | Low |

Risk Measurement and Monitoring

Effective risk measurement and monitoring are crucial for managing financial risks effectively. This involves employing both quantitative and qualitative techniques to assess the likelihood and potential impact of identified risks, establishing key performance indicators (KPIs) to track progress, and creating a robust system for reporting and analyzing risk exposures over time. This allows for proactive adjustments to risk mitigation strategies and ensures that the organization remains resilient in the face of uncertainty.

Quantitative and qualitative methods offer complementary perspectives on risk. Quantitative methods provide numerical measures of risk, allowing for objective comparisons and analysis, while qualitative methods provide valuable context and insights that numerical measures might miss. A comprehensive risk management framework will incorporate both approaches.

Quantitative Risk Measurement Methods

Several quantitative methods exist for measuring financial risk. Value at Risk (VaR) and Expected Shortfall (ES) are prominent examples, offering different perspectives on potential losses. Scenario analysis allows for the assessment of risk under various hypothetical market conditions. These methods help quantify the potential financial impact of adverse events.

Value at Risk (VaR) estimates the maximum possible loss in value of an asset or portfolio over a specific time period and confidence level. For example, a VaR of $1 million at a 95% confidence level means there is a 5% chance of losing more than $1 million over the specified period.

Expected Shortfall (ES), also known as Conditional Value at Risk (CVaR), measures the expected loss in the worst-case scenarios, exceeding the VaR threshold. This provides a more comprehensive view of tail risk compared to VaR alone. For instance, if the VaR is $1 million, the ES might be $1.5 million, indicating the expected loss when the worst 5% of outcomes occur.

Scenario Analysis involves creating various plausible scenarios, such as economic recessions, interest rate hikes, or changes in market sentiment, to assess the potential impact on a portfolio. For example, a scenario might involve a 20% decline in the stock market, allowing for the estimation of potential losses under that specific condition.

Establishing and Monitoring Key Risk Indicators (KRIs)

Key Risk Indicators (KRIs) are metrics that provide early warning signals of potential problems. Choosing the right KRIs depends on the specific risks faced by the organization. These indicators should be regularly monitored and analyzed to detect emerging risks and trends. Effective monitoring allows for timely intervention, minimizing the impact of adverse events.

A well-designed KRI system should include a clear definition of each indicator, the frequency of monitoring, and established thresholds for triggering action. For example, a bank might monitor its loan default rate as a KRI. If the default rate exceeds a predefined threshold (e.g., 5%), it might trigger a review of lending policies and practices.

Risk Reporting and Monitoring System

A robust risk reporting and monitoring system is essential for effective risk management. This system should provide a clear and concise overview of the organization’s risk exposures, highlighting significant changes over time. Regular reporting allows for informed decision-making and facilitates proactive risk mitigation.

The system should include mechanisms for collecting, analyzing, and reporting risk data. This might involve using dashboards to visualize key risk metrics, providing regular reports to senior management, and conducting periodic risk assessments. The reporting should be tailored to the needs of different stakeholders, ensuring that relevant information is communicated effectively. For example, a financial institution might use a dashboard to display key metrics such as credit risk, market risk, and operational risk, along with their corresponding KRIs, allowing for real-time monitoring of risk exposures and trends.

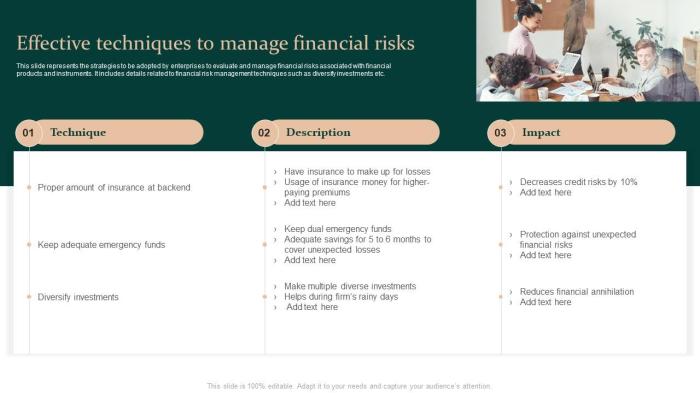

Risk Mitigation Techniques

Effective risk mitigation involves proactively reducing the likelihood or impact of identified financial risks. This involves a multi-faceted approach encompassing diversification, hedging, and risk transfer mechanisms. By strategically implementing these techniques, financial institutions and investors can significantly enhance their resilience to market fluctuations and unforeseen events.

Several key strategies contribute to effective risk mitigation. These strategies are not mutually exclusive and often work in concert to create a robust risk management framework.

Diversification’s Role in Reducing Portfolio Risk

Diversification is a fundamental principle of portfolio management, aiming to reduce overall portfolio risk by spreading investments across different asset classes, sectors, and geographies. By holding a diversified portfolio, an investor is less exposed to the impact of a single asset’s poor performance. For example, if an investor’s portfolio is heavily concentrated in technology stocks and the tech sector experiences a downturn, the entire portfolio will suffer significantly. However, a diversified portfolio, including exposure to real estate, bonds, and international equities, will likely experience a less severe impact, as losses in one sector may be offset by gains in another. The core idea is to reduce the correlation between assets, minimizing the potential for simultaneous negative returns. This principle is often described by the adage, “Don’t put all your eggs in one basket.”

Hedging Strategies to Mitigate Specific Financial Risks

Hedging involves using financial instruments to offset potential losses from an existing position. For instance, a farmer expecting to sell a large crop of corn in the future might use futures contracts to lock in a price today, protecting against potential price declines before harvest. Similarly, an importer expecting to pay for goods in a foreign currency could use currency forward contracts to mitigate the risk of exchange rate fluctuations. Effective hedging requires careful consideration of the specific risk being hedged and the characteristics of the hedging instrument used. The goal is not to eliminate risk entirely but to reduce its impact within acceptable limits. Hedging strategies can be complex and often require specialized knowledge.

Insurance and Other Risk Transfer Mechanisms

Insurance is a classic example of risk transfer. By paying premiums, individuals and businesses transfer the financial burden of potential losses to an insurance company. This is particularly effective for low-probability, high-impact events such as natural disasters or lawsuits. Other risk transfer mechanisms include surety bonds, which guarantee the performance of a contract, and securitization, where risks associated with loans or other assets are packaged and sold to investors. These mechanisms effectively shift the responsibility for managing certain risks to third parties, freeing up resources and reducing the potential impact on the original risk bearer. The selection of appropriate risk transfer mechanisms depends on the nature of the risk, the availability of suitable insurance or other products, and the cost of risk transfer.

Regulatory Compliance and Risk Management

Effective risk management in finance is inextricably linked to regulatory compliance. A robust risk management framework not only protects a financial institution from potential losses but also ensures adherence to the legal and ethical standards set by regulatory bodies. Failure to comply can result in significant financial penalties and reputational damage.

Regulatory frameworks, such as Basel III, play a crucial role in shaping risk management practices across the global financial industry. These frameworks establish minimum capital requirements, stress testing methodologies, and other guidelines aimed at enhancing the stability and resilience of financial institutions. Compliance with these regulations necessitates the development and implementation of sophisticated risk management systems.

The Role of Basel III in Shaping Risk Management Practices

Basel III, developed by the Basel Committee on Banking Supervision, represents a significant evolution in global banking regulation. Its core principles focus on strengthening capital adequacy, improving risk management, and enhancing the transparency of financial institutions. Key aspects include higher capital requirements, stricter liquidity standards (like the Liquidity Coverage Ratio and Net Stable Funding Ratio), and enhanced countercyclical capital buffers. These regulations necessitate a more comprehensive and sophisticated approach to risk identification, measurement, and mitigation. For instance, banks are required to conduct more rigorous stress tests to assess their resilience to various economic shocks, leading to more detailed scenario planning and contingency measures. The implementation of Basel III has significantly impacted how financial institutions structure their balance sheets, manage their capital, and approach liquidity risk.

The Importance of Internal Controls and Compliance Programs

Internal controls and compliance programs are essential components of an effective risk management framework. Internal controls encompass a range of policies, procedures, and processes designed to safeguard assets, ensure the reliability of financial reporting, and promote operational efficiency. A strong compliance program ensures that the institution adheres to all applicable laws, regulations, and industry best practices. This involves regular monitoring, training, and auditing to identify and address any compliance gaps. Robust internal controls, such as segregation of duties, authorization limits, and regular reconciliations, prevent fraud and operational errors. A comprehensive compliance program, including regular reviews of policies and procedures, ensures that the institution remains up-to-date with evolving regulations and best practices. This proactive approach reduces the likelihood of regulatory violations and strengthens the overall risk management framework.

Examples of Regulatory Penalties for Failures in Risk Management

Numerous examples illustrate the significant consequences of failing to effectively manage financial risks and comply with regulations. The global financial crisis of 2008-2009 highlighted the systemic risks associated with inadequate risk management, leading to widespread financial instability and government bailouts. More recently, several financial institutions have faced substantial fines and penalties for violations related to anti-money laundering (AML) regulations, sanctions compliance, and interest rate manipulation. For example, in 2012, JPMorgan Chase paid a record $1 billion fine for failing to adequately monitor and manage its trading activities. These penalties underscore the importance of strong risk management practices and the severe consequences of regulatory non-compliance. The magnitude of these fines demonstrates that the cost of non-compliance can significantly outweigh the cost of implementing robust risk management systems.

Risk Management in Specific Financial Areas

Effective risk management is crucial for the stability and profitability of financial institutions. Different sectors within finance face unique risk profiles, necessitating tailored strategies. This section examines risk management techniques in investment banking, commercial lending, and insurance, highlighting their specific challenges and approaches.

Risk Management Techniques in Investment Banking

Investment banking involves a wide range of activities, including underwriting securities, advising on mergers and acquisitions, and trading financial instruments. The inherent risks are substantial and multifaceted, encompassing market risk, credit risk, operational risk, and liquidity risk. Sophisticated risk models and quantitative techniques are employed to assess and manage these risks. For instance, Value at Risk (VaR) models are commonly used to estimate potential losses in trading portfolios over a specified time horizon and confidence level. Stress testing, simulating extreme market events, provides insights into the resilience of the bank’s portfolio under adverse conditions. Furthermore, robust internal controls and compliance procedures are critical in mitigating operational risks associated with fraud, errors, and regulatory breaches. Diversification strategies, both across asset classes and geographic regions, help to reduce overall portfolio risk.

Risk Management Strategies for Commercial Lending

Commercial lending involves extending credit to businesses for various purposes, from working capital to expansion projects. The primary risks are credit risk (the borrower’s inability to repay the loan), interest rate risk (fluctuations in interest rates affecting profitability), and operational risk (risks related to loan origination, administration, and recovery). Thorough credit analysis, including assessing the borrower’s financial health, industry outlook, and management capabilities, is paramount. Diversification of the loan portfolio across different industries and borrower types reduces concentration risk. Hedging strategies, such as interest rate swaps, can mitigate interest rate risk. Effective loan monitoring and early warning systems help identify potential credit problems and allow for timely intervention. Robust collection procedures are crucial for minimizing losses in case of default.

Risk Management Practices within Insurance Companies

Insurance companies face unique risks, primarily underwriting risk (the risk of losses exceeding premiums collected), market risk (fluctuations in investment returns), and operational risk (risks related to claims processing, fraud, and data security). Actuarial modeling plays a central role in assessing underwriting risk, estimating the probability and severity of insured events. Diversification across different lines of insurance and geographic regions reduces the impact of catastrophic events. Investment strategies need to balance risk and return, considering factors such as interest rate sensitivity and market volatility. Robust claims management processes are critical for efficient and fair claim settlements. Reinsurance plays a crucial role in transferring some of the underwriting risk to other insurers. Compliance with regulatory requirements regarding solvency and capital adequacy is paramount.

Comparison of Risk Management Across Financial Areas

| Risk Area | Investment Banking | Commercial Lending | Insurance |

|---|---|---|---|

| Primary Risks | Market, Credit, Operational, Liquidity | Credit, Interest Rate, Operational | Underwriting, Market, Operational |

| Key Risk Management Techniques | VaR, Stress Testing, Diversification, Internal Controls | Credit Analysis, Diversification, Hedging, Loan Monitoring | Actuarial Modeling, Diversification, Reinsurance, Claims Management |

| Regulatory Focus | Capital adequacy, market conduct, anti-money laundering | Credit risk assessment, loan-to-value ratios | Solvency, capital adequacy, reserving |

| Data Dependence | High reliance on market data, quantitative models | High reliance on borrower financial statements, credit reports | High reliance on actuarial data, claims data |

Technological Advancements and Risk Management

The rapid evolution of technology, particularly within the financial sector (FinTech), has profoundly reshaped the landscape of risk management. Traditional methods are increasingly being augmented, and in some cases replaced, by sophisticated algorithms, machine learning, and vast data sets. This shift presents both significant opportunities to enhance risk mitigation and new challenges requiring careful consideration and adaptation.

FinTech’s impact on financial risk management is multifaceted and transformative. The increased use of digital platforms and automated processes has led to both increased efficiency and new avenues for risk. For example, the speed and scale of online transactions necessitate robust real-time monitoring systems to detect and respond to fraudulent activities. Simultaneously, the reliance on complex algorithms introduces operational risks related to software failures and cybersecurity breaches.

FinTech’s Influence on Risk Management

The integration of FinTech solutions has significantly altered the way financial institutions approach risk management. Faster transaction processing enables quicker identification of potentially risky activities. Automated fraud detection systems, powered by machine learning, can analyze vast datasets to identify patterns and anomalies indicative of fraudulent behavior with far greater speed and accuracy than human analysts. However, the complexity of these systems introduces new risks, including the potential for algorithmic bias and the need for rigorous testing and validation to ensure accuracy and reliability. Furthermore, the reliance on third-party providers for FinTech solutions introduces additional layers of operational and reputational risk.

The Role of Big Data and Artificial Intelligence in Risk Assessment and Mitigation

Big data analytics and artificial intelligence (AI) are revolutionizing risk assessment and mitigation. The ability to process and analyze massive datasets allows for the identification of subtle patterns and correlations that might be missed using traditional methods. AI-powered algorithms can be used to predict credit risk, detect money laundering, and assess market volatility with greater accuracy and speed. For instance, AI can analyze thousands of data points – from social media activity to credit history – to provide a more comprehensive credit risk assessment than traditional credit scoring models. This improved predictive capability allows for proactive risk management, enabling institutions to take preventative measures before losses occur.

Challenges and Opportunities Presented by Emerging Technologies

The rapid pace of technological advancement presents both exciting opportunities and significant challenges for risk management. One key challenge is the potential for unforeseen risks associated with new technologies. For example, the rise of decentralized finance (DeFi) introduces new complexities related to regulatory oversight, cybersecurity, and operational resilience. Another challenge is the need for skilled professionals who can effectively manage and mitigate these new risks. The demand for data scientists, cybersecurity experts, and AI specialists is rapidly increasing. However, the opportunities are equally compelling. The use of blockchain technology, for example, can enhance transparency and traceability in financial transactions, reducing the risk of fraud and operational errors. Similarly, AI-powered tools can automate many aspects of risk management, freeing up human resources to focus on more strategic initiatives. Successfully navigating these challenges and seizing the opportunities requires a proactive and adaptive approach to risk management, emphasizing continuous learning and innovation.

Developing a Robust Risk Management Framework

A robust risk management framework is crucial for the stability and success of any financial institution. It provides a structured approach to identifying, assessing, responding to, and monitoring risks, ultimately protecting the institution’s assets, reputation, and stakeholders. This framework should be comprehensive, adaptable, and integrated into the institution’s overall strategic planning.

A comprehensive risk management framework for a hypothetical financial institution, “First National Bank,” would incorporate several key components. This framework would be designed to be dynamic, adapting to the ever-changing financial landscape and internal operational shifts.

Risk Appetite Definition and Statement

First National Bank’s risk appetite statement would clearly articulate the level of risk the institution is willing to accept in pursuit of its strategic objectives. This statement would define acceptable risk tolerances for various risk categories, such as credit risk, market risk, operational risk, and liquidity risk. For example, the bank might specify a maximum acceptable default rate for its loan portfolio or a limit on its exposure to a single counterparty. This statement would be regularly reviewed and updated by senior management to reflect changes in the bank’s strategic goals and the external environment.

Risk Policies and Procedures

The bank would establish clear and concise policies and procedures to guide risk management activities across all departments. These policies would cover areas such as risk identification, assessment, response, and monitoring. Procedures would detail the specific steps to be taken in each area, ensuring consistency and compliance. For instance, a detailed procedure would Artikel the steps involved in assessing the creditworthiness of a loan applicant, including credit scoring, financial statement analysis, and collateral evaluation. Regular training would ensure all employees understand and adhere to these policies and procedures.

Risk Reporting and Monitoring

A robust risk reporting and monitoring system is essential to track the effectiveness of the risk management framework. First National Bank would implement a system for regularly collecting, analyzing, and reporting risk data. This would include regular reports on key risk indicators (KRIs), such as loan defaults, market volatility, and operational losses. The reports would be distributed to relevant stakeholders, including senior management, the board of directors, and regulatory bodies. This system would also facilitate early warning signals, allowing for timely intervention and mitigation of potential risks. For example, a sudden increase in loan defaults might trigger a review of the bank’s lending policies and procedures.

Framework Implementation and Maintenance

Implementation would involve a phased approach, starting with a thorough risk assessment across all business units. This would identify existing and potential risks, their likelihood and impact. Subsequently, risk response strategies would be developed and implemented. Regular reviews of the framework’s effectiveness would be conducted, with adjustments made as needed to reflect changes in the business environment, regulatory requirements, or internal operational changes. This would involve regular training for staff on risk management principles and procedures, ensuring consistent application of the framework across the organization. The bank would also conduct regular audits to verify the framework’s effectiveness and compliance with relevant regulations. A dedicated risk management team, reporting directly to senior management, would be responsible for overseeing the implementation and maintenance of the framework.

Closing Summary

Mastering risk management techniques is paramount for sustained success in the financial sector. By implementing a robust framework that incorporates risk identification, assessment, response strategies, and continuous monitoring, financial institutions can navigate uncertainty, protect their assets, and capitalize on emerging opportunities. The integration of technological advancements further enhances these capabilities, paving the way for a more resilient and adaptable financial ecosystem.

User Queries

What is the difference between Value at Risk (VaR) and Expected Shortfall (ES)?

VaR estimates the minimum loss expected at a given confidence level over a specific time horizon. ES, on the other hand, calculates the expected loss in the worst-case scenarios within that same tail probability, providing a more comprehensive picture of potential losses.

How does stress testing contribute to risk management?

Stress testing simulates extreme market events to assess the resilience of a financial institution’s portfolio. By exposing vulnerabilities under hypothetical adverse conditions, it allows for proactive adjustments and strengthens preparedness for potential crises.

What role does corporate governance play in effective risk management?

Strong corporate governance structures establish clear lines of accountability, promote transparency, and foster a culture of risk awareness. This includes independent oversight, robust internal controls, and ethical decision-making processes.