Strategic financial management is the cornerstone of any successful business, transcending mere bookkeeping to become a proactive driver of growth and sustainability. It’s about aligning financial strategies with overarching business objectives, anticipating market shifts, and making informed decisions that maximize long-term value. This involves not just understanding current financial performance, but also projecting future scenarios and adapting strategies to navigate uncertainties.

This guide explores the core principles of strategic financial management, from meticulous financial planning and forecasting to shrewd capital budgeting and effective risk mitigation. We will delve into various frameworks, explore different financing options, and analyze key performance indicators that contribute to a holistic understanding of a company’s financial health and future potential. The aim is to equip readers with a practical understanding of how to leverage financial expertise to achieve strategic business goals.

Defining Strategic Financial Management

Strategic financial management is the process of aligning a company’s financial strategy with its overall business objectives. It’s about making long-term financial decisions that drive sustainable growth and enhance shareholder value, considering both internal capabilities and external market forces. Unlike operational finance, which focuses on day-to-day activities, strategic financial management takes a broader, more forward-looking perspective.

Strategic financial management rests on several core principles. Firstly, it emphasizes a long-term perspective, prioritizing sustainable value creation over short-term gains. Secondly, it necessitates a deep understanding of the company’s competitive landscape and industry dynamics. Thirdly, it involves proactive risk management, anticipating and mitigating potential financial threats. Finally, it relies on effective communication and collaboration across different departments to ensure alignment and execution.

Key Differences Between Strategic and Operational Financial Management

Strategic and operational financial management, while interconnected, have distinct focuses. Operational financial management deals with the day-to-day financial activities of a business, such as budgeting, cash flow management, and accounts payable/receivable. It is primarily concerned with efficiency and short-term financial health. In contrast, strategic financial management focuses on long-term financial planning, capital allocation, mergers and acquisitions, and overall financial strategy to achieve long-term goals. It’s about making decisions that shape the future direction of the company. For example, operational finance might manage monthly cash flow, while strategic finance might decide on a major capital investment in a new factory.

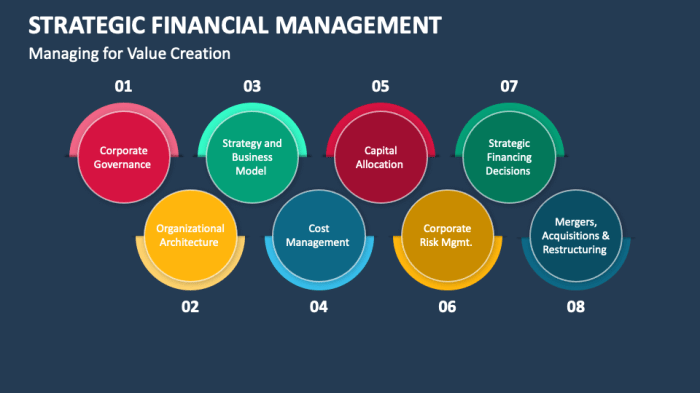

Strategic Financial Management Frameworks

Several frameworks guide strategic financial management. The most prominent include the Balanced Scorecard, which measures performance across financial, customer, internal processes, and learning & growth perspectives. Another popular framework is Value-Based Management (VBM), which focuses on maximizing shareholder value by aligning all business decisions with the creation of economic value. These frameworks offer different approaches but share the common goal of linking financial performance to overall business strategy. For instance, a company using the Balanced Scorecard might set targets for customer satisfaction alongside financial targets like return on equity (ROE), ensuring a holistic view of performance. Conversely, a company employing VBM might rigorously evaluate all investment opportunities based on their expected impact on net present value (NPV).

Examples of Strategic Financial Management’s Impact on Overall Company Strategy

Strategic financial management significantly impacts a company’s overall strategy. For example, a company deciding to pursue aggressive expansion through acquisitions would need robust strategic financial planning to secure funding, manage debt, and integrate acquired businesses effectively. Similarly, a company facing declining profitability might use strategic financial management to identify cost-cutting measures, restructure operations, or explore new market segments. A real-world example is Amazon’s strategic investment in logistics and technology, a financial decision that directly supported its long-term goal of becoming a dominant player in e-commerce. This involved significant upfront capital expenditure, but it ultimately led to improved efficiency, faster delivery times, and enhanced customer satisfaction, significantly boosting long-term profitability. Conversely, a company like Blockbuster’s failure to adapt to the rise of streaming services, partly due to a lack of strategic financial foresight and investment in digital technologies, ultimately led to its bankruptcy.

Financial Planning and Forecasting

Effective financial planning and forecasting are cornerstones of strategic financial management. They provide a roadmap for a company’s financial future, enabling proactive decision-making and resource allocation. A well-structured plan allows businesses to anticipate challenges and capitalize on opportunities, ultimately enhancing their chances of success. This section will explore the key components of financial planning and forecasting, including the creation of comprehensive plans and forecasts, and the crucial role of scenario planning and incorporating qualitative factors.

Financial Plan for a Hypothetical Startup

Let’s consider a hypothetical startup, “Eco-Friendly Solutions,” a company producing sustainable cleaning products. Their financial plan would encompass several key elements. First, a detailed business plan outlining their market analysis, competitive landscape, and marketing strategy is crucial. This would feed into their financial projections. Next, a comprehensive funding request outlining the required capital (e.g., seed funding, venture capital) and its intended use (e.g., equipment purchase, marketing campaign) is essential. A projected income statement, balance sheet, and cash flow statement for the first three to five years would detail their anticipated revenue, expenses, assets, liabilities, and cash flow. Finally, a clear exit strategy, outlining potential acquisition or IPO scenarios, would provide a long-term perspective. Key performance indicators (KPIs) such as customer acquisition cost, customer lifetime value, and gross margin would be continuously monitored to assess progress against the plan. Regular review and adjustment of the plan based on actual performance is critical.

Financial Forecast for a Rapidly Growing Company

Imagine a tech startup, “InnovateTech,” experiencing exponential growth. Their financial forecast would need to account for this rapid expansion. This requires a more dynamic approach than a simple linear projection. For example, they would need to forecast revenue growth based on factors like market penetration, customer acquisition rates, and pricing strategies. Their expense forecasts should account for increased personnel costs, marketing expenses, and potential scaling challenges. Crucially, they need to project their funding needs to support this growth, possibly involving multiple rounds of financing. The forecast should also consider potential risks associated with rapid growth, such as cash flow shortages, supply chain disruptions, and competition. Utilizing sophisticated forecasting techniques, such as regression analysis or time series modeling, could provide more accurate predictions than simple extrapolation. A sensitivity analysis, exploring various growth scenarios, would also prove invaluable in preparing for unexpected changes. For instance, a scenario with slower-than-expected growth would highlight potential cost-cutting measures or alternative funding strategies.

The Importance of Scenario Planning in Strategic Financial Management

Scenario planning is the process of developing multiple plausible future scenarios, each with its own set of assumptions and outcomes. This proactive approach allows businesses to prepare for a wider range of possibilities, rather than relying on a single, potentially unrealistic forecast. For example, a company might develop scenarios based on different economic conditions (e.g., recession, boom), changes in regulatory environments, or shifts in consumer behavior. Each scenario would then be used to develop a corresponding financial plan, enabling the company to adapt quickly to changing circumstances. This flexible approach allows for better resource allocation, risk management, and ultimately, improved decision-making. By anticipating potential challenges, companies can develop contingency plans, mitigating the impact of unexpected events and maintaining financial stability. The use of scenario planning helps to avoid the pitfalls of relying on overly optimistic or deterministic forecasts.

Best Practices for Incorporating Qualitative Factors into Financial Forecasts

While quantitative data forms the backbone of financial forecasts, incorporating qualitative factors is essential for a holistic and realistic outlook. These qualitative factors might include market sentiment, technological advancements, competitor actions, or changes in regulatory environments. One effective method is expert interviews with industry analysts, consultants, or internal subject matter experts. These interviews can provide insights that are difficult to quantify but crucial for shaping the forecast. Another valuable approach is the use of Delphi techniques, which involve a structured process of gathering expert opinions to achieve a consensus. Qualitative factors can be integrated into financial forecasts through sensitivity analysis or scenario planning, allowing for a more nuanced and robust projection. For example, a forecast might include scenarios that consider the impact of a new competitor entering the market or a potential change in government regulations. This approach ensures that the forecast is not overly reliant on historical data or simple extrapolations, providing a more comprehensive and realistic view of the future.

Capital Budgeting and Investment Decisions

Capital budgeting, the process of evaluating and selecting long-term investments, is crucial for a firm’s growth and profitability. Effective capital budgeting ensures that resources are allocated to projects that maximize shareholder value. This involves a systematic approach to analyzing potential investments, considering various financial and non-financial factors.

Methods for Evaluating Capital Investment Projects

Several methods exist to evaluate the financial viability of capital investment projects. These methods help businesses compare different projects and prioritize those that offer the best returns. The choice of method often depends on the specific circumstances of the project and the company’s overall financial strategy.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Net Present Value (NPV) | Calculates the difference between the present value of cash inflows and the present value of cash outflows over a project’s life. A positive NPV indicates a profitable investment. | Considers the time value of money, provides a direct measure of profitability. | Requires estimating future cash flows, which can be uncertain; sensitive to the discount rate used. |

| Internal Rate of Return (IRR) | Calculates the discount rate that makes the NPV of a project equal to zero. A higher IRR indicates a more attractive investment. | Easy to understand and compare projects; considers the time value of money. | Can be difficult to calculate for complex projects; may lead to multiple IRRs or no IRR in certain cases. |

| Payback Period | Calculates the time it takes for a project’s cumulative cash inflows to equal its initial investment. | Simple to understand and calculate; focuses on liquidity. | Ignores the time value of money; doesn’t consider cash flows beyond the payback period. |

Key Factors in Capital Budgeting Decisions

Several critical factors influence capital budgeting decisions. A thorough analysis considers these factors to ensure a well-informed investment choice. Ignoring these factors can lead to poor investment decisions and ultimately harm the company’s financial health.

These factors include:

- Initial Investment Cost: The upfront cost of the project, including equipment, installation, and training.

- Estimated Cash Flows: Projected cash inflows and outflows over the project’s life, considering factors like sales revenue, operating expenses, and taxes.

- Project Life: The expected duration of the project’s operational life.

- Discount Rate: The rate used to discount future cash flows to their present value, reflecting the risk associated with the project and the company’s cost of capital.

- Risk and Uncertainty: The inherent uncertainty associated with future cash flows, requiring sensitivity analysis and scenario planning.

- Strategic Fit: Alignment of the project with the company’s overall strategic goals and objectives.

Incorporating Risk and Uncertainty into Capital Budgeting Analysis

Risk and uncertainty are inherent in capital budgeting. To mitigate these, various techniques can be employed. These techniques aim to provide a more realistic assessment of project viability, accounting for potential deviations from initial projections.

Techniques include:

- Sensitivity Analysis: Examining how changes in key variables (e.g., sales volume, costs) affect the project’s NPV or IRR.

- Scenario Analysis: Evaluating the project’s performance under different scenarios (e.g., best-case, worst-case, most-likely).

- Simulation: Using computer models to simulate the project’s cash flows under various conditions, generating a probability distribution of possible outcomes.

- Decision Tree Analysis: A visual tool that helps evaluate sequential decisions under uncertainty.

Step-by-Step Process for Evaluating a Large-Scale Investment Opportunity

Evaluating a large-scale investment requires a structured approach. A well-defined process ensures a comprehensive evaluation, minimizing the risk of costly mistakes.

- Idea Generation and Screening: Identifying potential investment opportunities and conducting preliminary screening to eliminate clearly unsuitable projects.

- Detailed Analysis: Conducting a thorough financial analysis of promising projects, including forecasting cash flows, estimating the discount rate, and calculating NPV, IRR, and payback period.

- Risk Assessment: Evaluating potential risks and uncertainties associated with the project and incorporating them into the analysis using techniques such as sensitivity analysis, scenario planning, or simulation.

- Strategic Fit Assessment: Evaluating how the project aligns with the company’s overall strategic goals and objectives.

- Decision Making: Making a final investment decision based on the results of the analysis, considering both financial and strategic factors.

- Post-Audit: Monitoring the project’s performance after implementation and comparing actual results to projected outcomes.

Financing Decisions and Capital Structure

Securing the necessary funds to support a company’s operations and growth is a critical aspect of strategic financial management. The choices made regarding financing – the mix of debt and equity – significantly impact a company’s profitability, risk profile, and overall strategic trajectory. Understanding the nuances of different financing sources and their implications is paramount for effective decision-making.

Financing decisions involve selecting the appropriate blend of debt and equity financing to fund a company’s assets and operations. The capital structure, the relative proportion of debt and equity, directly influences the firm’s financial risk and return. A higher proportion of debt increases financial leverage, amplifying both returns and risk, while a higher equity proportion provides financial stability but potentially reduces returns on equity.

Comparison of Debt and Equity Financing

Debt financing involves borrowing money from lenders, requiring repayment with interest. Equity financing involves selling ownership stakes in the company to investors. Debt financing offers tax advantages due to the deductibility of interest payments, but it also carries the risk of financial distress if the company fails to meet its debt obligations. Equity financing dilutes ownership but doesn’t require repayment, providing greater financial flexibility.

Impact of Capital Structure on Profitability and Risk

A company’s capital structure significantly influences its profitability and risk profile. Higher leverage (more debt) can amplify returns during periods of high profitability, but it also increases the risk of bankruptcy during economic downturns. Conversely, a lower leverage (more equity) provides greater financial stability but may result in lower returns on equity. The optimal capital structure balances the trade-off between risk and return, maximizing the firm’s value. This balance is highly dependent on industry factors, economic conditions, and the company’s specific circumstances.

Optimal Capital Structure in the Technology Industry

The technology industry, characterized by high growth potential and significant upfront investment in research and development, often favors a more equity-heavy capital structure. This is because the high uncertainty associated with technological innovation makes it riskier to rely heavily on debt. Venture capital and private equity are common sources of equity financing for technology startups, providing the necessary capital for growth without the immediate pressure of debt repayment. Established technology companies may incorporate more debt into their capital structure as they mature and achieve greater stability. However, even then, the proportion of debt is often lower compared to more established industries with less volatile cash flows. For example, a company like Apple, despite its significant size and profitability, maintains a relatively conservative debt-to-equity ratio compared to, say, a manufacturing company of similar size.

Financing Decisions Influencing Strategic Goals

Financing decisions are intrinsically linked to a company’s strategic goals. For example, a company aiming for rapid expansion may opt for a higher proportion of debt to accelerate growth, accepting the increased financial risk. Conversely, a company prioritizing stability and long-term sustainability might choose a more conservative capital structure with a greater emphasis on equity. A company seeking to acquire another firm may utilize a combination of debt and equity financing, leveraging its existing resources and seeking external funding to complete the transaction. The choice of financing directly influences the speed, scale, and risk associated with achieving strategic objectives. For instance, a leveraged buyout (LBO) relies heavily on debt financing to acquire a company, which presents a high-risk, high-reward scenario. Conversely, a company pursuing a strategy of organic growth might rely more on retained earnings and equity financing to fund its expansion more gradually and conservatively.

Working Capital Management

Effective working capital management is crucial for a company’s financial health and overall success. It involves the efficient management of current assets (cash, accounts receivable, and inventory) and current liabilities (accounts payable, short-term debt) to ensure smooth operations and maximize profitability. Proper working capital management allows a business to meet its short-term obligations while optimizing the use of its resources.

Working capital management encompasses several key areas, all interconnected and vital for optimal performance. A holistic approach, considering the interplay between these areas, is necessary for effective management.

Key Components of Working Capital Management

The core components of working capital management involve the strategic administration of current assets and liabilities. Efficient management in each area directly impacts the company’s liquidity and profitability. These components are often interdependent; for example, efficient inventory management can positively affect cash flow and accounts receivable.

- Cash Management: This focuses on optimizing cash inflows and outflows, ensuring sufficient liquidity to meet immediate obligations while minimizing idle cash. Strategies include cash forecasting, efficient collection of receivables, and optimized disbursement of payments.

- Inventory Management: This aims to maintain optimal inventory levels to meet demand without tying up excessive capital. Effective inventory management minimizes storage costs, reduces the risk of obsolescence, and ensures timely availability of goods.

- Accounts Receivable Management: This involves establishing and enforcing credit policies, monitoring outstanding invoices, and pursuing timely collection of payments from customers. Efficient management reduces the days sales outstanding (DSO) and improves cash flow.

- Accounts Payable Management: This entails negotiating favorable payment terms with suppliers, optimizing payment schedules, and taking advantage of early payment discounts where appropriate. Effective management extends the company’s cash cycle.

- Short-Term Financing: This involves utilizing short-term financing options such as lines of credit, commercial paper, or factoring to bridge temporary funding gaps. Choosing the right financing option depends on the company’s specific needs and risk tolerance.

Impact of Effective Working Capital Management on Liquidity and Profitability

Effective working capital management directly enhances a company’s liquidity and profitability. Improved liquidity ensures the company can meet its short-term obligations, reducing the risk of financial distress. Simultaneously, efficient management of working capital frees up capital for investment in growth opportunities, leading to increased profitability. For instance, a reduction in inventory holding costs and faster collection of receivables directly increases net income.

Strategies for Optimizing Inventory Management and Accounts Receivable

Several strategies can be employed to optimize inventory and accounts receivable management. These strategies aim to minimize costs and improve efficiency, leading to better overall financial performance.

Inventory Management Optimization

Implementing a robust inventory management system, such as Just-in-Time (JIT) inventory, can significantly reduce storage costs and minimize waste from obsolescence. Regular inventory audits and accurate demand forecasting are crucial for maintaining optimal inventory levels. Utilizing technology, such as inventory management software, can streamline the process and provide real-time visibility into inventory levels.

Accounts Receivable Optimization

Strategies for optimizing accounts receivable include implementing a strict credit policy, offering early payment discounts, and utilizing technology for automated invoicing and payment processing. Regular monitoring of days sales outstanding (DSO) provides a key indicator of the efficiency of the accounts receivable process. Aggressive collection procedures for overdue invoices are essential to maintain cash flow.

Cash Flow Monitoring and Control System

A well-designed cash flow monitoring and control system is essential for effective working capital management. This system should include:

- Cash Forecasting: Predicting future cash inflows and outflows allows for proactive planning and management of cash resources. Forecasting can be based on historical data, sales projections, and other relevant factors.

- Cash Budgeting: Developing a cash budget provides a detailed plan for managing cash flows over a specific period. This budget should align with the company’s overall financial goals.

- Regular Monitoring: Closely monitoring actual cash flows against the budget allows for early identification of potential problems and timely corrective action. This may involve daily or weekly reviews of cash balances and transactions.

- Variance Analysis: Analyzing variances between actual and budgeted cash flows helps identify the causes of discrepancies and inform future planning. This involves investigating any significant deviations from the plan.

Performance Measurement and Evaluation

Effective performance measurement is crucial for guiding strategic decision-making and ensuring a company’s long-term success. It provides insights into operational efficiency, identifies areas for improvement, and ultimately helps to achieve strategic objectives. By regularly monitoring key performance indicators (KPIs), businesses can track progress, assess the impact of initiatives, and make data-driven adjustments to their strategies.

Key Financial Metrics for Business Performance Assessment

Several key financial metrics provide a snapshot of a business’s financial health and performance. These metrics offer a quantifiable assessment of profitability, liquidity, and solvency. Analyzing these metrics in conjunction with each other provides a more comprehensive understanding than relying on a single indicator.

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost. A higher ROI indicates a more efficient use of resources. For example, an ROI of 20% suggests that for every $1 invested, the business generated a profit of $0.20.

- Return on Equity (ROE): Shows how effectively a company is using shareholder investments to generate profit. A higher ROE implies better management of shareholder capital. A company with an ROE of 15% is generating $0.15 in profit for every $1 of shareholder equity.

- Profit Margin: Represents the percentage of revenue remaining after deducting all expenses. A higher profit margin signifies better cost control and pricing strategies. A net profit margin of 10% indicates that 10% of revenue remains as profit after all costs are covered.

- Earnings Per Share (EPS): Indicates the portion of a company’s profit allocated to each outstanding share. Higher EPS generally signals increased profitability and potential for higher share value. An EPS of $2 means that each share earns $2 in profit.

- Debt-to-Equity Ratio: Measures the proportion of a company’s financing that comes from debt compared to equity. A higher ratio suggests higher financial risk. A ratio of 0.5 indicates that for every $1 of equity, the company has $0.50 of debt.

Limitations of Solely Using Financial Metrics

While financial metrics are essential, relying solely on them for performance evaluation can be misleading. A narrow focus can neglect crucial non-financial aspects that contribute to long-term success. A company might achieve high short-term financial gains at the expense of employee morale, customer satisfaction, or innovation, ultimately leading to unsustainable growth.

Balanced Scorecard for a Hypothetical Company

A balanced scorecard provides a holistic view of performance by incorporating both financial and non-financial measures. Consider a hypothetical e-commerce company, “TechGear,” selling consumer electronics.

| Perspective | Measure | Target | Initiative |

|---|---|---|---|

| Financial | Revenue Growth | 15% year-over-year | Expand product line, improve marketing |

| Financial | Customer Acquisition Cost (CAC) | Below $50 | Optimize online advertising |

| Customer | Customer Satisfaction (CSAT) Score | 4.5 out of 5 | Improve customer service responsiveness |

| Internal Processes | Website Conversion Rate | 5% | Improve website usability and design |

| Learning & Growth | Employee Training Hours per Employee | 10 hours/year | Invest in employee development programs |

Using Performance Measurement to Drive Strategic Change

Performance measurement isn’t just about tracking; it’s a powerful tool for driving strategic change. By identifying performance gaps and areas for improvement, companies can proactively adapt their strategies. For instance, if TechGear’s customer satisfaction score falls below target, it can trigger initiatives to improve customer service, address product issues, or enhance communication. Regular review and analysis of the balanced scorecard enables data-driven decisions, ensuring that strategies are aligned with desired outcomes and leading to sustainable, long-term success.

Risk Management in Strategic Financial Decisions

Effective risk management is crucial for the long-term success and sustainability of any business. Ignoring potential financial risks can lead to significant losses, hindering growth and even causing bankruptcy. A proactive approach, identifying and mitigating these risks, is essential for sound strategic financial management.

Types of Financial Risks Faced by Businesses

Businesses face a multitude of financial risks, broadly categorized into market risk, credit risk, liquidity risk, operational risk, and strategic risk. Market risk encompasses fluctuations in market values due to changes in interest rates, exchange rates, or commodity prices. Credit risk stems from the possibility of borrowers defaulting on their loans or payments. Liquidity risk refers to the potential inability to meet short-term obligations due to insufficient readily available cash. Operational risk arises from internal processes, systems, or human errors, while strategic risk involves making incorrect business decisions or failing to adapt to changing market conditions. These risks are interconnected and can amplify each other, making a comprehensive risk management strategy essential.

Methods for Mitigating Financial Risks

Several methods can be employed to mitigate financial risks. Diversification, for example, spreads investments across different asset classes to reduce exposure to any single market’s volatility. Hedging involves using financial instruments like derivatives to offset potential losses from adverse price movements. Insurance can protect against unforeseen events like property damage or liability claims. Improving internal controls strengthens operational efficiency and reduces the likelihood of errors. Stress testing and scenario planning allow businesses to assess their vulnerability to various potential adverse events and develop contingency plans. Finally, robust financial planning and forecasting provide a clearer picture of potential risks and opportunities.

Risk Management Plan for a Company Entering a New Market

A company entering a new market should develop a comprehensive risk management plan addressing market-specific risks. This plan should begin with a thorough market analysis identifying potential challenges such as competition, regulatory hurdles, and economic instability. Next, the company should assess its own internal capabilities and resources, identifying potential weaknesses. A risk register should be created, documenting identified risks, their likelihood, and their potential impact. Mitigation strategies, such as market research, partnerships with local businesses, and contingency funding, should be defined for each risk. Regular monitoring and reporting mechanisms should be established to track the effectiveness of the risk management plan and allow for adjustments as needed. This plan should be reviewed and updated periodically to reflect changing market conditions and the company’s evolving circumstances. For example, a company entering a developing market might face political instability as a significant risk and would need to incorporate political risk insurance into its strategy.

Examples of Effective Risk Management Protecting a Company’s Financial Health

Effective risk management can significantly protect a company’s financial health. For example, a well-diversified investment portfolio shielded an investment firm from significant losses during the 2008 financial crisis, while a company that proactively insured against supply chain disruptions avoided substantial losses when a natural disaster impacted its primary supplier. Conversely, companies that failed to adequately manage risks often suffered severe consequences. The collapse of Lehman Brothers, for instance, serves as a stark reminder of the devastating effects of insufficient risk management, highlighting the importance of a proactive and comprehensive approach. A company that successfully hedged against currency fluctuations avoided significant losses when the value of a foreign currency dropped sharply, demonstrating the effectiveness of risk mitigation techniques.

Strategic Financial Management and Corporate Governance

Effective strategic financial management relies heavily on a robust corporate governance framework. This framework establishes the rules and processes by which a company is directed and controlled, ensuring accountability to shareholders and other stakeholders. Strong governance fosters trust, transparency, and ethical conduct, ultimately leading to improved financial performance and long-term sustainability.

The Role of Corporate Governance in Ensuring Effective Strategic Financial Management

Corporate governance provides the structure and oversight necessary for sound strategic financial management. A well-defined governance structure clarifies roles and responsibilities, preventing conflicts of interest and promoting efficient decision-making. Independent boards of directors, with diverse expertise and a commitment to oversight, play a crucial role in evaluating strategic financial plans, monitoring performance, and ensuring compliance with regulations and ethical standards. Effective internal controls, established and monitored by the board, safeguard assets and prevent fraud, contributing to accurate and reliable financial reporting. Furthermore, clear lines of communication between the board, management, and stakeholders ensure that strategic financial decisions are made with full awareness of potential risks and opportunities.

Transparency and Accountability in Financial Reporting

Transparency and accountability are cornerstones of effective corporate governance and are vital for maintaining investor confidence and attracting capital. Transparent financial reporting involves the timely and accurate disclosure of all material financial information, allowing stakeholders to make informed decisions. This includes providing detailed financial statements, adhering to accounting standards, and disclosing any significant risks or uncertainties. Accountability mechanisms, such as independent audits and internal controls, ensure the reliability of the reported information and hold management responsible for its accuracy. A lack of transparency and accountability can lead to a loss of trust, damage to reputation, and legal repercussions. The Enron scandal, for example, highlighted the devastating consequences of opaque financial reporting and a failure of corporate governance.

Ethical Considerations and Strategic Financial Decision-Making

Ethical considerations are paramount in strategic financial decision-making. Decisions should be made in a fair, transparent, and responsible manner, considering the interests of all stakeholders, not just shareholders. Ethical behavior promotes long-term value creation and strengthens the company’s reputation. Conversely, unethical practices, such as accounting fraud or insider trading, can severely damage a company’s financial performance and its standing with investors and the public. A strong ethical culture, fostered by the board and senior management, is essential for guiding financial decisions and ensuring compliance with ethical standards. Codes of conduct, ethics training programs, and whistleblower protection mechanisms can help to create and maintain an ethical environment.

Examples of Corporate Governance Failures and Their Impact on Financial Performance

Numerous instances of corporate governance failures demonstrate the critical importance of strong governance structures. The collapse of Lehman Brothers in 2008, partly attributed to poor risk management and a lack of effective oversight by the board, resulted in significant financial losses and a global economic crisis. Similarly, the WorldCom accounting scandal involved fraudulent accounting practices that concealed billions of dollars in expenses, ultimately leading to bankruptcy and devastating consequences for investors and employees. These cases highlight the severe financial repercussions of governance failures, emphasizing the need for robust governance mechanisms to prevent such occurrences. In contrast, companies with strong corporate governance often demonstrate superior financial performance, reflecting the positive correlation between good governance and long-term value creation.

Final Conclusion

Mastering strategic financial management is not merely about crunching numbers; it’s about wielding financial insights as a powerful tool for informed decision-making and sustainable growth. By understanding the interplay between financial planning, investment strategies, risk management, and corporate governance, businesses can navigate complexities, capitalize on opportunities, and build a resilient future. The journey towards effective strategic financial management is continuous, demanding constant adaptation and a commitment to long-term value creation.

Questions and Answers

What is the difference between strategic and operational financial management?

Strategic financial management focuses on long-term goals and overall business strategy, while operational financial management deals with day-to-day financial activities and short-term objectives.

How can I improve my company’s cash flow?

Implement robust accounts receivable management, optimize inventory levels, negotiate favorable payment terms with suppliers, and explore short-term financing options if needed.

What are some common financial risks businesses face?

Common risks include credit risk, market risk, liquidity risk, operational risk, and regulatory risk.

What is a balanced scorecard, and why is it important?

A balanced scorecard is a performance management tool that uses both financial and non-financial metrics to provide a comprehensive view of a company’s performance. It’s important because it offers a more holistic perspective than relying solely on financial measures.