Tax Optimization Techniques Review: Embark on a thrilling journey into the surprisingly fun world of tax efficiency! We’ll navigate the treacherous waters of deductions and credits, explore the exotic locales of tax-advantaged investments, and even uncover the secrets of ethical tax planning (because even tax professionals need a moral compass, apparently). Prepare for a rollercoaster ride of financial enlightenment—buckle up, it’s going to be a wild ride!

This review delves into the multifaceted strategies employed to legally minimize tax liabilities. We’ll examine various tax deductions and credits available to individuals and businesses, explore investment strategies that maximize after-tax returns, and analyze the intricacies of international tax laws. We will also discuss the ethical considerations inherent in tax optimization, highlighting the crucial distinction between clever planning and outright evasion (because let’s be honest, jail time isn’t very tax-efficient).

Introduction to Tax Optimization Techniques

Tax optimization, the art of legally minimizing your tax burden, is less about hiding money in offshore accounts and more about strategic financial planning. Think of it as a sophisticated game of financial chess, where the goal is not to avoid paying taxes entirely (that’s illegal!), but to pay only what’s legally required, freeing up more resources for investments, growth, or, you know, that ridiculously expensive avocado toast you’ve been eyeing.

Tax optimization strategies aren’t some newfangled invention; they’ve been around almost as long as taxes themselves. Early examples include utilizing deductions for charitable donations (even the Roman Empire had its share of philanthropic tax breaks, though likely for different reasons). The evolution of tax laws and financial instruments has, however, dramatically expanded the range of available strategies. Think of the shift from simple deductions to the complexities of tax shelters and international tax treaties – a testament to both human ingenuity and our enduring fascination with finding loopholes (legal ones, of course!).

Common Misconceptions About Tax Optimization

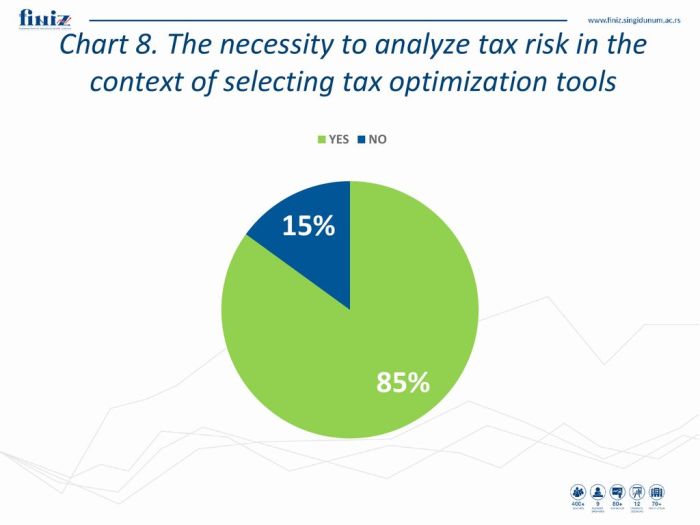

Many people harbor inaccurate beliefs about tax optimization, often fueled by sensationalized media portrayals. One prevalent misconception is that tax optimization is solely for the ultra-wealthy. While high-net-worth individuals certainly benefit from sophisticated strategies, basic tax optimization principles – like maximizing retirement contributions or utilizing deductions – are applicable to everyone, regardless of income level. Another common misconception is that all tax optimization is ethically questionable. This is demonstrably false. Legitimate tax optimization involves utilizing legal avenues to reduce your tax liability, not engaging in illegal tax evasion. Finally, some believe that tax optimization is overly complex and inaccessible. While some advanced strategies require professional expertise, many basic techniques are surprisingly straightforward and can be implemented with minimal effort. For instance, accurately tracking business expenses and contributing to a tax-advantaged retirement account are relatively simple yet highly effective strategies.

Tax Deductions and Credits

Navigating the often-bewildering world of taxes doesn’t have to feel like trying to solve a Rubik’s Cube blindfolded. Understanding tax deductions and credits can significantly reduce your tax burden, leaving you with more money to spend on things that actually bring joy (like, say, a lifetime supply of artisanal cheese). Let’s unravel this fascinating (and potentially lucrative) topic.

Tax deductions and credits are like the secret weapons in your tax arsenal, allowing you to legitimately lower your tax bill. While both reduce the amount you owe, they do so in slightly different ways. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Think of deductions as lowering the *price* of the tax bill, while credits are like getting a *discount* on the final price. The difference can be substantial, so understanding the nuances is key.

Types of Tax Deductions for Individuals and Businesses

Individuals and businesses have access to a variety of tax deductions, each with its own set of rules and requirements. For individuals, common deductions include those for charitable contributions, home mortgage interest, state and local taxes (subject to limitations), and self-employment taxes. Businesses, on the other hand, can deduct expenses like salaries, rent, utilities, and depreciation of assets. The key is to meticulously track all eligible expenses, as these deductions can significantly impact your bottom line. Remember, proper record-keeping is your best friend in this endeavor.

Eligibility Criteria for Various Tax Credits

Tax credits are even more appealing than deductions because they directly reduce your tax liability, dollar for dollar. Eligibility for various credits depends on factors like income, family size, and the type of credit claimed. For example, the Earned Income Tax Credit (EITC) is designed to help low-to-moderate-income working individuals and families, while the Child Tax Credit offers relief to families with qualifying children. The American Opportunity Tax Credit assists with the cost of higher education, and various other credits exist for specific circumstances such as renewable energy investments or adoption expenses. Each credit has specific requirements; therefore, careful examination of the IRS guidelines is crucial.

Comparison of Tax Deduction Strategies

Different tax deduction strategies can yield varying results depending on individual circumstances. For instance, itemizing deductions (listing individual deductions) might be beneficial for taxpayers with significant deductible expenses, while the standard deduction provides a simpler, pre-calculated deduction. The optimal strategy depends on the taxpayer’s unique financial situation and should be carefully evaluated each year. Consulting a tax professional can provide personalized guidance in choosing the most advantageous approach.

Common Tax Deductions and Their Limitations

| Deduction Type | Eligibility | Maximum Amount | Example |

|---|---|---|---|

| Charitable Contributions | Cash or property donations to qualified charities | Up to 60% of Adjusted Gross Income (AGI) for cash, varies for property | Donating $1000 to a registered charity |

| Home Mortgage Interest | Interest paid on a qualified mortgage for a primary residence | Interest on up to $750,000 of debt (for loans acquired after 2017) | Paying $10,000 in mortgage interest |

| State and Local Taxes (SALT) | State and local income, sales, and property taxes paid | $10,000 per household (as of 2023) | Paying $8,000 in state income tax and $3,000 in property tax |

| Business Expenses | Ordinary and necessary expenses incurred in running a business | Varies depending on the expense | Deducting office rent, supplies, and employee salaries |

Investment Strategies for Tax Optimization

Investing wisely isn’t just about growing your money; it’s also about keeping more of it. Smart tax planning can significantly boost your investment returns, turning a good investment into a truly great one. Think of it as a bonus round in the game of finance – you’re already making money, and now you’re getting to keep even more of it! Let’s explore some strategies to help you achieve this financial nirvana.

Tax-advantaged investment accounts and tax-efficient investment vehicles are your secret weapons in this battle against Uncle Sam. By understanding how these tools work, you can significantly reduce your tax burden and accelerate your wealth accumulation. It’s like having a personal tax-minimizing ninja working for you, silently optimizing your financial future.

Tax-Advantaged Investment Accounts

Tax-advantaged accounts offer significant benefits by allowing your investments to grow tax-deferred or tax-free. The most popular examples are 401(k)s and IRAs. 401(k)s are employer-sponsored retirement plans, often offering matching contributions, which is essentially free money! IRAs, on the other hand, are individual retirement accounts offering various options depending on your income and contribution needs. Both allow you to contribute pre-tax dollars, reducing your current taxable income, and your earnings grow tax-deferred until retirement. This strategy is akin to a financial magic trick: your money grows, and you pay taxes later, at a potentially lower tax bracket during retirement.

Tax-Efficient Investment Vehicles

Certain investments are inherently more tax-efficient than others. Municipal bonds, for instance, often offer tax-exempt interest income. This means the interest you earn is not subject to federal income tax, and sometimes not even state or local taxes, depending on where you live and the type of bond. Imagine the thrill of earning interest without the tax sting – it’s like finding a twenty-dollar bill in your old jeans, but much more substantial.

Hypothetical Tax-Optimized Investment Portfolio

Let’s craft a sample portfolio showcasing tax efficiency. This is not financial advice, of course; consult a professional for personalized guidance. Consider a portfolio diversified across various asset classes to minimize risk. For example:

A hypothetical portfolio might include:

* 401(k): Maximize employer matching contributions, then contribute enough to reach the maximum allowable contribution limit. This reduces your current taxable income and leverages employer matching, maximizing your investment growth.

* Roth IRA: Contribute to a Roth IRA to further reduce your taxable income, with the added bonus of tax-free withdrawals in retirement. This strategy is a long-term play, but the tax-free withdrawals in retirement make it incredibly rewarding.

* Taxable Brokerage Account: Allocate a portion of your investments to a taxable brokerage account. This might include a mix of stocks and bonds. For this portion, consider tax-efficient strategies such as harvesting capital losses to offset capital gains, thereby reducing your overall tax liability. This is like a financial game of chess – carefully planning your moves to minimize your tax burden.

* Municipal Bonds: Include a small allocation to municipal bonds for their tax-exempt interest income. This acts as a steady, tax-advantaged stream of income within your portfolio.

The rationale is to leverage tax-advantaged accounts to the fullest extent possible, while strategically managing investments in a taxable account to minimize tax consequences. It’s a delicate balance, but the rewards – a larger nest egg – are well worth the effort. Remember, this is just a hypothetical example, and a personalized portfolio should be tailored to your individual financial situation, risk tolerance, and time horizon.

Tax Planning for Businesses

Navigating the labyrinthine world of business taxes can feel like trying to solve a Rubik’s Cube blindfolded – challenging, but ultimately rewarding if you have the right strategy. Proper tax planning isn’t just about minimizing your tax bill; it’s about optimizing your financial health and ensuring your business thrives. This section will illuminate some key strategies for different business structures, helping you transform your tax burden from a headache into a manageable expense.

Effective tax planning is a proactive, year-round endeavor, not a last-minute scramble. It involves understanding the nuances of different tax laws and how they interact with your specific business structure and financial activities. Ignoring tax planning can lead to costly mistakes, penalties, and missed opportunities for growth.

Tax Planning Strategies for Small Businesses and Corporations

Small businesses and corporations face different tax challenges, requiring tailored approaches. Small businesses, often simpler in structure, might focus on maximizing deductions for expenses directly related to their operations. Corporations, on the other hand, have more complex structures and may explore strategies like dividend distribution to optimize shareholder taxation. Effective planning requires a deep understanding of the specific tax implications of each business structure. For example, a small business might benefit from utilizing a qualified retirement plan to reduce taxable income, while a corporation might utilize strategies like accelerated depreciation to minimize its tax liability in the early years of operation. These strategies should always be carefully considered in consultation with a qualified tax professional.

Tax Optimization Techniques for Different Business Structures, Tax Optimization Techniques Review

The optimal tax strategy varies significantly depending on the business structure.

- Sole Proprietorship: Sole proprietorships are the simplest structure, with business income and expenses reported directly on the owner’s personal tax return (Schedule C). Tax optimization focuses on maximizing allowable deductions for business expenses, such as home office deductions (if applicable and meeting IRS requirements), and contributing to self-employed retirement plans like SEP IRAs or solo 401(k)s. Careful record-keeping is crucial for claiming these deductions.

- LLC (Limited Liability Company): LLCs offer flexibility in taxation. They can be taxed as sole proprietorships, partnerships, S corporations, or C corporations, depending on election. The choice significantly impacts tax optimization strategies. For example, an LLC taxed as an S corporation allows for the distribution of profits as salaries and distributions, potentially lowering the overall tax burden compared to an LLC taxed as a sole proprietorship.

- S Corporation: S corporations are pass-through entities, meaning profits and losses are passed through to the owners’ personal tax returns. However, they offer the potential for tax savings by paying a reasonable salary to the owner-employee and distributing the remaining profits as distributions, which are taxed at a lower rate than salary income. This strategy requires careful consideration of payroll taxes and compliance with IRS regulations concerning reasonable compensation.

- C Corporation: C corporations are taxed separately from their owners. They pay corporate income tax on their profits, and shareholders pay taxes on dividends received. Tax optimization strategies for C corporations often involve maximizing deductions, utilizing tax credits, and carefully managing dividend distributions to minimize the overall tax burden across both the corporate and individual levels. This could involve strategies like utilizing tax-loss harvesting to offset capital gains.

Tax Implications of Various Business Expenses

Understanding the tax implications of different business expenses is critical. Some expenses are fully deductible, while others are subject to limitations or restrictions. For instance, meals and entertainment expenses are subject to a 50% deduction limit (under current IRS rules). Similarly, home office deductions require careful adherence to IRS guidelines to qualify. Accurate record-keeping and proper categorization of expenses are essential for maximizing deductions and avoiding IRS scrutiny. A common pitfall is improperly categorizing personal expenses as business expenses. This can result in penalties and increased tax liability.

Prioritized Business Tax Planning Strategies

The optimal tax strategy depends on individual circumstances, but generally, these strategies should be prioritized:

- Maximize Deductible Expenses: Meticulously track and categorize all legitimate business expenses to reduce taxable income. This is the foundation of effective tax planning.

- Choose the Right Business Structure: Selecting the most tax-efficient structure (sole proprietorship, LLC, S-corp, C-corp) significantly impacts your tax liability. This decision should be made in consultation with a tax professional.

- Utilize Tax Credits: Research and claim all applicable tax credits, such as the research and development credit or the work opportunity credit, to directly reduce your tax liability.

- Implement Retirement Savings Plans: Contribute to qualified retirement plans to reduce taxable income and build long-term savings. This is particularly beneficial for self-employed individuals.

- Strategic Asset Allocation: Consider the tax implications of your investments. For example, tax-advantaged accounts like 401(k)s and IRAs can significantly reduce your tax burden over time.

International Tax Optimization

Navigating the world of international tax optimization is like traversing a particularly treacherous, yet oddly fascinating, jungle. It’s filled with dense foliage (complex regulations), lurking predators (unexpected tax liabilities), and the occasional shimmering oasis (tax havens… but proceed with caution!). This section will illuminate some of the paths, pitfalls, and potential treasures within.

International tax laws and regulations are notoriously intricate, varying wildly from country to country. What constitutes a deductible expense in one jurisdiction might be a taxable event in another. This creates a landscape of complexities that requires careful planning and expert guidance. Think of it as a global game of tax Tetris, where you’re trying to fit oddly shaped tax blocks into a constantly shifting grid.

Tax Havens and Their Implications

Tax havens, often small island nations or territories with exceptionally low or no corporate income tax rates, attract significant criticism. While they can offer legitimate benefits to businesses, their use can also facilitate tax evasion and aggressive tax planning. The implications can be far-reaching, affecting not only the havens themselves but also the countries from which capital flows. Consider the case of Ireland, which, for a time, was considered a tax haven for many multinational corporations, leading to debates about its impact on global tax fairness. The potential for reputational damage and regulatory scrutiny makes using tax havens a high-risk, high-reward strategy.

Strategies for Optimizing Taxes on Foreign Income and Assets

Optimizing taxes on foreign income and assets involves a multifaceted approach. This might include utilizing double taxation treaties to reduce the overall tax burden, strategically structuring investments to minimize exposure to higher tax rates, and employing sophisticated transfer pricing strategies for transactions between related entities in different jurisdictions. A company might, for example, utilize a foreign subsidiary in a low-tax jurisdiction to hold intellectual property rights, thereby reducing its overall tax liability in its home country. However, these strategies must be carefully implemented to comply with all relevant regulations and avoid accusations of tax avoidance.

Key Tax Treaties Between Major Economies

The following table summarizes key aspects of tax treaties between some major economies. Remember, these are simplified representations, and consulting with a tax professional is crucial for specific guidance.

| Country A | Country B | Treaty Type | Key Provisions |

|---|---|---|---|

| United States | United Kingdom | Comprehensive Tax Treaty | Avoids double taxation on income and capital gains; provides for exchange of information. |

| Canada | Germany | Comprehensive Tax Treaty | Addresses taxation of dividends, interest, royalties, and capital gains; includes provisions on tax credits. |

| France | Japan | Comprehensive Tax Treaty | Reduces or eliminates double taxation; includes provisions for mutual assistance in tax collection. |

| China | Australia | Comprehensive Tax Treaty | Addresses taxation of various income streams; includes provisions on tax information exchange. |

Ethical Considerations in Tax Optimization: Tax Optimization Techniques Review

Navigating the world of tax optimization can feel like traversing a minefield of legal loopholes and ethical gray areas. While minimizing your tax burden is perfectly legal and often encouraged, the line between clever planning and outright deception can be surprisingly blurry. This section explores the ethical minefield, ensuring you avoid any unfortunate explosions of IRS scrutiny.

The ethical boundaries of tax optimization hinge on the fundamental principle of fairness and compliance with the letter and spirit of the law. It’s not just about avoiding penalties; it’s about contributing your fair share to the societal good. Remember, the tax system funds essential services – think roads, schools, and that surprisingly effective mosquito control program in your neighborhood. While legally minimizing your tax liability is acceptable, deliberately structuring your affairs to avoid paying your rightful dues is not.

Tax Avoidance versus Tax Evasion

Tax avoidance involves using legal methods to reduce your tax liability. This is perfectly acceptable, even encouraged. Think of it as a highly sophisticated game of financial chess, where you strategically move your assets to minimize your tax exposure. Tax evasion, on the other hand, is the illegal act of not paying taxes that are legally owed. This involves actively concealing income, falsifying documents, or employing other illicit means to cheat the system. The difference is simple: avoidance is playing by the rules, while evasion is breaking them. One gets you a pat on the back (metaphorically, of course), the other gets you a visit from the IRS, and possibly a lengthy stay in a rather unpleasant facility.

Examples of Unethical Tax Optimization Practices

Unethical tax optimization often involves deliberately misrepresenting facts or exploiting loopholes intended for specific situations. For example, claiming deductions for expenses that aren’t genuinely business-related, or using shell corporations in tax havens to hide assets and income, are clear violations of ethical and legal standards. Another example might be the use of complex, deliberately obfuscated financial instruments designed solely to confuse tax authorities and hinder proper scrutiny. These practices not only undermine the fairness of the tax system but also erode public trust in the integrity of financial institutions and individual taxpayers. Think of it as a sophisticated form of financial sleight of hand, but instead of coins, you’re juggling millions (and potentially facing the consequences).

A Code of Conduct for Ethical Tax Optimization Practices

A code of conduct for ethical tax optimization should emphasize transparency, accuracy, and a commitment to fair play. It should include:

Always ensure complete and accurate reporting of income and expenses.

Seek professional advice from qualified tax advisors, but never blindly follow their recommendations without understanding the implications.

Avoid using overly complex or opaque financial structures solely to minimize tax liability.

Prioritize substance over form – focus on the economic reality of transactions rather than just their legal structure.

Maintain thorough documentation of all financial transactions and tax-related decisions.

If unsure about the legality or ethical implications of a tax optimization strategy, err on the side of caution and seek independent advice.

Following these guidelines will help you navigate the complexities of tax optimization ethically and responsibly, ensuring that your tax planning strategy stands up to scrutiny and promotes a fair and equitable tax system for all.

Future Trends in Tax Optimization

The world of tax optimization is a thrilling rollercoaster, constantly looping through legislative changes and technological advancements. Buckle up, because the future promises both exhilarating opportunities and stomach-churning challenges for tax professionals and businesses alike. Predicting the future is, of course, a fool’s errand, but by examining current trends, we can make some educated guesses – and perhaps even a few shrewd investments.

Emerging technologies are reshaping the tax landscape at a dizzying pace. The days of manually sifting through mountains of paper receipts are thankfully fading into the dusty annals of history. This transformation is driven by the relentless march of automation and the ever-increasing power of data analytics.

The Rise of AI and Data Analytics in Tax Optimization

AI and sophisticated data analytics are no longer futuristic fantasies; they’re becoming indispensable tools for tax professionals. These technologies can automate routine tasks, such as data entry and reconciliation, freeing up human experts to focus on more complex strategic planning. Furthermore, AI algorithms can identify patterns and anomalies in vast datasets that might escape the human eye, leading to more effective tax planning and potentially uncovering significant savings. For example, imagine an AI system analyzing thousands of transactions to identify deductions previously overlooked, or predicting potential tax audits based on historical data and regulatory changes. This proactive approach can significantly reduce tax liabilities and minimize the risk of penalties. The use of AI also extends to real-time tax compliance monitoring, providing instant alerts on potential issues.

Challenges and Opportunities in the Future of Tax Optimization

The future of tax optimization presents a paradox: unprecedented opportunities alongside daunting challenges. The increasing complexity of tax laws and regulations, coupled with the growing internationalization of businesses, creates a need for sophisticated, adaptable strategies. However, the very technologies designed to simplify tax compliance also present new hurdles. For instance, the sheer volume of data generated by businesses can be overwhelming, requiring robust data management systems and specialized expertise to interpret effectively. Furthermore, the ethical implications of using AI in tax optimization must be carefully considered. Ensuring transparency and fairness is crucial to maintaining public trust and avoiding potential regulatory backlash.

Potential Evolution of Tax Laws and Regulations

Predicting future tax legislation is a high-stakes game, but some trends are discernible. Governments worldwide are grappling with the challenges of digital taxation, seeking ways to effectively tax the profits of multinational corporations operating in the digital sphere. We can anticipate further refinements in international tax agreements and the continued evolution of transfer pricing rules. Furthermore, increasing societal concerns about income inequality may lead to more progressive tax systems, with higher taxes on high earners and corporations. This could, in turn, necessitate more sophisticated tax planning strategies for high-net-worth individuals and large corporations. The recent global focus on environmental sustainability might also lead to tax incentives for green technologies and businesses committed to reducing their carbon footprint. For example, countries are already implementing carbon taxes and offering subsidies for renewable energy, prompting businesses to optimize their tax strategies in line with these policies.

Case Studies in Tax Optimization

Tax optimization, when done correctly, isn’t about hiding money from the taxman like a mischievous squirrel burying acorns; it’s about strategically leveraging the tax code to achieve significant financial gains. These case studies illustrate how smart planning can transform a tax burden into a powerful tool for growth. We’ll examine real-world examples, revealing the secrets behind their success – and perhaps inspiring your own tax-savvy endeavors.

The following case studies showcase diverse approaches to tax optimization, highlighting the importance of tailored strategies based on individual circumstances and business models. Remember, consulting with a qualified tax professional is crucial before implementing any tax optimization strategy. These examples are for illustrative purposes only and should not be considered professional tax advice.

Tax Optimization for a Growing Tech Startup

Imagine a rapidly expanding tech startup, “InnovateTech,” experiencing explosive growth. Their initial revenue stream primarily comes from software licensing, leading to a high taxable income. However, by strategically investing in research and development (R&D), InnovateTech was able to significantly reduce their tax liability. They qualified for substantial R&D tax credits, offsetting a large portion of their taxable income. This allowed them to reinvest profits back into the company, fueling further innovation and expansion. In their second year, they reduced their tax bill by 25%, saving $500,000. This allowed them to hire five additional engineers, accelerating their product development cycle and ultimately boosting their market share.

Key lessons learned from InnovateTech’s experience:

- Proactive tax planning is essential for growth companies.

- Understanding and utilizing available tax credits is crucial.

- Investing in R&D can offer significant tax advantages.

Tax-Efficient Retirement Planning for a High-Income Earner

Consider Sarah, a high-income earner approaching retirement. Concerned about minimizing her tax burden in retirement, Sarah implemented a multifaceted strategy. This included maximizing contributions to her 401(k) and Roth IRA accounts, thereby reducing her current taxable income. Additionally, she strategically invested in tax-advantaged municipal bonds, generating income that was exempt from federal income tax. Through this combined approach, Sarah reduced her annual tax liability by approximately 15%, freeing up funds for travel and other retirement pursuits. Over a ten-year period, this strategy saved her an estimated $150,000 in taxes.

Key lessons learned from Sarah’s experience:

- Diversification of investment strategies is vital for tax efficiency.

- Maximizing contributions to tax-advantaged retirement accounts is crucial.

- Understanding the tax implications of different investment vehicles is essential.

International Tax Optimization for a Multinational Corporation

“GlobalCorp,” a multinational corporation with operations in several countries, implemented a sophisticated international tax optimization strategy. By strategically structuring their international operations and utilizing available tax treaties, GlobalCorp minimized their global tax burden. This involved careful consideration of transfer pricing, foreign tax credits, and the location of intellectual property. Although the specifics of their strategy are complex and proprietary, it resulted in a significant reduction in their overall tax liability, freeing up capital for reinvestment and expansion into new markets. Their annual tax savings are estimated to be in the millions.

Key lessons learned from GlobalCorp’s experience:

- Expert advice is crucial for navigating complex international tax laws.

- Strategic structuring of international operations can significantly reduce tax burdens.

- Understanding and utilizing available tax treaties is paramount.

Final Summary

So, there you have it—a whirlwind tour through the captivating world of tax optimization! While the details can be complex, the core principle remains delightfully simple: keep more of your hard-earned money. Remember, responsible tax planning isn’t about cheating the system; it’s about strategically leveraging the rules to your advantage. Now go forth and conquer your tax returns—may your refunds be plentiful and your audits few!

Common Queries

What’s the difference between tax avoidance and tax evasion?

Tax avoidance is the legal use of tax laws to reduce your tax liability. Tax evasion, on the other hand, is illegal and involves intentionally misrepresenting your income or deductions to avoid paying taxes.

Can I deduct my pet’s therapy sessions?

Unfortunately, unless your pet is a service animal with documented assistance, the IRS is unlikely to consider those emotional support purrs deductible. Consult a tax professional for specific guidance; it might be worth a shot though, for the sheer entertainment value.

Are there tax benefits to donating to charity?

Yes! Charitable donations are often tax-deductible, offering a satisfying blend of altruism and financial savvy. Consult a tax advisor to determine the specifics and ensure you comply with all regulations. It’s a win-win!