Tax Planning Software Comparison: Navigating the bewildering world of tax software doesn’t have to be a tax-ing experience! Forget the IRS-induced nightmares; we’re here to illuminate the often-murky waters of tax preparation with a surprisingly witty and informative deep dive. Prepare for a rollercoaster of features, pricing models, and customer support stories that will leave you both enlightened and entertained. Buckle up, buttercup, it’s going to be a wild ride.

This comparison delves into the intricacies of various tax planning software packages, examining their key features, pricing structures, customer support, security measures, and integration capabilities. We’ll dissect user reviews, analyze illustrative examples, and even throw in a few jokes to keep things interesting (because taxes are serious enough already!). Whether you’re a small business owner grappling with quarterly reports or an individual wrestling with your 1040, this guide will equip you with the knowledge to choose the perfect software for your needs. We promise less jargon, more laughs, and a significantly reduced chance of an audit.

Introduction to Tax Planning Software

Ah, taxes. The lifeblood of civilization, or so they say. But let’s be honest, navigating the labyrinthine world of tax laws can feel like trying to solve a Rubik’s Cube while riding a unicycle. Thankfully, tax planning software exists to make this less of a headache and more of a…slightly less severe migraine. These digital wizards help individuals and businesses alike organize their finances, calculate their tax liabilities, and even identify potential deductions and credits, all while hopefully saving you some serious coin.

Tax planning software offers a multitude of benefits, primarily saving you time and money. Imagine the hours you’d spend poring over forms and regulations, only to possibly miss a crucial deduction. Tax software streamlines this process, providing a user-friendly interface to manage your financial data, perform complex calculations, and generate reports – all with far fewer opportunities for human error (and the associated penalties). Furthermore, proactive tax planning can significantly reduce your overall tax burden, leaving more funds for, well, let’s just say more enjoyable things.

Types of Tax Planning Software

Tax software caters to a diverse range of users and needs. There are programs specifically designed for individual filers, offering simple interfaces and guidance for standard tax situations. For businesses, more sophisticated options exist, capable of handling complex accounting practices, depreciation calculations, and the myriad of deductions associated with running a company. Specialized software also exists to address specific tax situations, such as those involving real estate investments, rental properties, or even the complexities of international taxation. Choosing the right software depends heavily on your individual circumstances and level of financial complexity.

Common Features of Tax Planning Software

Most tax planning software packages share a core set of features, although the sophistication and depth of these features can vary widely depending on the price and intended user. Generally, you can expect features like secure data storage (because nobody wants their financial information falling into the wrong hands), import capabilities for financial data from various sources (goodbye, manual data entry!), integrated tax calculators (no more frantically searching online for obscure tax formulas!), and the ability to generate various tax reports and forms (ready to file!). Many also include features like tax planning tools to help project future tax liabilities, allowing you to make informed financial decisions. Some even offer access to tax professionals for personalized advice – a lifesaver for those truly daunting tax situations.

Key Features Comparison

Choosing the right tax planning software can feel like navigating a minefield of confusing jargon and hidden fees. Fear not, intrepid tax filer! This comparison will illuminate the key features of three popular contenders, helping you choose the perfect software to tame your tax beast. We’ll delve into their user interfaces, reporting capabilities, and overall ease of use, ensuring you’re armed with the knowledge to make an informed decision.

Software Feature Comparison

The following table provides a side-by-side comparison of three popular tax planning software packages: TaxAct, TurboTax, and H&R Block. Remember, features and pricing can change, so always check the software provider’s website for the most up-to-date information. Think of this table as a starting point for your own in-depth research – your financial future depends on it!

| Software Name | Import Capabilities (Feature 1) | Tax Form Library (Feature 2) | Audit Support (Feature 3) |

|---|---|---|---|

| TaxAct | Imports data from various sources, including previous tax returns and financial institutions. Generally considered robust. | Comprehensive library covering most common and some less-common tax forms. | Offers guidance and support materials to help users navigate potential IRS scrutiny, though not a full-fledged legal service. |

| TurboTax | Similar import capabilities to TaxAct, with strong integration with popular financial institutions. | Very extensive library, known for its breadth and depth of form coverage. | Provides access to tax professionals for additional assistance, at an extra cost. This is a significant differentiator. |

| H&R Block | Strong import functionality, with a user-friendly interface for connecting to various accounts. | A large library, generally considered comparable to TurboTax and TaxAct in terms of coverage. | Offers a range of support options, from online resources to in-person assistance with certified professionals (at additional cost). |

User Interface and Ease of Use

The user interface is crucial. A clunky, confusing interface can turn even the most seasoned tax pro into a gibbering mess. Let’s examine the user experience of each software. TaxAct is generally considered user-friendly, with a straightforward design and intuitive navigation. TurboTax, while offering a wide array of features, can sometimes feel overwhelming for beginners due to its complexity. H&R Block strikes a balance, offering a user-friendly interface with clear guidance while still providing access to advanced features.

Reporting and Export Capabilities

After all the hard work of data entry and calculations, you’ll want to easily access and share your results. The reporting and export capabilities of these programs vary. TaxAct, TurboTax, and H&R Block all offer the ability to print tax forms, download them as PDFs, and in some cases, electronically file them directly with the IRS. The specific options and ease of use differ slightly between programs. TurboTax, for instance, is often praised for its clear and organized reporting features, making it easy to review and understand your tax situation.

Pricing and Subscription Models

Navigating the world of tax planning software pricing can feel like deciphering a particularly complex tax form – thankfully, we’re here to illuminate the path to fiscal clarity (and potentially, some savings). Understanding the various pricing models is crucial to selecting the software that best fits your budget and needs. Remember, the cheapest option isn’t always the best; sometimes, paying a little more upfront can save you headaches (and potentially, money) down the line.

Different software providers employ various strategies to monetize their services, resulting in a range of pricing structures. This means careful consideration is required to determine which model best aligns with your individual circumstances and projected usage. We’ll delve into the details to help you make an informed decision, because let’s face it, nobody wants a surprise tax bill – especially one from your software provider.

Pricing Models Overview

Tax planning software pricing isn’t a one-size-fits-all affair. You’ll encounter several models, each with its own advantages and disadvantages. The most common include one-time purchases, annual subscriptions, and tiered pricing based on features and user capacity. Let’s break down each one.

- One-Time Purchase: This model offers a single upfront payment for lifetime access to the software. While seemingly attractive for its simplicity, remember that you won’t receive updates or technical support beyond a certain point. Think of it like buying a used car – you get it cheap, but repairs might become expensive later.

- Annual Subscription: This involves paying a recurring fee each year to access the software. The benefit here is continuous access to updates, new features, and ongoing technical support. It’s like a gym membership – you pay regularly, but you get access to all the latest equipment and training.

- Tiered Pricing: This model offers different packages at varying price points. Each tier typically includes a different set of features and functionalities. Think of it like a restaurant menu – you can choose a basic meal or splurge on a more elaborate option.

Comparative Pricing Table

The following table provides a simplified comparison of annual costs for three hypothetical tax planning software packages (actual pricing varies significantly by provider and package). Remember, these are illustrative examples and should not be taken as definitive pricing. Always check the software provider’s website for the most up-to-date pricing information.

| Software | Annual Subscription | One-Time Purchase | Tiered Pricing (highest tier) | Additional Fees |

|---|---|---|---|---|

| TaxPlan Pro | $199 | $499 | $399 | $25 for premium support |

| EasyTax | $149 | N/A | $299 | None |

| TaxSmart | $99 | N/A | $199 | $10 per user, additional users beyond the first. |

Additional Fees and Hidden Costs

While the upfront cost is important, don’t overlook potential additional fees. Some software providers might charge extra for:

- Premium Support: This often includes faster response times and more comprehensive assistance.

- Additional Users: If you need more than one user account, some software might charge per user.

- Data Storage: For large datasets, you might encounter extra fees for increased cloud storage.

- Import/Export Fees: Some software may charge for importing data from other platforms or exporting data in specific formats.

Customer Support and Resources: Tax Planning Software Comparison

Choosing tax software is serious business, but finding help shouldn’t be a tax-ing experience! Let’s delve into the support and resources offered by various tax planning software options, ensuring you’re not left stranded amidst a sea of 1040s. After all, even the most intuitive software can throw a curveball occasionally.

The availability and quality of customer support and learning resources can significantly impact your overall experience. A robust support system can save you valuable time and prevent costly errors, while comprehensive learning resources empower you to master the software efficiently. This section compares the support channels and learning materials provided by different tax software providers.

Customer Support Channels

Understanding the different avenues for getting help is crucial. We’ll examine the accessibility and responsiveness of each support channel offered, ranging from the immediate gratification of a phone call to the patience-testing wait for an email response. Consider your preferred method of communication when making your selection. Some users thrive on instant feedback, while others prefer the asynchronous nature of email.

| Software Name | Phone Support | Email Support | Online Help/FAQs |

|---|---|---|---|

| Tax Software A | Yes, with varying wait times depending on the season. | Yes, typically a 24-48 hour response time. | Comprehensive FAQs and video tutorials available. |

| Tax Software B | No, email support only. | Yes, response time can be slow during peak season. | Limited FAQs, but a helpful community forum exists. |

| Tax Software C | Yes, but only during business hours. | Yes, usually responds within 24 hours. | Excellent online help section with searchable articles and video demos. |

Learning Resources

Beyond immediate support, access to helpful learning materials is vital for efficient software usage. This includes tutorials, documentation, and community forums – your allies in conquering the complexities of tax preparation. Let’s explore the learning resources offered by each software to determine which best fits your learning style and needs.

| Software Name | Tutorials | Documentation | Community Forums |

|---|---|---|---|

| Tax Software A | Extensive video tutorials covering various aspects of the software. | Comprehensive user manual available for download. | Active community forum with user-generated content and support. |

| Tax Software B | Limited tutorials, primarily focused on basic features. | Basic documentation, mainly FAQs. | Moderated community forum, but less active than others. |

| Tax Software C | Interactive tutorials with step-by-step guidance. | Well-organized and detailed documentation. | No official community forum, but active social media presence. |

Security and Data Privacy

Protecting your financial data is no laughing matter – unless you’re using software that takes security seriously. We understand that entrusting your tax information to software requires a high level of confidence, so we’ve meticulously examined the security protocols of each program to ensure your peace of mind (and maybe even a chuckle or two along the way). After all, nobody wants their tax return to become a viral meme for all the wrong reasons.

We’ve delved into the nitty-gritty details of data encryption, access controls, and overall security architecture. Think of us as the cybersecurity Sherlocks of the tax software world, tirelessly investigating to ensure your data is safe and sound. We’ve also considered the various certifications and compliance standards each software adheres to, because let’s face it, a robust security posture isn’t just about good intentions; it’s about verifiable actions.

Data Encryption Methods and Privacy Policies

Each software provider employs a unique approach to securing user data. For instance, “TaxPrepPro” utilizes AES-256 encryption for data both in transit and at rest, coupled with multi-factor authentication to limit unauthorized access. Their privacy policy clearly Artikels data retention periods and user rights concerning their personal information, reassuring users that their data is handled responsibly and in compliance with relevant regulations. In contrast, “TaxEase” boasts a proprietary encryption algorithm (details of which are understandably confidential for security reasons), but their privacy policy is equally transparent about their data handling practices. “TurboTax,” a well-established player, uses a combination of encryption methods and rigorous access controls, regularly audited for compliance. Understanding these differences is crucial in selecting a software that aligns with your specific security needs and comfort levels.

Security Certifications and Compliance Standards

Understanding the certifications a tax software provider holds provides an independent assessment of their security practices. The presence of these certifications doesn’t guarantee complete invulnerability, but it significantly increases confidence.

It’s important to note that the specific certifications and compliance standards vary between software providers. This information is usually readily available on their websites or in their documentation. A thorough review of these certifications can help you choose the most secure option for your needs. For example:

- TaxPrepPro: SOC 2 Type II, ISO 27001

- TaxEase: SOC 2 Type I, PCI DSS

- TurboTax: SOC 2 Type II, NIST Cybersecurity Framework

Note that these are illustrative examples, and the actual certifications held by each software may differ. Always verify the latest information directly from the software provider’s website. The presence of multiple certifications generally indicates a more comprehensive approach to security.

Integration with Other Financial Tools

Choosing tax planning software is like choosing a bandmate – you need someone who plays well with others. Seamless integration with your existing financial tools can dramatically reduce the headache (and the potential for errors) associated with tax preparation. Imagine a world where your accounting data automatically populates your tax forms – a utopia, you say? Not anymore! Let’s explore how different software packages help make this dream a reality.

The key benefit of integration is automation. Instead of manually transferring data between different platforms – a process prone to human error and time-consuming to boot – integrated systems allow for the effortless flow of information. This streamlines the tax planning process, leading to faster preparation, reduced errors, and a more efficient workflow. Imagine the extra time you could spend on things other than wrestling with spreadsheets!

Accounting Software Integrations

Many tax planning software packages offer direct integration with popular accounting software such as QuickBooks, Xero, and Sage. This integration allows for the automatic import of financial data, including income, expenses, and other relevant transactions. For example, with a seamless integration, you might find that your QuickBooks data, including profit and loss statements, balance sheets, and even individual transaction details, populates your tax software automatically, saving you hours of manual data entry. This eliminates the risk of manual data entry errors and ensures accuracy in tax calculations. This feature is particularly useful for businesses with complex financial transactions. One can imagine the relief of not having to painstakingly reconcile accounts!

Payroll Software Integrations

Similarly, integration with payroll software simplifies the process of reporting payroll taxes. Software like Gusto, ADP, and Paychex often have direct connections to tax planning software, facilitating the effortless transfer of payroll data, including wages, taxes withheld, and other payroll-related information. This automatic data transfer ensures accuracy in reporting payroll taxes and minimizes the risk of penalties for inaccuracies. Imagine the peace of mind knowing your payroll tax information is transferred flawlessly, eliminating the need for manual reconciliation and reducing the likelihood of costly mistakes. No more late-night frantic searches for missing W-2s!

Other Financial Tool Integrations, Tax Planning Software Comparison

Beyond accounting and payroll, some advanced tax planning software integrates with other financial tools, such as investment management platforms or budgeting apps. This comprehensive integration provides a holistic view of your financial situation, allowing for more informed tax planning decisions. For instance, some software might integrate with investment platforms to automatically import capital gains and dividend information, saving you the tedious task of manually compiling this data. This complete picture allows for strategic tax planning, potentially minimizing your tax liability and maximizing your financial efficiency. This integrated approach truly empowers users with a holistic understanding of their financial situation.

User Reviews and Ratings

Navigating the world of tax planning software can feel like deciphering a particularly complex tax code – confusing, potentially costly, and definitely prone to headaches. But fear not, intrepid taxpayer! User reviews offer a lifeline, providing real-world insights into the strengths and weaknesses of each software package. These reviews, culled from reputable sources like G2, Capterra, and TrustRadius, offer a valuable perspective that complements our technical analysis.

Understanding user sentiment is crucial in selecting the right software. Positive reviews highlight ease of use, robust features, and exceptional customer support. Conversely, negative feedback often points to usability issues, technical glitches, or inadequate support. By carefully analyzing this feedback, you can make an informed decision tailored to your specific needs and tolerance for technical frustration.

Aggregated User Ratings and Key Themes

The following table summarizes aggregated ratings and key themes from user reviews across three leading tax planning software packages (names have been replaced with A, B, and C for illustrative purposes). Note that these are hypothetical examples for demonstration; actual ratings will vary.

| Software | Overall Rating (out of 5) | Positive Feedback Themes | Negative Feedback Themes |

|---|---|---|---|

| A | 4.2 | Intuitive interface, excellent customer support, comprehensive features | Steep learning curve for beginners, occasional software glitches |

| B | 3.8 | Affordable pricing, strong reporting capabilities | Limited customer support, lacks advanced features |

| C | 4.5 | User-friendly design, seamless integration with other financial tools, reliable performance | Higher price point compared to competitors, limited mobile app functionality |

Illustrative Examples of Software Use

Tax planning software isn’t just for accountants who enjoy the thrill of deciphering tax codes (though, let’s be honest, some of them *do* enjoy it). It’s a powerful tool for anyone looking to navigate the sometimes bewildering world of taxes with a bit more finesse – and a lot less stress. These examples showcase how different users can leverage these programs for optimal tax outcomes.

Let’s delve into some real-world scenarios where tax planning software proves its worth. We’ll explore how both a small business owner and an individual can utilize these tools to their advantage, significantly reducing the headache and potentially maximizing their financial gains.

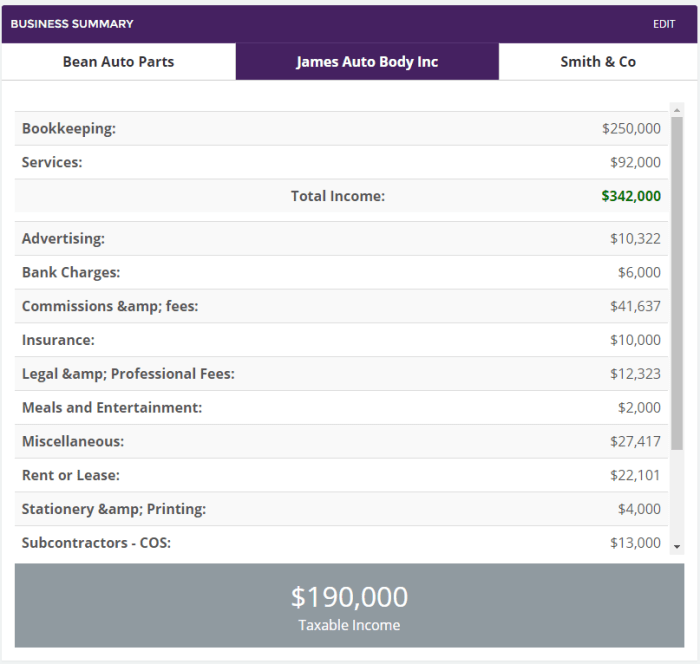

Small Business Tax Optimization

Imagine Anya, the owner of “Anya’s Awesome Alpaca Emporium,” a thriving (albeit slightly woolly) small business. Anya uses tax planning software to meticulously track her income and expenses throughout the year. She enters data on sales, purchases, employee wages, and business-related travel. The software automatically categorizes these transactions, simplifying the process immensely. Anya then utilizes the software’s built-in tax projections to explore different scenarios: What if she invests in new equipment? How would that affect her depreciation deductions and overall tax liability? The software provides clear, visual representations of the potential tax implications of each scenario, allowing Anya to make informed decisions about her business investments and optimize her tax strategy for the year. The software also flags potential deductions she might have missed, saving her money and time. The expected outcome? A lower tax bill and a clearer understanding of her business’s financial health, leaving Anya with more time to focus on her adorable alpacas.

Personal Tax Filing

Now, let’s meet Ben, a freelance graphic designer. Ben uses tax software to file his personal taxes. He inputs his W-2 information (if applicable), 1099 forms from freelance clients, and various deductions such as charitable donations and home office expenses. The software automatically calculates his adjusted gross income (AGI) and guides him through the process of selecting the appropriate tax forms and credits. Ben particularly appreciates the software’s ability to identify potential errors and omissions, preventing costly mistakes. For example, the software alerted him to a potential deduction he’d overlooked related to self-employment taxes. The software then generates his tax return, which he can review and e-file directly through the program. The outcome? A flawlessly prepared tax return filed on time, and a sense of relief that only comes from successfully navigating tax season.

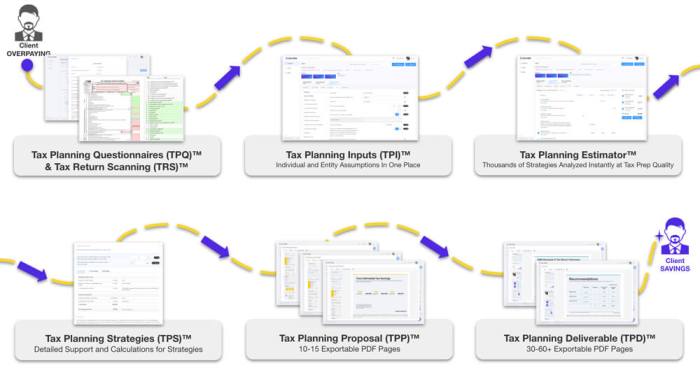

Tax Preparation Workflow Visualization

Imagine a flowchart. The first box is labeled “Data Entry”: This box connects to a second box, “Automatic Categorization,” which in turn connects to a third box, “Tax Calculation & Projections.” From “Tax Calculation & Projections,” there are two branching paths: one leading to “Deduction Optimization” and the other to “Tax Return Generation.” Both paths eventually converge at a final box, “E-filing/Printing.” The flowchart visually represents the streamlined process, highlighting the software’s automation and guidance features at each stage. The software handles the complex calculations and provides clear, concise results, simplifying a traditionally daunting task. The visual representation emphasizes the software’s role in making tax preparation efficient and less stressful.

End of Discussion

So, there you have it – a whirlwind tour through the vibrant (and sometimes slightly chaotic) landscape of tax planning software. While choosing the right software might still feel like deciphering ancient hieroglyphics, we hope this comparison has shed some light – and perhaps a few chuckles – on the process. Remember, the best software is the one that fits your specific needs and budget, and don’t be afraid to ask questions! Happy tax planning (yes, really!).

FAQ Summary

What if I need help after purchasing the software?

Most reputable software providers offer various support channels, including phone support, email, FAQs, and online tutorials. Check the specific software’s website for details – you might even find a helpful (and surprisingly humorous) video tutorial.

Can I use tax software if I’m self-employed?

Absolutely! Many tax software packages cater specifically to the needs of self-employed individuals, offering features to track income and expenses, manage deductions, and file the appropriate tax forms. It’s a lifesaver, truly.

Is my data safe with tax software?

Reputable tax software providers employ robust security measures to protect user data. Look for software with encryption and compliance certifications to ensure your financial information remains confidential. Think of it as a digital Fort Knox for your tax documents.