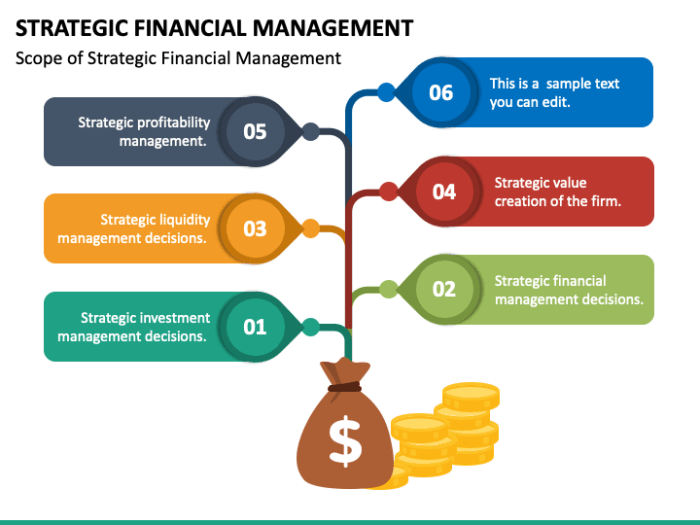

Strategic financial management is the art and science of aligning a company’s financial resources with its overarching strategic goals. It’s not just about crunching numbers; it’s about making informed decisions that drive growth, profitability, and long-term sustainability. This involves a holistic approach, encompassing everything from forecasting future performance to managing risk and making crucial investment choices.

This guide delves into the core principles of strategic financial management, exploring key areas such as financial planning, capital budgeting, working capital management, and financing decisions. We’ll examine various techniques and strategies, providing practical examples and insights to help you navigate the complexities of financial decision-making within a strategic framework. The ultimate aim is to equip you with the knowledge and tools to make sound financial decisions that contribute to your organization’s success.

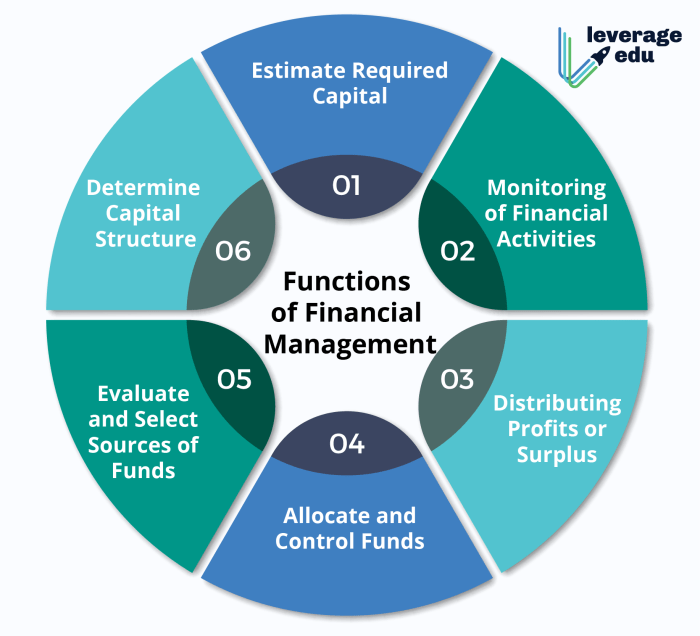

Defining Strategic Financial Management

Strategic financial management is the process of aligning a company’s financial resources with its overall strategic goals. It’s not just about managing day-to-day finances; it’s about making long-term financial decisions that drive sustainable growth and profitability. This involves a proactive approach to financial planning, anticipating future challenges and opportunities, and ensuring the financial health of the organization supports its strategic ambitions.

Strategic financial management operates on several core principles. These include maximizing shareholder value, optimizing capital structure, managing risk effectively, and ensuring financial flexibility. Maximizing shareholder value acts as the overarching goal, guiding decisions towards actions that increase the company’s worth for its investors. Optimizing capital structure involves finding the right balance between debt and equity financing to minimize the cost of capital. Effective risk management identifies and mitigates potential threats to the financial stability of the organization, while financial flexibility ensures the company has the resources to adapt to changing market conditions.

Strategic versus Operational Financial Management

The key difference between strategic and operational financial management lies in their time horizon and focus. Operational financial management deals with the day-to-day financial activities of a company, such as managing cash flow, accounts payable and receivable, and budgeting for short-term expenses. It focuses on efficiency and short-term performance. In contrast, strategic financial management takes a longer-term perspective, focusing on major financial decisions that shape the company’s future, such as mergers and acquisitions, capital investments, and long-term financing. It’s concerned with growth, profitability, and long-term value creation. A simple analogy would be a ship’s captain (strategic) charting a course versus the crew (operational) maintaining the ship’s day-to-day functions.

Examples of Strategic Financial Management’s Impact

Strategic financial management significantly impacts a company’s overall strategy. For example, a company deciding to invest heavily in research and development (R&D) requires careful strategic financial planning. This includes securing the necessary funding, assessing the potential return on investment, and managing the associated risks. Similarly, a company considering a merger or acquisition needs a thorough strategic financial analysis to evaluate the financial implications of the deal, including valuation, financing, and integration costs. Another example is a company’s decision to expand into new markets. Strategic financial management would be crucial in assessing the financial viability of this expansion, including the capital requirements, potential risks, and expected returns. Apple’s massive investment in its ecosystem, including app stores and services, is a prime example of strategic financial management impacting long-term growth.

Short-Term and Long-Term Financial Goals within a Strategic Framework

The following table compares and contrasts short-term and long-term financial goals within a strategic framework:

| Goal Type | Time Horizon | Examples | Strategic Alignment |

|---|---|---|---|

| Short-Term | Less than one year | Managing cash flow, collecting receivables, controlling expenses | Supports operational efficiency and provides resources for long-term initiatives. |

| Long-Term | More than one year | Increasing market share, expanding into new markets, improving profitability margins, acquiring other companies | Drives overall growth, profitability, and shareholder value. |

| Short-Term | Up to 3 years | Improving working capital management, reducing debt, launching new products | Contributes to the foundation for long-term sustainability and growth. |

| Long-Term | 5-10 years or more | Achieving sustainable growth, maximizing shareholder value, ensuring long-term financial stability | Defines the overall direction and success of the company. |

Financial Planning and Forecasting

Effective financial planning and forecasting are cornerstones of strategic financial management, enabling businesses to navigate uncertainty, make informed decisions, and achieve their long-term objectives. A well-structured financial plan provides a roadmap for resource allocation, investment strategies, and operational efficiency, while accurate forecasting allows for proactive risk mitigation and opportunity identification. This section will delve into the process of financial planning for a hypothetical startup, explore various forecasting methods, and discuss best practices for creating realistic and achievable financial projections.

Financial Planning Process for a Hypothetical Startup

A comprehensive financial plan for a startup typically involves several key stages. First, a detailed business plan outlining the company’s mission, products or services, target market, and competitive landscape is crucial. This forms the basis for projecting revenue and expenses. Next, the startup needs to develop pro forma financial statements, including income statements, balance sheets, and cash flow statements, projecting these statements over a period of typically 3-5 years. These projections should consider various scenarios, such as best-case, worst-case, and most-likely scenarios. Finally, the plan should incorporate key performance indicators (KPIs) to track progress against targets and allow for necessary adjustments throughout the life of the business. Regular monitoring and review are essential to ensure the plan remains relevant and adaptable to changing market conditions. For example, a food truck startup might project revenue based on anticipated customer traffic, average order value, and operating days per week, while simultaneously forecasting expenses for food costs, rent, and marketing.

Forecasting Methods in Strategic Financial Management

Several forecasting methods are employed in strategic financial management, each with its strengths and limitations. Qualitative methods, such as expert opinions and market research, provide valuable insights but are subjective and less precise. Quantitative methods, on the other hand, rely on numerical data and statistical techniques for more objective predictions. These include time series analysis (e.g., moving averages, exponential smoothing), which identifies patterns in historical data to forecast future trends, and regression analysis, which establishes relationships between variables to predict outcomes. For instance, a retail company might use time series analysis to predict future sales based on past sales data, while regression analysis could be used to model the relationship between advertising spending and sales revenue. The choice of method depends on the specific context, data availability, and desired level of accuracy.

Best Practices for Developing Realistic and Achievable Financial Forecasts

Developing realistic and achievable financial forecasts requires a combination of rigorous data analysis, sound judgment, and a clear understanding of the business environment. This includes using historical data as a starting point, but also incorporating industry benchmarks and competitor analysis to inform projections. Sensitivity analysis, which examines the impact of changes in key assumptions on the forecast, is vital for identifying potential risks and opportunities. Furthermore, regular review and revision of the forecast are crucial to account for unexpected events and changing market conditions. Finally, a clear communication strategy to disseminate the forecast to relevant stakeholders ensures alignment and accountability. For example, a technology startup might incorporate market research data on the adoption rate of similar technologies to refine its revenue projections.

Potential Risks and Uncertainties Impacting Financial Forecasts

Several factors can significantly impact the accuracy of financial forecasts. It’s important to acknowledge and mitigate these risks whenever possible.

- Economic downturns: Recessions or economic slowdowns can dramatically reduce consumer spending and business investment, impacting revenue projections.

- Competitive pressures: The entry of new competitors or aggressive pricing strategies by existing competitors can negatively affect market share and profitability.

- Changes in regulations: New laws or regulations can increase operating costs or restrict business activities.

- Technological disruptions: Rapid technological advancements can render existing products or services obsolete, impacting demand and revenue.

- Natural disasters or pandemics: Unexpected events can disrupt operations and supply chains, leading to significant financial losses.

- Changes in consumer preferences: Shifts in consumer tastes and preferences can affect demand for products or services.

- Supply chain disruptions: Problems with sourcing raw materials or distributing finished goods can impact production and sales.

- Inflation and interest rate fluctuations: Changes in inflation and interest rates can affect input costs, borrowing costs, and consumer spending.

Capital Budgeting and Investment Decisions

Capital budgeting, the process of planning and managing a firm’s long-term investments, is crucial for sustainable growth and profitability. Effective capital budgeting involves evaluating potential projects, selecting those that align with strategic goals, and efficiently allocating resources. This process considers various factors, including financial projections, risk assessment, and the overall impact on the firm’s value.

Capital Budgeting Techniques

Several techniques are employed to evaluate the financial viability of capital projects. Each method offers a unique perspective, highlighting different aspects of the investment’s potential. The choice of technique often depends on the specific circumstances of the project and the firm’s overall financial strategy.

- Net Present Value (NPV): NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over a project’s life. A positive NPV indicates that the project is expected to generate more value than it costs, thus adding to shareholder wealth. It’s considered a superior method because it directly measures the increase in firm value.

- Internal Rate of Return (IRR): IRR is the discount rate that makes the NPV of a project equal to zero. It represents the project’s expected rate of return. A project is accepted if its IRR exceeds the firm’s cost of capital. While intuitively appealing, IRR can lead to ambiguous results in certain situations, such as mutually exclusive projects with differing scales.

- Payback Period: This method determines the time it takes for a project’s cumulative cash inflows to equal its initial investment. It’s simple to understand and calculate, but it ignores the time value of money and cash flows beyond the payback period, potentially overlooking profitable long-term projects.

- Discounted Payback Period: This addresses the limitation of the traditional payback period by incorporating the time value of money. It calculates the time it takes for the discounted cash inflows to equal the initial investment. While an improvement, it still ignores cash flows beyond the discounted payback period.

- Profitability Index (PI): The PI is the ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a positive NPV and suggests the project is worthwhile. It is useful for ranking projects when capital is limited.

Comparison of NPV and IRR

NPV and IRR are the two most commonly used capital budgeting techniques. While both aim to assess project profitability, they differ in their approach and interpretation.

| Feature | NPV | IRR |

|---|---|---|

| Definition | Present value of cash flows minus initial investment | Discount rate that makes NPV zero |

| Decision Rule | Accept if NPV > 0 | Accept if IRR > cost of capital |

| Scale Independence | Yes | No |

| Multiple IRRs | No | Possible |

| Ranking Mutually Exclusive Projects | Always consistent | May lead to inconsistencies |

Factors in Investment Opportunity Evaluation

Evaluating investment opportunities requires a holistic approach, considering several key factors beyond purely financial metrics.

- Strategic Fit: Does the project align with the company’s overall strategic goals and objectives?

- Risk Assessment: What are the potential risks associated with the project, and how can they be mitigated?

- Financial Projections: Are the projected cash flows realistic and supported by sound assumptions?

- Market Analysis: Is there sufficient market demand for the project’s output?

- Competitive Landscape: What is the competitive intensity in the relevant market?

- Management Expertise: Does the company have the necessary expertise to manage the project successfully?

- Environmental and Social Impact: What are the potential environmental and social impacts of the project?

Sensitivity Analysis in Capital Budgeting

Sensitivity analysis is a valuable tool for assessing the impact of uncertainty on a project’s profitability. It involves systematically changing key input variables (e.g., sales volume, unit cost, discount rate) to observe their effect on the NPV or IRR. For example, if a project’s NPV is highly sensitive to changes in sales volume, it suggests that the project carries a significant level of market risk. This information helps managers make informed decisions and develop contingency plans. A simple example would be analyzing how a 10% increase or decrease in projected sales impacts the NPV of a new product launch. A large negative impact highlights the importance of achieving sales targets.

Working Capital Management

Effective working capital management is crucial for a company’s financial health and overall strategic success. It ensures the smooth operation of daily business activities while providing the flexibility to seize growth opportunities. Poor working capital management, on the other hand, can lead to liquidity problems, hindering a company’s ability to meet its short-term obligations and potentially jeopardizing its long-term goals.

Efficient working capital management directly contributes to achieving strategic goals by optimizing resource allocation, enhancing profitability, and mitigating financial risks. By effectively managing current assets and liabilities, a company can improve its cash flow, reduce financing costs, and strengthen its overall financial position, allowing it to pursue strategic initiatives such as expansion, innovation, or acquisitions.

Strategies for Optimizing Cash Flow and Reducing Working Capital Needs

Optimizing cash flow and reducing working capital needs involves a multifaceted approach focusing on both increasing cash inflows and decreasing cash outflows. Strategies include improving forecasting accuracy to better anticipate cash needs, negotiating favorable payment terms with suppliers to extend payment periods, and implementing robust accounts receivable management to accelerate collections from customers. Furthermore, efficient inventory management and optimized production scheduling can significantly reduce working capital tied up in inventory. Effective cost control measures across all areas of the business also play a crucial role.

Effective Inventory Management Strategies

Effective inventory management minimizes costs and maximizes efficiency by striking a balance between meeting customer demand and avoiding excessive inventory holding. Strategies include implementing a robust inventory control system, using forecasting techniques to predict demand accurately, employing Just-in-Time (JIT) inventory systems to minimize storage costs and reduce waste, and regularly reviewing inventory levels to identify slow-moving or obsolete items. For example, a retail company might use point-of-sale data to predict demand for specific products, allowing them to optimize their inventory levels and reduce storage costs associated with overstocking. Similarly, a manufacturing company might implement a Kanban system to signal the need for replenishment of raw materials, ensuring a smooth and efficient production process.

Improving Accounts Receivable and Payable Management

Efficient management of accounts receivable and payable is essential for optimizing cash flow. Improving accounts receivable management involves establishing clear credit policies, promptly invoicing customers, and implementing efficient collection procedures, including automated reminders and follow-up calls. Strategies for improving accounts payable management include negotiating favorable payment terms with suppliers, taking advantage of early payment discounts when financially feasible, and centralizing payment processing to improve efficiency and control.

| Area | Improvement Strategy | Example | Benefit |

|---|---|---|---|

| Accounts Receivable | Implement automated invoicing and payment reminders | Using accounting software to automatically send invoices and follow-up emails | Reduced days sales outstanding (DSO) |

| Accounts Payable | Negotiate extended payment terms with suppliers | Agreeing to a 30-day payment term instead of 15 days | Improved cash flow |

| Inventory | Implement Just-in-Time (JIT) inventory management | Ordering materials only when needed for production | Reduced storage costs and minimized waste |

| Cash Management | Centralize cash management and utilize cash forecasting | Using a centralized treasury management system | Improved visibility and control of cash flow |

Financing Decisions and Capital Structure

Effective financing is crucial for a firm’s success, directly impacting its growth trajectory and overall value. The choices made regarding the sources and mix of funding – a company’s capital structure – significantly influence its financial health and risk profile. Understanding these decisions is paramount for strategic financial management.

Sources of Business Financing

Businesses have access to a variety of financing options, each with its own advantages and disadvantages. The choice depends on factors such as the company’s size, stage of development, risk tolerance, and the nature of the project being funded.

- Debt Financing: This involves borrowing money that must be repaid with interest. Sources include bank loans, bonds, and commercial paper. Debt financing offers tax advantages because interest payments are often tax-deductible. However, it increases financial leverage and the risk of default.

- Equity Financing: This involves selling ownership shares in the company. Sources include issuing common stock or preferred stock, or seeking venture capital or private equity investments. Equity financing doesn’t require repayment, but it dilutes ownership and may require sharing profits with investors.

- Internal Financing: This leverages the company’s own resources, such as retained earnings or cash flow. It avoids external debt or equity obligations, but limits growth potential based on available internal funds.

- Hybrid Financing: This combines elements of debt and equity financing. Convertible bonds, for example, are debt instruments that can be converted into equity under certain conditions. This provides flexibility for both the issuer and the investor.

Debt Financing versus Equity Financing

Debt and equity financing represent distinct approaches to raising capital, each with a unique impact on a firm’s financial structure and risk profile.

| Feature | Debt Financing | Equity Financing |

|---|---|---|

| Ownership | No change in ownership | Dilution of ownership |

| Repayment | Mandatory repayment with interest | No mandatory repayment |

| Tax Implications | Interest payments are usually tax-deductible | Dividends may be taxed |

| Risk | Higher financial risk (default risk) | Lower financial risk (no repayment obligation) |

| Control | No loss of control | Potential loss of control depending on the level of equity financing |

Optimal Capital Structure and Firm Value

The optimal capital structure is the mix of debt and equity financing that maximizes a firm’s value. This is often represented as the point where the cost of capital is minimized. The trade-off between debt and equity involves balancing the tax benefits of debt with the increased financial risk associated with higher leverage. A higher proportion of debt can lead to higher returns for shareholders but also increases the risk of bankruptcy. The optimal capital structure varies depending on industry, firm size, and market conditions. The Modigliani-Miller theorem, while offering a theoretical framework, is often modified in practice to account for factors such as taxes, bankruptcy costs, and agency costs.

The optimal capital structure balances the tax shield benefits of debt with the costs of financial distress.

Financing Strategy for Rapid Expansion

A company aiming for rapid expansion needs a robust financing strategy that supports aggressive growth while managing risk. This often involves a multi-faceted approach.

- Secured Debt Financing: Securing loans using assets as collateral can reduce borrowing costs and increase access to capital. This could involve taking out a term loan or a line of credit secured by real estate or equipment.

- Strategic Equity Partnerships: Partnering with investors who bring not only capital but also industry expertise and networks can be beneficial. This could involve attracting venture capital or private equity funding.

- Internal Funding Optimization: Improving operational efficiency and cash flow management to maximize internally generated funds. This may involve implementing lean manufacturing techniques or improving inventory management.

- Phased Funding Approach: Securing funding in stages, starting with smaller amounts to test the market and prove the business model, before seeking larger investments as the company scales. This approach mitigates risk and allows for adjustments based on performance.

For example, a technology startup aiming for rapid expansion might initially secure seed funding from angel investors, followed by Series A and B funding from venture capitalists as it progresses through various stages of development. As the company matures and achieves profitability, it may transition to debt financing or an IPO to fuel further growth.

Performance Measurement and Evaluation

Effective performance measurement and evaluation are crucial for ensuring that a company’s financial strategies are achieving their intended goals. By tracking key metrics and analyzing their trends, businesses can identify areas of strength and weakness, make informed decisions, and ultimately enhance their overall financial health. This section will explore key performance indicators (KPIs), evaluation methods, and the use of financial ratios for assessing financial health.

Key Performance Indicators (KPIs) in Strategic Financial Management

Strategic financial management relies on a range of KPIs to monitor progress towards strategic objectives. These indicators provide a quantifiable measure of performance across various aspects of the business. Selection of KPIs should align with the specific strategic goals of the organization. Examples include Return on Investment (ROI), Return on Equity (ROE), Earnings Per Share (EPS), and Net Profit Margin. These metrics provide insights into profitability, efficiency, and shareholder value creation. Other important KPIs might encompass liquidity ratios (like the current ratio and quick ratio), leverage ratios (debt-to-equity ratio), and activity ratios (inventory turnover). The choice of KPIs will depend on the industry, company size, and strategic focus.

Methods for Evaluating the Effectiveness of Financial Strategies

Evaluating the effectiveness of financial strategies involves a multi-faceted approach. One common method is variance analysis, comparing actual results against budgeted or forecasted figures. This helps identify deviations and pinpoint areas requiring attention. Benchmarking, comparing performance against industry peers or best-in-class companies, provides a valuable external perspective. Sensitivity analysis, examining the impact of changes in key variables on financial outcomes, helps assess risk and uncertainty. Post-implementation reviews, conducted after a strategy has been implemented, offer critical feedback on its success and areas for improvement. These evaluations should be regularly conducted to ensure strategies remain aligned with evolving business conditions and objectives.

Using Financial Ratios to Assess a Company’s Financial Health

Financial ratios provide a concise summary of a company’s financial position and performance. Analyzing these ratios allows for a comprehensive assessment of various aspects of financial health. For example, a high current ratio (current assets/current liabilities) indicates strong short-term liquidity, while a low debt-to-equity ratio suggests a conservative capital structure. A high inventory turnover ratio implies efficient inventory management, whereas a low profit margin may signal pricing or cost issues. By comparing ratios over time and against industry benchmarks, analysts can identify trends and potential problems. For instance, a consistently declining profit margin could indicate a need for cost-cutting measures or a review of pricing strategies.

Dashboard Illustrating Key Financial Metrics and Their Trends

The following dashboard provides a visual representation of key financial metrics and their trends over a three-year period (hypothetical data):

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Profit Margin (%) | 10% | 12% | 15% |

| Return on Equity (%) | 15% | 18% | 20% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.3 |

| Current Ratio | 2.0 | 2.2 | 2.5 |

This dashboard demonstrates a positive trend in profitability (Net Profit Margin and ROE) and improved financial leverage (Debt-to-Equity Ratio) and liquidity (Current Ratio) over the three-year period. Such a dashboard allows for quick identification of performance trends and facilitates informed decision-making.

Risk Management and Financial Control

Effective risk management and robust financial controls are crucial for the long-term health and sustainability of any business. Ignoring these aspects can lead to significant financial losses, reputational damage, and even business failure. This section explores various financial risks, mitigation strategies, and the implementation of internal controls to prevent errors and fraud.

Types of Financial Risks

Businesses face a multitude of financial risks, broadly categorized into market risk, credit risk, liquidity risk, operational risk, and compliance risk. Market risk encompasses fluctuations in interest rates, exchange rates, and commodity prices, impacting profitability and the value of assets. Credit risk arises from the possibility of borrowers defaulting on loans or payments, leading to potential losses for lenders. Liquidity risk refers to the inability of a business to meet its short-term obligations due to insufficient cash flow. Operational risk stems from internal failures, such as system breakdowns or human error, while compliance risk involves failing to adhere to relevant laws and regulations, leading to penalties and legal issues. For example, a company heavily reliant on exporting goods faces significant market risk due to fluctuating exchange rates. A bank faces considerable credit risk from its loan portfolio. A small business with limited cash reserves might experience liquidity risk during an economic downturn.

Strategies for Mitigating Financial Risks

Several strategies can effectively mitigate financial risks. Diversification spreads investments across different asset classes to reduce the impact of losses in any single area. Hedging involves using financial instruments, such as derivatives, to offset potential losses from price fluctuations. Insurance provides protection against unforeseen events, such as property damage or liability claims. Stress testing simulates various adverse scenarios to assess the resilience of the business and identify potential vulnerabilities. For instance, a company could diversify its product portfolio to reduce reliance on a single product and minimize the impact of a potential decline in demand for that product. An airline might hedge against fuel price increases by purchasing fuel futures contracts.

The Importance of Internal Controls in Preventing Financial Fraud and Errors

Internal controls are processes and procedures designed to safeguard assets, ensure the accuracy and reliability of financial information, and promote operational efficiency. Strong internal controls act as a critical defense against financial fraud and errors, fostering trust among stakeholders and improving decision-making. They encompass various elements, including segregation of duties, authorization procedures, regular reconciliations, and independent audits. Weak internal controls create opportunities for fraud and errors, potentially leading to significant financial losses and reputational damage. For example, a lack of segregation of duties, where one person handles both cash receipts and record-keeping, creates a significant risk of embezzlement.

Implementing Effective Financial Controls

Implementing effective financial controls requires a structured approach.

- Segregation of Duties: Assign different individuals to handle authorization, custody, and record-keeping functions to prevent fraud and errors.

- Authorization Procedures: Establish clear authorization limits and procedures for all transactions to ensure that only authorized personnel can approve transactions.

- Regular Reconciliations: Regularly reconcile bank statements, accounts receivable, and accounts payable to detect discrepancies and prevent errors.

- Independent Audits: Conduct regular internal and external audits to assess the effectiveness of internal controls and identify areas for improvement.

- Physical Safeguards: Implement physical security measures to protect assets from theft or damage, such as secure storage facilities and access controls.

- Technology Controls: Utilize technology to enhance control measures, such as accounting software with built-in security features and access controls.

Implementing these controls, alongside regular training for employees on ethical conduct and financial procedures, creates a robust system that significantly reduces the risk of financial fraud and errors. For example, a company might use access control software to restrict access to sensitive financial data based on employee roles and responsibilities. Regular bank reconciliations help identify any discrepancies between the company’s records and the bank statement, allowing for prompt investigation and correction.

Mergers, Acquisitions, and Corporate Restructuring

Mergers and acquisitions (M&A) and corporate restructuring are significant strategic tools employed by companies to enhance shareholder value, achieve growth objectives, and improve operational efficiency. These actions often involve substantial financial implications and require careful planning and execution. This section will explore the financial aspects of M&A, the evaluation process for potential acquisitions, various corporate restructuring strategies, and a hypothetical merger scenario to illustrate the financial impact.

Financial Implications of Mergers and Acquisitions

Mergers and acquisitions significantly impact a company’s financial position. The combined entity’s financial statements reflect the amalgamation of assets, liabilities, revenues, and expenses from both organizations. Synergies, cost savings, and increased market share are potential benefits, leading to higher profitability and increased shareholder value. However, there are also risks, such as integration challenges, unforeseen liabilities, and potential goodwill impairment. Valuation methodologies, such as discounted cash flow analysis and comparable company analysis, are crucial in determining the fair value of the target company and the overall financial implications of the transaction. Financing the acquisition, whether through debt or equity, significantly influences the post-merger capital structure and financial risk profile. Post-merger integration costs and potential write-downs of assets also need to be considered.

Evaluating Potential Acquisition Targets

A rigorous evaluation process is critical for successful acquisitions. This involves a thorough due diligence process to assess the target company’s financial health, operational efficiency, legal compliance, and market position. Financial statement analysis, including ratio analysis and trend analysis, provides insights into the target’s profitability, liquidity, and solvency. The valuation of the target is performed using various methods, including discounted cash flow (DCF) analysis, precedent transactions, and market multiples. Furthermore, an assessment of the target’s strategic fit with the acquirer, potential synergies, and integration challenges is crucial. A comprehensive due diligence process minimizes unforeseen risks and maximizes the likelihood of a successful acquisition.

Types of Corporate Restructuring Strategies

Corporate restructuring encompasses a range of strategies aimed at improving a company’s financial health and operational efficiency. These strategies include divestitures (selling off non-core assets), spin-offs (creating independent companies from existing divisions), leveraged buyouts (acquiring a company using significant debt financing), and debt restructuring (negotiating with creditors to modify debt terms). The choice of restructuring strategy depends on the specific circumstances of the company, including its financial position, industry dynamics, and strategic goals. Each strategy has distinct financial implications, impacting the company’s capital structure, profitability, and risk profile. For example, a divestiture might lead to a reduction in debt and improved profitability, while a leveraged buyout could increase financial risk but potentially unlock value.

Hypothetical Merger Scenario and Financial Impact

Let’s consider a hypothetical merger between Company A, a large established manufacturer with strong brand recognition but limited growth opportunities, and Company B, a smaller, innovative technology company with high growth potential but limited production capacity. Company A acquires Company B for $1 billion, financing the acquisition with a combination of debt and equity. The projected synergies include increased market share, access to new technologies, and cost savings through economies of scale. However, there are also integration costs associated with merging the two organizations’ operations and systems. The initial financial impact might show increased debt levels and integration costs, but over the long term, the synergies could lead to higher revenue, profitability, and increased shareholder value. A detailed financial model would be necessary to quantify the impact on key financial metrics such as earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio. The success of the merger would depend on effective integration and the realization of projected synergies. Failure to achieve projected synergies could result in a decline in shareholder value.

International Financial Management

International financial management presents a unique set of challenges beyond those encountered in domestic operations. The complexities arise from fluctuating exchange rates, diverse regulatory environments, political risks, and varying accounting standards across different countries. Effectively navigating these complexities is crucial for multinational corporations aiming to maximize profitability and minimize risk in their global ventures.

Challenges of Managing Finances in a Global Environment

Operating in multiple countries introduces several significant challenges. Differences in legal and regulatory frameworks, including tax laws, accounting standards, and labor regulations, require careful consideration and compliance. Political instability and economic fluctuations in certain regions can drastically impact investment returns and operational efficiency. Furthermore, managing diverse currencies and hedging against exchange rate volatility is a constant concern for businesses with international operations. Communication and coordination across geographically dispersed teams also add layers of complexity to financial management. For example, a company expanding into a country with strict environmental regulations might face unexpected costs and delays if not adequately prepared for these local requirements.

Foreign Exchange Risk Management

Foreign exchange risk, or FX risk, is the potential for losses arising from fluctuations in exchange rates. Managing this risk is paramount for international businesses. Several strategies exist, including hedging using forward contracts, futures contracts, or options. Hedging aims to lock in a specific exchange rate to mitigate the impact of future rate changes. Another approach is natural hedging, which involves matching foreign currency inflows and outflows to offset exposure. For instance, a company exporting goods to Europe and receiving payment in Euros could simultaneously source materials from a European supplier, reducing its overall net exposure to Euro fluctuations. Effective FX risk management requires careful forecasting of future exchange rates and a deep understanding of the specific risks faced by the business.

Strategies for International Capital Budgeting and Investment Decisions

International capital budgeting involves evaluating investment opportunities in foreign countries. This process is more complex than domestic capital budgeting due to factors such as political risk, exchange rate fluctuations, and differing tax systems. Companies typically use discounted cash flow (DCF) analysis, adjusting for these factors. This often involves forecasting future cash flows in the local currency, converting them to the home currency using projected exchange rates, and then discounting them at a risk-adjusted rate that reflects the specific risks of the foreign investment. Sensitivity analysis is crucial to assess the impact of different exchange rate scenarios on the project’s profitability. For example, a company considering building a factory in Brazil needs to account for the potential risks of currency devaluation and political instability when evaluating the project’s feasibility.

Managing International Tax Implications

Effective management of international tax implications is crucial for minimizing tax liabilities and ensuring compliance with various tax jurisdictions. This involves understanding the tax laws and treaties in each country of operation, utilizing tax havens strategically (while complying with all regulations), and optimizing the structure of international transactions.

- Tax Treaties: Taking advantage of tax treaties between countries to reduce double taxation on income or capital gains.

- Transfer Pricing: Setting prices for goods and services transferred between related entities in different countries to minimize overall tax burden while adhering to arm’s-length principles.

- Foreign Tax Credits: Claiming foreign tax credits to offset taxes paid to foreign governments against domestic tax liabilities.

- Tax Shelters: Utilizing legitimate tax planning strategies to minimize tax exposure within the bounds of the law. This could include establishing subsidiaries in low-tax jurisdictions for specific operations.

Failure to properly manage international tax implications can lead to significant financial penalties and reputational damage. For example, a multinational corporation could face substantial fines if it fails to comply with transfer pricing regulations, resulting in accusations of tax evasion.

Last Word

Mastering strategic financial management is crucial for any organization aiming for sustainable growth and long-term prosperity. By understanding the interconnectedness of financial planning, investment decisions, risk management, and performance evaluation, businesses can optimize their resource allocation, enhance profitability, and navigate the ever-changing economic landscape. The principles Artikeld in this guide provide a solid foundation for making informed financial decisions that align with overall strategic objectives, leading to improved financial health and competitive advantage.

Commonly Asked Questions

What is the difference between strategic and operational financial management?

Strategic financial management focuses on long-term goals and overall business strategy, while operational financial management deals with day-to-day financial activities.

How can sensitivity analysis improve capital budgeting decisions?

Sensitivity analysis helps assess how changes in key variables (e.g., sales volume, costs) impact project profitability, enabling more informed investment choices.

What are some common financial risks faced by businesses?

Common risks include market risk, credit risk, liquidity risk, operational risk, and regulatory risk.

How does optimal capital structure impact firm value?

An optimal capital structure balances debt and equity financing to minimize the cost of capital and maximize firm value.