Tax Planning Software Trial: Embark on a thrilling adventure into the world of tax preparation, where spreadsheets aren’t your only weapon against the IRS. This isn’t your grandpa’s tax season; we’re diving headfirst into the wild west of free trials, freemium models, and demo versions, dodging the pitfalls of overly complicated software and celebrating the victories of perfectly optimized tax strategies. Prepare for a journey filled with laughter, enlightenment, and maybe just a touch of mild panic as we unravel the mysteries of tax software trials.

We’ll explore the various types of trials, comparing and contrasting their features and limitations. We’ll arm you with a checklist to ensure you thoroughly test each software, navigate data import and export like a seasoned pro, and even delve into illustrative scenarios to help you conquer your tax demons. Consider this your survival guide to the often-bewildering world of tax software trials – because let’s face it, taxes are serious business, but the software doesn’t have to be.

Understanding Tax Planning Software Trials

Embarking on the thrilling adventure of tax preparation? Before you commit to a full-blown relationship with tax software, a trial period offers a chance to see if it’s the right match. Think of it as a tax-themed dating app, but with less awkward small talk and more deductions. Let’s delve into the delightful world of tax software trials.

Tax planning software trials come in various enticing flavors, each with its own unique appeal. Understanding these differences is key to finding the perfect trial for your needs. Choosing wisely will save you time, money, and possibly a few tears during tax season.

Types of Tax Planning Software Trials

The landscape of tax software trials is surprisingly diverse. Each type offers a different level of access and commitment, catering to various levels of tax expertise and apprehension.

- Free Trials: These are the all-you-can-eat buffet of the tax software world. You get full access to the software’s features for a limited time, usually a few weeks. This allows for a comprehensive test drive before making a purchase. Think of it as a test-drive before buying a car, but instead of a car, you’re getting a potentially life-changing tax solution.

- Freemium Models: A bit like a sample platter, freemium models offer a basic version of the software for free, permanently. However, advanced features or unlimited filing capabilities are often locked behind a paywall. It’s a great option for those who only need basic tax preparation services.

- Demo Versions: These are more like a guided tour. Demo versions typically showcase the software’s key features through pre-loaded data or limited functionalities. Think of it as a walkthrough of a house before you move in. You get a sense of the layout, but not the full experience of living there.

Features Included in Trial Versions vs. Full Versions

Trial versions are designed to give you a taste of the full software experience, but with some key differences. Understanding these limitations is crucial to making an informed decision.

| Feature | Trial Version | Full Version |

|---|---|---|

| Data Import | Limited or no import options | Full import capabilities from various sources |

| Filing Capabilities | May be limited to a single return or a specific tax form | Unlimited filing capabilities |

| Customer Support | May have limited or no access to customer support | Full access to customer support channels |

| Advanced Features | Often excludes advanced features such as tax optimization tools or specialized forms | Includes all advanced features |

Limitations of Trial Versions Across Popular Software Options

Different software providers offer varying trial experiences. Researching the specific limitations of each software before signing up is advisable to avoid any unpleasant surprises.

For instance, some software may limit the number of tax returns you can file during the trial, while others may restrict access to certain advanced features. Always check the terms and conditions of the trial before committing.

Signing Up for and Accessing a Tax Planning Software Trial

The process of signing up for a tax planning software trial is usually straightforward, but some steps are crucial to avoid issues.

- Visit the Software Website: Navigate to the official website of the tax software you are interested in.

- Locate the Trial Offer: Look for a prominent “Free Trial,” “Demo,” or similar button or link.

- Create an Account: You will likely need to create an account by providing basic information such as your email address and potentially a password.

- Download and Install (if applicable): Some software requires a download and installation, while others are web-based and accessible directly through a browser.

- Activate the Trial: Follow the on-screen instructions to activate your trial period.

Evaluating Tax Planning Software During a Trial

Embarking on a tax planning software trial is like trying on a bespoke suit – you want to ensure it fits perfectly before committing to the tailor’s hefty bill (or, in this case, the annual subscription). A well-structured trial allows you to thoroughly assess the software’s capabilities and determine if it’s the right fit for your specific needs. Don’t just passively click buttons; actively engage with the software to unearth its true potential (or its glaring flaws).

Evaluating tax planning software during a trial requires a strategic approach, blending technical proficiency with a healthy dose of skepticism. This process allows you to identify whether the software aligns with your specific requirements and workflow.

Key Factors to Consider During a Trial

Several critical factors should guide your evaluation. Consider the software’s user-friendliness, the comprehensiveness of its features, the quality of its reporting capabilities, and its overall reliability. Don’t forget to assess customer support responsiveness – after all, even the best software can occasionally throw a curveball. Finally, weigh the software’s cost against its benefits to ensure a sound financial decision.

Best Practices for Efficiently Testing Core Functionalities

To maximize your trial period, create a structured testing plan. Start with the software’s core features, such as tax form completion and calculation accuracy. Then, move onto more advanced features like tax planning scenarios and reporting tools. Use realistic data to simulate your actual tax situations. Time each task to gauge efficiency. Document your findings, including both positive and negative experiences. Remember, the devil is in the details – don’t overlook seemingly minor issues, as they can accumulate into significant frustrations down the line.

Checklist for Thorough Feature Assessment

A comprehensive checklist ensures no stone is left unturned.

Before starting your trial, create a checklist based on your specific needs. This could include items like:

- Ease of data import from previous tax software.

- Accuracy of tax calculations across various scenarios.

- Clarity and comprehensiveness of reports generated.

- Efficiency of navigation and interface design.

- Responsiveness and helpfulness of customer support.

- Integration with other financial software (if needed).

- Security features and data protection protocols.

This structured approach ensures a complete assessment, reducing the likelihood of overlooking crucial aspects.

Comparison of Four Tax Planning Software Options

This table summarizes the strengths and weaknesses of four hypothetical tax planning software options, based on trial usage. Remember, these are examples and actual performance may vary.

| Software Name | Strengths | Weaknesses | Overall Impression |

|---|---|---|---|

| TaxPro Max | Intuitive interface, excellent reporting, robust customer support. | Limited integration with other platforms, slightly expensive. | A strong contender, but the price might be a deterrent for some. |

| EasyTax | Affordable, user-friendly for basic tax filings. | Lacks advanced features, limited reporting options. | Suitable for simple tax situations, but lacks sophistication for complex needs. |

| TaxGenius | Comprehensive features, excellent for complex tax scenarios. | Steep learning curve, customer support can be slow. | Powerful but requires significant time investment to master. |

| TaxSmart | Good balance of features and price, solid customer support. | Reporting could be improved, lacks some niche features. | A reliable and versatile option for most users. |

Data Import and Management in Trial Versions

Navigating the world of tax planning software trials can feel like a thrilling expedition into the heart of a spreadsheet jungle. Fear not, intrepid tax adventurer! This section will illuminate the often-overlooked, yet critically important, aspects of data import and management during your trial period. We’ll equip you with the knowledge to tame the data beast and emerge victorious, ready to conquer your tax returns.

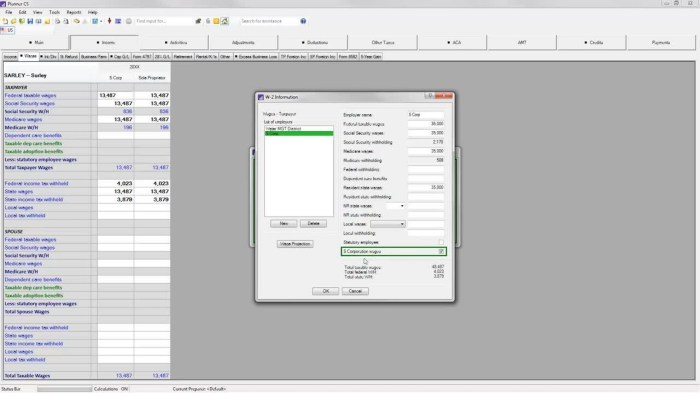

Data import into tax planning software trials typically involves uploading existing tax data from various sources. This might include CSV files from your previous tax software, spreadsheets meticulously maintained over the years (we’ve all been there!), or even direct imports from your bank or brokerage accounts. The process varies depending on the specific software, but generally involves selecting the appropriate import function, choosing your data source, and carefully mapping the data fields to ensure accuracy. Remember, accuracy is key; a misplaced decimal can lead to a tax-audit-inducing headache.

Data Import Methods

The methods for importing tax data differ between software packages. Some offer seamless integration with popular financial institutions, automatically pulling in transaction data. Others rely on manual uploads of CSV files or spreadsheets. Regardless of the method, careful data validation after import is crucial to prevent errors. Imagine importing your data and finding out your income is listed as $10, instead of $100,000! That’s a mistake that could make even the most seasoned tax professional wince. Always review the imported data meticulously.

Data Security and Privacy During Trials

Protecting your sensitive financial information is paramount, especially during trial periods. Reputable software providers employ robust security measures, including encryption and secure servers, to safeguard your data. However, it’s prudent to review the software provider’s privacy policy to understand how your data is handled and protected. Look for statements regarding data encryption both in transit and at rest. Consider the reputation of the company; a well-established firm is more likely to prioritize data security than a fly-by-night operation.

Data Export Methods After Trial Conclusion

Once your trial period ends, you’ll likely want to export your data. Most software allows you to download your data in common formats such as CSV or Excel files. This enables you to transfer your information to another software package or keep a local backup. Before exporting, make sure to verify the completeness and accuracy of the exported data to avoid losing valuable information. This step is critical; imagine losing all that meticulously entered data! It’s enough to make one reach for a large mug of something strong.

Common Data Import Challenges and Solutions

The import process isn’t always smooth sailing. Common challenges include incompatible file formats, incorrect data mapping, and missing data fields. Solutions often involve using data conversion tools to change file formats, carefully reviewing and adjusting data mappings during the import process, and verifying that all necessary fields are included in the source data. If you encounter errors, consult the software’s help documentation or support team. Don’t hesitate to reach out; they’re there to help you navigate the sometimes-tricky waters of data import. For example, a common error might be a mismatch between the software’s expected date format (e.g., MM/DD/YYYY) and the format in your source data (e.g., DD/MM/YYYY). Correcting this seemingly small issue can prevent significant headaches down the line.

Specific Features and Functionality in Trials

Embarking on a tax planning software trial is like test-driving a luxury car before committing to the hefty price tag – you want to know it handles the potholes (unexpected tax deductions) and has a decent sound system (user-friendly interface). This section will delve into the nitty-gritty of exploring the features offered in trial versions, ensuring you make an informed decision that doesn’t leave you with a tax headache. We’ll navigate the complexities of tax calculations, projections, and user experience comparisons with the grace of a seasoned tax professional (who also happens to enjoy a good pun).

Let’s explore the practical aspects of utilizing trial software to its fullest potential. Understanding the capabilities of the software during the trial period is crucial for making an informed decision. This involves more than just clicking buttons; it’s about understanding how these features translate into real-world tax savings and efficiency.

Tax Calculation and Reporting Features

Trial versions typically offer a subset of the full software’s calculation and reporting capabilities. You can usually input real (or sample) tax data and see how the software processes it, generating reports mimicking those you’d receive at the end of the tax year. For example, you might enter income, deductions, and credits to generate a projected tax liability. The trial version will likely limit the number of returns you can process or the complexity of the tax situations you can model, but this is still valuable for testing the core functionality. Observe the clarity and organization of the reports; are they easily understandable? Do they provide the information you need in a format you find accessible? This is crucial for determining if the software fits your workflow.

Creating and Reviewing Tax Projections

Tax projection features allow you to explore different tax scenarios – “What if I contribute more to my 401k?” or “What’s the impact of this potential business expense?”. Trial versions often allow for a limited number of projections. Focus on using these opportunities to test the software’s ability to handle various scenarios relevant to your specific tax situation. For instance, if you anticipate significant changes in income next year, use the trial to project your tax liability under different income levels. The ability to easily adjust variables and see the immediate impact on your projected tax liability is a key feature to evaluate.

User Interface and User Experience Comparison

Different tax software packages boast varying levels of user-friendliness. Some might be intuitive and easy to navigate, while others might present a steeper learning curve. The trial period is your chance to experience this firsthand. Compare the visual design, the layout of menus and features, and the overall ease of data entry and report generation across different trial versions. Consider the software’s responsiveness – does it feel sluggish, or does it handle large datasets efficiently? A smooth, intuitive user interface significantly impacts efficiency, particularly during tax season’s high-pressure environment.

Pros and Cons of Different Software Based on Trial Features

Before diving into a detailed comparison, it’s important to note that the features available in trial versions might not reflect the full functionality of the paid software. However, the trial offers a valuable glimpse into the user experience and core capabilities.

The following table summarizes the pros and cons of three hypothetical tax software packages (TaxGenius, NumberCruncher 5000, and TaxEase) based on their trial versions. Remember, these are hypothetical examples and your experience may vary.

| Software | Pros | Cons |

|---|---|---|

| TaxGenius |

|

|

| NumberCruncher 5000 |

|

|

| TaxEase |

|

|

Post-Trial Considerations

So, your trial period is ending. The suspense is killing you (almost as much as the impending tax deadline!). Don’t worry, navigating the post-trial landscape doesn’t have to be a tax nightmare. Let’s explore your options with the grace and efficiency of a seasoned tax professional (minus the exorbitant fees, of course).

The transition from trial to full version should be as smooth as a perfectly filed tax return. Purchasing the full version is often a straightforward process, typically involving a simple online transaction. Think of it as upgrading from a free sample to the gourmet feast. You’ve tasted the goodness, now it’s time to indulge!

Purchasing the Full Version

After a successful trial, purchasing the full version usually involves visiting the software vendor’s website. You’ll likely find a clear “Buy Now” or “Purchase” button, guiding you through a secure checkout process. Expect to provide standard billing information, and depending on the vendor, you might have options for different license types (single-user, multi-user, etc.). Many vendors offer various payment methods, such as credit cards, PayPal, or even direct bank transfers. The exact process will vary slightly based on the specific software and vendor. For example, some might offer a discount for purchasing an annual license compared to a monthly one.

Options When the Trial Doesn’t Meet Needs

If, after a thorough trial, the software isn’t quite the right fit, don’t despair! Most reputable vendors understand that a trial is an evaluation period. There’s usually no pressure to purchase if it doesn’t align with your requirements. You might consider exploring alternative software solutions, perhaps searching for one with specific features you missed in the trial. Think of it as finding the perfect tax-preparation partner; sometimes, the first date isn’t the one. It’s all part of the process!

Post-Trial Support Resources

Even after the trial concludes, access to support resources is often still available, especially if you’ve purchased the full version. Most vendors provide comprehensive documentation, FAQs, and potentially email or phone support. Think of it as having a personal tax advisor on speed dial (again, minus the high fees!). This support can be invaluable in troubleshooting issues, understanding advanced features, and generally ensuring you get the most out of your software investment. Many vendors also have active online communities or forums where users can connect and share tips and solutions.

Transitioning from Trial to Full Version

Moving from the trial version to the full version is usually a seamless process. Many software vendors allow you to simply upgrade your existing trial installation without losing any data. It’s like a magic trick, but with less glitter and more efficiency. This often involves entering a license key or activation code received after purchasing the full version. The vendor’s website usually provides clear instructions on this process, often with helpful videos or tutorials. Before you upgrade, it’s wise to back up your trial data, just in case anything unexpected happens. It’s better to be safe than sorry, especially when dealing with important financial information.

Illustrative Scenarios

Let’s delve into some real-world examples of how tax planning software trials can be a lifesaver (or at least a significant stress reducer) for various users. These scenarios illustrate the software’s capabilities and highlight potential challenges, all within the safe confines of a trial period. Remember, no commitment, just enlightenment!

Small Business Owner’s Tax Return Preparation

Imagine Beatrice, owner of “Beatrice’s Bountiful Baked Goods,” a thriving (but slightly chaotic) small bakery. Facing her annual tax return with the usual blend of dread and lukewarm coffee, Beatrice decides to try a tax planning software trial. She meticulously inputs her income from sales, meticulously tracks every crumb of expense (even that questionable late-night donut run), and discovers the software’s helpful categorization tools. The software automatically calculates her deductions, prompting Beatrice to realize she’d forgotten to claim a significant depreciation on her industrial-sized mixer. This revelation alone almost makes the trial worth it. Through the software’s intuitive interface, Beatrice prepares her return, feeling a sense of accomplishment far exceeding the satisfaction of a perfectly risen sourdough. The trial allows her to confidently file, armed with a clear understanding of her tax obligations, and a newfound appreciation for efficient tax software.

Freelancer Optimizing Tax Strategy

Meet Carlos, a freelance graphic designer whose income fluctuates as wildly as his artistic inspiration. Carlos is notorious for his less-than-stellar record-keeping. He uses the trial to explore different tax strategies, inputting his income and expenses for the past year. The software presents various scenarios, showcasing the potential impact of different deductions and tax credits. Carlos discovers the significant tax advantages of contributing to a self-employed retirement plan, a strategy he hadn’t considered before. He also learns about potential tax deductions related to his home office expenses. By the end of the trial, Carlos has a much clearer picture of how to optimize his tax strategy, not only saving money but also significantly reducing his future tax preparation headaches. He even feels a surge of creative inspiration, now fueled by financial clarity rather than caffeinated desperation.

Overcoming Trial Challenges

Then there’s Amelia, a meticulous accountant (ironically) who initially struggled with importing her data into the trial version. The software required a specific file format, which Amelia initially didn’t possess. However, after consulting the software’s comprehensive help documentation (yes, some software actually *has* helpful documentation!), she discovered a readily available converter tool. After overcoming this initial hurdle, Amelia found the software’s features incredibly powerful and intuitive. The trial allowed her to explore advanced tax planning scenarios, and she even discovered a hidden feature that optimized her client’s tax returns significantly. This experience highlighted the importance of thorough documentation and the potential for even the most experienced users to encounter minor initial challenges – challenges that are usually easily overcome with a bit of patience and resourcefulness. The trial, therefore, proved invaluable not just for its features, but also for its educational value, showcasing the importance of understanding the software’s intricacies.

Last Word

So, there you have it – a whirlwind tour through the exciting (yes, exciting!) world of tax planning software trials. Remember, the right software can transform your tax preparation from a dreaded chore into a surprisingly manageable, even enjoyable, experience. Don’t be afraid to experiment, utilize those free trials, and find the perfect software to match your needs. And if all else fails, remember there’s always the charm of handwritten tax forms… just kidding (mostly!). Happy tax planning!

Frequently Asked Questions: Tax Planning Software Trial

What happens to my data after the trial ends?

This varies by software. Some delete your data, others offer options to export it or purchase a license to retain it. Check the software’s terms and conditions.

Can I use a trial version for a client’s taxes?

Generally, no. Trial versions are usually for personal evaluation, not for professional use with client data. Using a trial version for client work may violate the software’s terms of service.

What if I encounter a problem during the trial?

Most software providers offer some form of trial support, often through FAQs or online help. Contact their support channels if you run into significant issues.

Are there any limitations on the number of tax returns I can prepare during a trial?

Yes, often trial versions limit the number of returns or the complexity of returns you can process. Check the software’s specifications for details.