Tax Planning Strategies Comparison: Navigating the bewildering world of taxes doesn’t have to be a comedic tragedy! This guide unveils the secrets to optimizing your financial future, transforming tax season from a dreaded chore into a surprisingly… manageable event. We’ll explore deductions, credits, retirement strategies, and even the tax implications of gifting your prized pet hamster (kidding… mostly). Prepare for a journey filled with insightful comparisons and, dare we say, a touch of tax-related amusement.

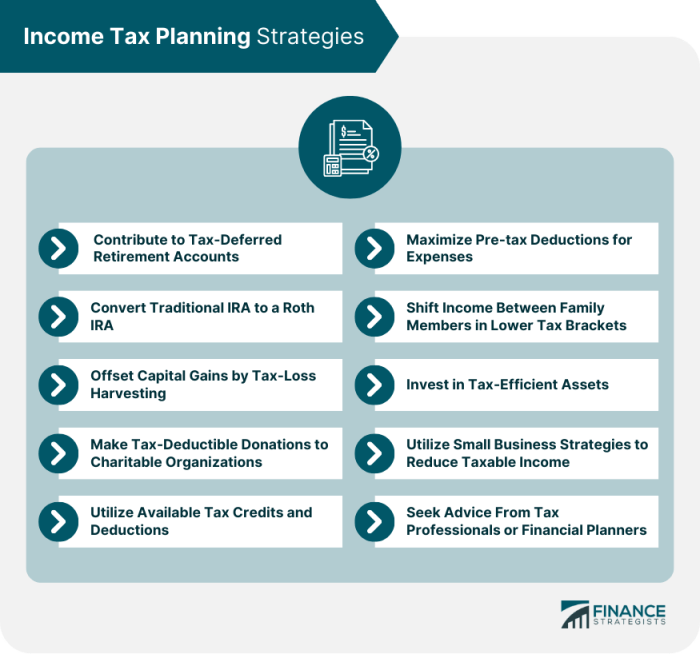

From understanding the nuances of itemized deductions versus the standard deduction to mastering the art of retirement planning and minimizing your tax burden, this comprehensive guide provides a clear and engaging overview of various tax planning strategies. We’ll compare different tax credits, analyze the tax implications of various investment vehicles, and delve into the specifics of tax planning for small businesses and estate planning. Buckle up, it’s going to be a wild ride (through the tax code).

Introduction to Tax Planning Strategies

Ah, taxes! The very word conjures images of frantic last-minute scrambles, questionable deductions, and a lingering sense of unease. But fear not, dear reader, for tax planning is not the villain it’s often made out to be. Instead, think of it as a sophisticated game of financial chess, where strategic moves can significantly reduce your tax burden and leave you with more moolah to enjoy the finer things in life (or, you know, just pay the bills without the existential dread). Proper tax planning is about proactively managing your financial affairs to minimize your tax liability legally and ethically, maximizing your after-tax income.

Tax planning strategies aren’t a one-size-fits-all affair. They can be broadly categorized as either long-term or short-term, depending on their intended impact and time horizon. Long-term strategies focus on building wealth and minimizing taxes over an extended period, often involving complex estate planning or long-term investment strategies. Short-term strategies, on the other hand, concentrate on immediate tax reductions, perhaps by optimizing deductions in a given tax year. Think of it as the difference between meticulously planning a cross-country road trip (long-term) and grabbing a quick bite to avoid paying for highway tolls (short-term).

Factors Influencing Tax Planning Strategy Selection

The choice of tax planning strategies isn’t arbitrary; it’s a deeply personal decision influenced by a variety of factors. Income level plays a crucial role, as higher earners often have access to more sophisticated strategies (and a greater need for them!). Investment goals are equally important; someone aiming for aggressive growth might employ different strategies than someone prioritizing capital preservation. Your family situation, age, risk tolerance, and even your overall financial philosophy all contribute to the ideal tax plan. For example, a young family with children might prioritize strategies that maximize deductions for childcare expenses, while a retiree might focus on minimizing capital gains taxes on investment withdrawals. A high-net-worth individual might engage in sophisticated estate planning to minimize estate taxes, while someone with a modest income might benefit from maximizing deductions for charitable contributions. Ultimately, the best strategy is the one that aligns with your unique circumstances and financial objectives. Remember, a well-crafted tax plan isn’t just about minimizing taxes today; it’s about building a sustainable financial future.

Comparing Deductions and Credits

Ah, the delightful dance of deductions and credits! These are the two main ways you can reduce your tax bill, but they work in subtly different, and delightfully quirky, ways. Think of them as two mischievous tax-reducing gremlins, each with its own brand of magic.

Understanding the difference between deductions and credits is crucial for maximizing your tax savings. A deduction reduces your taxable income, while a credit directly reduces your tax liability. This seemingly small difference can have a significant impact on your bottom line. Imagine a deduction as a discount on your shopping bill, while a credit is like receiving cold, hard cash back!

Itemized Deductions versus the Standard Deduction

The standard deduction is a flat amount set by the IRS, offering a straightforward way to lower your taxable income. It’s like a pre-packaged tax break, readily available to everyone. However, if your itemized deductions (things like charitable contributions, medical expenses exceeding a certain percentage of your income, and mortgage interest) exceed the standard deduction, you’ll get a bigger tax reduction by itemizing. This is where things get interesting! It’s like choosing between a free appetizer (standard deduction) and a customized meal (itemized deductions) – sometimes the customized meal is more satisfying.

Tax Credits: A Smorgasbord of Savings

Tax credits are the real heroes of tax reduction. Unlike deductions, they directly reduce the amount of tax you owe, dollar for dollar. This is much more powerful than just lowering your taxable income. The IRS offers a variety of credits, each designed to help specific groups of taxpayers. It’s like a buffet of tax savings, where everyone can find something delicious to their liking.

Comparison of Tax Credits

Let’s delve into the juicy details of three popular tax credits. Remember, eligibility requirements and credit amounts can change, so always consult the IRS website for the most up-to-date information. This table provides a snapshot of the situation, not a legally binding document!

| Tax Credit | Eligibility Requirements | Benefit | Example |

|---|---|---|---|

| Child Tax Credit | Qualifying child under age 17, meet residency and relationship tests. | Up to $2,000 per qualifying child (potentially refundable). | A family with two qualifying children could receive up to $4,000. |

| Earned Income Tax Credit (EITC) | Low-to-moderate-income working individuals and families. Income and number of children are factors. | Variable, depending on income and family size. Can be a substantial amount for eligible taxpayers. | A single parent with one child may receive several thousand dollars, helping them stay afloat financially. |

| American Opportunity Tax Credit (AOTC) | For the first four years of post-secondary education, with eligibility requirements on student status, enrollment, and other factors. | Up to $2,500 per student per year. | A student attending college could receive up to $10,000 across four years. |

Retirement Savings Strategies

Ah, retirement. That glorious time when you can finally swap spreadsheets for sunbathing (or, you know, whatever floats your boat). But before you start picturing yourself on a beach sipping margaritas, there’s the small matter of securing your financial future. This involves navigating the sometimes-bewildering world of retirement savings plans. Let’s dive in, shall we? Prepare for a tax-deductible adventure!

Retirement savings plans offer a fantastic way to build a nest egg while potentially reducing your current tax burden. However, each plan has its own quirks and tax implications. Understanding these differences is key to maximizing your savings and minimizing your tax liability. Think of it as a financial treasure hunt, but instead of X marking the spot, it’s a tax-efficient retirement.

401(k) Plans

401(k) plans are employer-sponsored retirement savings plans. Contributions are often made through payroll deductions, and many employers offer matching contributions – free money! The money grows tax-deferred, meaning you don’t pay taxes on it until you withdraw it in retirement.

- Tax Advantages: Contributions may be tax-deductible, reducing your taxable income in the present. Growth is tax-deferred.

- Tax Disadvantages: Withdrawals in retirement are taxed as ordinary income. Early withdrawals (before age 59 1/2) may be subject to a 10% penalty, plus taxes.

Traditional IRAs

Individual Retirement Accounts (IRAs) offer a flexible way to save for retirement, even if your employer doesn’t offer a 401(k). Contributions may be tax-deductible, depending on your income and whether you or your spouse also participates in a retirement plan at work. Similar to 401(k)s, growth is tax-deferred.

- Tax Advantages: Contributions may be tax-deductible, reducing your taxable income. Growth is tax-deferred.

- Tax Disadvantages: Withdrawals in retirement are taxed as ordinary income. Early withdrawals are generally subject to a 10% penalty, plus taxes.

Roth IRAs

Roth IRAs are similar to traditional IRAs, but with a key difference: contributions are made after tax, but withdrawals in retirement are tax-free. This makes them particularly attractive for those who anticipate being in a higher tax bracket in retirement than they are now.

- Tax Advantages: Withdrawals in retirement are tax-free. Contributions can be withdrawn at any time without penalty.

- Tax Disadvantages: Contributions are not tax-deductible. Income limits may restrict eligibility for contributions.

Investment Strategies for Tax Optimization

Investing wisely isn’t just about growing your money; it’s also about keeping more of it. Strategic investment choices can significantly reduce your tax burden, leaving you with a healthier bottom line (and perhaps a slightly more luxurious vacation fund). Let’s delve into the delightful world of tax-efficient investing.

Different investment types carry varying tax implications. Understanding these nuances is crucial for maximizing your returns. Think of it as a financial game of chess – you need to anticipate your opponent’s (the taxman’s) moves to win.

Tax Implications of Different Investment Types

The tax implications of your investments depend largely on the type of investment and how long you hold it. For example, the short-term gains on stocks are taxed at your ordinary income tax rate, while long-term gains (held for more than one year) enjoy preferential tax rates. Bonds, on the other hand, often generate interest income, taxed as ordinary income. Mutual funds, a diversified mix of investments, can present a more complex picture, with capital gains distributions and dividend income adding to the tax equation. Navigating this requires careful consideration of your individual tax bracket and investment timeline.

Tax-Advantaged Investment Accounts

Fortunately, the tax code offers several havens for your hard-earned money. These tax-advantaged accounts allow your investments to grow tax-deferred or even tax-free, depending on the account type. This is where the real magic happens – shielding your gains from immediate taxation allows for exponential growth.

One prime example is the 529 plan, designed specifically for education savings. Contributions are often tax-deductible at the state level, and the earnings grow tax-free as long as the money is used for qualified education expenses. This can be a game-changer for families saving for college, essentially turning tuition fees into a slightly less painful experience.

Comparison of Investment Vehicles

To visualize the tax efficiency of various investment options, consider the following simplified comparison. Note that tax rates are subject to change and individual circumstances may vary significantly. This table is intended for illustrative purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

| Investment Vehicle | Tax Treatment of Income/Gains | Tax Advantages | Potential Drawbacks |

|---|---|---|---|

| Stocks (Long-Term) | Capital gains tax (preferential rates) | Potential for higher returns, lower tax rates on long-term gains. | Market volatility, potential for losses. |

| Stocks (Short-Term) | Ordinary income tax rates | Liquidity | Higher tax rates compared to long-term gains. |

| Bonds | Ordinary income tax rates on interest | Generally less volatile than stocks. | Lower potential returns compared to stocks, taxed at ordinary income rates. |

| Mutual Funds | Capital gains distributions and dividend income taxed at applicable rates. | Diversification. | Management fees, potential for capital gains distributions. |

| 529 Plan | Tax-deferred growth, tax-free withdrawals for qualified education expenses. | Significant tax savings for education costs. | Penalties for non-qualified withdrawals. |

Tax Planning for Small Businesses: Tax Planning Strategies Comparison

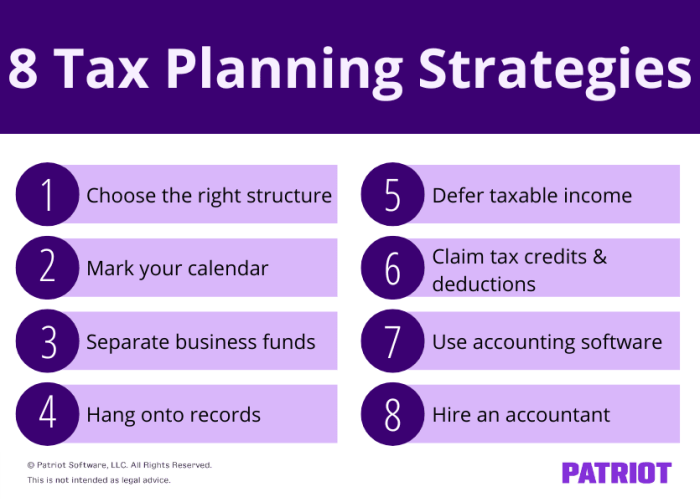

Navigating the tax landscape as a small business owner can feel like trying to solve a Rubik’s Cube blindfolded – challenging, but ultimately rewarding if you know the right moves. Choosing the right tax structure is the first crucial step, impacting everything from your tax liability to your personal liability. Understanding the nuances of each structure is key to minimizing your tax burden and maximizing your profits.

Small Business Tax Structures

The choice of business structure significantly impacts a small business’s tax obligations. Each structure offers a unique set of advantages and disadvantages regarding taxation and liability. The three most common structures are sole proprietorships, LLCs, and S corporations.

Sole Proprietorship Taxation

A sole proprietorship is the simplest structure, blending the business and owner’s identities. Profits and losses are reported on the owner’s personal income tax return (Schedule C). This simplicity comes with a trade-off: the owner is personally liable for all business debts and obligations. Tax rates are determined by the individual’s overall income bracket, and the business doesn’t pay separate taxes. Think of it as a tax-reporting merger – the business and the owner become one for tax purposes. For example, if a sole proprietor earns $100,000 in profit, that entire amount is reported on their personal income tax return and taxed according to their individual tax bracket.

LLC Taxation

Limited Liability Companies (LLCs) offer a balance between simplicity and liability protection. By default, an LLC is taxed as a pass-through entity, similar to a sole proprietorship. This means profits and losses are passed through to the owner(s) and reported on their personal income tax returns. However, some LLCs may elect to be taxed as an S corporation or a partnership, depending on the state and the number of owners. The key advantage here is the limited liability – the owner’s personal assets are generally protected from business debts. Imagine it as a tax-reporting roommate situation: the business and owner share expenses and profits, but the owner’s personal space is protected.

S Corporation Taxation, Tax Planning Strategies Comparison

An S corporation offers a more complex but potentially more advantageous tax structure. It allows business profits to be passed through to the owners, but it also allows the owner to take a salary and pay themselves a portion of the profits as dividends. This can lead to lower overall tax liability, as dividends are generally taxed at a lower rate than ordinary income. However, the administrative burden is higher, with more stringent record-keeping requirements. It’s like a tax-reporting family with a carefully crafted division of labor and resources to minimize the overall tax burden. For instance, an S-corp owner might draw a reasonable salary to cover living expenses and then receive the remaining profits as lower-taxed dividends.

Tax Deductions for Small Businesses

Small businesses are eligible for a plethora of tax deductions designed to offset their expenses and reduce their overall tax liability. These deductions can significantly impact a business’s bottom line, so it’s crucial to understand what’s available. Properly claiming these deductions requires meticulous record-keeping and potentially professional tax advice.

Common Small Business Tax Deductions

Many deductions are available, including those for home office expenses (if a portion of your home is used exclusively for business), business-related travel, vehicle expenses, health insurance premiums for self-employed individuals, and contributions to qualified retirement plans. The specifics of each deduction and eligibility requirements can be complex and vary based on individual circumstances and the type of business. Think of these deductions as tax-saving treasure hunts—discovering and utilizing them effectively is vital. For example, meticulously documenting home office expenses, such as a portion of rent, utilities, and depreciation, can lead to a substantial reduction in taxable income.

Estate Planning and Tax Minimization

Estate planning isn’t just for the obscenely wealthy; it’s about ensuring your hard-earned assets are distributed according to your wishes, minimizing tax burdens for your heirs, and – let’s be honest – avoiding any potentially messy family feuds over Grandma’s prized porcelain poodle collection. Proper planning can significantly reduce the financial strain on your loved ones after you’re gone, leaving them to mourn you, not your tax bill.

The specter of estate tax looms large for many, but understanding the intricacies of estate tax laws and available strategies can dramatically reduce its impact. The goal is to legally minimize the amount your estate owes in taxes, maximizing the inheritance your loved ones receive. This involves careful consideration of asset distribution, timing of transfers, and the strategic use of various legal tools.

Estate Tax Implications and Minimization Strategies

Understanding estate tax is crucial. Estate tax is a tax levied on the net value of a person’s assets after their death. The current federal estate tax exemption is quite high, meaning many estates don’t face this tax at all. However, exceeding that threshold can lead to significant tax liabilities. Strategies to minimize estate taxes include gifting assets during your lifetime (within annual gift tax limits), utilizing charitable donations to reduce your taxable estate, and employing sophisticated tax planning techniques such as creating trusts. For example, gifting smaller amounts each year to multiple beneficiaries can effectively reduce the overall taxable estate over time, similar to making small, regular deposits instead of one large, taxable lump sum.

The Use of Trusts in Estate Planning

Trusts act as intermediaries, holding assets on behalf of beneficiaries according to your specific instructions. Different types of trusts serve different purposes, offering various tax advantages. For instance, a revocable living trust allows you to maintain control over your assets during your lifetime, while a testamentary trust takes effect only upon your death. Irrevocable trusts, on the other hand, offer more significant tax benefits but relinquish control over the assets. The choice of trust depends on individual circumstances and tax objectives. A well-structured trust can help avoid probate, minimize estate taxes, and protect assets from creditors. For instance, a family with significant real estate holdings might use a trust to ensure the property remains within the family without incurring substantial estate taxes upon the death of the property owner.

Examples of Estate Planning Strategies Reducing Tax Burdens

Several strategies can significantly reduce your estate’s tax burden. One effective method is gifting assets to family members while you are still alive, taking advantage of the annual gift tax exclusion. This allows you to transfer wealth without incurring gift taxes, thereby reducing the size of your taxable estate. Another strategy involves utilizing life insurance policies, which pay out tax-free to beneficiaries. This can provide liquidity to cover estate taxes or other expenses without impacting the overall estate’s value. Furthermore, establishing a charitable remainder trust allows you to make charitable donations while also receiving income during your lifetime and minimizing estate taxes upon your death. For example, a philanthropist might use this trust to donate a portion of their assets to a favorite charity while still receiving income from the trust’s investment returns.

Tax Implications of Charitable Giving

Ah, charitable giving – the act of giving back to the community while potentially getting a little something back for yourself (tax-wise, of course!). It’s a win-win situation, unless you’re donating to a charity that only accepts sentient toasters. Then it’s just a win. Let’s delve into the delightful world of tax deductions and charitable contributions.

Donating to qualified charities can significantly reduce your taxable income, leading to a lower tax bill. The amount you can deduct depends on several factors, including your donation method and your overall income. Think of it as a financial high-five from Uncle Sam for your generosity. Or, perhaps a slightly less enthusiastic pat on the back; Uncle Sam’s not exactly known for his flamboyant displays of affection.

Deduction Calculation for Charitable Contributions

Calculating your charitable deduction is simpler than it sounds (we promise!). For cash contributions, you can deduct up to 60% of your adjusted gross income (AGI). For non-cash contributions like stocks or property, the rules are slightly more nuanced. Let’s say you donated $10,000 in cash and your AGI is $50,000. You can deduct the full $10,000 because it’s less than 60% of your AGI ($30,000). However, if your AGI was $10,000 and you donated $10,000, you could only deduct $6,000 (60% of your AGI). See? Simple! (Mostly.)

Methods of Charitable Giving

Different methods of giving have different tax implications. Cash donations are straightforward, allowing for a direct deduction on your tax return. But, hold on to your hats, because donating appreciated assets, such as stocks or property held for more than one year, offers additional tax advantages. When you donate appreciated assets, you can deduct the fair market value of the asset at the time of donation, while avoiding capital gains tax on the appreciation. This means you get a bigger deduction than if you sold the asset and then donated the proceeds. Imagine donating a painting you bought for $100 that’s now worth $1,000. You get to deduct the $1,000, not just the $100 you originally paid. It’s like magic, but with slightly less glitter.

Tax Benefits of Charitable Donations

The tax benefits of charitable giving are substantial, especially for high-income taxpayers. By reducing your taxable income, you lower your overall tax liability. This allows you to keep more of your hard-earned money. Furthermore, some charitable contributions may qualify for additional tax credits or deductions, depending on the type of charity and the specific donation. These benefits vary by state and locality, so be sure to check your local regulations. Remember, consulting a tax professional is always a good idea to navigate the complexities of charitable giving and maximize your tax benefits. Think of them as your tax-deductible Sherpas, guiding you through the mountainous terrain of tax law.

Impact of Tax Laws and Regulations

Navigating the ever-shifting sands of tax law can feel like trying to solve a Rubik’s Cube blindfolded while riding a unicycle – challenging, to say the least! But understanding how tax law changes impact your planning is crucial to keeping your financial house in order and avoiding a tax-audit-induced existential crisis.

Recent tax law changes have significantly altered the landscape of tax planning. For example, the Tax Cuts and Jobs Act of 2017 (TCJA) dramatically altered individual and corporate tax rates, leading to significant changes in strategies for both individuals and businesses. These changes, while intended to stimulate the economy, created a ripple effect that required many to re-evaluate their long-term financial plans. The increased standard deduction, for instance, simplified tax preparation for many but also rendered some itemized deductions less effective.

Recent Tax Law Changes and Their Impact on Tax Planning Strategies

The TCJA, as mentioned, wasn’t just a minor tweak; it was a major overhaul. The reduction in the corporate tax rate from 35% to 21% spurred significant investment and restructuring by businesses. Simultaneously, the changes to individual tax brackets and deductions necessitated a reevaluation of investment strategies, retirement planning, and charitable giving. Many individuals found themselves needing to adjust their tax withholding to avoid unexpected tax bills or refunds. The impact on state taxes also varied widely, as states adjusted their own tax codes in response to the federal changes. Some states saw an increase in tax revenue, while others experienced a decrease. This complex interplay between federal and state tax laws highlights the dynamic nature of tax planning and the need for continuous adaptation.

Potential Future Tax Law Changes and Their Implications

Predicting the future of tax law is akin to predicting the weather in a hurricane – it’s possible, but with a hefty dose of uncertainty. However, based on current political and economic climates, certain trends emerge. Discussions around wealth taxes, increased capital gains taxes, and potential changes to retirement plan contributions are frequently surfacing. These potential changes could significantly affect high-net-worth individuals, investors, and those planning for retirement. For example, an increase in the capital gains tax rate could lead investors to favor dividend-paying stocks over growth stocks, thereby altering investment portfolios. Similarly, changes to retirement plan contribution limits could force individuals to adjust their savings strategies. The increasing focus on environmental sustainability might also lead to tax incentives for green technologies and energy-efficient practices. This could create opportunities for tax optimization for businesses and individuals engaged in these areas.

Staying Updated on Current Tax Laws and Regulations

Staying abreast of tax law changes is not a passive activity; it’s an ongoing commitment. Think of it as a marathon, not a sprint. Utilizing resources such as the IRS website, reputable financial news sources, and consulting with a qualified tax professional are all vital steps. Subscribing to tax newsletters, attending tax seminars, and regularly reviewing your own tax situation can help you anticipate and adapt to changes effectively. Ignoring these changes is akin to ignoring a flashing warning light on your financial dashboard – you might get away with it for a while, but eventually, you’ll likely face some unpleasant consequences.

Illustrative Examples of Tax Planning Scenarios

Tax planning isn’t just for the ultra-wealthy or those who enjoy the thrill of deciphering complex tax codes (though, let’s be honest, there’s a certain charm to it). Effective tax planning can benefit anyone, from families juggling childcare costs to small business owners striving for growth. Let’s explore some real-world scenarios to illustrate how strategic planning can make a difference.

High-Income Earner Tax Planning

Imagine Amelia, a successful software engineer earning $300,000 annually. Her high income pushes her into a higher tax bracket, but she’s not content to simply let the IRS take a larger slice of her hard-earned money. Amelia’s tax advisor suggests several strategies: maximizing contributions to her 401(k) and HSA to reduce her taxable income, exploring tax-loss harvesting to offset capital gains from investments, and contributing to a Roth IRA for tax-free withdrawals in retirement. By strategically utilizing these options, Amelia significantly lowers her current tax liability and builds a robust retirement nest egg. The key here is to not only reduce her current tax burden but to plan for future tax efficiency. A good tax advisor is a significant investment.

Tax Planning for a Family with Children

Meet the Millers, a family with two young children and a combined annual income of $150,000. Their priorities are childcare, education, and saving for their children’s future. Their tax advisor guides them towards claiming the Child Tax Credit and the Child and Dependent Care Credit, significantly reducing their tax burden. They also explore the benefits of 529 plans for college savings, which offer tax advantages on both contributions and growth. The Millers understand that every dollar saved on taxes is a dollar closer to achieving their family’s financial goals. It’s not just about minimizing taxes, it’s about maximizing their financial well-being.

Small Business Owner Tax Planning

Consider David, the owner of a thriving bakery. His business is profitable, but he’s struggling to understand the complexities of business taxes. His accountant advises him to explore various deductions available to small business owners, such as home office deductions, business expenses, and depreciation of assets. David learns about the potential benefits of structuring his business as an LLC or S-Corp to minimize his personal tax liability. By carefully tracking his expenses and utilizing available deductions, David significantly reduces his overall tax burden, freeing up capital for business expansion and reinvestment. Understanding the nuances of small business tax laws is vital for growth and sustainability. Think of it as baking the perfect tax cake – the right ingredients are key!

Summary

Ultimately, effective tax planning is less about finding loopholes and more about strategically aligning your financial decisions with the tax code. By understanding the various strategies available and choosing those that best suit your individual circumstances, you can significantly reduce your tax liability and achieve your financial goals. So, while we can’t promise to make taxes fun (that’s a tall order), we can promise to make them less painful. Happy planning!

Expert Answers

What is the difference between a tax deduction and a tax credit?

A deduction reduces your taxable income, while a credit directly reduces the amount of tax you owe. Credits are generally more valuable.

How often should I review my tax plan?

Annually, or whenever there’s a significant life change (marriage, birth, job change, etc.). Tax laws change, and your needs evolve.

Can I deduct my home office expenses?

Potentially, yes. Specific criteria must be met regarding its exclusive and regular use for business. Consult a tax professional for specifics.

What are the penalties for not filing taxes?

Penalties can include interest charges, fines, and even legal action. The severity depends on the extent and nature of the non-compliance.