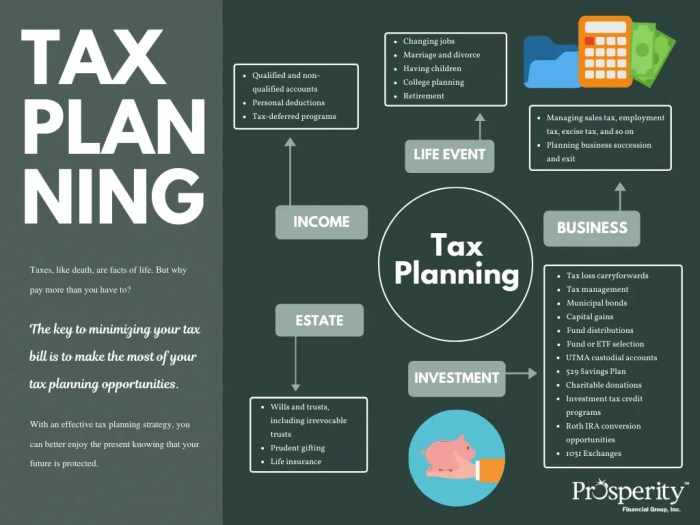

Effective tax planning is crucial for individuals and businesses alike, offering the potential to significantly reduce tax liabilities and maximize financial resources. This involves understanding various tax deductions, credits, and investment strategies tailored to individual circumstances and financial goals. From retirement planning and estate management to navigating the complexities of business ownership and international tax considerations, a well-defined tax strategy is an essential component of long-term financial well-being.

This guide explores a comprehensive range of tax planning strategies, providing practical insights and actionable steps to help you optimize your financial position. We will delve into various tax-efficient investment options, explore the nuances of different business structures and their tax implications, and offer guidance on navigating potential tax audits. Ultimately, our aim is to empower you with the knowledge and tools to make informed decisions that protect your financial future.

Tax Deductions and Credits

Understanding tax deductions and credits is crucial for minimizing your tax liability. Both reduce the amount of tax you owe, but they do so in different ways, offering distinct advantages depending on your individual financial situation. Effectively utilizing these tools can significantly impact your bottom line.

Tax Deductions and Credits: Key Differences

Tax deductions reduce your taxable income, while tax credits directly reduce the amount of tax you owe. A deduction of $1,000, for example, will reduce your taxable income by $1,000, resulting in a tax savings dependent on your tax bracket. A $1,000 tax credit, however, directly reduces your tax bill by $1,000, regardless of your tax bracket. Therefore, tax credits generally provide a greater tax savings than deductions of the same amount, especially for those in higher tax brackets. For instance, a $1000 deduction for someone in the 22% tax bracket would save them $220, whereas a $1000 credit would save them $1000.

Common Tax Deductions for Individuals and Small Businesses

The availability of specific deductions can vary depending on your circumstances and the tax year. Always consult the latest IRS guidelines or a tax professional for the most up-to-date information.

| Deduction | Eligibility | Example | Notes |

|---|---|---|---|

| Itemized Deductions (Medical Expenses, State and Local Taxes, Charitable Contributions, Home Mortgage Interest) | Exceeding the standard deduction amount. Specific requirements apply to each itemized deduction. | A taxpayer with significant medical expenses exceeding 7.5% of their adjusted gross income (AGI) can deduct the excess amount. | Itemizing is beneficial only if the total itemized deductions surpass the standard deduction. |

| Self-Employment Tax Deduction | Self-employed individuals. | A freelancer can deduct one-half of their self-employment tax. | This deduction reduces the impact of self-employment taxes on taxable income. |

| Home Office Deduction | Individuals using a portion of their home exclusively and regularly for business. | A writer using a dedicated room in their home as their office can deduct a portion of their home expenses. | Strict guidelines apply regarding the exclusive and regular use of the space for business. |

| Business Expenses (e.g., supplies, travel, advertising) | Small business owners. | A small business owner can deduct the cost of office supplies, travel related to business, and advertising expenses. | Proper documentation and record-keeping are essential for claiming these deductions. |

Hypothetical Scenario: Maximizing Deductions and Credits

Let’s consider Sarah, a self-employed graphic designer. In a given year, Sarah earned $70,000. She contributed $6,000 to a traditional IRA, paid $5,000 in eligible medical expenses (exceeding the 7.5% AGI threshold), and had $2,000 in business expenses. She also qualified for the Child Tax Credit of $2,000 for her child.

Without utilizing deductions and credits, Sarah’s taxable income would be $70,000. However, by deducting her IRA contributions ($6,000), medical expenses ($5,000, after exceeding the AGI threshold), and business expenses ($2,000), her taxable income is reduced to $57,000. Furthermore, the $2,000 Child Tax Credit directly reduces her tax liability by $2,000. This combined effect significantly lowers her overall tax burden compared to not utilizing these available tax advantages. The exact tax savings will depend on her applicable tax bracket and other factors. This illustrates the power of maximizing available deductions and credits.

Retirement Planning and Tax Optimization

Planning for retirement involves more than just saving money; it’s about strategically managing your finances to minimize your tax burden both during your working years and in retirement. Understanding the various retirement savings vehicles available and their tax implications is crucial for maximizing your retirement nest egg. This section will explore various retirement plans and strategies to optimize your tax position.

Retirement planning is a multifaceted process, requiring careful consideration of various factors including your income, age, risk tolerance, and financial goals. The tax implications of your chosen retirement plan significantly impact your overall financial health, both in the present and the future. Choosing the right plan and implementing effective contribution strategies can significantly reduce your current and future tax liability, allowing you to retain more of your hard-earned money.

Retirement Savings Plans and Their Tax Implications

Several retirement savings plans offer different tax advantages. Understanding the distinctions between these plans is critical for making informed decisions. The three most common plans are 401(k)s, traditional IRAs, and Roth IRAs. Each plan operates under different tax rules, influencing the timing of tax benefits and the taxability of withdrawals in retirement.

A comparison of these plans highlights the trade-offs between tax benefits during accumulation and tax benefits during distribution. The optimal choice depends heavily on individual circumstances and projections of future tax brackets.

| Feature | 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Contributions | Pre-tax (deductible) | Pre-tax (deductible, subject to income limits) | After-tax (non-deductible) |

| Growth | Tax-deferred | Tax-deferred | Tax-free |

| Withdrawals | Taxed in retirement | Taxed in retirement | Tax-free in retirement |

| Income Limits | None (contribution limits apply) | Yes, for full deductibility | Yes, for contributions |

| Early Withdrawal Penalties | Generally applies | Generally applies, with exceptions | Generally applies, with exceptions |

Strategies for Optimizing Retirement Contributions

Minimizing your tax liability while maximizing your retirement savings requires a proactive approach. Several strategies can help optimize your contributions and reduce your tax burden.

These strategies focus on maximizing the use of available tax deductions and credits, strategically timing contributions, and diversifying retirement investments to minimize risk and maximize returns. Careful consideration of your current and projected income levels is crucial in selecting the most appropriate approach.

- Maximize employer matching contributions: Many employers offer matching contributions to employee 401(k) plans. This essentially provides free money, and maximizing this match is a crucial first step in optimizing retirement savings.

- Contribute the maximum allowable amount: Understanding and contributing the maximum allowable amount to your chosen retirement plan each year is essential for maximizing tax advantages and building a substantial retirement nest egg. This amount is subject to annual adjustments.

- Consider tax-loss harvesting: Tax-loss harvesting involves selling investments that have lost value to offset capital gains from other investments. This strategy can reduce your overall tax liability.

- Diversify your investments: Diversification is a key component of risk management. Spreading your investments across various asset classes reduces the overall risk of your portfolio.

Choosing the Most Suitable Retirement Plan

Selecting the appropriate retirement plan depends on individual circumstances and financial goals. A step-by-step guide can help navigate this decision-making process.

This process involves self-assessment, professional consultation, and ongoing monitoring to ensure your retirement plan remains aligned with your evolving financial circumstances and objectives.

- Assess your current financial situation: Evaluate your income, expenses, debts, and existing savings to determine your capacity for retirement contributions.

- Determine your risk tolerance: Consider your comfort level with investment risk. Higher-risk investments offer potentially higher returns but also come with greater potential for losses.

- Project your future income and tax bracket: Consider your projected income in retirement and your expected tax bracket to determine the best tax advantages for your circumstances.

- Consult a financial advisor: A qualified financial advisor can provide personalized guidance based on your specific situation and financial goals.

- Regularly review and adjust your plan: Your financial situation and goals may change over time. Regularly reviewing and adjusting your retirement plan ensures it remains aligned with your evolving needs.

Tax-Advantaged Investments

Smart investing isn’t just about maximizing returns; it’s also about minimizing your tax burden. Tax-advantaged investments offer the potential to grow your wealth while reducing your tax liability, making them a crucial component of a comprehensive financial plan. Understanding the various options available and their associated benefits is key to making informed decisions.

Tax-advantaged investments provide a range of benefits, including deferring or eliminating taxes on investment gains, reducing your taxable income, and potentially lowering your overall tax bill. However, it’s crucial to remember that each investment type carries its own level of risk and potential return, and the best choice will depend on your individual financial circumstances and goals.

Municipal Bonds

Municipal bonds, often called “munis,” are debt securities issued by state and local governments to finance public projects such as schools, roads, and hospitals. A key advantage of municipal bonds is that the interest income they generate is often exempt from federal income tax. In some cases, interest may also be exempt from state and local taxes, depending on where you live and the bond’s issuer. This tax exemption can significantly reduce your overall tax liability, making them particularly attractive to investors in higher tax brackets. For example, a high-income earner might find the tax-free income from municipal bonds more appealing than a taxable bond offering a higher interest rate. The risk profile of municipal bonds generally depends on the creditworthiness of the issuing municipality. Generally, bonds issued by larger, more financially stable municipalities are considered lower risk than those issued by smaller, less stable entities. Returns on municipal bonds are typically lower than those of taxable bonds, reflecting the tax advantage.

529 Plans

529 plans are education savings plans that offer significant tax advantages for saving for qualified education expenses. Contributions to 529 plans are typically made with after-tax dollars, but the earnings grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free at the federal level. This means you can avoid paying taxes on the investment gains, significantly boosting your savings over time. For instance, a family saving for their child’s college education could contribute regularly to a 529 plan, allowing the funds to grow tax-deferred and providing a tax-free withdrawal for tuition, fees, and other qualified expenses. The risk profile of 529 plans depends on the investment options chosen within the plan. Some plans offer age-based investment options that become more conservative as the beneficiary approaches college age, while others allow for more customized investment strategies. Returns can vary depending on the market performance of the underlying investments.

Roth IRAs

Roth IRAs are individual retirement accounts that offer significant tax advantages for retirement savings. Unlike traditional IRAs, contributions to Roth IRAs are made with after-tax dollars, but withdrawals in retirement are tax-free. This means that you pay taxes upfront, but you won’t owe taxes on your withdrawals in retirement, allowing your savings to grow tax-free. For example, a young professional could contribute to a Roth IRA annually, paying taxes on the contributions but enjoying tax-free withdrawals in retirement. The risk profile of a Roth IRA depends on the investments chosen within the account. Investors can choose from a wide range of investment options, allowing for varying levels of risk and potential return. Returns are not guaranteed and depend on the market performance of the chosen investments.

Estate Planning and Inheritance Tax

Estate planning and inheritance tax are complex areas that often intertwine. Understanding these intricacies is crucial for ensuring your assets are distributed according to your wishes while minimizing tax burdens for your heirs. Effective estate planning involves proactively managing your assets to reduce the potential impact of these taxes.

Estate and inheritance taxes are levied on the transfer of assets upon death. The specific rules and tax rates vary significantly depending on jurisdiction (e.g., federal and state laws in the United States, or similar legislation in other countries). These taxes can be substantial, particularly for high-net-worth individuals. Furthermore, gift taxes, which apply to transfers of assets during one’s lifetime, can also significantly impact overall tax liability. Careful planning is necessary to mitigate these taxes effectively.

Gift Tax Implications

Gift taxes are levied on the transfer of assets during a person’s lifetime. The annual gift tax exclusion allows for a certain amount of gifting each year without incurring tax. However, gifts exceeding this limit are subject to gift tax, and these gifts can also reduce the amount of assets subject to estate tax upon death. Strategic gifting, within the legal limits, can be a valuable tool for estate tax reduction. For example, gifting assets that are expected to appreciate significantly to beneficiaries can reduce the overall estate tax burden in the long run. Careful consideration of the applicable tax laws and regulations is essential.

Strategies for Minimizing Estate Tax Liabilities

Several strategies can significantly reduce estate tax liabilities. These include establishing trusts, utilizing life insurance policies strategically, making charitable donations, and gifting assets within the annual gift tax exclusion.

Sample Estate Plan

A sample estate plan might include the following components: A revocable living trust to manage assets during life and facilitate smooth transfer after death; life insurance policies designed to cover potential estate taxes; a detailed will specifying the distribution of remaining assets; and a durable power of attorney for healthcare and financial matters, ensuring someone can act on your behalf if you become incapacitated. This plan could also include the annual gifting of assets to beneficiaries within the allowed gift tax exclusion limit, reducing the overall taxable estate. This is a simplified example, and a comprehensive plan should be tailored to individual circumstances and needs with the guidance of a qualified estate planning professional.

Tax Implications of Business Ownership

Choosing the right business structure is a crucial decision for entrepreneurs, significantly impacting their tax obligations. The tax implications vary considerably depending on whether you operate as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Understanding these differences is essential for effective tax planning and minimizing your tax burden.

Sole Proprietorship Taxation

A sole proprietorship is the simplest business structure, where the business and owner are considered one and the same for tax purposes. Profits and losses are reported directly on the owner’s personal income tax return, using Schedule C. This means the owner pays self-employment taxes (Social Security and Medicare taxes) in addition to income tax on their business profits. There is no separate tax filing for the business itself. While simple to set up and manage, this structure offers limited liability protection; the owner’s personal assets are at risk if the business incurs debt or faces lawsuits.

Partnership Taxation

Partnerships, involving two or more individuals, also lack the legal separation of the business from its owners. Similar to sole proprietorships, profits and losses are “passed through” to the partners and reported on their individual tax returns. Each partner’s share of the profits is taxed at their individual income tax rate. A partnership files an informational tax return (Form 1065), summarizing the partnership’s income and expenses, but does not pay taxes directly. The liability protection offered varies depending on the type of partnership established, with limited partnerships offering some protection to limited partners.

Limited Liability Company (LLC) Taxation

LLCs provide a flexible structure combining the pass-through taxation of partnerships with the limited liability protection of corporations. The IRS generally treats single-member LLCs as disregarded entities, meaning the owner’s income is reported on their personal tax return. Multi-member LLCs are typically taxed as partnerships, unless they elect to be taxed as corporations (S-Corp or C-Corp). This flexibility allows owners to choose the taxation method that best suits their circumstances. The liability protection afforded to LLC members shields their personal assets from business debts and liabilities.

Corporation Taxation

Corporations are separate legal entities distinct from their owners. This structure offers the strongest liability protection. C-corporations pay corporate income tax on their profits, and shareholders pay taxes again on dividends received, leading to double taxation. S-corporations, in contrast, avoid double taxation. Profits and losses are passed through to the shareholders and reported on their individual tax returns, similar to partnerships and LLCs. However, shareholders must meet specific requirements, and the number of shareholders is limited. The choice between C-corp and S-corp structures depends on factors such as the number of shareholders, the level of income, and the desired level of liability protection.

Tax Strategies for Small Business Owners

Small business owners can employ various strategies to reduce their tax liability. One common deduction is for home office expenses. If a portion of your home is exclusively used for business, you can deduct a percentage of expenses such as mortgage interest, property taxes, utilities, and depreciation. The Qualified Business Income (QBI) deduction, introduced under the Tax Cuts and Jobs Act of 2017, allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income. This deduction can significantly reduce taxable income. Accurate record-keeping is crucial for claiming these and other deductions. Consulting with a tax professional is recommended to ensure compliance and maximize tax benefits.

Tax Audits and Dispute Resolution

Navigating a tax audit can be a stressful experience, but understanding the process and available dispute resolution options can significantly reduce anxiety and improve outcomes. This section Artikels the steps involved in a tax audit, common audit triggers, and strategies for resolving disputes with the IRS.

The IRS conducts audits to ensure taxpayers are accurately reporting their income and deductions. While the vast majority of returns are processed without audit, understanding the process is crucial for preparedness.

The Tax Audit Process

A tax audit begins with a notification from the IRS, usually by mail, informing the taxpayer that their return has been selected for review. The notification will specify the tax year under review and the type of audit. There are three main types: correspondence audits (focus on a specific item on the return), office audits (conducted at an IRS office), and field audits (conducted at the taxpayer’s home or business). Taxpayers should respond promptly to the notification, providing requested documentation and cooperating fully with the IRS agent. Maintaining meticulous records throughout the year is paramount; this includes receipts, bank statements, and any other supporting documentation for claimed deductions or credits. Failure to provide requested information can prolong the audit process and potentially lead to unfavorable outcomes. It is often beneficial to seek professional assistance from a tax advisor or attorney, particularly for complex audits. They can help gather and organize necessary documents, represent the taxpayer during the audit, and negotiate with the IRS on their behalf.

Common Audit Triggers

Certain factors can increase the likelihood of a tax audit. These include inconsistencies in reported income (e.g., discrepancies between reported income and information received from third parties like employers or banks), unusually high deductions or credits compared to similar taxpayers, and mathematical errors on the tax return. Furthermore, claiming significant losses from business activities or substantial charitable contributions can also trigger an audit. Businesses with complex financial structures or those operating in high-risk industries are also more prone to scrutiny. To minimize the risk of an audit, taxpayers should ensure their tax returns are accurately and completely filled out, with supporting documentation readily available for any claims. Maintaining organized financial records and seeking professional tax advice can significantly reduce the chance of being selected for an audit.

Resolving Tax Disputes with the IRS

If the IRS proposes adjustments to a taxpayer’s return, they have the right to appeal the findings. The appeals process begins with an informal meeting with the IRS agent to discuss the proposed changes. If the issue is not resolved at this stage, the taxpayer can request a formal appeal with the IRS Appeals Office. This involves submitting a written protest outlining the reasons for disagreeing with the proposed adjustments. The Appeals Office will review the case and may schedule a conference to discuss the matter further. If the appeal is unsuccessful at the Appeals Office level, the taxpayer can take the case to the U.S. Tax Court, a specialized court that hears tax disputes. Alternatively, taxpayers can pay the disputed tax and then file a claim for a refund. This option allows the taxpayer to receive a refund if the IRS eventually agrees with their position. The choice of dispute resolution method depends on several factors, including the amount of tax in dispute, the complexity of the issue, and the taxpayer’s resources. Engaging a qualified tax professional is strongly recommended during this process.

Long-Term Tax Planning

Effective tax planning isn’t just about minimizing your tax bill this year; it’s about strategically managing your finances to achieve long-term financial goals while minimizing your overall tax burden over your lifetime. A well-structured long-term tax plan considers your evolving financial situation and adjusts accordingly, ensuring you maximize opportunities and minimize liabilities.

Long-term financial goals significantly influence the strategies employed in tax planning. For instance, aiming for early retirement requires a different approach than planning for college tuition. Strategies for accumulating wealth for retirement, such as maximizing contributions to tax-advantaged retirement accounts, differ from strategies for saving for college, which might involve utilizing 529 plans and other education savings vehicles. Understanding these differences and integrating them into a comprehensive plan is crucial.

Long-Term Tax Plan Example: A Young Professional

Let’s consider Anya, a 25-year-old young professional earning $60,000 annually. Her long-term goals include buying a home within five years, saving for a down payment, and eventually retiring comfortably at age 60. Her initial tax plan focuses on maximizing contributions to a Roth IRA, taking advantage of the tax-advantaged growth. She also contributes to a 401(k) plan offered by her employer to receive matching contributions. She itemizes deductions, including mortgage interest and charitable contributions (once she starts making significant charitable donations).

As Anya’s circumstances change, so does her tax plan. For instance, when she gets married and her income increases, she may need to re-evaluate her contribution levels to tax-advantaged accounts to stay within income limits for certain deductions and credits. When she buys a home, her mortgage interest deduction becomes significant, potentially affecting her tax bracket and her choice between itemizing or taking the standard deduction. As her income grows, she may explore other investment strategies with favorable tax implications, such as tax-loss harvesting. The birth of a child will likely introduce additional tax credits and deductions, further altering her tax planning strategy. Throughout her career, regular review and adjustments are necessary to optimize her tax efficiency.

The Importance of Regular Tax Planning Reviews

Regular reviews of your tax plan are essential for several reasons. Firstly, tax laws change frequently. What was a beneficial strategy last year may no longer be optimal. Secondly, your personal circumstances are constantly evolving – marriage, childbirth, career changes, inheritance – all necessitate adjustments to your tax strategy. Finally, regular reviews allow you to proactively identify and address potential tax liabilities, avoiding surprises and penalties. A yearly review, or at least every three years, is generally recommended, particularly during significant life events. Professional guidance from a tax advisor can be invaluable in navigating these complexities and ensuring your long-term financial and tax goals are aligned.

International Tax Considerations

Navigating the complexities of international tax law is crucial for individuals and businesses with global income or assets. Understanding the unique rules and regulations governing cross-border transactions is essential for compliance and minimizing tax liabilities. This section Artikels key considerations and provides a framework for managing international tax obligations.

International tax differs significantly from domestic tax due to the involvement of multiple jurisdictions, each with its own tax laws and treaties. This creates a complex landscape where income, assets, and business activities can be subject to taxation in more than one country. Careful planning is therefore vital to prevent double taxation and ensure compliance with all applicable regulations.

Foreign Tax Credits and Treaties

Foreign tax credits (FTCs) allow taxpayers to offset taxes paid to foreign governments against their U.S. tax liability, preventing double taxation on the same income. The amount of the credit is generally limited to the lesser of the foreign taxes paid or the U.S. tax on the foreign-source income. This limitation helps ensure that taxpayers do not receive a tax benefit greater than they would have received if the income had been sourced domestically. Furthermore, tax treaties between countries aim to avoid double taxation and promote cooperation in tax matters. These treaties often define which country has the right to tax specific types of income and provide mechanisms for resolving tax disputes between the countries involved. For example, a tax treaty might specify that dividends paid from a company in one country to a shareholder in another country are only taxed in the country where the shareholder resides.

Checklist for International Tax Matters

Proper management of international tax matters requires proactive planning and meticulous record-keeping. Below is a checklist of steps individuals and businesses should consider:

Before engaging in any international transaction, it is crucial to understand the tax implications in all relevant jurisdictions. This includes determining the applicable tax rates, reporting requirements, and potential tax credits or deductions available.

- Identify all sources of foreign income and assets: This includes employment income, investment income, rental income, and ownership of foreign assets.

- Determine the applicable tax treaties: Check for any tax treaties between the relevant countries to understand the rules for avoiding double taxation.

- Maintain accurate and detailed records: Keep meticulous records of all international transactions, including dates, amounts, and supporting documentation.

- File all necessary tax returns: File all required tax returns in each relevant jurisdiction, ensuring compliance with all reporting requirements and deadlines.

- Seek professional advice: Consult with a qualified tax advisor specializing in international tax matters to ensure compliance and optimize tax planning strategies.

- Stay updated on changes in tax laws: International tax laws are constantly evolving, so it is crucial to stay informed of any changes that may impact your tax obligations.

End of Discussion

By strategically employing the tax planning strategies discussed, individuals and businesses can effectively manage their tax obligations, optimize their financial resources, and achieve their long-term financial objectives. Remember that proactive tax planning is an ongoing process requiring regular review and adjustments to reflect changing circumstances and evolving tax laws. Seeking professional advice when needed is crucial to ensure you’re taking full advantage of all available opportunities and mitigating potential risks.

Common Queries

What is the difference between a tax deduction and a tax credit?

A tax deduction reduces your taxable income, while a tax credit directly reduces your tax liability. A credit is generally more valuable.

When should I start planning for retirement?

The sooner the better! Starting early allows for the power of compounding returns and maximizing tax advantages.

How often should I review my tax plan?

At least annually, or more frequently if significant life changes occur (marriage, job change, etc.).

What are the penalties for not filing taxes?

Penalties vary but can include interest charges, fines, and even legal action. It’s crucial to file on time, even if you owe money.

Can I deduct charitable donations?

Yes, subject to limitations. Consult tax guidelines for specifics on deductible amounts and types of charities.