Tax Audit Preparation Checklist: Facing a tax audit feels like a scene from a suspense movie, doesn’t it? Suddenly, your meticulously organized (or not-so-meticulously organized) financial life is under the intense scrutiny of the tax authorities. But fear not, intrepid taxpayer! This checklist isn’t just a list; it’s your secret weapon, a roadmap to navigate the treacherous terrain of tax audits and emerge victorious (or at least, unscathed).

This guide will walk you through every step, from gathering your financial records (yes, even those receipts tucked away in your sock drawer) to communicating effectively with the tax authorities. We’ll tackle common audit issues, offering solutions that are as practical as they are (dare we say it?) entertaining. Prepare to transform your audit anxiety into confident action. Because let’s face it, a well-prepared taxpayer is a happy taxpayer.

Understanding Tax Audit Preparation

Ah, the tax audit. The mere mention sends shivers down the spine of even the most seasoned accountant (and possibly a few less seasoned squirrels). But fear not, dear reader! With proper preparation, you can transform this potential financial apocalypse into a mere…financial inconvenience. Think of it as a game of tax-themed hide-and-seek, where you’re the one hiding (your perfectly organized records), and the auditor is…well, the auditor.

Thorough preparation is paramount for navigating a tax audit successfully. Failing to adequately prepare is like going to a sword fight armed with a spork – you might win, but the odds are heavily stacked against you. The consequences of inadequate preparation range from minor inconveniences (like extra paperwork and a few extra grey hairs) to major catastrophes (like hefty penalties, interest charges, and even legal battles that could make a courtroom drama look like a tea party). Let’s avoid the drama, shall we?

Organizing Financial Records Before a Tax Audit

The key to surviving a tax audit is meticulous record-keeping. Think of your financial records as your personal tax army – the better organized they are, the more effectively they’ll defend you. A systematic approach is crucial. Start by creating a dedicated file for all tax-related documents. This isn’t just a folder; it’s a fortress of financial fortitude. Within this fortress, categorize documents chronologically and by type (income statements, expense reports, bank statements, etc.). Consider using a color-coding system for added flair and organizational prowess. Imagine the auditor’s awe!

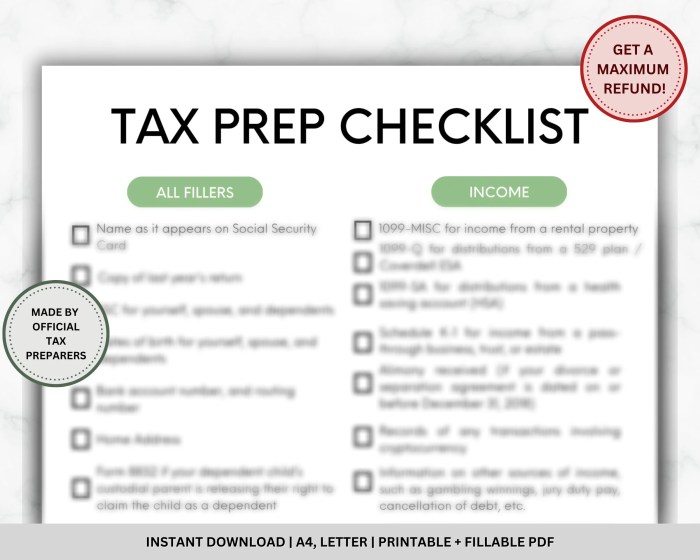

Essential Documents for a Tax Audit Checklist

A well-organized checklist is your roadmap to tax audit success. Having everything readily available will not only impress the auditor but also significantly reduce your stress levels. Remember, the auditor is merely a human being (albeit one who wields the power of the tax code). A little respect (and organization) goes a long way.

- Tax returns for the years under review: These are the foundational documents, the bedrock upon which your defense rests. Make sure they are complete and accurate.

- Supporting documentation for all income sources: This includes W-2s, 1099s, and any other forms demonstrating income received. Think of these as your income’s personal bodyguard.

- Detailed expense records: This is where the fun begins (or ends, depending on your perspective). Keep receipts, invoices, and bank statements for all business expenses. Be prepared to justify every single deduction – even that questionable purchase of a novelty rubber ducky.

- Bank statements and canceled checks: These provide a detailed account of your financial transactions. They’re like the detectives of your financial world, providing clues to the whereabouts of every penny.

- Records of assets and liabilities: A comprehensive list of your assets and liabilities provides a complete picture of your financial health. It’s like a financial health check-up for the auditor.

- Any other relevant documents: This is a catch-all category for anything else that might be relevant, such as contracts, invoices, or correspondence with clients.

Gathering and Organizing Financial Records

Ah, the thrill of tax season! It’s a time for reflection, spreadsheets, and the joyous rediscovery of receipts from questionable purchases (was that really a “business expense,” or just a really good burrito?). Properly organizing your financial records is crucial; think of it as building a magnificent castle of fiscal responsibility – a castle the tax auditor will admire, not siege. Failing to do so is akin to inviting a dragon to your meticulously crafted tax return. Let’s avoid that.

Efficiently organizing your receipts, invoices, and bank statements is the cornerstone of a successful tax audit preparation. This isn’t about becoming a professional organizer overnight; it’s about establishing a system that works for *you* and prevents the annual tax-related panic attack.

Methods for Efficiently Organizing Financial Records

A well-organized system saves time and stress. Consider using a dedicated filing cabinet (physical or digital) categorized by month and year. Alternatively, utilize cloud-based accounting software with robust tagging and search capabilities. Imagine: instantly finding that elusive receipt for the aforementioned burrito – a true victory. For a truly impressive system, use a color-coded system. Red for expenses, blue for income, and perhaps a flamboyant gold for those truly magnificent business lunches.

Strategies for Dealing with Missing or Incomplete Documentation

Missing documents? Don’t panic! First, retrace your steps. Check old emails, credit card statements, and bank transactions. If the trail goes cold, contact the relevant parties – vendors, clients, banks – and politely request duplicates. Remember, honesty is the best policy (and often the most effective). If all else fails, document your diligent search and explain the situation to your tax advisor. They’re the knights in shining armor of the tax world, ready to defend your financial kingdom.

Categorizing Financial Records for Easy Retrieval

Categorization is key. A simple system using broad categories like “Office Supplies,” “Travel Expenses,” and “Marketing Costs” will suffice for most. More complex businesses may need a more granular system, perhaps using subcategories within each main category. Think of it as creating a detailed map of your financial landscape. The more precise the map, the easier it is to navigate during an audit.

Best Practices for Storing Digital and Physical Financial Records

For physical records, use sturdy files and clearly labeled folders. Consider scanning important documents and storing them digitally as a backup. For digital records, use secure cloud storage with password protection and robust security features. Remember to regularly back up your data to an external hard drive or another secure location. This isn’t just about avoiding data loss; it’s about creating a digital fortress to protect your financial information. Think of it as building a digital castle to complement your physical one.

Reconciling Bank and Credit Card Statements

Reconciling your bank and credit card statements with your tax records might sound like a trip to the dentist – nobody *loves* it, but it’s absolutely essential for a smooth tax season. Think of it as a financial spring cleaning, getting rid of those pesky discrepancies before they become monstrous tax headaches. Accurate reconciliation ensures your tax return accurately reflects your income and expenses, avoiding potential audits and penalties. Let’s dive in!

Reconciling your financial records involves comparing your bank and credit card statements against your accounting records (whether that’s a spreadsheet, accounting software, or shoebox full of receipts – we don’t judge!). This meticulous process uncovers any inconsistencies, allowing you to identify and correct errors before submitting your tax return. The goal is to ensure every transaction is accounted for, leaving no room for the dreaded “Where did that money go?” mystery.

Common Discrepancies Between Bank Statements and Tax Records

Discrepancies can arise from various sources. Sometimes, it’s a simple matter of timing; a transaction might appear on your statement before it’s recorded in your accounting software. Other times, it’s a matter of human error – a misplaced decimal point, a transposed number, or a completely forgotten expense. Incorrectly categorized transactions are also a frequent culprit. For example, a business expense might accidentally be recorded as a personal expense, leading to an inaccurate representation of your deductible business costs. Furthermore, unreconciled deposits or payments can lead to significant discrepancies, especially for businesses dealing with high transaction volumes.

Correcting Errors Found During the Reconciliation Process

Let’s say you find a discrepancy. Don’t panic! The key is methodical investigation. First, carefully compare the transaction details on your statement with your records. Look for matching dates, amounts, and descriptions. If you identify a missing transaction in your records, add it. If a transaction is incorrectly categorized, recategorize it. If the amount is wrong, correct it. For example, if you recorded a $500 client payment as $50, you’ll need to adjust your records to reflect the correct amount. Document all corrections clearly, noting the date of the correction and the nature of the error. Consider using a reconciliation worksheet or software to track your progress and ensure accuracy. This diligent approach transforms a potential problem into a learning opportunity, improving your financial record-keeping for the future.

Importance of Accurate Bank and Credit Card Statement Reconciliation

Accurate reconciliation is paramount for several reasons. Firstly, it helps prevent costly errors on your tax return, avoiding potential penalties or interest charges from the tax authorities. Secondly, it provides a clear picture of your financial health, enabling better financial planning and decision-making. Thirdly, it strengthens your audit defense, should you ever face a tax audit. Imagine explaining a discrepancy of thousands of dollars to a tax auditor – not fun! A meticulously reconciled set of records will help you navigate such a situation with confidence. Finally, it helps maintain accurate financial records, contributing to the overall health of your business. Think of it as preventative maintenance for your financial well-being – a small investment with significant returns.

Preparing Supporting Documentation: Tax Audit Preparation Checklist

Ah, the supporting documentation. The unsung hero (or villain, depending on your organizational skills) of the tax audit process. Think of it as the evidence in your tax court case – you need it to be compelling, complete, and readily available. Otherwise, you might find yourself facing a judge (or, more likely, a slightly exasperated auditor) who’s not convinced of your meticulous record-keeping.

Proper preparation of supporting documentation is crucial for a smooth audit. A well-organized collection of documents can significantly reduce the time and stress involved in the process. Conversely, a disorganized mess can lead to delays, additional requests for information, and, let’s be honest, a whole lot of unnecessary anxiety.

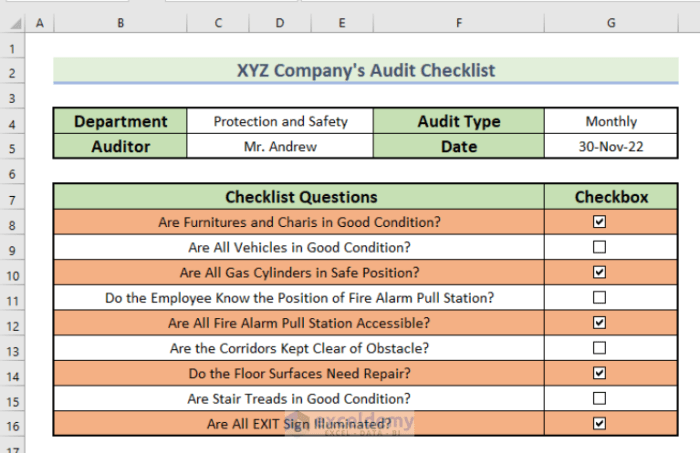

Supporting Documentation Types and Purposes

The following table Artikels various types of supporting documentation, their purpose, examples, and ideal storage locations. Remember, the more organized you are, the less likely you are to spend your evenings frantically searching for that elusive receipt for that questionable expense.

| Document Type | Purpose | Example | Location |

|---|---|---|---|

| Receipts | To substantiate business expenses, charitable contributions, or other deductible items. | Restaurant receipt for a business meeting, donation receipt from a charity. | Dedicated folder labeled “Receipts,” organized chronologically or by category. |

| Bank Statements | To verify income and expenses, especially for those who operate a business. | Monthly bank statement showing deposits and withdrawals. | Dedicated folder labeled “Bank Statements,” organized chronologically. |

| Invoices | To support business expenses, particularly for purchases from vendors. | Invoice from a supplier for office supplies. | Dedicated folder labeled “Invoices,” organized alphabetically by vendor or chronologically. |

| Payroll Records | To support wage and salary expenses, and to verify employee compensation. | Payroll register or W-2 forms. | Dedicated folder labeled “Payroll Records,” organized chronologically. |

Preparing Supporting Documentation for Deductions and Credits

Preparing supporting documentation for deductions and credits requires meticulous attention to detail. Each deduction or credit needs specific supporting evidence to ensure its validity. Think of it like building a strong case – every piece of evidence strengthens your position.

For example, claiming a home office deduction requires detailed records of the space used for business purposes, including its percentage of total home square footage. Similarly, claiming charitable contributions requires receipts or canceled checks to verify the donation amount. The key is to anticipate what an auditor might ask for and have that information readily available.

Ensuring Accuracy and Completeness of Supporting Documentation

Accuracy and completeness are paramount. Inaccurate or incomplete documentation can lead to delays and potential adjustments. Imagine the frustration of finding a crucial receipt with a smudged date or a missing amount!

To ensure accuracy, double-check all documents for errors. Use accounting software to help track expenses and generate reports. For completeness, maintain a systematic record-keeping process throughout the year. Don’t wait until tax time to start organizing – it’s like trying to assemble a puzzle with missing pieces!

Organizing Supporting Documentation for Easy Access

Organizing your supporting documentation is like organizing a well-stocked library – you need a system that allows for quick and easy retrieval. A chaotic pile of papers will only lead to frustration and wasted time. A well-organized system, however, can save you countless hours during the audit process.

Consider using a cloud-based storage system or a dedicated filing cabinet. Organize documents chronologically or by category. Clearly label each file and folder. And remember, a little bit of organization goes a long way in reducing stress and ensuring a smoother audit experience. Think of it as investing in your peace of mind – priceless!

Understanding Tax Laws and Regulations

Navigating the world of tax laws can feel like trying to decipher a particularly cryptic treasure map, but fear not, intrepid tax preparer! Understanding the relevant regulations for your specific tax year is crucial to avoid a tax audit that’s less “treasure” and more “treacherous.” This section will illuminate the path to tax compliance, ensuring you’re not left stranded on the shores of an audit.

The tax code, while vast and occasionally baffling, isn’t inherently malicious. It’s a complex system designed (mostly) to fairly distribute the burden of funding government services. Think of it as a sophisticated game of financial Jenga – one wrong move, and the whole thing could come crashing down. Understanding the rules of the game is paramount to winning (or at least, not losing spectacularly).

Relevant Tax Laws and Regulations

The specific tax laws and regulations applicable to your tax year are, of course, dependent on the tax year itself. However, some common areas of focus often include income tax brackets, deductions (like the standard deduction or itemized deductions), credits (such as the earned income tax credit or child tax credit), and applicable state and local taxes. These aspects of the tax code change yearly, so consulting the IRS website or a qualified tax professional is always recommended. For example, in 2023, the standard deduction for single filers was $13,850, while the child tax credit was up to $2,000 per qualifying child. These numbers fluctuate annually, so remember to check the current year’s figures.

Common Tax Audit Issues and Their Resolution, Tax Audit Preparation Checklist

Common tax audit issues frequently revolve around discrepancies in reported income, inaccurate deductions, and improper classification of expenses. For instance, failing to properly report all income sources, including 1099 forms or freelance earnings, is a frequent trigger for audits. Similarly, claiming deductions without adequate supporting documentation (receipts, invoices, etc.) can lead to problems. Addressing these issues proactively involves meticulous record-keeping and ensuring all reported information is accurate and verifiable. In the event of a discrepancy, it’s best to prepare a clear and concise explanation supported by the relevant documentation.

Identifying and Resolving Potential Tax Liabilities

Identifying potential tax liabilities involves a thorough review of all financial records and a careful calculation of taxable income. This process often requires an understanding of various tax forms and schedules. For example, Schedule C is used to report income and expenses from a business, while Form 1040 is the main tax return form. Proactive resolution involves addressing any potential issues before they become significant problems. This could include making estimated tax payments throughout the year to avoid underpayment penalties or consulting with a tax professional to strategize for optimal tax planning. Imagine it like preemptively patching holes in your roof before a storm hits; much less stressful, and considerably cheaper in the long run.

Staying Updated on Current Tax Laws and Regulations

The tax landscape is constantly shifting, with new laws and regulations implemented regularly. Staying updated is essential to avoid costly mistakes and ensure compliance. Regularly reviewing the IRS website, subscribing to tax newsletters, or consulting with a tax professional can help you stay informed about changes that may impact your tax situation. Think of it as constantly updating your navigation system; you wouldn’t want to rely on a map from 1985, would you?

Communicating with the Tax Authority

Navigating the world of tax audits can feel like tiptoeing through a minefield of jargon and regulations. But fear not, intrepid taxpayer! Effective communication is your secret weapon, transforming a potentially stressful experience into a surprisingly… manageable one. Remember, clarity and professionalism are key to a smooth audit process.

The art of communicating with the tax authority during an audit hinges on proactive engagement and a respectful, yet assertive, approach. Think of it as a polite but firm negotiation, where your goal is to present your case clearly and concisely, providing all necessary documentation to support your claims. This isn’t a game of hide-and-seek with your financial records; it’s about demonstrating your commitment to transparency and compliance.

Responding to Audit Requests

Responding promptly and professionally to all audit requests is paramount. Delays only prolong the process and can lead to unnecessary complications. Imagine the tax auditor as a highly caffeinated detective with a very specific case file – your tax return. The quicker you provide the requested information, the faster they can close the case, freeing you to get back to more enjoyable pursuits, like counting your (hopefully increased) tax refund. Aim to respond within the stipulated timeframe, and if you anticipate any delays, contact the auditor immediately to explain the situation and propose a revised timeline. Maintain a respectful and professional tone in all correspondence, whether it’s via email, phone, or snail mail (yes, they still use those sometimes!).

Effective Communication Strategies for Resolving Audit Issues

When discrepancies arise, maintaining open and honest communication is crucial. Don’t try to sweep anything under the rug – remember, the auditor is likely far more familiar with tax codes than you are. Instead, clearly present your side of the story, supported by relevant documentation. For instance, if a deduction is questioned, provide supporting receipts, bank statements, or other evidence to justify the claim. A calm and respectful approach, even when faced with challenging questions, will go a long way in building a positive working relationship with the auditor. Think of it as a collaborative effort to resolve the issue, rather than a confrontation. Remember, a well-organized and clearly presented case is your best ally.

Key Points to Remember When Communicating with the Tax Authority

Before embarking on any communication with the tax authority, take a moment to prepare. This isn’t about crafting a legal brief, but ensuring clarity and efficiency.

Here are some key points to keep in mind:

- Maintain a professional and respectful tone in all communications.

- Respond to requests promptly and within the specified timeframe.

- Provide clear, concise, and well-organized documentation.

- Keep accurate records of all communications, including dates, times, and contact information.

- If you disagree with the auditor’s findings, clearly and respectfully state your position, supported by evidence.

- Seek professional advice from a tax advisor if needed. Sometimes, an expert’s intervention can help navigate complex situations.

Post-Audit Procedures

Ah, the audit is over! The confetti cannons have (hopefully) not gone off prematurely, and the tax man (or woman!) has finally departed. Now comes the slightly less thrilling, but equally important, task of post-audit procedures. Think of it as the post-game analysis – crucial for future success, even if it lacks the immediate excitement of the game itself.

The post-audit phase involves meticulously reviewing the audit findings, implementing any necessary corrections, and refining your record-keeping strategies to prevent future audit-related headaches. It’s about learning from the experience and emerging stronger – like a phoenix from the ashes of a meticulously organized spreadsheet.

Reviewing Audit Findings and Adjustments

Carefully examine the auditor’s report, noting all adjustments made to your tax return. Don’t just skim it; understand the reasoning behind each change. If anything is unclear, don’t hesitate to contact the auditor for clarification. This isn’t a game of “spot the difference,” it’s about ensuring the accuracy of your tax liability. Imagine it as a detective novel, but instead of solving a murder, you’re solving a minor accounting mystery. The stakes are slightly lower, but the satisfaction is almost as great.

Ensuring Accurate Record-Keeping After the Audit

The audit is a valuable learning experience. Identify weaknesses in your previous record-keeping practices that contributed to the audit process or adjustments. For example, if you lacked sufficient documentation for a particular expense, implement a system to ensure better documentation in the future. Perhaps a dedicated folder for receipts, meticulously labeled and organized chronologically, or even a sophisticated accounting software system. This improved record-keeping isn’t just about avoiding future audits; it’s about gaining a clearer picture of your financial health. Think of it as a spring cleaning for your financial life, but instead of throwing things out, you’re organizing them into a perfectly categorized system.

Filing Amended Tax Returns

If the audit resulted in adjustments that require changes to your original tax return, you’ll need to file an amended return. This is done using Form 1040-X. Be sure to include all supporting documentation that justifies the changes. This process can seem daunting, but it’s a straightforward process if you follow the instructions carefully. Think of it as a “do-over,” a chance to ensure your tax return is perfectly aligned with the findings of the audit. The IRS appreciates accuracy, even if it means a slight delay. Consider it a refined version of your original masterpiece, a testament to your dedication to accuracy.

Illustrative Examples of Common Audit Issues

Navigating the tax world can feel like a game of financial whack-a-mole; just when you think you’ve got one deduction sorted, another pops up! Let’s delve into some common audit triggers, so you can avoid the dreaded audit letter and keep your hard-earned cash where it belongs – in your pocket (or, you know, your slightly less exciting savings account).

Home Office Deduction Errors

Incorrectly claiming the home office deduction is a classic audit trap. Many taxpayers mistakenly believe that simply having a laptop and a desk in a spare room qualifies. The IRS, however, requires the space to be your principal place of business, exclusively used for business, or used regularly and exclusively for administrative or management activities of your business. Failure to meet these stringent requirements can result in a disallowance of the deduction, leading to additional tax liability and potentially penalties. A simple flowchart illustrating this would show a decision tree: Does the space meet IRS requirements? Yes – deduction allowed; No – deduction disallowed. Further branches would illustrate the nuances of “principal place of business” and “exclusively used.” Avoiding this pitfall involves meticulously documenting the usage of the space, including square footage calculations, business expenses specifically tied to the home office, and a clear explanation of how it meets the IRS criteria. Consider keeping a detailed log of hours spent working in the designated space.

Improperly Categorized Business Expenses

This issue often stems from a lack of clarity regarding what constitutes a legitimate business expense. For instance, claiming personal expenses (like a family vacation disguised as a “business trip” – don’t even *think* about it!) as business deductions is a surefire way to attract unwanted attention from the IRS. The consequences can range from a partial disallowance of expenses to full disallowance and penalties, including interest. A visual representation could be a Venn diagram showing the overlap (or lack thereof) between personal and business expenses. The solution lies in meticulous record-keeping. Maintain detailed receipts, invoices, and expense reports for every business-related expenditure. Separate personal and business accounts to avoid confusion. When in doubt, err on the side of caution and consult with a tax professional. Think of it as insurance against a tax-audit headache.

Misreporting Rental Income and Expenses

Rental properties can be a lucrative investment, but they also come with complex tax implications. One common audit issue involves inaccurately reporting rental income or expenses. This could involve underreporting rental income, overstating deductible expenses (like repairs versus improvements), or improperly allocating expenses between personal and rental use. The penalties for this can be significant, including back taxes, interest, and potentially even fraud penalties. A flowchart could visually represent the process of calculating rental income and expenses, highlighting the points where errors frequently occur (e.g., incorrectly categorizing expenses, neglecting to account for depreciation). To prevent this, maintain separate bank accounts for rental income and expenses. Keep detailed records of all income and expenses, including lease agreements, repair invoices, and depreciation calculations. Consider consulting with a tax professional experienced in rental property taxation to ensure compliance.

Last Word

So, there you have it: your comprehensive guide to conquering the tax audit beast. Remember, preparation is key. By diligently following this checklist, you’ll not only minimize the stress of an audit but also demonstrate your commitment to tax compliance. And who knows, maybe you’ll even find a hidden tax deduction or two along the way! Now go forth and audit-proof your financial life. You’ve got this!

General Inquiries

What if I can’t find all my receipts?

Don’t panic! Document what you *can* find and explain the circumstances. Reconstructing records is possible, though it requires extra effort.

How long should I keep my tax records?

Generally, keep tax records for at least three years, but longer for significant purchases or investments. Consult a tax professional for specific guidance.

What if I disagree with the audit findings?

Document your disagreement thoroughly and follow the official channels for appealing the findings. Consider seeking professional tax advice.

Can I represent myself during a tax audit?

Yes, you can. However, professional representation is often recommended, especially for complex audits.