Tax Audit Preparation Checklist: Facing a tax audit? Don’t panic! While the prospect might feel like a visit from the tax-collecting Grim Reaper, proper preparation can transform this potential nightmare into a mere tax-induced inconvenience. This checklist isn’t just a list; it’s your battle plan, your shield against the dreaded audit, and your passport to a less stressful tax season. We’ll equip you with the knowledge and strategies to navigate the audit process with confidence, leaving the auditor wondering if they’ve accidentally stumbled onto a perfectly organized financial masterpiece.

This guide will walk you through every step, from gathering those elusive documents (yes, even the ones hiding under the couch cushions) to mastering the art of the audit interview (think charmingly assertive, not nervously sweating). We’ll unravel the mysteries of reconciling bank statements, highlight common audit pitfalls, and even provide a thrilling case study of a small business bravely facing the audit beast. Get ready to conquer your tax audit fears – one meticulously organized document at a time.

Understanding Tax Audit Preparation

Ah, the tax audit. The mere mention sends shivers down the spines of even the most seasoned accountants. But fear not, dear reader! With proper preparation, you can transform this potential financial horror story into a slightly less terrifying, perhaps even mildly amusing, anecdote. Thorough preparation is the key to navigating this treacherous tax terrain with grace (and minimal sweating).

The importance of meticulous tax audit preparation cannot be overstated. Think of it like this: would you go into a sword fight armed with a spoon? Probably not. Similarly, facing a tax audit unprepared is a recipe for disaster. A well-organized approach will not only minimize stress but also significantly improve your chances of a positive outcome. Remember, the tax authorities are looking for accuracy and transparency; providing them with this in a timely and efficient manner is the best defense.

Potential Consequences of Inadequate Preparation

Failing to adequately prepare for a tax audit can lead to a variety of unpleasant consequences. These range from minor inconveniences, such as lengthy delays in processing your return, to major headaches, including hefty penalties, interest charges, and even legal action. Imagine the scenario: the auditor asks for a specific document, and you’re left frantically searching through piles of disorganized paperwork, sweating profusely, while the clock ticks relentlessly. Not a pretty picture, is it? In more severe cases, insufficient documentation can lead to accusations of tax evasion, which can have serious legal and financial repercussions. Proper preparation safeguards against these potential pitfalls, transforming a stressful experience into a more manageable one.

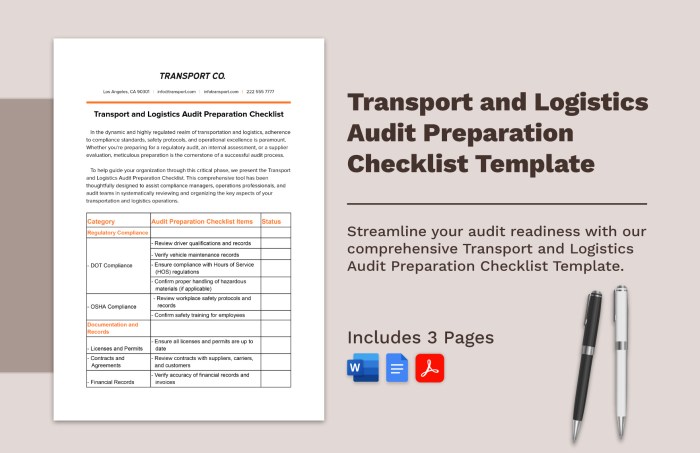

Initiating the Tax Audit Preparation Process: A Step-by-Step Guide, Tax Audit Preparation Checklist

A successful tax audit preparation begins with a structured, systematic approach. Let’s break down the process into manageable steps:

- Gather all relevant financial documents: This includes bank statements, receipts, invoices, tax returns from previous years, and any other documentation related to your income and expenses. Think of this as assembling your tax army – the more soldiers (documents) you have, the stronger your defense.

- Organize your documents systematically: Don’t just throw everything into a pile. Create a well-organized filing system, perhaps using folders categorized by year, type of expense, or client. A little organization goes a long way in avoiding the aforementioned “frantic searching” scenario.

- Review your tax returns: Carefully examine your past tax returns for any potential inconsistencies or areas that might require further clarification. This proactive approach can help identify and address any issues before they become major problems.

- Prepare a detailed explanation for any unusual transactions: If you have any transactions that might appear unusual to an auditor (e.g., large cash deposits, significant deductions), prepare a detailed explanation with supporting documentation. Think of this as your “case file” – presenting a clear, well-documented explanation will go a long way in demonstrating your transparency and good faith.

- Consult with a tax professional: If you’re feeling overwhelmed or unsure about any aspect of the process, don’t hesitate to seek professional help. A qualified tax advisor can provide invaluable guidance and support, helping you navigate the complexities of the tax audit process with confidence.

Gathering Necessary Documents

Ah, the paperwork. The bane of every accountant’s existence, and the lifeblood of a successful tax audit. Let’s face it, nobody *loves* gathering tax documents, but a well-organized approach can transform this tedious task into a surprisingly manageable (and even slightly less soul-crushing) endeavor. Think of it as a treasure hunt, where the treasure is…well, a less stressful tax season.

The key to a smooth tax audit is meticulous preparation. This means assembling all relevant financial documents – the more organized you are, the less time you’ll spend frantically searching for missing receipts come audit time. Remember, the IRS appreciates thoroughness almost as much as they appreciate timely filings (almost!).

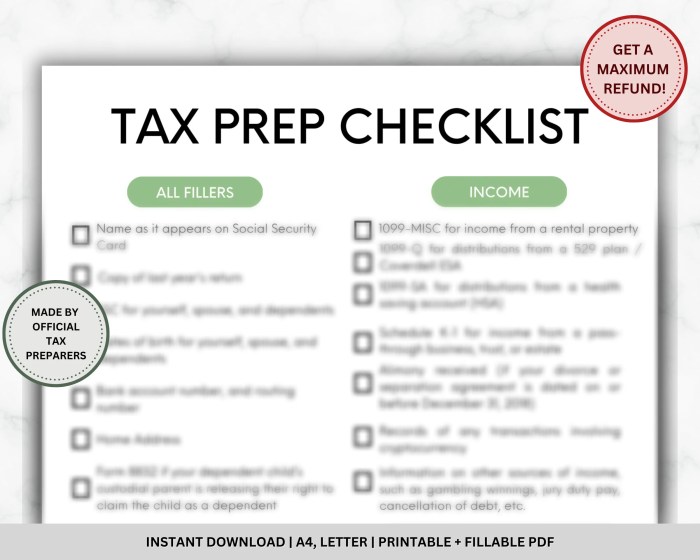

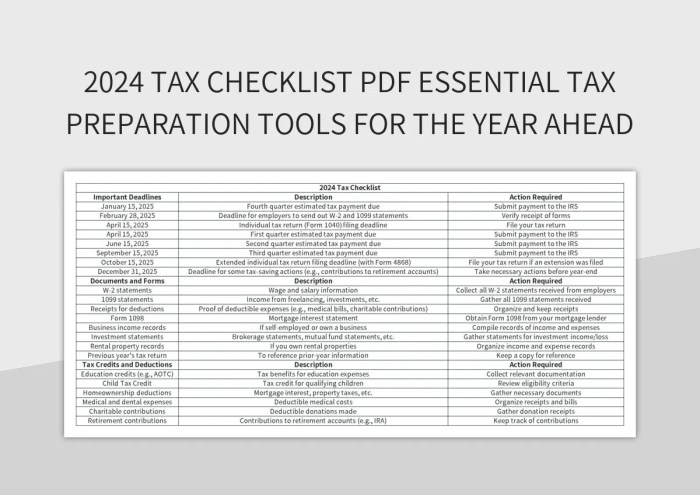

Essential Financial Documents for a Tax Audit

Below is a comprehensive checklist of essential documents. Remember, this isn’t an exhaustive list, and specific requirements may vary depending on your unique circumstances and tax situation. Always consult with your tax advisor for personalized guidance. They’re the real heroes in this story, not us.

| Document Type | Description | Location | Due Diligence Steps |

|---|---|---|---|

| Tax Returns (Prior Years) | Copies of your previously filed tax returns. | Filing cabinet, cloud storage, or tax professional’s records. | Verify accuracy, check for any discrepancies, and ensure they’re readily accessible. |

| W-2 Forms | Wage and tax statements from employers. | Payroll records, personal files. | Confirm the accuracy of reported wages, taxes withheld, and employer identification numbers. |

| 1099 Forms | Forms reporting various types of income, including interest, dividends, and freelance payments. | Bank statements, brokerage accounts, client records. | Match the reported income with your own records and bank statements. Pay special attention to the payer’s identification number. |

| Receipts and Invoices | Proof of expenses claimed as deductions. | Dedicated expense folders, accounting software, or cloud storage. | Ensure all receipts are properly dated, itemized, and clearly linked to the related expense. Don’t forget those tiny coffee receipts! |

| Bank Statements | Records of all financial transactions. | Online banking portals, physical bank statements. | Reconcile bank statements with your accounting records to ensure consistency. Missing a few months? That’s a red flag (and a potential audit headache). |

| Business Records (if applicable) | Financial statements, profit and loss statements, balance sheets. | Accounting software, business files. | Ensure financial statements are accurate, complete, and prepared according to generally accepted accounting principles (GAAP). |

Overlooked Documents

Some documents frequently get lost in the shuffle. These often-forgotten items can significantly impact your audit outcome, so be sure to include them in your meticulous collection.

Common culprits include canceled checks (especially for significant payments), documentation supporting home office deductions (including detailed measurements and photos – yes, really!), and records related to charitable donations (detailed receipts, or even better, bank statements showing the donation). Don’t forget those pesky investment records, detailing capital gains and losses. And remember those receipts for business-related travel expenses; they’re your best friend in the audit game.

Efficient Organization and Storage Strategies

Organizing your tax documents efficiently is crucial. A chaotic mess will only amplify the stress of an audit. Consider using a dedicated filing system, either physical or digital, to categorize documents by year and type. Cloud storage services offer secure and accessible options for digital storage. Investing in good accounting software can streamline the process and help you automatically organize and categorize your documents.

Remember, the goal is to create a system that works for *you*. Whether it’s color-coded folders, meticulously labeled digital files, or a combination of both, find a method that ensures easy access and retrieval of all your important tax documents. Your future self (and the IRS) will thank you.

Reconciling Financial Records

Ah, reconciliation! The beautiful dance between your bank statement and your meticulously kept (we hope!) accounting records. It’s less a tango and more a slightly awkward waltz, but a necessary one if you want to avoid a tax audit tango with the IRS – a dance you definitely don’t want to lead. This process is your financial sanity check, ensuring everything adds up (pun intended!).

Reconciling bank statements with accounting records involves comparing your internal financial records with your bank’s records of your transactions. This seemingly simple process reveals discrepancies, allowing for timely correction and preventing larger issues down the line. Think of it as a financial detective story, where you’re the intrepid investigator, and the discrepancies are the clues leading to a balanced, happy ending.

Bank Statement Reconciliation Process

The reconciliation process typically begins with obtaining a bank statement and a copy of your company’s accounting records for the same period. You then systematically compare each transaction listed on the bank statement against your records. Any discrepancies – transactions appearing in one record but not the other, or transactions with differing amounts – are investigated. This involves reviewing supporting documentation, such as invoices, receipts, and payment confirmations, to determine the correct amount and appropriate accounting treatment. Finally, adjustments are made to your accounting records to match the bank statement, resulting in a reconciled balance.

Identifying and Correcting Discrepancies

Discrepancies can arise from various sources, including simple data entry errors, timing differences (a check issued but not yet cashed), unrecorded transactions, or even outright fraud. Identifying these requires careful scrutiny and a healthy dose of skepticism. For instance, a missing deposit might be spotted by comparing the total deposits on the bank statement with the total deposits recorded in your accounting software. A discrepancy in amounts often points to a data entry error, perhaps a misplaced decimal point or a transposed number. A thorough investigation often involves checking supporting documents to trace the source of the error and make the necessary corrections.

Common Reconciliation Errors and Solutions

Let’s face it, errors happen. It’s human nature. But understanding common errors helps us avoid them. One frequent mistake is failing to account for outstanding checks. These are checks you’ve written but haven’t yet cleared the bank. The solution? Keep a separate record of outstanding checks and deduct them from the bank balance during reconciliation. Another common error is neglecting bank charges. Banks charge fees for various services; forgetting to account for these will lead to discrepancies. The solution is straightforward: Review the bank statement carefully, identify all charges, and record them in your accounting records. Finally, a classic mistake is mismatched deposit dates. Sometimes, deposits made on one day might appear on the bank statement on a different day due to processing delays. This is easily resolved by carefully comparing dates and ensuring the correct accounting period is used.

Reviewing Tax Returns and Supporting Documentation

Ah, the glorious past! Let’s delve into those previously filed tax returns, not with the dread of a looming audit, but with the detached amusement of an archaeologist excavating a particularly quirky civilization (your past self, in this case). A systematic approach is key, preventing you from accidentally unearthing a tax-related dinosaur.

This process involves more than just a cursory glance; it’s a detailed comparison, a forensic accounting investigation (minus the dramatic courtroom scenes, hopefully). Think of it as a friendly audit of your own work, ensuring consistency and identifying potential discrepancies before the authorities do. Identifying these discrepancies early allows for proactive corrections, saving you from potential headaches down the line. Remember, a little preventative care goes a long way.

Systematic Review of Previously Filed Tax Returns

Begin by chronologically reviewing each return, starting with the most recent. Compare each return to the preceding one, noting any significant changes in income, deductions, or credits. This helps to identify trends and potential inconsistencies. For example, a sudden jump in charitable donations might warrant further scrutiny, while a consistent pattern of claiming the same deductions is reassuring (unless, of course, those deductions are, shall we say, *optimistically* interpreted). Remember, consistency is your friend, but don’t let it blind you to potential errors.

Potential Areas of Concern or Discrepancies

Inconsistencies between reported income and bank statements are a red flag. Similarly, discrepancies between reported deductions and supporting documentation can raise questions. For example, if you claimed a home office deduction, ensure that the square footage and expenses align with the supporting documentation. Also, watch out for unusual fluctuations in income or deductions, especially those that lack clear explanations. A sudden drop in income without a clear explanation, such as job loss or retirement, should be documented. Another example would be unusually high deductions, which might require more detailed substantiation.

Verification of Supporting Documentation

This is where the rubber meets the road (or, more accurately, the paperwork meets the tax return). Each entry on the tax return must be meticulously cross-referenced with the corresponding supporting documentation. This includes pay stubs, 1099 forms, receipts, bank statements, and any other relevant documents. Missing documentation or discrepancies between the documentation and the return are major issues that need immediate attention. Think of it like a puzzle; every piece needs to fit perfectly. If a piece doesn’t fit, you know something is amiss. For example, a receipt for a business expense that doesn’t match the amount claimed on the return needs clarification.

Preparing for the Audit Interview: Tax Audit Preparation Checklist

The audit interview: It’s the moment of truth, the culmination of weeks (or months!) of meticulous record-keeping and hair-pulling. But fear not, intrepid taxpayer! With the right preparation, you can transform this potential ordeal into a surprisingly… pleasant experience. Think of it as a friendly chat with a highly-trained professional, albeit one who holds your financial fate in their hands.

Preparing for the audit interview involves more than just dusting off your best suit (though that’s a good start!). It’s about crafting a strategic approach that allows you to present your financial information clearly and confidently, while maintaining a calm and professional demeanor. This will allow you to navigate the interview with grace and (hopefully) minimal stress.

Strategies for Effective Communication with the Auditor

Effective communication is key to a successful audit interview. This involves more than just answering questions; it’s about proactively guiding the conversation and ensuring the auditor has all the information they need to complete their assessment efficiently. Think of yourself as a tour guide leading the auditor through your financial landscape – highlighting the scenic viewpoints (positive aspects of your returns) and politely diverting attention from any less-than-stellar areas (legitimate deductions that might require more explanation). Prepare a concise overview of your financial situation, focusing on key points and any areas that might require additional clarification. This will help the auditor quickly understand your situation and avoid unnecessary delays.

Maintaining a Professional and Cooperative Demeanor

Remember, the auditor is just doing their job. Maintaining a professional and cooperative attitude, even when faced with challenging questions, will greatly improve the overall experience. A calm and respectful approach demonstrates your commitment to transparency and compliance. Avoid getting defensive or argumentative, even if you feel the auditor is misinterpreting the information. Instead, politely explain your position, providing clear and concise documentation to support your claims. Think of it as a game of chess – strategic maneuvering, not a shouting match. A simple smile and a genuine willingness to cooperate can go a long way.

Examples of Appropriate Responses to Common Auditor Questions

Anticipating common auditor questions is crucial. While the specific questions will vary depending on your individual circumstances, some common themes emerge. For example, if asked about a significant expense, instead of simply stating the amount, provide context. For instance, “This expense of $10,000 represents the purchase of new equipment for our business, as detailed in invoice number 12345, which I have provided in the supporting documentation.” If asked about a discrepancy, rather than becoming flustered, calmly state, “I noticed that discrepancy as well. After reviewing my records, I believe it’s due to [clear and concise explanation with supporting documentation].” Always back up your answers with concrete evidence. Think of it as presenting a well-researched case to a judge – facts, figures, and documentation are your best friends. Remember, preparedness is your superpower!

Understanding Common Audit Issues

Navigating a tax audit can feel like a trip through a particularly thorny jungle, but understanding the common pitfalls can transform you from a terrified explorer into a seasoned, if slightly nervous, adventurer. Knowing what auditors typically focus on can significantly reduce your stress levels and increase your chances of a smooth audit process. Think of this section as your trusty machete, clearing the path ahead.

Auditors, like diligent bloodhounds, sniff out inconsistencies and anomalies. Their keen senses are particularly attuned to certain areas, often revealing discrepancies that might otherwise go unnoticed. This section will highlight those areas and help you prepare for a less stressful encounter.

Commonly Scrutinized Areas

Auditors are trained to look for patterns and inconsistencies. Common areas that often attract their attention include expense deductions (particularly those that seem extravagant or lack sufficient documentation), income reporting (ensuring all income sources are declared accurately), and the accuracy of depreciation calculations. Another frequent area of focus is the proper classification of business expenses versus personal expenses. A blurry line here is a surefire way to attract unwanted attention. Remember, the IRS is looking for evidence of intentional tax evasion, but even honest mistakes can lead to further scrutiny.

Red Flags That Trigger Deeper Scrutiny

Several factors can trigger a more thorough audit. These “red flags” often involve inconsistencies in reported income and expenses, significant changes in income from previous years without a clear explanation, and unusual or excessive deductions. For example, claiming a home office deduction without a properly documented workspace could raise a flag. Similarly, a sudden surge in charitable donations without sufficient supporting documentation could lead to a more detailed examination. These seemingly minor discrepancies can snowball, so meticulous record-keeping is paramount.

Implications of Audit Findings

The consequences of audit findings vary greatly depending on the severity and nature of the discrepancy. Minor discrepancies, often resulting from simple errors, might only require adjustments to your tax return. However, more serious findings, such as intentional tax evasion, can lead to penalties, interest charges, and even criminal prosecution. A common penalty is the accuracy-related penalty, imposed when the IRS determines that a taxpayer’s underpayment of tax is due to negligence or disregard of rules and regulations. The amount of the penalty can be substantial, highlighting the importance of accuracy and thorough documentation. Remember, even a small error can have large consequences.

Post-Audit Procedures

Ah, the audit is over! The confetti cannons have (hopefully) not been deployed prematurely, and the celebratory champagne remains chilling. But before you uncork that bottle, let’s navigate the often-overlooked, yet critically important, post-audit procedures. Think of it as the post-game analysis – crucial for future success and avoiding a replay of the same stressful match.

The post-audit phase isn’t simply about dusting off your hands and forgetting about the whole ordeal. It’s about understanding the auditor’s findings, addressing any discrepancies, and implementing changes to prevent future issues. This stage is your opportunity to learn from the experience and strengthen your financial management practices. Consider it an investment in your financial future – one that might save you headaches (and possibly money) down the line.

Responding to Audit Findings

Responding to audit findings requires a measured and methodical approach. It’s not a time for emotional outbursts or blaming others; rather, it’s about calmly analyzing the findings and formulating a response. This often involves a detailed review of the auditor’s report, identifying any discrepancies between the auditor’s findings and your own records. If there are disagreements, you’ll need to provide supporting documentation to substantiate your claims. Think of it like a friendly (but firm) debate with evidence – your meticulously kept records being your strongest ally. Remember, clear and concise communication is key. A well-structured response that directly addresses each point raised will demonstrate your professionalism and commitment to accuracy. For example, if the auditor questions a specific expense, provide detailed invoices, receipts, and any other relevant documentation to support the legitimacy of the expenditure. Don’t just throw everything at them; organize your evidence logically and systematically.

Implementing Corrective Actions

Once you’ve addressed the auditor’s findings, it’s time to implement corrective actions. This might involve updating your accounting software, revising internal controls, or implementing new procedures to prevent similar issues from arising in the future. Think of this as preventative medicine for your financial health. A simple example might be improving your record-keeping system to ensure all transactions are properly documented and easily accessible. Another could be establishing a more rigorous approval process for large expenditures to avoid future discrepancies. By proactively addressing these issues, you’ll not only improve the accuracy of your financial statements but also enhance the overall efficiency of your financial operations. This proactive approach demonstrates a commitment to good financial governance and reduces the likelihood of future audit findings.

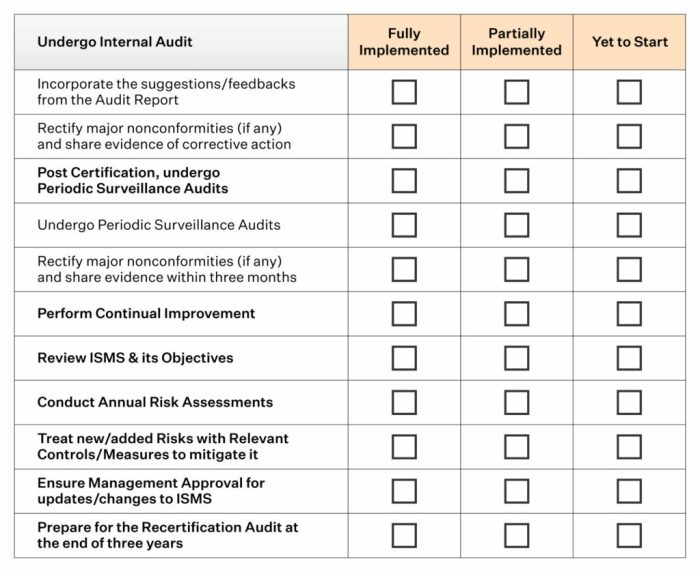

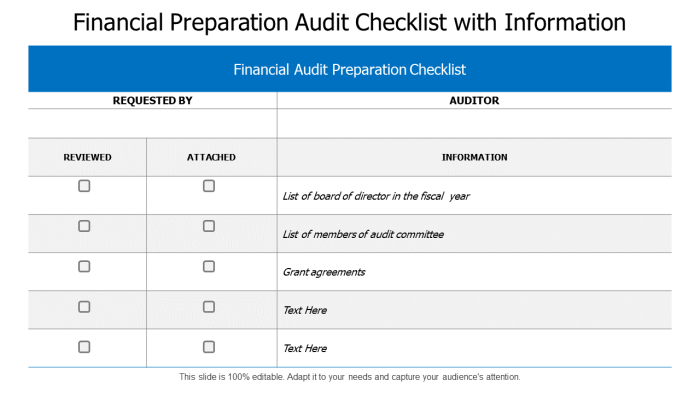

Post-Audit Compliance Checklist

Preparing a post-audit compliance checklist is like creating a roadmap for maintaining financial health. It helps ensure that all necessary steps are taken to maintain compliance and prevent future audit issues. This checklist should include tasks such as reviewing and updating internal controls, ensuring proper documentation of all financial transactions, and conducting regular internal audits to identify potential problems early on. For example, a company might schedule regular reviews of their expense reports, implementing a system of checks and balances to verify the legitimacy of each claim. Another element could be establishing a training program for employees to ensure everyone understands and adheres to the company’s financial policies and procedures. A well-structured checklist, tailored to your specific business needs, ensures ongoing compliance and helps avoid the stress of future audits.

Illustrative Example: A Small Business Audit

Barnaby’s Bake Shop, a charming but slightly chaotic bakery specializing in artisanal sourdough, found itself the subject of an IRS audit. Barnaby, the owner, a man whose organizational skills were inversely proportional to his baking talent, had a sinking feeling when the letter arrived. This wasn’t just any audit; it was a full-blown, deep-dive examination of Barnaby’s Bake Shop’s financial records for the past three years. Fortunately, Barnaby had (somewhat reluctantly) attended a tax seminar a few months prior, and vaguely remembered something about a checklist.

Applying the Tax Audit Preparation Checklist

The seminar’s checklist became Barnaby’s unlikely savior. First, he tackled “Understanding Tax Audit Preparation,” realizing the importance of maintaining calm (easier said than done with a looming audit) and gathering all relevant documentation. This was a Herculean task involving sorting through mountains of receipts, invoices, and baking-related paraphernalia. The “Gathering Necessary Documents” section proved invaluable, as it prompted Barnaby to locate bank statements, sales records, and even his rather eccentric expense tracking system (a series of color-coded sticky notes on a whiteboard). Reconciling his financial records was a nightmare, but following the checklist’s steps allowed him to identify several discrepancies, which, although initially alarming, were easily explained (mostly involving misplaced decimal points). Reviewing tax returns and supporting documentation, a step Barnaby initially skipped, unearthed a small error in his depreciation calculations, thankfully easily corrected.

The Audit Interview

The “Preparing for the Audit Interview” section was a lifesaver. Barnaby practiced answering potential questions, learning to articulate his bookkeeping methods (or lack thereof) in a clear and concise manner. He even invested in a new, slightly less chaotic filing system. The audit itself was surprisingly less terrifying than anticipated. The auditor, a surprisingly patient woman named Ms. Periwinkle, appreciated Barnaby’s organized approach (a stark contrast to his usual methods) and his willingness to cooperate.

Addressing Common Audit Issues

Barnaby’s biggest challenge was related to the “Understanding Common Audit Issues” section of the checklist. He had inadvertently mixed personal and business expenses, a common pitfall for small business owners. However, by meticulously documenting his business-related expenditures and presenting a clear distinction between personal and business finances, he was able to address this concern. Ms. Periwinkle acknowledged the initial oversight but appreciated his transparency and thoroughness in rectifying the situation.

Post-Audit Procedures

Following the audit, Barnaby diligently followed the “Post-Audit Procedures” Artikeld in the checklist. He meticulously documented all communications with the auditor, ensuring all adjustments were properly reflected in his records. He even implemented a new, more organized accounting system. The experience, while initially stressful, ultimately proved to be a valuable learning experience. Barnaby emerged from the audit not only unscathed but also with a newfound appreciation for proper accounting practices and a significantly improved organizational system. His sticky notes, however, remained a constant.

Utilizing Technology in Tax Audit Preparation

Let’s face it, tax audits are about as much fun as a root canal without anesthesia. But fear not, dear reader! Technology can be your knight in shining armor, rescuing you from the drudgery and potential pitfalls of manual tax preparation. By embracing the digital age, you can significantly streamline the process, improve accuracy, and perhaps even (dare we say it?) enjoy a slightly less stressful experience.

The role of accounting software in streamlining the preparation process is nothing short of revolutionary. Gone are the days of endless spreadsheets and the risk of human error leading to a mountain of recalculations. Modern accounting software automates many tedious tasks, allowing you to focus on the strategic aspects of your tax preparation and audit defense. Think of it as having a tireless, highly accurate, and exceptionally organized digital assistant dedicated to your financial well-being.

Accounting Software’s Impact on Accuracy and Efficiency

Accounting software offers a multitude of ways to enhance both the accuracy and efficiency of tax audit preparation. Automated data entry minimizes the chance of manual input errors, a common source of headaches during audits. Real-time reporting capabilities provide immediate insights into your financial health, allowing for proactive identification and correction of potential issues. Furthermore, features like automated reconciliation and bank feeds significantly reduce the time spent on tedious manual tasks, freeing up valuable time for more strategic activities, like planning your next vacation (after the audit, of course!). For example, imagine the time saved by automatically importing bank transactions instead of manually entering each one. The software can even flag suspicious transactions, saving you the effort of manually sifting through thousands of records.

Comparison of Tax Audit Preparation Software

Several software options cater specifically to tax audit preparation, each with its own strengths and weaknesses. Some packages are designed for small businesses, offering simplified interfaces and streamlined workflows. Others are more comprehensive, suitable for larger enterprises with complex financial structures. Factors to consider when choosing software include the size and complexity of your business, your budget, the level of integration with other systems (like payroll software), and the level of support provided by the vendor. A robust search online will unveil a range of options, from cloud-based solutions to desktop applications, each with detailed specifications and user reviews. Careful consideration of your specific needs will help you select the perfect digital sidekick for your tax audit preparation. Consider factors like ease of use, reporting capabilities, and integration with other software you already use. Don’t just choose the first one you see; do your research!

Closing Notes

So, there you have it: your comprehensive guide to conquering the tax audit beast! Remember, thorough preparation is your secret weapon. By meticulously following this checklist, you’ll not only survive the audit but potentially even impress the auditor with your organizational prowess. Embrace the challenge, and remember, even the most daunting tax audit can be tamed with the right strategy and a healthy dose of preparedness. Now go forth and conquer those tax demons!

Question Bank

What if I can’t find a specific document?

Document your diligent search. Explain the efforts made to locate the missing document. A proactive approach showing good faith goes a long way.

Can I represent myself during the audit?

Yes, but consider seeking professional tax advice. A tax professional can provide invaluable support and guidance throughout the process.

What happens if discrepancies are found?

Cooperate fully, provide explanations, and work with the auditor to resolve the discrepancies. Accurate documentation is key.

How long does a tax audit typically take?

It varies greatly depending on the complexity of your tax return and the nature of the audit. Be prepared for a process that may span several weeks or months.