Navigating a tax audit can feel daunting, but with the right preparation, it becomes significantly more manageable. This comprehensive checklist serves as your roadmap, guiding you through each stage of the process, from gathering essential documents to communicating effectively with the auditor. We’ll demystify the complexities of tax audits, empowering you with the knowledge and tools to confidently handle any challenges that arise.

This guide breaks down the tax audit process into easily digestible steps, providing practical advice and actionable strategies. We cover everything from understanding the audit timeline and common mistakes to preparing accurate financial statements and addressing specific tax issues. By following this checklist, you’ll significantly reduce stress and increase your chances of a successful audit outcome.

Understanding the Tax Audit Process

A tax audit can be a daunting experience, but understanding the process can significantly reduce stress and improve your chances of a positive outcome. This section Artikels the various stages involved, typical timelines, and strategies for effective response. Knowing what to expect and how to prepare is crucial for navigating this process successfully.

Stages of a Tax Audit

The tax audit process generally unfolds in several distinct stages. Initially, the tax authority selects returns for audit based on various risk factors. This is followed by the issuance of an audit notice, which initiates formal communication between the taxpayer and the auditor. Next, the audit itself takes place, involving document review and potentially interviews. Finally, the auditor issues a report detailing their findings and any adjustments or penalties. This process can vary in complexity and duration depending on the specifics of the case.

Typical Timeline for a Tax Audit

The timeframe for a tax audit can vary widely depending on the complexity of the return and the responsiveness of the taxpayer. A simple audit might be completed within a few months, while more complex audits could take a year or longer. For example, a straightforward audit involving a small business with clear records might conclude within three to six months, whereas a large corporation under investigation for potential fraud could take considerably longer, potentially extending beyond a year or even several years.

Responding to an Audit Notice

Responding promptly and effectively to an audit notice is paramount. First, carefully review the notice to understand its scope and requirements. Gather all relevant financial documents, including tax returns, receipts, bank statements, and supporting documentation. Then, organize these documents systematically for easy access during the audit. Finally, respond to the notice within the stipulated timeframe, providing the requested information clearly and completely. Consider seeking professional assistance from a tax advisor if the audit is complex or involves significant financial implications.

Common Mistakes During Tax Audits

Several common mistakes can negatively impact the outcome of a tax audit. Ignoring or delaying responses to audit notices is a major error, as it can lead to penalties and increased scrutiny. Failing to maintain adequate records is another common pitfall; disorganized or incomplete documentation can hinder the audit process and create unfavorable impressions. Lastly, attempting to conceal or misrepresent information is a serious offense that can result in severe consequences. Maintaining accurate and organized records and seeking professional guidance are crucial steps in avoiding these mistakes.

Flowchart Illustrating the Audit Process

Imagine a flowchart beginning with “Tax Return Filed.” This branches to “Return Selected for Audit” and “Return Not Selected.” The “Return Selected for Audit” branch leads to “Audit Notice Issued,” followed by “Taxpayer Response,” then “Audit Conducted.” The “Audit Conducted” box leads to two possible outcomes: “No Adjustments/No Penalties” and “Adjustments/Penalties.” Both outcomes lead to “Audit Completion.” The “Return Not Selected” branch simply ends at “Audit Completion.” This visual representation demonstrates the linear progression of the audit process, highlighting key decision points and potential outcomes.

Gathering Necessary Documents

Preparing for a tax audit involves compiling a comprehensive set of financial records. A well-organized collection of documents significantly streamlines the audit process and minimizes potential delays or complications. Proactive preparation ensures a smoother experience and demonstrates your commitment to transparency and compliance.

Accurate record-keeping is paramount for a successful tax audit. Maintaining detailed and organized financial records not only simplifies the audit process but also helps prevent potential discrepancies and disputes with the tax authorities. It demonstrates a commitment to financial transparency and responsible tax management.

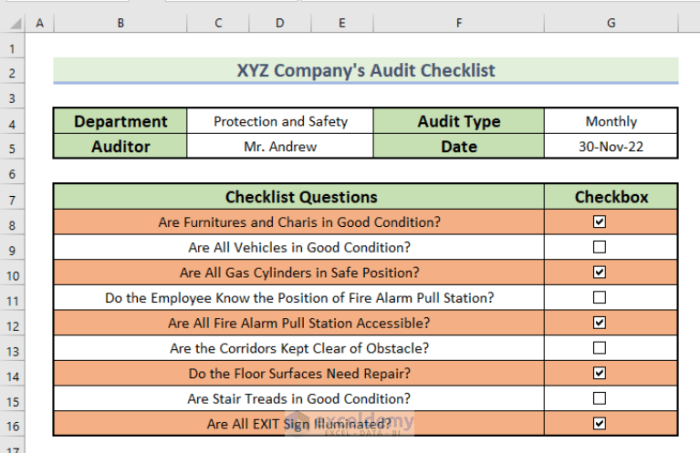

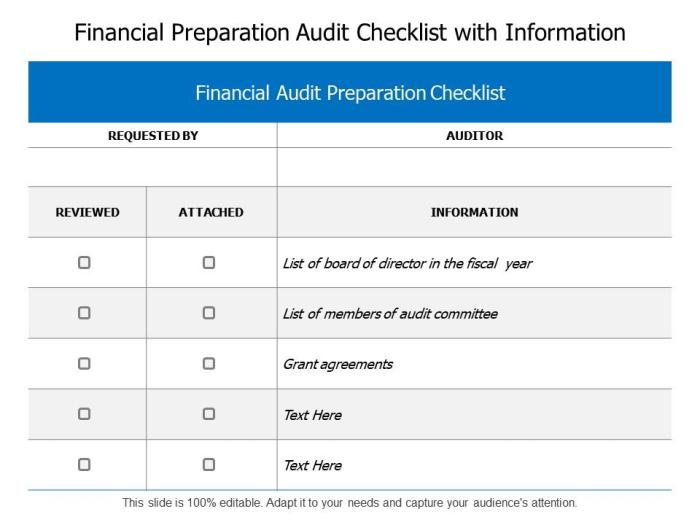

Essential Documents Checklist

The following table provides a checklist of essential documents needed for tax audit preparation. Remember that specific requirements may vary depending on your business structure and tax obligations. Consult with your tax advisor to ensure you have all necessary documentation.

| Document Type | Description | Location | Due Date |

|---|---|---|---|

| Tax Returns (all relevant years) | Filed income tax returns, including amendments. | Filing cabinet, digital storage | Prior to audit commencement |

| Income Statements | Detailed records of all income and expenses. | Accounting software, spreadsheets | Prior to audit commencement |

| Balance Sheets | Statements of assets, liabilities, and equity. | Accounting software, spreadsheets | Prior to audit commencement |

| Bank Statements | Records of all bank transactions. | Bank statements, online banking records | Prior to audit commencement |

| Invoices and Receipts | Proof of income and expenses. | Filing cabinet, digital storage | Prior to audit commencement |

| Payroll Records | Records of employee wages, salaries, and taxes withheld. | Payroll software, spreadsheets | Prior to audit commencement |

| Depreciation Schedules | Records of asset depreciation. | Accounting software, spreadsheets | Prior to audit commencement |

| General Ledger | Complete record of all financial transactions. | Accounting software | Prior to audit commencement |

| Business Licenses and Permits | Proof of legal operation. | Filing cabinet, digital storage | Prior to audit commencement |

| Contracts and Agreements | Relevant contracts with clients, suppliers, and employees. | Filing cabinet, digital storage | Prior to audit commencement |

Sources of Missing or Incomplete Documentation

Missing or incomplete documentation often stems from inadequate record-keeping practices, such as inconsistent data entry, lack of a centralized system, or insufficient employee training. Other sources include misplaced or damaged physical records, lost or corrupted digital files, and failure to retain records for the legally required period. For example, a small business might lose receipts due to poor organization, while a larger company might struggle with data integrity across different departments.

Organizing and Accessing Financial Records

Efficient organization is crucial for quick access to relevant information during an audit. Implementing a robust filing system, whether physical or digital, is essential. This could involve using a cloud-based accounting software, a well-organized physical filing cabinet with clear labeling, or a combination of both. Regularly backing up digital files is also critical to prevent data loss. A well-defined chart of accounts and consistent coding practices will also help you easily locate and retrieve the necessary documents.

Acceptable Documentation Formats

Both digital and paper formats are generally acceptable, provided they are legible, accurate, and readily accessible. Digital formats offer advantages in terms of storage, searchability, and ease of sharing. However, it’s important to ensure data security and backup procedures are in place. Paper records should be well-organized, clearly labeled, and stored in a secure location. Consider scanning paper documents for digital backup and easy access.

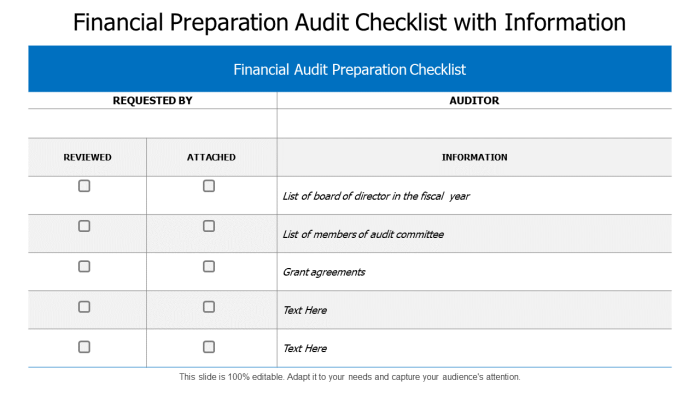

Preparing Financial Statements

Accurate and complete financial statements are crucial for a smooth tax audit. They provide the auditor with a comprehensive overview of your business’s financial health and allow for a thorough examination of your tax liability. Preparing these statements correctly minimizes the risk of delays and potential discrepancies.

Key Financial Statements Required

The primary financial statements needed during a tax audit are the balance sheet, the income statement, and the cash flow statement. The balance sheet presents a snapshot of your assets, liabilities, and equity at a specific point in time. The income statement summarizes your revenues and expenses over a period, revealing your net profit or loss. The cash flow statement tracks the movement of cash into and out of your business during a specific period, highlighting your operating, investing, and financing activities. These three statements work together to provide a complete picture of your financial position and performance.

Bank Statement Reconciliation

Reconciling bank statements with accounting records is essential for ensuring accuracy and identifying any discrepancies. This process involves comparing your bank statement balance with your internal accounting records. Any differences should be investigated and accounted for. This may include identifying outstanding deposits, outstanding checks, bank charges, and errors in either the bank statement or your accounting records. A well-documented reconciliation process demonstrates a commitment to financial accuracy and strengthens the credibility of your financial statements during an audit. For example, a discrepancy of $500 might be traced to a deposit recorded in your books but not yet reflected on the bank statement.

Preparing Supporting Schedules

Supporting schedules provide detailed breakdowns of various income and expense items reported on the main financial statements. These schedules offer the auditor the necessary evidence to support the figures presented. For instance, a schedule for cost of goods sold might detail the direct materials, direct labor, and manufacturing overhead costs incurred. Similarly, a schedule for depreciation might list each asset, its useful life, and the depreciation method used. Comprehensive schedules enhance the transparency and verifiability of your financial records.

Best Practices for Presenting Financial Information

Presenting financial information clearly and accurately is vital for a successful tax audit. This involves using a consistent and logical format, employing clear and concise language, and ensuring that all figures are accurately calculated and properly supported. Using standardized accounting principles (like GAAP or IFRS, depending on your jurisdiction) enhances the credibility of your financial statements. Proper labeling of accounts, consistent use of units (e.g., currency), and clear presentation of data tables are also crucial. A well-organized presentation reduces the time and effort required by the auditor to understand your financial position, thereby streamlining the audit process.

Sample Financial Statement Organization

A typical organization of financial statements for an audit might include the following:

- Balance Sheet: Presented first, showing assets, liabilities, and equity at the end of the accounting period.

- Income Statement: Presented next, showing revenues, expenses, and net income/loss for the accounting period.

- Cash Flow Statement: Presented third, detailing cash inflows and outflows from operating, investing, and financing activities.

- Supporting Schedules: Presented after the main statements, including detailed breakdowns of specific income and expense items (e.g., depreciation schedule, accounts receivable aging schedule, inventory schedule).

- Notes to the Financial Statements: These provide additional context and explanations for the figures presented in the main statements and supporting schedules.

This structured format ensures a clear and logical flow of information, making it easier for the auditor to review and understand your financial position. The inclusion of notes clarifies any unusual items or accounting policies.

Addressing Specific Tax Issues

Tax audits often focus on specific areas where inaccuracies or discrepancies are more likely to occur. Understanding these common areas and preparing appropriate documentation is crucial for a smooth audit process. This section will Artikel common audit scrutiny points and provide strategies for effective justification.

Preparing for a tax audit involves proactively addressing potential issues. This includes reviewing deductions, credits, and depreciation calculations for accuracy and ensuring supporting documentation is readily available. A well-organized approach minimizes surprises and strengthens your position during the audit.

Common Areas of Tax Audit Scrutiny

Tax authorities frequently examine deductions, credits, and depreciation calculations. Deductions for business expenses are often scrutinized for substantiation and proper categorization. Similarly, tax credits require meticulous documentation to prove eligibility. Depreciation methods and calculations are also subject to close examination to ensure compliance with tax regulations. Discrepancies in these areas can lead to significant adjustments.

Justifying Deductions and Credits

Adequate documentation is key to justifying deductions and credits. For business expenses, receipts, invoices, bank statements, and expense reports are essential. For tax credits, supporting documentation might include employment certifications, educational records, or investment statements, depending on the specific credit claimed. Maintaining detailed records throughout the year simplifies the justification process during an audit. For example, a home office deduction requires documentation demonstrating the dedicated space’s exclusive use for business purposes, including its percentage of total home square footage.

Depreciation Calculation Methods

Several methods exist for calculating depreciation, including straight-line, declining balance, and sum-of-the-years’ digits. The chosen method impacts the annual depreciation expense and, consequently, the taxable income. It’s crucial to select the appropriate method and consistently apply it. The Internal Revenue Service (IRS) provides guidelines on acceptable depreciation methods. For example, a business purchasing a piece of equipment with a five-year useful life and a $10,000 cost would use a different depreciation calculation under the straight-line method (annual depreciation of $2,000) compared to the double-declining balance method (higher depreciation in the early years). Proper documentation of the asset’s cost, useful life, and salvage value is vital for justifying the chosen depreciation method.

Documentation for Specific Tax Claims

Supporting documentation varies depending on the specific tax claim. For example, charitable contributions require a written acknowledgement from the recipient organization. Medical expense deductions need receipts and explanations of the medical necessity of the expenses. Investment tax credits necessitate documentation verifying the investment’s eligibility and the amount invested. Maintaining a well-organized system for storing and retrieving these documents is critical.

Comparison of Tax Accounting Methods

Businesses can choose between different tax accounting methods, such as cash basis and accrual basis. The cash basis recognizes revenue when received and expenses when paid, while the accrual basis recognizes revenue when earned and expenses when incurred. The choice depends on factors such as the business’s size and complexity. A proper understanding of the chosen method and its implications is crucial for accurate tax reporting. For example, a small business might find the cash basis simpler to manage, while a larger company might be required to use the accrual basis. Choosing the correct method and applying it consistently is vital for accurate financial reporting and tax compliance. The implications of each method on timing of revenue and expense recognition significantly impacts the tax liability for the reporting period.

Post-Audit Procedures

The completion of the tax audit doesn’t mark the end of the process; rather, it initiates a crucial post-audit phase. Careful review and follow-up actions are essential to ensure accuracy and compliance. This section Artikels the necessary steps to effectively manage the post-audit procedures and minimize potential future issues.

Reviewing the Audit Report

Thoroughly reviewing the auditor’s report is paramount. This involves checking for accuracy in calculations, ensuring all relevant information is included, and verifying that the conclusions align with your understanding of your financial situation. Discrepancies should be identified and addressed promptly. Pay close attention to any adjustments made and the rationale behind them. Comparing the report to your original tax filings and supporting documentation is crucial for identifying any errors or omissions. A second set of eyes, perhaps a tax professional, can be invaluable in this process.

Filing Amended Tax Returns

If the audit reveals errors or omissions in your original tax return, filing an amended return (Form 1040-X) is necessary. This process involves correcting the inaccuracies and providing any missing documentation. It’s important to file the amended return promptly to avoid penalties. The amended return should clearly indicate the specific corrections being made and include supporting documentation. For example, if an error in depreciation calculation was discovered, the amended return would detail the correct calculation and provide the supporting asset records. Remember to keep a copy of the amended return and all supporting documentation for your records.

Addressing Disagreements with Auditor Findings

Disagreements with the auditor’s findings are possible. In such cases, you have several options. First, you should attempt to resolve the discrepancies through open communication with the auditor, providing additional evidence or clarification as needed. If this doesn’t resolve the issue, you may need to seek professional advice from a tax attorney or CPA. They can help navigate the appeals process, which may involve submitting a formal protest or petition. The specific process depends on the tax authority involved and the nature of the disagreement. It is crucial to maintain thorough documentation throughout this process.

Preventing Future Audit Issues

Proactive measures significantly reduce the likelihood of future audits. Maintaining meticulous financial records, including receipts, invoices, and bank statements, is crucial. Understanding tax laws and regulations is essential, and seeking professional advice when needed can prevent costly mistakes. Implementing robust internal controls, such as regular financial reviews and reconciliation, can help identify potential problems early on. Staying organized and utilizing accounting software can simplify record-keeping and reduce the risk of errors. Finally, ensuring timely filing of tax returns and payment of taxes is vital.

Post-Audit Task Checklist

- Review the audit report thoroughly for accuracy and completeness.

- Compare the report to original tax filings and supporting documentation.

- Identify and document any discrepancies.

- If necessary, prepare and file an amended tax return (Form 1040-X).

- Maintain copies of all amended returns and supporting documentation.

- If disagreements arise, attempt to resolve them with the auditor.

- If necessary, seek professional advice from a tax attorney or CPA.

- Implement measures to prevent future audit issues, including improved record-keeping and internal controls.

Final Summary

Preparing for a tax audit requires meticulous planning and attention to detail. This checklist provides a structured approach, ensuring you’re well-equipped to handle every aspect of the process. By proactively gathering necessary documentation, accurately preparing your financial statements, and communicating effectively with the auditor, you can significantly improve your chances of a smooth and successful audit experience. Remember, proactive preparation is key to mitigating potential issues and achieving a favorable outcome.

FAQs

What happens if I can’t find all the required documents?

Contact the auditor immediately to explain the situation. Provide any documentation you do have and Artikel your efforts to locate the missing information. They may grant an extension.

Can I represent myself during a tax audit?

Yes, you can represent yourself, but it’s often advisable to seek professional assistance from a tax advisor or attorney, especially for complex cases.

What if I disagree with the auditor’s findings?

You have the right to appeal the auditor’s findings through the established appeals process. This usually involves submitting a formal protest and potentially attending a hearing.

How long does a tax audit typically take?

The duration varies greatly depending on the complexity of your case and the responsiveness of the taxpayer. It can range from a few weeks to several months.