Navigating the complexities of the stock market requires a keen understanding of various forecasting techniques. From the fundamental analysis of a company’s financial health to the intricate patterns revealed through technical charting, investors employ a diverse arsenal of tools to predict future market movements. This exploration delves into the core methodologies, examining their strengths, weaknesses, and practical applications in formulating informed investment strategies.

Understanding these techniques is crucial for both novice and experienced investors. This guide will cover fundamental analysis, focusing on key financial ratios and valuation metrics; technical analysis, including chart patterns and indicators; quantitative analysis, employing statistical models and predictive algorithms; sentiment analysis, leveraging news and social media data; and finally, methods for predicting and managing market volatility. By understanding these approaches, investors can build a more robust and informed investment strategy.

Fundamental Analysis

Fundamental analysis is a method of evaluating a security by examining related economic and financial factors. It attempts to measure the intrinsic value of a security by examining related economic and financial factors. This contrasts with technical analysis, which focuses on price and volume data to identify trends. Successful fundamental analysis requires a deep understanding of financial statements and industry dynamics.

Key Financial Ratios in Fundamental Analysis

Several key financial ratios are crucial for evaluating a company’s financial health and forecasting its future performance. These ratios provide insights into profitability, liquidity, solvency, and efficiency. Analyzing these ratios in conjunction with each other provides a more comprehensive picture than any single ratio in isolation.

- Profitability Ratios: These ratios assess a company’s ability to generate profits. Examples include Gross Profit Margin (Gross Profit / Revenue), Net Profit Margin (Net Income / Revenue), and Return on Equity (Net Income / Shareholder Equity). A higher margin generally indicates better profitability.

- Liquidity Ratios: These ratios measure a company’s ability to meet its short-term obligations. Key examples include Current Ratio (Current Assets / Current Liabilities) and Quick Ratio ((Current Assets – Inventory) / Current Liabilities). A ratio above 1 generally suggests sufficient liquidity.

- Solvency Ratios: These ratios evaluate a company’s ability to meet its long-term obligations. Important examples are the Debt-to-Equity Ratio (Total Debt / Shareholder Equity) and Interest Coverage Ratio (Earnings Before Interest and Taxes (EBIT) / Interest Expense). Lower ratios often indicate better solvency.

- Efficiency Ratios: These ratios assess how effectively a company utilizes its assets. Examples include Inventory Turnover (Cost of Goods Sold / Average Inventory) and Asset Turnover (Revenue / Average Total Assets). Higher turnover generally indicates more efficient asset utilization.

Interpreting Financial Statements for Forecasting

Analyzing a company’s balance sheet, income statement, and cash flow statement is essential for forecasting. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. The income statement shows a company’s revenues, expenses, and profits over a period. The cash flow statement tracks the movement of cash both into and out of the company.

- Balance Sheet: Examining trends in current and long-term assets and liabilities helps to assess liquidity and solvency. Changes in working capital can indicate potential future cash flow issues or opportunities.

- Income Statement: Analyzing revenue growth, cost structure, and profit margins provides insights into a company’s profitability and competitive position. Consistent revenue growth and improving margins are positive signs.

- Cash Flow Statement: This statement is critical for understanding a company’s cash generation capabilities. Strong operating cash flow is a crucial indicator of financial health and ability to fund future investments and debt repayment.

Examples of Companies with Strong Fundamentals

Companies like Johnson & Johnson (JNJ) and Coca-Cola (KO) are often cited as having strong fundamentals. JNJ’s diversified healthcare portfolio and consistent dividend payouts demonstrate financial stability. Coca-Cola’s global brand recognition and strong cash flows suggest long-term growth potential. These companies’ stock prices often reflect their solid financial positions. However, it’s important to remember that past performance is not indicative of future results.

Comparing Valuation Metrics

Different valuation metrics provide different perspectives on a company’s worth. The Price-to-Earnings (P/E) ratio compares a company’s stock price to its earnings per share. The Price-to-Earnings-to-Growth (PEG) ratio adjusts the P/E ratio for the company’s growth rate. Discounted Cash Flow (DCF) analysis estimates a company’s intrinsic value based on its projected future cash flows.

- P/E Ratio: A high P/E ratio might suggest the market expects high future growth, but it could also indicate overvaluation. A low P/E ratio might suggest undervaluation or lower growth prospects.

- PEG Ratio: This ratio helps to normalize the P/E ratio by considering growth. A PEG ratio of 1 is often considered fair value, while a ratio below 1 might suggest undervaluation.

- Discounted Cash Flow (DCF): DCF analysis is a more complex valuation method that requires forecasting future cash flows and discounting them back to their present value. It provides a more comprehensive valuation but is highly sensitive to assumptions.

Hypothetical Portfolio Based on Fundamental Analysis

A hypothetical portfolio built solely on fundamental analysis might include:

- Johnson & Johnson (JNJ): Selected for its strong balance sheet, consistent dividend payments, and diversified business model.

- Microsoft (MSFT): Selected for its dominant market position in software and cloud computing, strong cash flows, and growth potential.

- Procter & Gamble (PG): Selected for its portfolio of well-established consumer brands, stable earnings, and defensive characteristics.

The selection criteria prioritize companies with strong balance sheets, consistent profitability, and sustainable competitive advantages. The rationale is to invest in companies with a high probability of long-term growth and stability. This is a simplified example and does not constitute investment advice. Thorough due diligence is always necessary before making any investment decisions.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis focuses solely on price and volume data to predict future price movements. It assumes that all factors affecting the price of a security are already reflected in its price chart, making historical price data a valuable tool for forecasting.

Chart Patterns

Chart patterns are visually identifiable formations on price charts that suggest potential future price movements. Identifying these patterns requires practice and experience in interpreting price action. These patterns are often used to identify potential entry and exit points for trades, and can help traders to gauge the strength and direction of a trend.

- Head and Shoulders: This bearish reversal pattern resembles a head with two shoulders. A break below the neckline (a trendline connecting the lows of the two shoulders) is typically considered a bearish signal, suggesting a potential price decline.

- Double Tops/Bottoms: A double top is a bearish reversal pattern where the price reaches a high twice, failing to break above the previous high. Conversely, a double bottom is a bullish reversal pattern where the price reaches a low twice, failing to break below the previous low. A break above (double top) or below (double bottom) the neckline suggests a potential change in trend.

- Triangles: Triangles are continuation patterns that often represent a period of consolidation before a breakout. Symmetrical triangles, ascending triangles, and descending triangles are common variations, each with its own implications for potential price movements. A break above the upper trendline (ascending triangle or symmetrical triangle) is typically bullish, while a break below the lower trendline (descending triangle or symmetrical triangle) is typically bearish.

Technical Indicators

Technical indicators are mathematical calculations based on price and volume data that provide traders with signals about potential market trends. They are often used in conjunction with chart patterns to confirm trading signals and manage risk.

- Moving Averages: Moving averages smooth out price fluctuations and highlight trends. Common types include simple moving averages (SMA) and exponential moving averages (EMA). Crossovers between different moving averages (e.g., a short-term MA crossing above a long-term MA) can signal potential buy or sell opportunities.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 are often considered overbought, suggesting a potential price correction, while readings below 30 are often considered oversold, suggesting a potential price rebound.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. Crossovers of the MACD line and signal line, as well as divergences between the MACD and price, can signal potential changes in trend.

Support and Resistance Levels

Support levels are price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are price points where selling pressure is expected to outweigh buying pressure, preventing further price increases. These levels are often identified by observing previous price highs and lows, as well as through the use of technical indicators. A break above resistance or below support can often signal a significant change in trend. For example, if a stock consistently finds support at $50, a break below that level might signal a potential downward trend.

Technical Analysis Methodologies

Different methodologies exist within technical analysis.

- Candlestick Charting: Candlestick charts provide a visual representation of price movements over a specific period, including open, high, low, and closing prices. The patterns formed by the candlesticks can offer insights into market sentiment and potential future price movements. For example, a “hammer” candlestick pattern is often interpreted as a bullish reversal signal.

- Elliott Wave Theory: This theory suggests that market prices move in specific patterns (waves) that can be used to predict future price movements. It is based on the idea that market psychology drives price movements in a cyclical manner. However, its complexity and subjective interpretation limit its widespread adoption.

Hypothetical Trading Strategy

This hypothetical strategy uses a combination of moving averages and RSI.

Entry Point: Buy when the 50-day SMA crosses above the 200-day SMA and the RSI is below 30. This suggests a bullish crossover with an oversold condition.

Exit Point: Sell when the 50-day SMA crosses below the 200-day SMA or the RSI reaches 70. This suggests a bearish crossover or an overbought condition.

Risk Management: Use stop-loss orders to limit potential losses. For example, place a stop-loss order at 10% below the entry price. Diversify investments to avoid overexposure to any single security.

Quantitative Analysis

Quantitative analysis leverages mathematical and statistical models to forecast stock market movements. Unlike fundamental or technical analysis, which rely on qualitative factors or chart patterns, quantitative analysis uses historical data to identify patterns and predict future price behavior. This approach is particularly favored by hedge funds and institutional investors who manage large portfolios and require sophisticated analytical tools.

Statistical Models in Stock Market Forecasting

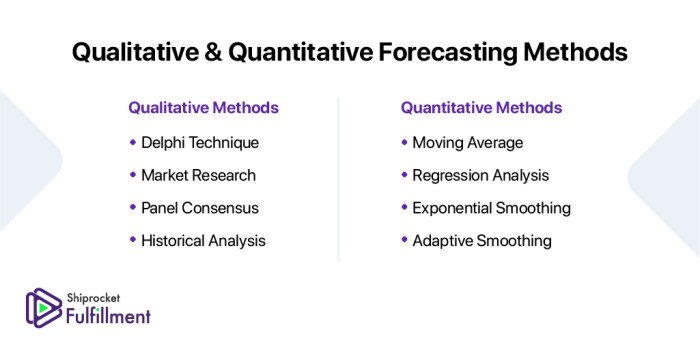

Regression analysis and time series analysis are two prominent statistical models used in quantitative stock market forecasting. Regression analysis seeks to establish relationships between a dependent variable (e.g., stock price) and one or more independent variables (e.g., earnings per share, interest rates). Time series analysis, on the other hand, focuses on the temporal dependencies within a single variable, modeling the stock price’s evolution over time. These models allow analysts to identify trends, seasonality, and other patterns that can be used to make predictions. For instance, a regression model might predict future stock prices based on historical earnings growth, while a time series model might forecast volatility using past price fluctuations.

Building a Predictive Model Using Historical Stock Price Data

Constructing a quantitative predictive model involves several steps. First, relevant historical data must be gathered, including stock prices, trading volume, and potentially other macroeconomic indicators. This data is then cleaned and prepared for analysis, handling missing values and outliers. Next, an appropriate statistical model is selected, based on the data characteristics and the forecasting goal. The model is then calibrated using a portion of the historical data, and its performance is evaluated using metrics such as mean squared error or R-squared. Finally, the model is used to generate forecasts for future periods. The process requires iterative refinement, testing different models and parameters to optimize predictive accuracy.

Examples of Quantitative Strategies

Hedge funds and institutional investors employ a range of quantitative strategies. Pairs trading, for example, involves identifying two stocks with historically correlated prices. When their prices diverge, the strategy suggests buying the undervalued stock and shorting the overvalued one, anticipating a price convergence. Mean reversion strategies exploit the tendency of asset prices to revert to their historical averages. These strategies often involve identifying stocks trading below their average and buying them, expecting a price increase. Factor-based investing identifies specific factors (e.g., value, momentum, size) that are associated with higher returns and constructs portfolios based on these factors.

Comparison of Quantitative Approaches

Different quantitative approaches possess varying strengths and weaknesses. Regression models, while relatively simple to implement, can be limited by the accuracy of the assumed relationships between variables. Time series models, on the other hand, are better suited for capturing temporal dependencies but can be sensitive to model misspecification. The choice of the most appropriate model depends on the specific forecasting problem and the characteristics of the available data. For example, a simple moving average model might be sufficient for short-term forecasts, while more complex models like ARIMA or GARCH might be necessary for longer-term predictions or volatility forecasting.

A Simple Quantitative Model for Stock Price Prediction

This example demonstrates a simple linear regression model to predict the future price of a specific stock. The model uses historical closing prices and trading volume as predictors.

| Parameter | Description | Data Source | Calculation Method |

|---|---|---|---|

| Dependent Variable (Y) | Future Stock Price | Historical Stock Data | Predicted using the regression equation |

| Independent Variable 1 (X1) | Current Stock Price | Historical Stock Data | Directly from historical data |

| Independent Variable 2 (X2) | Trading Volume | Historical Stock Data | Directly from historical data |

| Regression Coefficients (β0, β1, β2) | Intercept and slopes of the regression line | Regression Analysis | Estimated using Ordinary Least Squares (OLS) |

| Regression Equation | Y = β0 + β1*X1 + β2*X2 | Regression Analysis | Derived from OLS estimation |

Sentiment Analysis

Sentiment analysis plays a crucial role in stock market forecasting by providing insights into the overall market mood and investor expectations. By analyzing textual data from various sources, we can gauge whether the prevailing sentiment is bullish (positive), bearish (negative), or neutral, offering a valuable complementary perspective to traditional quantitative and qualitative methods. This approach leverages the power of natural language processing (NLP) to decipher the emotional tone within vast quantities of text.

Sentiment analysis draws upon news articles, social media posts, financial blogs, and even company press releases to understand the collective opinion surrounding specific stocks or the broader market. The underlying assumption is that market movements are, at least partially, driven by investor psychology and collective sentiment. A predominantly positive sentiment can indicate potential upward pressure on prices, while negative sentiment may foreshadow a decline. However, it’s crucial to remember that sentiment is just one piece of the puzzle and should be used in conjunction with other forecasting techniques for a more comprehensive picture.

Sources of Sentiment Data and Their Use

News articles provide a structured and often professional perspective on market events and company performance. Social media platforms, on the other hand, offer a more immediate and less filtered reflection of public opinion, encompassing a wider range of viewpoints, from professional analysts to individual investors. Financial blogs and forums provide a blend of both professional and amateur insights, potentially highlighting emerging trends or sentiments that may not be reflected in mainstream news. Effective sentiment analysis involves carefully selecting data sources based on the specific investment objective and understanding the potential biases inherent in each. For instance, analyzing only positive news articles could lead to an overly optimistic forecast.

Natural Language Processing (NLP) Techniques in Sentiment Analysis

Natural Language Processing (NLP) techniques are essential for automatically analyzing large volumes of textual data and extracting sentiment. These techniques typically involve several steps: data cleaning (removing irrelevant characters, handling slang), text preprocessing (tokenization, stemming, lemmatization), feature extraction (creating numerical representations of words or phrases), and sentiment classification (using machine learning algorithms to categorize text as positive, negative, or neutral). Common NLP techniques include lexicon-based approaches (using pre-defined dictionaries of words and their associated sentiment scores) and machine learning approaches (training algorithms on labeled datasets of text to predict sentiment). The choice of NLP technique depends on factors such as the size and nature of the data, the desired level of accuracy, and computational resources available.

Sentiment Analysis Integration with Other Forecasting Methods

Sentiment analysis is most effective when integrated with other forecasting methods. For example, combining sentiment scores with technical indicators (such as moving averages or relative strength index) can provide a more robust signal for trading decisions. A strong bullish sentiment combined with a positive technical indicator may suggest a higher probability of price appreciation. Similarly, integrating sentiment analysis with fundamental analysis can help assess the market’s reaction to a company’s earnings report or other significant events. A positive earnings surprise might be amplified if the overall market sentiment is also positive, leading to a more significant price increase.

Comparison of Sentiment Analysis Approaches

Different sentiment analysis approaches have varying levels of accuracy and complexity. Lexicon-based approaches are relatively simple to implement but may be less accurate due to the limitations of pre-defined dictionaries. Machine learning approaches, particularly deep learning models, can achieve higher accuracy but require large labeled datasets for training and significant computational resources. The choice of approach depends on the specific needs and resources available. Furthermore, hybrid approaches, combining lexicon-based and machine learning methods, can leverage the strengths of both to improve overall accuracy.

Hypothetical Scenario: Sentiment Analysis Informs Trading Decision

Imagine a scenario where a trader is considering investing in a technology company, “InnovateTech,” whose stock price has recently experienced a period of stagnation. The trader decides to employ sentiment analysis to inform their trading decision.

* Data Collection: The trader gathers news articles, social media posts (Twitter, Reddit), and financial blog comments related to InnovateTech and the broader technology sector.

* Data Preprocessing: The collected data is cleaned and preprocessed using NLP techniques. This involves removing irrelevant information, converting text to lowercase, and handling slang and abbreviations.

* Sentiment Analysis: A machine learning model, trained on a large dataset of financial news and social media posts, is used to analyze the preprocessed data and assign sentiment scores (positive, negative, or neutral) to each piece of text.

* Aggregation and Interpretation: The individual sentiment scores are aggregated to obtain an overall sentiment score for InnovateTech. The trader also analyzes the sentiment trends over time to identify any shifts in market opinion.

* Integration with Other Methods: The sentiment score is then combined with a technical analysis of InnovateTech’s price chart (looking for patterns like support and resistance levels) and fundamental analysis of the company’s financial performance.

* Trading Decision: Based on the combined analysis, the trader determines that the sentiment towards InnovateTech is increasingly positive, coupled with positive technical indicators, and strong fundamentals. This leads to a decision to invest in InnovateTech, expecting a price increase.

Predicting Market Volatility

Market volatility, the degree to which market prices fluctuate, is a crucial factor for investors and traders. Understanding and predicting volatility allows for more informed decision-making, risk management, and potentially higher returns. Accurately forecasting volatility, however, remains a challenging task due to the complex interplay of numerous factors.

Key Factors Contributing to Market Volatility

Several interconnected factors contribute to market volatility. Economic data releases, such as unexpectedly high inflation figures or disappointing employment reports, can trigger significant price swings. Geopolitical events, including wars, political instability, and international trade disputes, also introduce considerable uncertainty into the market. Changes in monetary policy, such as interest rate hikes or quantitative easing programs implemented by central banks, influence investor sentiment and market behavior. Furthermore, investor psychology and market sentiment, often driven by news headlines and social media trends, can amplify existing volatility or create new fluctuations. Finally, unexpected corporate announcements, such as earnings surprises or mergers and acquisitions, can significantly impact individual stock prices and broader market trends.

Utilizing Volatility Indicators

The VIX index, often referred to as the “fear gauge,” is a widely used measure of market volatility based on S&P 500 index options prices. A higher VIX indicates higher expected volatility, suggesting investors anticipate greater price fluctuations in the near future. While the VIX doesn’t directly predict future volatility, it provides valuable insights into current market sentiment and helps gauge the potential for significant price swings. Other volatility indicators exist, focusing on specific assets or markets, offering diverse perspectives on anticipated price fluctuations. For example, some indicators might track volatility in specific sectors, like technology or energy, allowing for more targeted risk management strategies.

Strategies for Hedging Against Market Volatility

Hedging involves employing strategies to mitigate potential losses stemming from market volatility. One common approach is using options contracts. Buying put options, which grant the right but not the obligation to sell an asset at a specific price, acts as insurance against price declines. Similarly, diversification across different asset classes (stocks, bonds, real estate) reduces the overall impact of volatility in any single asset. Diversification reduces the concentration of risk, minimizing the effect of a downturn in one area on the overall portfolio performance. Another strategy involves investing in low-volatility assets, such as government bonds, which tend to exhibit less price fluctuation than equities during volatile periods. These provide a degree of stability to the portfolio during periods of market uncertainty.

Risk Management Approaches in Volatile Markets

Managing risk in volatile markets requires a multi-faceted approach. Conservative investment strategies, such as dollar-cost averaging (investing a fixed amount at regular intervals), reduce the impact of buying high during market peaks. Stop-loss orders automatically sell an asset when it reaches a predetermined price, limiting potential losses. Portfolio rebalancing, adjusting asset allocations to maintain a target distribution, helps manage risk by taking profits from overperforming assets and reinvesting in underperforming ones. Thorough due diligence, including fundamental and technical analysis, is crucial for making informed investment decisions and assessing risk exposure. Sophisticated risk models, often employed by institutional investors, incorporate various factors to assess and quantify risk.

Estimating Future Volatility Using Historical Data

Historical volatility data can be used to estimate future volatility using statistical methods. A common approach involves calculating the standard deviation of historical price returns over a specific period (e.g., the past 20 days, 50 days, or 200 days). This standard deviation represents the historical volatility. Assuming volatility follows a random walk, or a similar model, this historical volatility can be used as an estimate for future volatility. However, it’s crucial to acknowledge that this is just an estimate and doesn’t guarantee future performance. More sophisticated models, such as GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models, can account for changing volatility patterns over time, offering more accurate forecasts. A hypothetical chart depicting volatility levels over time would show periods of high volatility represented by tall peaks and periods of low volatility represented by low troughs. The pattern would likely show clustering, where periods of high volatility tend to be followed by more high volatility, and vice versa. The chart might also illustrate the limitations of simply using recent historical data to predict future volatility, as significant events can dramatically alter the volatility landscape.

Ultimate Conclusion

Mastering stock market forecasting is a continuous journey of learning and adaptation. While no method guarantees perfect predictions, a comprehensive understanding of fundamental, technical, quantitative, and sentiment analysis, coupled with effective volatility management, significantly enhances the probability of successful investment outcomes. By combining these techniques and continuously refining one’s approach, investors can navigate the market’s inherent uncertainties with greater confidence and potentially achieve their financial goals.

Essential FAQs

What is the difference between fundamental and technical analysis?

Fundamental analysis focuses on a company’s intrinsic value based on its financial statements and economic factors, while technical analysis uses price charts and indicators to identify trends and predict future price movements.

How accurate are stock market forecasting techniques?

No forecasting technique guarantees accuracy. Market behavior is influenced by numerous unpredictable factors. These techniques aim to improve the probability of successful outcomes, not provide certainty.

Can I use these techniques for short-term or long-term investing?

Both. Fundamental analysis is often better suited for long-term investments, while technical analysis can be used for both short-term and long-term strategies. Quantitative and sentiment analysis can be adapted to various time horizons.

What are the risks involved in using these techniques?

All investment strategies involve risk. Misinterpreting data, relying solely on one technique, and neglecting risk management can lead to significant losses. Diversification and careful risk assessment are crucial.