Tax Planning Strategies Comparison: Let’s face it, taxes aren’t exactly a party, but navigating them strategically can be surprisingly fun (in a nerdy, spreadsheet-loving kind of way). This exploration dives into the delightful world of tax optimization, comparing various strategies to help you maximize your after-tax income. We’ll uncover the secrets to deductions, credits, and retirement planning, all while keeping things engaging and, dare we say, mildly entertaining.

From the intricacies of investment income to the nuances of small business tax planning, we’ll unravel the complexities of tax law with clarity and wit. Whether you’re a seasoned investor or just starting to think about your financial future, this comparison will equip you with the knowledge to make informed decisions and potentially keep a little more of your hard-earned cash.

Introduction to Tax Planning Strategies

Ah, taxes. The lifeblood of civilization, or so the government assures us. But let’s be honest, nobody *loves* paying taxes. Fortunately, strategic tax planning can transform that annual ritual from a teeth-grinding experience into something more akin to… well, maybe not a party, but certainly less of a root canal. Effective tax planning isn’t about avoiding taxes altogether (that’s illegal and generally frowned upon), it’s about legally minimizing your tax burden and maximizing your financial well-being. Think of it as a highly sophisticated game of financial chess, where you, the brilliant strategist, are trying to checkmate Uncle Sam.

Tax planning isn’t just for the ultra-wealthy or multinational corporations; it’s a crucial element of financial health for individuals and businesses alike. Proactive planning allows you to leverage various legal strategies to reduce your overall tax liability, potentially freeing up significant funds for investments, retirement planning, or even that much-deserved vacation. However, like any complex financial maneuver, it involves understanding the rules of the game and choosing the right moves. A poorly executed plan can lead to penalties and unnecessary complications, so it’s always wise to consult with a qualified professional.

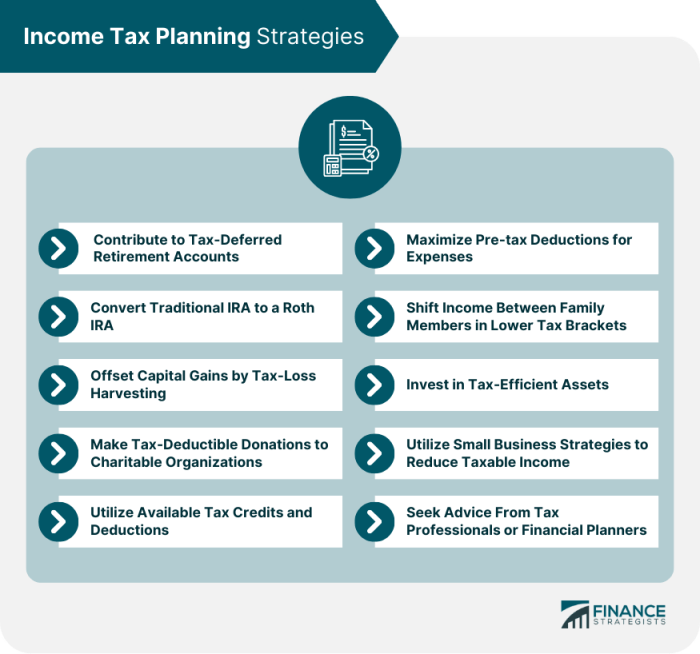

Types of Tax Planning Strategies

Several strategies exist, each tailored to different financial situations and goals. These range from simple deductions and credits to more complex techniques involving investments and business structures. Understanding these options is the first step towards making informed decisions. Ignoring them is like playing chess with your eyes closed – you might get lucky, but the odds are stacked against you.

Tax Deductions and Credits

Tax deductions reduce your taxable income, while tax credits directly reduce the amount of tax you owe. A common example of a deduction is charitable contributions, while a child tax credit directly lowers your tax bill. The impact of these can be significant, especially for those in higher tax brackets. For instance, a $10,000 deduction saves a taxpayer in the 22% bracket $2,200, while a $1,000 tax credit saves them $1,000, regardless of their tax bracket. This highlights the potential power of both strategies.

Retirement Planning Strategies

Retirement planning isn’t just about saving money; it’s also about strategically minimizing your tax liability throughout your working years and during retirement. Contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs, often reduce your taxable income in the present while potentially offering tax-deferred or tax-free growth. The specific tax advantages vary depending on the type of account and your income level. For example, contributions to a Roth IRA are made after tax, but withdrawals in retirement are tax-free, making it a powerful tool for long-term tax planning.

Investment Strategies

Smart investing can significantly influence your tax burden. Understanding the tax implications of different investment vehicles – stocks, bonds, mutual funds, real estate – is crucial for optimizing your returns. Capital gains taxes, for instance, are levied on profits from the sale of assets, and their rates vary depending on the holding period. Careful consideration of these tax implications can lead to substantial long-term savings. Imagine strategically selling assets to minimize your capital gains tax liability in a low-tax year, rather than a high-tax year. That’s the power of strategic tax planning in action.

Business Tax Planning

For business owners, tax planning is even more critical. Choosing the right business structure (sole proprietorship, partnership, LLC, S corp, C corp) significantly impacts tax liability. Each structure has different rules regarding taxation of profits and how those profits are passed through to the owner(s). Furthermore, businesses can utilize various deductions and credits specific to their industry and operations. A thorough understanding of these nuances is paramount for minimizing the tax burden and maximizing profitability. For example, a small business owner might deduct home office expenses or certain equipment purchases, directly reducing their taxable income.

Comparing Tax Deductions and Credits

Navigating the tax system can feel like traversing a particularly thorny jungle, filled with unexpected vines of jargon and bewildering brambles of bureaucracy. But fear not, intrepid taxpayer! Understanding the difference between tax deductions and tax credits is your machete through this green hell. Both can reduce your tax bill, but they do so in dramatically different ways, like a stealthy ninja versus a charging rhino.

Tax deductions and credits both lessen your tax burden, but their methods differ significantly. Deductions reduce your *taxable income*, while credits directly reduce your *tax liability*. Think of it this way: deductions shrink the size of the pie, while credits take a direct slice out of the already baked pie. This seemingly subtle difference can have a huge impact on your bottom line, depending on your tax bracket.

Tax Deductions: Shrinking the Pie

Tax deductions lower your adjusted gross income (AGI), the amount of your income subject to tax. Because this reduction happens *before* your tax rate is applied, the savings are proportional to your tax bracket. A higher tax bracket means a larger reduction in your overall tax bill from the same deduction. This is why deductions are most beneficial to higher-income taxpayers.

Common examples of tax deductions include charitable contributions (giving to your favorite charity – good for the soul and potentially your wallet!), mortgage interest (the interest portion of your home loan payments – a reward for homeownership!), and state and local taxes (SALT) – although the SALT deduction is currently capped under current legislation. These deductions can provide significant savings, particularly for those with higher incomes and significant eligible expenses.

Tax Credits: A Direct Slice

Tax credits, unlike deductions, directly reduce the amount of tax you owe. This is a dollar-for-dollar reduction, regardless of your tax bracket. This makes them particularly beneficial to lower- and middle-income taxpayers. A $1,000 tax credit reduces your tax bill by $1,000, period.

Popular tax credits include the Child Tax Credit (helping families with children – a much-needed break!), the Earned Income Tax Credit (EITC) (a vital safety net for low-to-moderate-income working individuals and families), and the American Opportunity Tax Credit (assisting with higher education costs – a lifeline for aspiring students!). These credits can provide substantial relief, especially for those who qualify.

Comparison of Common Tax Deductions and Credits

The following table compares several common tax deductions and credits. Remember, eligibility requirements and maximum amounts can change, so always consult the most current IRS publications for the most up-to-date information. (Don’t blame us if the rules change – we’re just the messengers!)

| Item | Type | Eligibility Requirements | Maximum Amount (2023 – Subject to Change!) |

|---|---|---|---|

| Charitable Contributions | Deduction | Cash contributions to qualified charities; itemized deductions must exceed the standard deduction. | Up to 60% of AGI (for cash contributions to certain public charities) |

| Mortgage Interest | Deduction | Interest paid on a qualified mortgage loan (generally, up to $750,000 of debt) | Limited by loan amount and interest rate |

| State and Local Taxes (SALT) | Deduction | State and local income, sales, and property taxes paid; subject to $10,000 limit. | $10,000 per household |

| Child Tax Credit | Credit | Qualifying child; meet certain age, residency, and relationship requirements. | Varies depending on income and number of children; consult IRS publications for specifics. |

| Earned Income Tax Credit (EITC) | Credit | Low-to-moderate income; meet specific income and work requirements. | Varies depending on income, filing status, and number of children; consult IRS publications for specifics. |

Retirement Savings Tax Advantages

Ah, retirement. The golden years, the time to finally relax and enjoy the fruits of your labor… or perhaps just the slightly less-ripe plums, depending on your tax planning prowess. Let’s delve into the fascinating (yes, really!) world of retirement savings and the tax breaks that can make your later years a little less…frugal. We’ll explore the delightful dance between you, your hard-earned cash, and Uncle Sam.

Retirement savings plans offer a variety of tax advantages, allowing you to potentially reduce your current tax liability and grow your nest egg more efficiently. The key lies in understanding the nuances of different plans and choosing the one that best aligns with your individual financial situation and risk tolerance. Think of it as choosing the right weapon in a tax-avoidance RPG; the wrong choice could leave you with a hefty tax bill at the end of the game.

Traditional vs. Roth Retirement Accounts: A Tax Tale of Two Accounts

Traditional and Roth retirement accounts offer distinct tax advantages at different life stages. Traditional accounts allow you to deduct contributions from your taxable income in the present, reducing your current tax bill. However, withdrawals in retirement are taxed as ordinary income. Roth accounts, conversely, involve contributing after-tax dollars, meaning no upfront tax deduction. The reward? Tax-free withdrawals in retirement! It’s a bit like choosing between a smaller tax bill now or a larger tax-free payout later – a strategic decision that depends on your current and projected future tax brackets. Imagine it like this: a traditional account is like investing in a bond that pays interest later, while a Roth account is like a winning lottery ticket you can cash in tax-free during your retirement.

Contribution Limits and Income Restrictions

The world of retirement savings isn’t a free-for-all; there are limits! Contribution limits vary yearly for both 401(k)s and IRAs, and income restrictions can impact your eligibility for certain plans, particularly Roth IRAs. For example, in 2023, the maximum contribution to a 401(k) was $23,000, with an additional $7,500 catch-up contribution allowed for those age 50 and older. These limits are adjusted annually by the IRS, so always check the current year’s guidelines. Exceeding these limits can lead to penalties, so it’s best to stay within the lines – unless you want to pay extra taxes, of course! Think of these limits as the “max level” in a video game; going beyond them might result in a game over situation.

Key Differences in Tax Treatment: Traditional vs. Roth IRAs

Understanding the core differences between Traditional and Roth IRAs is crucial for effective tax planning. Here’s a summary:

- Contributions: Traditional IRA contributions are tax-deductible, while Roth IRA contributions are not.

- Growth: Traditional IRA growth is tax-deferred, meaning you don’t pay taxes on investment earnings until retirement. Roth IRA growth is tax-free.

- Withdrawals: Traditional IRA withdrawals are taxed as ordinary income. Roth IRA withdrawals of contributions are tax-free; withdrawals of earnings are also tax-free if certain conditions are met (e.g., after age 59 1/2 and at least five years after the first contribution).

- Required Minimum Distributions (RMDs): Traditional IRAs are subject to RMDs starting at age 73 (or 75, depending on birth year), while Roth IRAs have no RMDs.

Choosing between a Traditional and Roth IRA depends heavily on your individual circumstances and projections for your future tax bracket. Will you be in a higher tax bracket in retirement? A Roth IRA might be more advantageous. Are you in a higher tax bracket now? A Traditional IRA might offer more immediate benefits. It’s a careful balancing act, much like walking a tightrope on a unicycle while juggling chainsaws – only slightly less dangerous (hopefully!).

Tax Planning for Investment Income

Investing can be a rollercoaster—thrilling highs and stomach-churning lows. But one thing’s for sure: Uncle Sam always wants a piece of the action. Understanding the tax implications of your investment choices is crucial to maximizing your returns, and not just in the form of stock gains. Let’s navigate this financial minefield together, ensuring we emerge victorious (and with more money in our pockets).

Different investment vehicles have different tax consequences. Ignoring these nuances can lead to a significantly smaller nest egg than you might expect. Think of it like this: you wouldn’t wear flip-flops to a formal gala, right? Similarly, a one-size-fits-all approach to tax planning for investments is a recipe for disaster. Careful planning, however, can allow you to keep more of your hard-earned money.

Tax Implications of Different Investment Types

Stocks, bonds, and mutual funds each have unique tax implications. Stocks, for instance, are taxed on capital gains when sold—the difference between the purchase price and the selling price. Bonds, on the other hand, often generate taxable interest income. Mutual funds can distribute both capital gains and dividends, adding another layer of complexity. The key is understanding the specific tax treatment of each investment type to strategically manage your overall tax burden.

Comparison of Capital Gains and Dividends

Capital gains and dividends are both forms of investment income, but they are taxed differently. Capital gains result from selling an asset for more than you paid for it, while dividends are payments made by companies to their shareholders. Capital gains taxes depend on how long you held the asset (short-term or long-term), while dividend tax rates vary based on factors like the type of dividend (qualified or non-qualified) and your income bracket. Strategic allocation between these investment types can significantly impact your tax liability.

Strategies for Minimizing Taxes on Investment Income

Minimizing your tax bill on investment income involves a multifaceted approach. This includes understanding tax-advantaged accounts like 401(k)s and IRAs, harvesting tax losses to offset gains, and strategically timing the sale of assets to maximize long-term capital gains treatment. Remember, seeking professional advice is always a smart move—think of it as an investment in your financial future.

Comparison of Long-Term versus Short-Term Capital Gains

The length of time you hold an asset before selling significantly impacts the tax rate on your capital gains. Long-term capital gains (assets held for more than one year) generally have lower tax rates than short-term capital gains (assets held for one year or less). This difference can be substantial, especially for high-income earners. Proper planning allows you to take advantage of these lower rates, substantially increasing your after-tax returns.

| Capital Gain Type | Holding Period | Tax Rate Example (Illustrative – Consult Tax Professional) | Tax Savings Potential |

|---|---|---|---|

| Short-Term | ≤ 1 year | Taxed at your ordinary income tax rate. For example, a 35% rate on $10,000 gain results in a $3,500 tax. | Lower compared to long-term. |

| Long-Term | > 1 year | Taxed at a preferential long-term capital gains rate (e.g., 15% or 20% depending on income). For example, a 15% rate on the same $10,000 gain results in a $1,500 tax. | Higher due to preferential rates. |

Tax Planning for Small Businesses: Tax Planning Strategies Comparison

Ah, the joys of entrepreneurship! The thrill of building something from the ground up, the satisfaction of seeing your vision come to life… and the slightly less thrilling prospect of navigating the complexities of small business taxes. Fear not, aspiring tycoon! This section will arm you with the knowledge to conquer the tax beast and keep more of your hard-earned dough. We’ll delve into the delightful world of deductions, credits, and choosing the right business structure – all while keeping things (relatively) lighthearted.

Successfully navigating small business taxes requires understanding the various deductions and credits available, selecting the optimal business structure, and implementing effective expense management strategies. Ignoring these aspects can significantly impact your bottom line, leaving you with less to reinvest in your business or, heaven forbid, to enjoy the fruits of your labor.

Common Tax Deductions and Credits for Small Businesses

The IRS offers a treasure trove of tax breaks specifically designed for small businesses. Think of them as little financial fairies sprinkling tax-reducing magic dust on your profits. These deductions and credits can significantly reduce your tax liability, freeing up funds for expansion, new equipment, or maybe even a much-needed vacation (you deserve it!).

- Home Office Deduction: If you use a portion of your home exclusively and regularly for business, you can deduct expenses like mortgage interest, rent, utilities, and depreciation. Just make sure to keep meticulous records – the IRS likes to see the receipts!

- Qualified Business Income (QBI) Deduction: This deduction allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income. It’s a significant benefit that can dramatically reduce your taxable income.

- Self-Employment Tax Deduction: The self-employment tax is a double whammy – you pay both the employer and employee portions. Fortunately, you can deduct one-half of the self-employment tax from your gross income.

- Research and Experimentation Credit: If your business invests in research and development, you may be eligible for a credit based on your qualified expenses. Think of it as a reward for innovation!

Comparison of Business Structures and Their Tax Implications

Choosing the right business structure is a crucial decision that will impact your tax liability for years to come. Each structure has its own set of rules and regulations, so careful consideration is key. Let’s examine a few popular options.

| Business Structure | Tax Implications |

|---|---|

| Sole Proprietorship | Profits and losses are reported on your personal income tax return (Schedule C). Simple, but your personal assets are at risk. |

| Limited Liability Company (LLC) | Offers liability protection while providing flexibility in taxation (can be taxed as a sole proprietorship, partnership, or corporation). |

| S Corporation | Profits and losses are passed through to the owners’ personal income tax returns, but can offer tax advantages through the separation of owner compensation and business profits. |

Strategies for Managing Business Expenses to Minimize Tax Liability

Effective expense management is the unsung hero of tax planning. By meticulously tracking and categorizing your expenses, you can maximize your deductions and minimize your tax burden. It’s not just about saving money; it’s about strategic financial planning.

Consider implementing a robust accounting system to track income and expenses. This will not only help you manage your finances but also make tax preparation a breeze (or at least less of a headache). Remember, accurate record-keeping is your best friend when it comes to the IRS.

Utilizing Depreciation and Amortization for Tax Purposes

Depreciation and amortization allow you to deduct the cost of business assets over their useful lives, rather than all at once. This can significantly reduce your taxable income in the short term. Think of it as spreading the tax pain out over time – a much more palatable approach.

For example, if you purchase a delivery van for your business, you can depreciate its cost over several years, reducing your taxable income annually. Similarly, if you spend money on intangible assets like software, you can amortize the cost over time. Consult a tax professional to determine the most appropriate depreciation and amortization methods for your specific assets.

Estate and Gift Tax Planning

Navigating the world of estate and gift taxes can feel like trying to solve a particularly tricky Sudoku puzzle – lots of numbers, complex rules, and the potential for a hefty penalty if you make a wrong move. But fear not, dear reader, for we shall illuminate this potentially taxing topic (pun intended!). Understanding estate and gift taxes is crucial for ensuring your hard-earned wealth is distributed according to your wishes, and not just to the ever-hungry taxman.

Estate and gift taxes are levied on the transfer of assets from one person (the grantor) to another, either during their lifetime (gift tax) or after their death (estate tax). The basic premise is simple enough: the government wants its share of your riches, especially the really big piles. However, the specifics can be surprisingly convoluted, involving intricate calculations, exemptions, and deductions that could make a CPA’s head spin. Think of it as a high-stakes game of financial Jenga, where one wrong move could cause the whole tower to come crashing down (financially speaking, of course).

Estate Tax Basics

The estate tax is imposed on the value of a deceased person’s assets that exceed a certain threshold, known as the estate tax exemption. This exemption amount is adjusted periodically to account for inflation and is quite substantial. Essentially, you get to keep a large chunk of your estate before the taxman comes knocking. Beyond that exemption, however, the tax rates can be quite steep. Imagine it as a particularly expensive toll booth on the highway to the afterlife – you can pass through freely if your estate is small enough, but larger estates face a significant fee.

Gift Tax Basics

The gift tax, on the other hand, applies to assets given away during a person’s lifetime. Think of it as a preemptive strike against the estate tax. By strategically gifting assets, you can reduce the size of your taxable estate and potentially minimize your overall tax burden. However, there are limits to how much you can gift each year without incurring gift tax. This is known as the annual gift tax exclusion, a generous allowance that allows for some tax-free gifting.

Annual Gift Tax Exclusion and its Implications, Tax Planning Strategies Comparison

Each year, individuals can gift a certain amount of money or property to others without incurring gift tax. This annual exclusion is indexed for inflation and provides a valuable tool for estate planning. For example, if the annual exclusion is $17,000 (a hypothetical number, check current regulations for the exact amount), you could gift $17,000 to as many individuals as you wish without triggering any gift tax liability. This strategy is often used to transfer wealth to family members while minimizing the impact on your overall estate. It’s like a tax-free allowance for generosity!

Estate Planning Strategies: Trusts and Wills

Choosing between a will and a trust is a critical decision in estate planning. A will is a legal document outlining how your assets will be distributed after your death. Think of it as a roadmap for your possessions post-mortem. A trust, however, is a more sophisticated arrangement where assets are held by a trustee for the benefit of beneficiaries. Trusts offer greater control over asset distribution, and can provide significant tax advantages, especially in complex estate situations. They can also offer protection from creditors and lawsuits. The choice between a will and a trust depends on individual circumstances, asset complexity, and desired level of control. A financial advisor or estate planning attorney can help you navigate this complex decision.

Gifting Strategies to Reduce Future Estate Tax Liability

Gifting assets during your lifetime can be a powerful strategy to reduce your estate tax liability. By strategically gifting assets to beneficiaries below the annual gift tax exclusion, you can reduce the size of your taxable estate. This is particularly advantageous for high-net-worth individuals who anticipate significant estate taxes. However, careful consideration should be given to the potential implications of gifting, including potential gift tax on amounts exceeding the annual exclusion, and the impact on the recipient’s financial situation. Gifting is a powerful tool, but like a finely tuned sports car, it requires skillful handling.

Tax Implications of Charitable Giving

Ah, charitable giving – the act of giving back to the community while potentially getting a little something back for yourself (tax-wise, of course!). It’s a win-win, unless you’re a particularly stingy Scrooge McDuck, in which case, well, maybe reconsider your life choices. But for the rest of us, let’s explore the delightful dance between generosity and tax deductions.

The tax benefits of charitable donations can be surprisingly substantial, offering a welcome reduction in your tax bill. Donating to qualified charities allows you to deduct the amount of your contribution from your taxable income, thus lowering the amount of taxes you owe. This is particularly beneficial for higher-income taxpayers who are in higher tax brackets, as the tax savings are proportionally greater. Think of it as a reward for your altruism, a pat on the back from Uncle Sam (metaphorically speaking, of course. He’s busy auditing someone else’s returns).

Types of Charitable Contributions

There’s more than one way to show your generosity (and lower your tax burden). The most common type of charitable contribution is a cash donation, made either by check or electronic transfer. This is simple, straightforward, and easily documented. However, you can also donate property, such as stocks, bonds, or even real estate. The tax implications vary depending on the type of property donated and its fair market value at the time of the donation. Donating appreciated property (assets that have increased in value since you acquired them) can offer significant tax advantages, as you may be able to deduct the fair market value while avoiding capital gains taxes. This is a particularly advantageous strategy for those holding onto assets that have appreciated significantly over time.

Limitations and Restrictions on Charitable Deductions

Unfortunately, the world of tax deductions isn’t a free-for-all. There are limitations. For cash contributions, you can generally deduct up to 60% of your adjusted gross income (AGI). For donations of property, the rules are a bit more complex, and the deduction may be limited to 50% or 30% of your AGI, depending on the type of property. Additionally, you must obtain a written acknowledgement from the charity for contributions exceeding $250. Failure to comply with these rules can result in penalties, so keep your records meticulously organized. Think of it as a highly detailed treasure map to your tax savings. Lose it, and you’ll be sailing the seas of higher tax bills.

Claiming Charitable Deductions

To claim your charitable deduction, you’ll need to complete Schedule A (Form 1040), Itemized Deductions. This involves listing your charitable contributions and supporting documentation. It’s crucial to keep accurate records of your donations, including dates, amounts, and the recipient charity’s name and tax identification number.

Remember, always consult a tax professional for personalized advice, as tax laws can be complex and vary depending on individual circumstances. They’re like the Sherpas of the tax mountain, guiding you safely to the summit of savings (or at least, to the base camp of a smaller tax bill).

Impact of Tax Laws and Regulations

The tax landscape, much like a particularly mischievous chameleon, is constantly shifting its colors. Understanding how these changes impact your tax planning is crucial, lest you find yourself unexpectedly facing a rather large bill from Uncle Sam (or your equivalent tax authority). Failing to adapt to these changes can be as financially painful as accidentally stepping on a Lego brick in the dark.

Tax laws and regulations are the very foundation upon which all tax planning strategies are built. Any shift in these foundations, however small, can have a ripple effect across various strategies, necessitating adjustments to maintain optimal tax efficiency. This necessitates a proactive approach to tax planning, requiring continuous monitoring and adaptation to the ever-changing rules of the game.

Changes in Tax Laws and Their Effects on Tax Planning Strategies

Recent tax law changes, particularly those affecting deductions and credits, have significantly impacted both individual and business tax planning. For example, the changes to the standard deduction in several countries have altered the number of individuals who itemize, thus influencing the strategic use of charitable contributions or mortgage interest deductions. Similarly, adjustments to the corporate tax rate can drastically affect investment decisions for businesses, shifting priorities and investment strategies. The implications are far-reaching, requiring careful recalculation of tax liabilities and a reassessment of optimal strategies.

Examples of Recent Tax Law Changes and Their Impact

Consider the recent alterations to capital gains taxes in several jurisdictions. Previously, long-term capital gains were taxed at a lower rate than ordinary income, making long-term investments attractive. However, recent increases in these rates have potentially made other investment vehicles, such as tax-advantaged retirement accounts, relatively more appealing. This shift has prompted many investors to reassess their portfolios and adjust their investment strategies to minimize their tax burden. Similarly, changes to depreciation rules for businesses have altered how companies account for the wear and tear of assets, affecting their overall profitability and tax obligations.

Tax Brackets and Marginal Tax Rates: Their Influence on Tax Planning Decisions

Tax brackets and marginal tax rates are pivotal in guiding tax planning decisions. Understanding your marginal tax rate – the rate applied to the next dollar earned – is paramount. For instance, if you’re in a higher marginal tax bracket, minimizing taxable income becomes significantly more important. This might involve maximizing tax deductions, contributing to tax-advantaged retirement accounts, or strategically timing capital gains. Conversely, those in lower brackets might find less urgency in aggressive tax minimization strategies. The interplay between your income level and the applicable tax brackets dictates the most effective course of action. Consider the following simplified example: If an individual is in a 25% tax bracket and can deduct $1,000, they effectively save $250 in taxes. This illustrates the power of understanding your tax bracket and using it to your advantage.

Ultimate Conclusion

So, there you have it – a whirlwind tour through the often-bewildering landscape of tax planning. While we can’t guarantee a sudden influx of riches (sorry, we’re not miracle workers!), understanding these strategies can significantly improve your financial health. Remember, proper planning is key, and seeking professional advice is always a smart move. Now go forth and conquer those tax returns! (Or at least, approach them with a newfound confidence.)

Question & Answer Hub

What’s the difference between a tax deduction and a tax credit?

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe. Credits generally offer a bigger bang for your buck.

Can I deduct my home office expenses?

Possibly! The IRS has specific rules regarding home office deductions, requiring a dedicated and regularly used workspace. Consult a tax professional for eligibility.

What is a qualified charitable contribution?

It’s a donation to a qualified 501(c)(3) organization, allowing you to deduct the contribution on your taxes. There are limitations on the amount you can deduct, depending on the type of contribution (cash vs. property).

How often should I review my tax strategy?

Annually, at minimum. Tax laws change, and your financial situation may evolve, requiring adjustments to your strategy.