Navigating the complexities of the stock market requires a keen understanding of various analytical tools. From fundamental analysis focusing on a company’s intrinsic value to technical analysis charting price trends, and the increasingly sophisticated world of quantitative analysis employing algorithms and statistical modeling, the options are vast and varied. This guide provides a structured exploration of these tools, their applications, and how to effectively utilize them for informed investment decisions, emphasizing both the opportunities and inherent risks.

We will delve into the strengths and weaknesses of different analytical approaches, examine reliable data sources, and Artikel a step-by-step process for leveraging these tools responsibly. Furthermore, we’ll explore advanced techniques, including the use of machine learning in stock price prediction and the interpretation of key financial ratios and technical indicators. The goal is to equip you with the knowledge necessary to confidently approach stock market analysis.

Types of Stock Market Tools

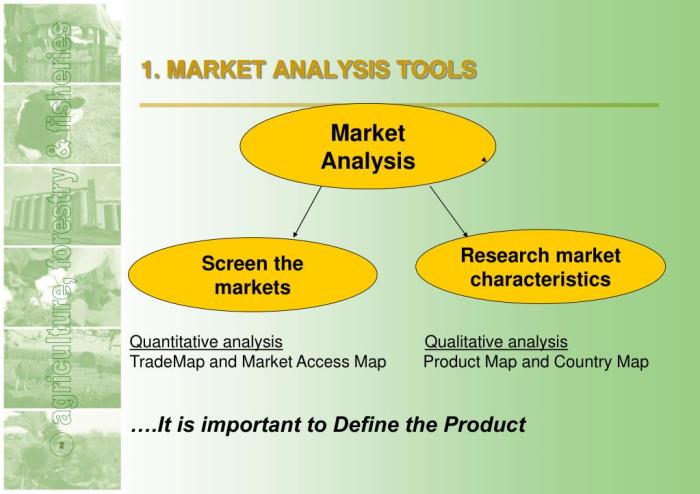

Navigating the complexities of the stock market requires a robust toolkit. Investors employ a variety of analytical tools to inform their decisions, broadly categorized into fundamental analysis, technical analysis, and quantitative analysis. Understanding the strengths and weaknesses of each category, as well as the specific functionalities of individual tools, is crucial for effective investment strategies.

Categorization of Stock Market Tools

The following table provides a categorized list of common stock market tools, highlighting their functionalities and examples. Different investors will favor different tools depending on their investment style and risk tolerance.

| Tool Name | Category | Description | Example |

|---|---|---|---|

| Financial Statement Analysis | Fundamental Analysis | Examines a company’s financial health using balance sheets, income statements, and cash flow statements to assess its intrinsic value. | Analyzing a company’s debt-to-equity ratio to assess its financial leverage. |

| Discounted Cash Flow (DCF) Analysis | Fundamental Analysis | Projects future cash flows and discounts them back to their present value to estimate a company’s intrinsic value. | Using a DCF model to estimate the fair value of a tech company based on projected future earnings. |

| Comparative Company Analysis | Fundamental Analysis | Compares a company’s financial performance and valuation metrics to its peers to identify undervalued or overvalued opportunities. | Comparing the price-to-earnings (P/E) ratio of a bank to its competitors. |

| Industry Analysis | Fundamental Analysis | Analyzes the overall health and trends of a specific industry to identify attractive investment opportunities. | Assessing the growth potential of the renewable energy sector. |

| Dividend Discount Model (DDM) | Fundamental Analysis | Estimates the intrinsic value of a stock based on its expected future dividend payments. | Using the Gordon Growth Model to value a utility stock with a consistent dividend payout. |

| Moving Averages | Technical Analysis | Calculates the average price of a stock over a specific period to identify trends and potential support/resistance levels. | Using a 50-day and 200-day moving average to identify potential buy or sell signals. |

| Relative Strength Index (RSI) | Technical Analysis | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | Using an RSI value of 70 to indicate an overbought condition and a potential sell signal. |

| Candlestick Charts | Technical Analysis | Visual representation of price movements that can reveal patterns and potential trading opportunities. | Identifying a bullish engulfing pattern on a candlestick chart as a potential buy signal. |

| Bollinger Bands | Technical Analysis | Plots standard deviations around a moving average to identify volatility and potential reversals. | Using Bollinger Bands to identify potential breakouts or pullbacks. |

| Fibonacci Retracement | Technical Analysis | Uses Fibonacci numbers to identify potential support and resistance levels based on past price movements. | Identifying potential support levels at 38.2% and 61.8% Fibonacci retracement levels. |

| Regression Analysis | Quantitative Analysis | Statistical method used to model the relationship between variables and make predictions. | Using regression analysis to predict future stock prices based on historical data and economic indicators. |

| Monte Carlo Simulation | Quantitative Analysis | Uses random sampling to model the probability of different outcomes. | Simulating various market scenarios to assess the risk of an investment portfolio. |

| Optimization Algorithms | Quantitative Analysis | Algorithms used to find the optimal solution to a problem, such as portfolio optimization. | Using a genetic algorithm to optimize a portfolio for maximum return with a given level of risk. |

| Backtesting | Quantitative Analysis | Testing a trading strategy on historical data to evaluate its performance. | Backtesting a trading strategy using historical stock price data to assess its profitability. |

| Machine Learning Algorithms | Quantitative Analysis | Using machine learning to identify patterns and predict future stock prices. | Employing a neural network to predict stock price movements based on various market indicators. |

Strengths and Weaknesses of Analytical Categories

Fundamental analysis focuses on a company’s intrinsic value, offering a long-term perspective. However, it can be time-consuming and requires significant expertise in accounting and finance. Its weakness lies in its reliance on estimations and projections, which can be inaccurate.

Technical analysis focuses on price charts and patterns, providing short-term trading signals. Its strength is its objectivity and ease of use. However, it’s susceptible to market manipulation and may not always accurately predict future price movements. It also doesn’t consider the underlying fundamentals of a company.

Quantitative analysis uses mathematical and statistical models to identify patterns and make predictions. Its strength is its objectivity and ability to handle large datasets. However, it requires significant expertise in programming and statistics, and its models may not always be accurate. Over-reliance on quantitative models can lead to ignoring crucial qualitative factors.

Data Sources for Stock Market Analysis

Accessing reliable and comprehensive data is crucial for effective stock market analysis. The quality of your data directly impacts the accuracy and validity of your investment decisions. Choosing the right data source depends on your specific needs, analytical goals, and budget. This section explores various options, highlighting their strengths and weaknesses.

Numerous data providers cater to different levels of experience and investment strategies. The spectrum ranges from free, publicly available information to sophisticated, subscription-based platforms offering real-time data and advanced analytical tools. Understanding the nuances of each source is key to making informed choices.

Reputable Data Sources for Stock Market Analysis

The following list provides a range of reputable data sources, categorized for clarity. Remember to always critically evaluate the information provided, considering potential biases or limitations inherent in any data set.

- Free Sources:

- Yahoo Finance: Offers fundamental data, stock charts, and news, though the depth of analysis may be limited.

- Google Finance: Provides basic stock information, including prices, charts, and some financial statements. Data may lag slightly behind real-time.

- SEC Edgar Database: A treasure trove of company filings (10-K, 10-Q, etc.), offering raw, unfiltered financial data. Requires some financial literacy to interpret effectively.

- Finviz: A free screener offering a wide array of data points for stock selection and analysis. Limited historical data is available.

- Paid Sources:

- Bloomberg Terminal: A comprehensive, professional-grade platform offering real-time data, analytics, and news. Extremely expensive, targeted towards institutional investors.

- Refinitiv Eikon: A competitor to Bloomberg, offering similar comprehensive data and analytical tools at a high cost.

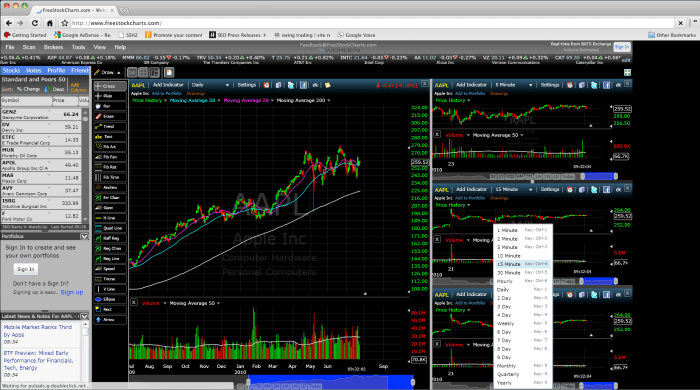

- TradingView: A popular platform for charting and technical analysis, offering a range of data and indicators. Pricing varies based on features and data access.

- FactSet: A leading provider of financial data and analytics, utilized by many professional investors. High cost, extensive data coverage.

Reliability and Accuracy of Data Sources

The reliability and accuracy of data vary significantly across providers. Free sources often lag in real-time updates and may lack the depth of data offered by paid services. Paid platforms generally provide more accurate, real-time data, but come with a substantial price tag. Furthermore, even paid data sources can have occasional errors or inconsistencies. It’s advisable to cross-reference data from multiple sources to ensure accuracy and identify any potential discrepancies.

Data Provider Comparison

The following table compares several data providers based on key factors. User reviews are summarized and represent general sentiment, not a definitive rating.

| Data Provider | Data Types Offered | Pricing Model | User Reviews Summary |

|---|---|---|---|

| Yahoo Finance | Fundamental data, stock charts, news | Free | Generally positive for basic needs, but lacks depth and real-time data. |

| Bloomberg Terminal | Real-time data, analytics, news, extensive financial data | Subscription, high cost | Highly regarded for comprehensiveness and accuracy, but expensive. |

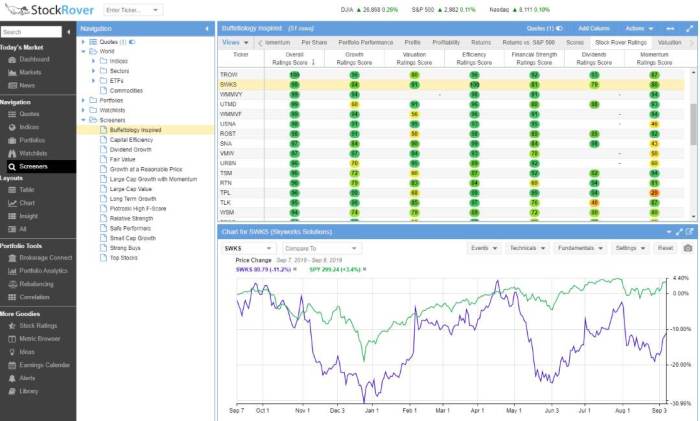

| TradingView | Charts, technical indicators, fundamental data, social sentiment | Subscription, tiered pricing | Popular for charting and technical analysis; user experience praised, but data depth varies by plan. |

| SEC Edgar Database | Company filings (10-K, 10-Q, etc.) | Free | Highly valuable for raw data, but requires financial expertise to interpret. |

Fundamental vs. Technical Analysis

Choosing the right approach to stock market analysis is crucial for successful investing. While both fundamental and technical analysis aim to predict future price movements, they employ vastly different methodologies and cater to different investor profiles. Understanding their strengths and weaknesses, and potentially combining them, is key to making informed investment decisions.

Fundamental Analysis Methodologies

Fundamental analysis focuses on evaluating the intrinsic value of a company. It involves examining a company’s financial statements, management, competitive landscape, and overall economic conditions to determine whether its stock price accurately reflects its true worth. Investors using this approach believe that market prices eventually align with a company’s inherent value.

- Financial Statement Analysis: Examining balance sheets, income statements, and cash flow statements to assess profitability, liquidity, and solvency.

- Ratio Analysis: Calculating key financial ratios (e.g., Price-to-Earnings ratio, Return on Equity) to compare a company’s performance to its peers and industry benchmarks. For example, a low P/E ratio might suggest a stock is undervalued.

- Competitive Analysis: Evaluating a company’s competitive position within its industry, considering factors such as market share, brand strength, and technological innovation. A company with a strong competitive advantage is likely to generate higher profits.

- Economic Analysis: Assessing the macroeconomic environment and its impact on the company’s performance. Factors such as interest rates, inflation, and economic growth can significantly influence a company’s prospects.

Technical Analysis Methodologies

Technical analysis, in contrast, focuses on identifying patterns in past market data to predict future price movements. It assumes that market prices reflect all available information and that historical price trends and volume data can predict future price action. This approach relies heavily on charts and various indicators.

- Chart Pattern Recognition: Identifying recurring patterns in price charts (e.g., head and shoulders, double tops/bottoms) to anticipate potential price reversals or breakouts.

- Technical Indicators: Using mathematical formulas and calculations based on price and volume data to generate buy/sell signals (e.g., moving averages, relative strength index (RSI), MACD).

- Support and Resistance Levels: Identifying price levels where buying or selling pressure is expected to be strong, potentially leading to price reversals.

- Volume Analysis: Examining trading volume to confirm price trends and identify potential breakouts or reversals. High volume accompanying a price move suggests stronger conviction.

Investor Profiles for Each Approach

Fundamental analysis is typically favored by long-term investors, value investors, and those who focus on intrinsic value. These investors are willing to hold a stock for an extended period, confident that the market will eventually recognize its true worth. Warren Buffett is a prime example of a successful investor who heavily relies on fundamental analysis.

Technical analysis is often preferred by short-term traders and those who focus on price action and momentum. These investors may be less concerned with a company’s fundamentals and more interested in capitalizing on short-term price fluctuations. Day traders frequently utilize technical analysis to make quick trading decisions.

Combining Fundamental and Technical Analysis

While seemingly disparate, fundamental and technical analysis can be used synergistically for a more comprehensive investment strategy. Fundamental analysis can identify undervalued companies with strong long-term potential, while technical analysis can help determine optimal entry and exit points, minimizing risk and maximizing returns. For instance, an investor might use fundamental analysis to identify a fundamentally sound company, then use technical analysis to identify a favorable entry point based on chart patterns and indicators, potentially reducing the risk of buying at an inflated price.

Using Stock Market Tools Effectively

Mastering stock market analysis tools is crucial for making sound investment decisions. While these tools provide valuable insights, their effective use requires a structured approach and a clear understanding of their limitations. Successful application hinges on combining technical proficiency with prudent risk management and a realistic understanding of market dynamics.

Effective utilization of stock market analysis tools involves a multi-step process. A systematic approach, coupled with continuous learning and adaptation, significantly improves the chances of achieving investment goals.

A Step-by-Step Guide to Utilizing Stock Market Analysis Tools

The following steps Artikel a practical approach to leveraging these tools for informed investment choices. Remember that each step is interconnected, and success relies on a holistic understanding of the process.

- Define Your Investment Goals and Risk Tolerance: Before employing any tool, clearly articulate your financial objectives (e.g., long-term growth, short-term gains, income generation). Determine your risk tolerance—how much potential loss you can accept—to guide your tool selection and investment strategy.

- Select Appropriate Tools: Choose tools aligned with your investment style and goals. Fundamental analysis tools are suited for long-term investors focusing on company financials, while technical analysis tools are better for short-term traders focusing on price charts and patterns. Consider using a combination of both.

- Gather and Analyze Data: Utilize reliable data sources (e.g., reputable financial websites, brokerage platforms) to feed your chosen tools. Thoroughly analyze the data, considering multiple indicators and perspectives to avoid biases.

- Backtest Your Strategies: Before deploying any strategy in the live market, backtest it using historical data. This allows you to assess the strategy’s performance under various market conditions and refine it accordingly. This step is critical to reducing risk.

- Monitor and Adapt: Continuously monitor your investments and the market conditions. Be prepared to adjust your strategy based on new information or changing market dynamics. Flexibility is crucial for long-term success.

- Document and Review: Maintain detailed records of your investment decisions, rationale, and results. Regularly review your performance to identify areas for improvement and learn from both successes and failures.

The Importance of Risk Management

Risk management is paramount when using stock market analysis tools. Even the most sophisticated tools cannot eliminate market risk entirely. A robust risk management strategy mitigates potential losses and protects your capital.

Effective risk management involves diversifying your portfolio across different asset classes, setting stop-loss orders to limit potential losses on individual investments, and avoiding over-leveraging (borrowing excessively to invest).

Common Mistakes Investors Make When Using Stock Market Tools and How to Avoid Them

Many investors fall prey to common pitfalls when using stock market analysis tools. Understanding these mistakes and implementing preventative measures is crucial for success.

- Over-Reliance on a Single Tool or Indicator: Relying solely on one tool or indicator can lead to biased analysis and flawed decisions. Utilize multiple tools and indicators to gain a more comprehensive understanding.

- Ignoring Fundamental Analysis: Focusing solely on technical analysis without considering the underlying fundamentals of a company can be risky. A strong company with a solid business model is more likely to withstand market downturns.

- Emotional Decision-Making: Letting emotions like fear and greed dictate investment decisions is detrimental. Stick to your investment plan and avoid impulsive trades based on short-term market fluctuations.

- Ignoring Risk Management: Failing to implement a proper risk management strategy can lead to significant losses. Always define your risk tolerance and employ strategies to protect your capital.

- Chasing Past Performance: Past performance is not indicative of future results. Avoid investing solely based on past trends and focus on the current fundamentals and market outlook.

Advanced Stock Market Analysis Techniques

Advanced stock market analysis goes beyond basic fundamental and technical analysis, incorporating sophisticated quantitative methods and leveraging the power of machine learning to uncover complex patterns and potentially improve investment strategies. These techniques require a strong understanding of statistics, programming, and financial markets. While not guaranteed to produce profits, they offer a more nuanced approach to understanding market dynamics.

Quantitative Analysis Techniques and Algorithmic Trading

Quantitative analysis (quant) utilizes mathematical and statistical models to analyze market data and identify trading opportunities. Algorithmic trading, a direct application of quant analysis, employs computer programs to execute trades based on pre-defined rules and algorithms. These algorithms can react to market changes far faster than a human trader, potentially capitalizing on fleeting opportunities. Statistical modeling plays a crucial role, allowing analysts to build models that predict future price movements based on historical data. For example, a regression model might predict stock price changes based on factors like earnings per share, industry trends, and macroeconomic indicators. The complexity of these models can range from simple linear regressions to sophisticated time series models like ARIMA (Autoregressive Integrated Moving Average) or GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models, which are designed to handle the volatility often found in financial markets. Algorithmic trading strategies can incorporate these models to make buy or sell decisions automatically.

Machine Learning Algorithms for Stock Price Prediction

Machine learning algorithms offer powerful tools for predicting stock prices by identifying complex, non-linear relationships within vast datasets that may be missed by traditional statistical methods. These algorithms learn from historical data to build predictive models. Several algorithms have found application in this field. For instance, Support Vector Machines (SVMs) can identify optimal boundaries to classify stocks as likely to increase or decrease in price. Neural networks, particularly recurrent neural networks (RNNs) like Long Short-Term Memory (LSTM) networks, are well-suited for analyzing time-series data like stock prices, as they can capture long-term dependencies and trends. Random Forests, an ensemble learning method, combines multiple decision trees to improve prediction accuracy and robustness. For example, a researcher might train an LSTM network on years of historical stock price data, along with relevant economic indicators, to predict future price movements. The accuracy of these predictions will depend on the quality and quantity of the data, the chosen algorithm, and the inherent unpredictability of the market.

Advanced Charting Techniques in Technical Analysis

Technical analysis relies heavily on charting to identify patterns and trends in price movements. Beyond basic candlestick charts and moving averages, several advanced techniques offer deeper insights.

Point and Figure Charts

Point and figure charts filter out noise by only recording price changes of a predetermined magnitude (e.g., a $1 or 5% move). They focus on price reversals, ignoring time. A new column is started when the price moves in the opposite direction by the predetermined amount. X’s represent price increases, and O’s represent price decreases. This visual simplification can help identify support and resistance levels more clearly than traditional charts. For example, a long series of X’s followed by a significant reversal to O’s could signal a potential trend change.

Market Profile

The market profile is a visual representation of trading activity over a specific period, showing the distribution of price and volume. It helps identify areas of value (where most trading occurred) and areas of low volume (indicating potential support or resistance). By combining the market profile with volume analysis, traders can gain a better understanding of the market’s underlying dynamics and identify potential price targets. For instance, a high-volume node in the market profile could suggest a strong support or resistance level.

Fibonacci Retracement

Fibonacci retracement levels are based on the Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13…), a mathematical sequence found in nature. These levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) are used to identify potential support and resistance areas during price corrections. Traders often look for price reversals near these levels. For example, if a stock price has risen significantly, a pullback to the 38.2% Fibonacci retracement level might be seen as a buying opportunity by some traders, anticipating a resumption of the uptrend.

Interpreting Stock Market Data

Understanding and interpreting stock market data is crucial for making informed investment decisions. This involves analyzing various financial metrics, charting techniques, and financial statements to gain a comprehensive view of a company’s performance and potential. Effective interpretation requires a blend of quantitative analysis and qualitative judgment.

Key Financial Ratios

Financial ratios provide a standardized way to compare a company’s performance over time or against its competitors. Analyzing these ratios helps assess a company’s profitability, liquidity, solvency, and efficiency. For example, a high Price-to-Earnings (P/E) ratio might suggest a company is overvalued, while a high debt-to-equity ratio could indicate a higher financial risk. It’s essential to consider these ratios within the context of the company’s industry and overall economic conditions.

- Price-to-Earnings Ratio (P/E): This ratio compares a company’s stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating high growth expectations or overvaluation. A low P/E ratio might suggest undervaluation or lower growth potential. For instance, a P/E ratio of 20 means investors are willing to pay $20 for every $1 of earnings.

- Debt-to-Equity Ratio: This ratio indicates the proportion of a company’s financing that comes from debt versus equity. A high debt-to-equity ratio suggests the company relies heavily on debt financing, increasing its financial risk. A lower ratio indicates a more conservative financial structure. A debt-to-equity ratio of 1.5 means the company has 1.5 times more debt than equity.

- Return on Equity (ROE): ROE measures a company’s profitability relative to its shareholders’ equity. A higher ROE generally indicates better management of shareholder investments. A low ROE might suggest inefficiencies in using equity capital. For example, an ROE of 15% means the company generates 15 cents of profit for every dollar of shareholder equity.

Candlestick Chart Interpretation

Candlestick charts visually represent price movements over a specific period. Each candlestick represents a single period (e.g., a day, week, or month), showing the opening, closing, high, and low prices. Interpreting these charts involves identifying patterns and trends to predict future price movements. Experienced traders look for patterns like “hammer” formations, “engulfing patterns,” and “doji” to anticipate potential price reversals or continuations. These patterns, however, are not foolproof and should be used in conjunction with other indicators.

Interpreting Financial Statements

Analyzing a company’s financial statements—the balance sheet, income statement, and cash flow statement—provides a comprehensive picture of its financial health and performance. The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The income statement reports its revenues, expenses, and profits over a period. The cash flow statement tracks the movement of cash into and out of the company. By comparing these statements over several periods, investors can identify trends and assess the company’s financial stability and growth prospects.

- Balance Sheet Analysis: Examine the company’s assets, liabilities, and equity to assess its financial position. Look for trends in working capital, debt levels, and equity growth.

- Income Statement Analysis: Analyze revenue growth, profit margins, and expense trends to evaluate the company’s profitability and operational efficiency.

- Cash Flow Statement Analysis: Assess the company’s cash flow from operating, investing, and financing activities. This helps determine its ability to generate cash and meet its financial obligations.

Summary

Mastering stock market analysis tools is a journey, not a destination. While this guide provides a robust foundation, continuous learning and adaptation are crucial. Remember that no tool guarantees success, and risk management remains paramount. By combining a thorough understanding of fundamental and technical analysis, leveraging reliable data sources, and employing responsible risk management strategies, investors can significantly enhance their decision-making process and navigate the dynamic landscape of the stock market with greater confidence and potentially, greater returns. Consistent practice and a willingness to learn from both successes and setbacks are essential components of long-term success.

FAQ

What are the ethical considerations when using stock market analysis tools?

Ethical considerations include avoiding insider trading, ensuring data accuracy and transparency, and responsible risk management to protect investors’ capital. Avoid relying solely on automated systems without understanding the underlying logic and potential biases.

How often should I review my stock market analysis?

Frequency depends on your investment strategy and market volatility. Regular monitoring, at least weekly or monthly, is advisable to track performance and adjust strategies as needed. More frequent monitoring might be necessary during periods of high market volatility.

What is the role of human judgment in stock market analysis?

While tools provide valuable data and insights, human judgment remains crucial. Tools should augment, not replace, your understanding of market dynamics, economic factors, and company-specific information. Critical thinking is essential to interpret data and make informed decisions.