Navigating the world of Value Added Tax (VAT) can feel like traversing a complex maze, especially for businesses expanding internationally or reaching certain revenue thresholds. This guide aims to illuminate the path, providing a clear and concise understanding of VAT registration, from determining your eligibility to mastering the intricacies of returns and reclaims. Whether you’re a seasoned entrepreneur or just starting out, understanding VAT is crucial for compliance and financial success.

We’ll explore the varying VAT registration thresholds across different countries, detailing the process, record-keeping best practices, and potential pitfalls to avoid. We’ll also cover the implications of VAT for various business structures and offer guidance on when to seek professional advice. By the end, you’ll possess a solid foundation for confidently managing your VAT obligations.

Understanding VAT Registration Thresholds

Value Added Tax (VAT), or Goods and Services Tax (GST) in some regions, is a consumption tax levied on most goods and services. Understanding the registration thresholds is crucial for businesses to comply with tax regulations and avoid penalties. These thresholds vary significantly across countries, reflecting differences in economic structures and tax policies.

VAT Registration Thresholds Across Countries

The VAT registration threshold is the minimum turnover a business must reach before it’s legally required to register for VAT. Exceeding this threshold triggers the obligation to charge VAT on sales, remit collected VAT to the tax authority, and handle the associated administrative tasks. Failing to register on time can result in significant financial penalties. The thresholds are often expressed in local currency and can fluctuate due to currency exchange rates.

Examples of Businesses Exceeding and Not Exceeding Thresholds

A large retail chain with multiple stores and high annual sales would almost certainly exceed the VAT registration threshold in most countries. Conversely, a small freelance photographer operating on a limited scale might well remain below the threshold for many years. A restaurant with high foot traffic and substantial revenue would likely surpass the threshold, while a home-based bakery selling primarily to local neighbors might not. The specific circumstances of each business, including its sales volume, type of goods or services provided, and location, determine whether it crosses the registration threshold.

Penalties for Late VAT Registration

Late VAT registration carries substantial penalties. These penalties can include significant back taxes, interest charges on unpaid VAT, and even potential legal action. The exact penalties vary by country and the extent of the delay. For example, some jurisdictions impose daily or monthly penalties, while others might levy a flat fee based on the amount of unpaid VAT. It is always advisable to register promptly to avoid incurring these costs and potential legal repercussions.

Comparison of VAT Registration Thresholds

| Country | Threshold (in local currency) | Threshold (in USD equivalent) *(Approximate, subject to exchange rate fluctuations)* | Notes |

|---|---|---|---|

| United States (Many states have sales tax, not VAT) | N/A (varies by state) | N/A | Sales tax thresholds vary widely by state and are not directly comparable to VAT thresholds. |

| United Kingdom | £85,000 | ~$107,000 | This threshold applies to the supply of goods and services. |

| Canada | CAD 30,000 | ~$22,000 | Thresholds may vary slightly by province. |

| Germany | €22,000 | ~$24,000 | This is the general threshold; some exceptions may apply. |

| Australia | AUD 75,000 | ~$50,000 | This is the GST turnover threshold. |

*Note: USD equivalents are approximate and based on recent exchange rates. Always consult the relevant tax authority for the most up-to-date information.

The VAT Registration Process

Registering for Value Added Tax (VAT) can seem daunting, but understanding the process in a step-by-step manner can significantly ease the burden. This section Artikels the VAT registration process in the UK, detailing the necessary documentation and potential challenges businesses might encounter. While specific requirements might vary slightly depending on your business structure, this guide provides a general overview applicable to most scenarios.

Required Documentation for UK VAT Registration

Gathering the correct documentation is crucial for a smooth registration process. Incomplete or inaccurate information can lead to delays or rejection of your application. The necessary documents typically include proof of identity for the business owner(s), details about the business’s structure (sole trader, partnership, limited company, etc.), and evidence of the business’s address. Specifically, you’ll likely need:

- Proof of identity (passport, driving licence) for all directors or partners.

- Business registration documents (certificate of incorporation for limited companies, partnership agreement).

- Proof of business address (utility bill, bank statement).

- National Insurance number (if applicable).

- Bank details for VAT repayments or payments.

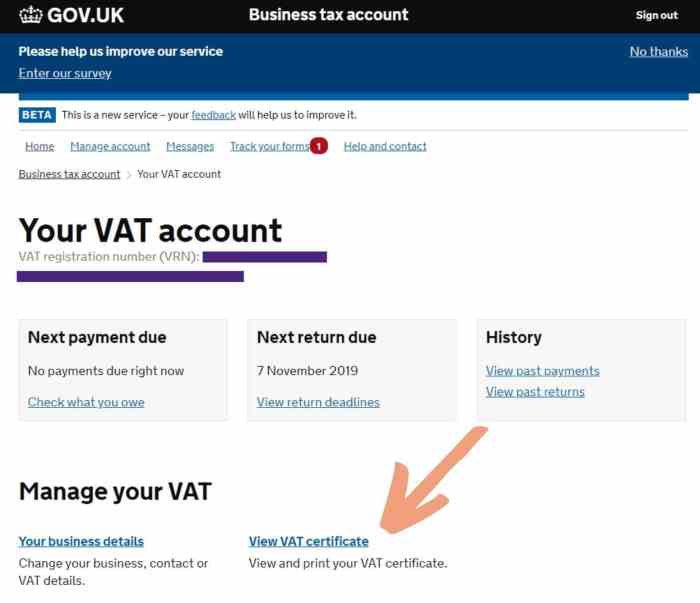

Step-by-Step Guide to UK VAT Registration

The UK’s VAT registration process is largely online. Following these steps will help ensure a successful application. Remember to keep records of all correspondence and confirmation numbers.

- Online Application: The application is completed through HMRC’s online portal. You’ll need a Government Gateway user ID and password. This initial step involves providing basic business information and selecting the correct registration type.

- Business Details: This section requires detailed information about your business, including its name, address, nature of activity, and anticipated turnover. Accuracy is paramount to avoid future complications.

- Director/Partner Details: Full details of all directors, partners, or individuals with significant control over the business must be provided, including their National Insurance numbers and contact information.

- Upload Supporting Documents: You will need to upload scanned copies of the necessary supporting documentation listed in the previous section. Ensure the documents are clear and legible.

- Review and Submit: Carefully review all the information entered before submitting the application. Once submitted, you will receive a confirmation number.

- VAT Number Allocation: Upon successful application review, HMRC will allocate a VAT number to your business. This number is essential for all future VAT transactions.

Potential Challenges During VAT Registration

While the process is generally straightforward, businesses may encounter some challenges. These could include:

- Incomplete or Incorrect Information: Submitting an application with missing or inaccurate information will almost certainly lead to delays and may require resubmission.

- Technical Issues with the Online Portal: HMRC’s online portal can experience occasional technical glitches. Patience and persistence are key in these situations. Consider contacting HMRC’s helpline for assistance.

- Verification Delays: HMRC may request further information or verification before approving the application. Responding promptly to these requests is crucial to expedite the process.

- Understanding VAT Regulations: A lack of understanding of VAT regulations can lead to errors in the application or subsequent VAT returns. Seeking professional advice if unsure is advisable.

Maintaining VAT Records

Maintaining accurate and organized VAT records is crucial for complying with tax regulations and avoiding potential penalties. Accurate record-keeping allows for the smooth and timely filing of VAT returns, demonstrating compliance to tax authorities. Neglecting this aspect can lead to significant financial and legal repercussions.

Effective VAT record-keeping involves the systematic and meticulous documentation of all VAT-related transactions. This includes both input VAT (VAT you pay on purchases) and output VAT (VAT you charge on sales). The records should be detailed enough to allow for easy reconciliation with your VAT returns and provide supporting evidence in case of an audit.

Common VAT Record-Keeping Mistakes and Consequences

Failing to maintain proper VAT records can result in a range of negative consequences. These can include inaccurate VAT returns leading to underpayment or overpayment of tax, delays in processing VAT refunds, increased risk of audits, and potentially significant financial penalties and legal action. Even minor errors can accumulate over time, creating substantial discrepancies and complicating the process of rectifying mistakes.

Designing a VAT Record-Keeping System

A well-structured system is essential for efficient VAT record-keeping. A simple table can be used to record relevant information for each transaction.

| Date | Invoice Number | Description | VAT Amount | Total Amount |

|---|---|---|---|---|

| 2024-10-26 | INV-001 | Sale of Goods | £100 | £600 |

| 2024-10-27 | INV-002 | Purchase of Supplies | £50 | £350 |

| 2024-10-28 | INV-003 | Sale of Services | £75 | £475 |

This simple table provides a basic framework. More complex systems might include additional fields, such as customer/supplier details, payment method, and tax rate. The key is to ensure all necessary information is captured and easily accessible.

The Importance of Digital Record-Keeping and Available Software Solutions

Digital record-keeping offers significant advantages over manual methods. It improves accuracy, reduces the risk of errors, simplifies data retrieval, and facilitates efficient reporting. Many software solutions are available to manage VAT records, ranging from simple spreadsheet programs to sophisticated accounting software packages. These solutions often automate tasks such as calculating VAT, generating reports, and integrating with other business systems. Choosing a system that suits the scale and complexity of your business is crucial for maximizing efficiency and compliance. For example, small businesses might use spreadsheet software, while larger enterprises may require dedicated accounting software with VAT compliance features.

VAT Returns and Payments

Submitting VAT returns and making timely payments are crucial aspects of VAT compliance. Failure to do so can result in significant penalties. This section details the process of completing a VAT return, available payment methods, and the consequences of non-compliance.

Completing a VAT Return Form

Let’s illustrate completing a VAT return with a hypothetical example. Imagine a small business, “Acme Widgets,” registered for VAT. During a VAT period (e.g., a quarter), they made taxable supplies of £100,000 and received VAT-inclusive purchases of £30,000. The standard VAT rate is 20%.

To complete the return, Acme Widgets would first calculate the VAT collected on their sales: £100,000 * (20%/120%) = £16,666.67. Next, they’d calculate the VAT they can reclaim on their purchases: £30,000 * (20%/120%) = £5,000. Finally, their net VAT due would be: £16,666.67 – £5,000 = £11,666.67. This amount would be entered on the appropriate line of the VAT return form, along with other relevant information such as the VAT registration number and the period covered. The specific format of the return form varies depending on the country and tax authority, but the core principle of calculating net VAT payable remains the same.

VAT Payment Methods

Several methods are typically available for paying VAT. These often include online banking transfers directly to the tax authority’s designated account, paying via a dedicated tax portal, or using a cheque (though this method is becoming less common). Some countries may also offer payment via debit or credit card. The chosen method will usually be specified by the relevant tax authority, and it’s essential to follow their instructions precisely to avoid delays or payment issues.

Penalties for Late or Incorrect VAT Returns

Late or inaccurate VAT returns attract penalties. These penalties vary depending on the severity and duration of the delay or the extent of the inaccuracy. Penalties might include late payment interest, additional charges for incorrect information provided, and in some cases, potential legal action. For example, a late submission might incur interest charges calculated daily on the outstanding VAT amount. Similarly, significant discrepancies in the reported figures could lead to investigations and potentially substantial fines. It is always advisable to submit VAT returns on time and accurately to avoid any penalties.

VAT Return and Payment Process Flowchart

The process can be illustrated with a flowchart:

[Imagine a flowchart here. The flowchart would begin with “Start,” then proceed to “Calculate VAT due,” followed by “Complete VAT Return Form,” then “Choose Payment Method,” followed by “Make Payment,” and finally “Submit VAT Return” and “End.”] The flowchart visually represents the sequential steps involved in filing a VAT return and making the associated payment, emphasizing the importance of timely and accurate completion of each stage.

VAT Deductions and Reclaims

Understanding VAT deductions and reclaims is crucial for businesses registered for VAT. Correctly claiming allowable deductions can significantly reduce your tax liability and improve your cash flow. This section Artikels the eligible expenses, methods for claiming deductions, and provides a real-world example of a successful VAT reclaim.

Eligible Expenses for VAT Deductions

Businesses can generally deduct VAT on expenses directly related to their VAT-registered activities. This includes a wide range of costs, but it’s vital to ensure the expense is genuinely for business purposes and not for personal use. Incorrectly claiming VAT on ineligible expenses can lead to penalties.

Examples of VAT Reclaimable Situations

Several common situations allow for VAT reclaims. For instance, VAT paid on the purchase of business equipment, such as computers or machinery, is typically reclaimable. Similarly, VAT paid on business premises rent, utilities (electricity, gas, water), marketing and advertising costs, and professional services (accountancy, legal) are often eligible for reclaim. Importantly, VAT paid on goods and services used exclusively for business purposes is deductible. VAT incurred on goods intended for resale is also reclaimable.

Methods for Claiming VAT Deductions

The method for claiming VAT deductions depends largely on the specific tax system of your country and how you file your VAT returns. Generally, businesses will claim VAT deductions by inputting the relevant amounts on their VAT return forms. This usually involves keeping detailed records of all VAT-inclusive invoices and receipts. Some jurisdictions may allow for simplified methods for smaller businesses, while larger companies may use specialized accounting software to manage and automatically deduct VAT. It is crucial to consult the relevant tax authority guidelines in your region to ensure compliance with local regulations and procedures.

Case Study: Successful VAT Reclaim

Imagine a small bakery, “Sweet Success,” registered for VAT. They purchased a new industrial oven for £10,000 (including £2,000 VAT). They also spent £500 on ingredients (including £100 VAT) and £200 on marketing materials (including £40 VAT). “Sweet Success” meticulously kept all invoices. When filing their VAT return, they claimed back the VAT paid on the oven (£2,000), ingredients (£100), and marketing materials (£40), totaling £2,140. This significantly reduced their overall tax liability for that period. This demonstrates the importance of accurate record-keeping and diligent claim submission for maximizing VAT recovery.

VAT Implications for Different Business Structures

Understanding how your business structure impacts VAT compliance is crucial for accurate record-keeping and avoiding penalties. Different structures have varying registration thresholds and accounting procedures. This section will clarify the VAT implications for sole traders, partnerships, and limited companies.

The VAT system interacts differently with each business structure, influencing registration requirements, accounting methods, and overall compliance. Careful consideration of these implications during business setup and ongoing operation is essential for efficient VAT management.

VAT Implications for Sole Traders

Sole traders are considered self-employed individuals running their own businesses. Their VAT registration threshold is typically the same as for other business structures. However, their accounting procedures are often simpler, as they usually maintain personal and business finances within a single system. This can lead to both advantages and disadvantages regarding VAT compliance. Advantages include streamlined record-keeping, while disadvantages can include a lack of separation between personal and business finances, potentially making VAT calculations more complex.

VAT Implications for Partnerships

Partnerships involve two or more individuals who agree to share in the profits or losses of a business. The VAT registration threshold for partnerships is usually the same as for sole traders and limited companies. Partnership VAT accounting requires careful allocation of VAT liabilities and deductions among the partners. This can add complexity compared to sole traders but often offers greater flexibility in terms of shared responsibility and resource management.

VAT Implications for Limited Companies

Limited companies are separate legal entities from their owners. They have their own VAT registration threshold, often identical to other business structures. Their accounting procedures are generally more formal and complex, requiring adherence to specific corporate accounting standards. The separation of the company’s finances from the personal finances of its directors and shareholders simplifies VAT accounting in many respects, providing clearer financial records and potentially simplifying audits. However, this increased formality necessitates a more robust accounting system.

Comparison of VAT Implications Across Business Structures

| Business Structure | Registration Requirements | Accounting Procedures | Advantages/Disadvantages Regarding VAT |

|---|---|---|---|

| Sole Trader | Typically same threshold as other structures; simpler registration process. | Often simpler; may integrate personal and business finances. | Advantages: Streamlined record-keeping. Disadvantages: Potential complexity in separating personal and business finances for VAT purposes. |

| Partnership | Typically same threshold as other structures; requires agreement among partners. | Requires careful allocation of VAT liabilities and deductions among partners. | Advantages: Shared responsibility and resource management. Disadvantages: Increased complexity compared to sole traders in VAT accounting. |

| Limited Company | Typically same threshold as other structures; more formal registration process. | More formal and complex; requires adherence to corporate accounting standards. | Advantages: Clear separation of business and personal finances, simplifying VAT accounting and audits. Disadvantages: Increased administrative burden and complexity. |

Common VAT Mistakes and How to Avoid Them

Navigating the complexities of VAT can be challenging, and even businesses with the best intentions sometimes make errors. These mistakes can lead to penalties, interest charges, and reputational damage. Understanding common pitfalls and implementing preventative measures is crucial for maintaining compliance and minimizing financial risks. This section Artikels frequent VAT errors and offers practical solutions to prevent them.

Incorrect VAT Calculation

Incorrect VAT calculations are a prevalent issue. This stems from errors in applying the correct VAT rate to different goods and services, miscalculating the VAT amount on invoices, or failing to account for VAT on expenses. The consequences of incorrect calculations range from minor discrepancies to significant underpayment or overpayment, leading to potential audits and penalties. To avoid this, businesses should implement robust accounting software capable of automatically calculating VAT, double-check all calculations manually, and regularly review their VAT records for accuracy. They should also ensure staff are adequately trained in VAT calculation procedures.

Failure to Register for VAT

Businesses exceeding the VAT registration threshold are legally required to register. Failure to do so can result in substantial backdated VAT liabilities, penalties, and even legal action. Businesses should monitor their turnover closely and register promptly once they reach the threshold. Maintaining accurate records of turnover is essential to ensure timely registration.

Incorrect Treatment of Exempt Supplies

Some goods and services are VAT-exempt. Incorrectly treating exempt supplies as taxable can lead to overpayment of VAT, while incorrectly treating taxable supplies as exempt can lead to underpayment. Understanding which supplies are exempt is crucial. Businesses should seek professional advice if unsure about the VAT treatment of specific supplies.

Incorrect Input VAT Reclaims

Businesses can reclaim VAT paid on business expenses. However, claiming VAT on ineligible expenses is a common mistake. This can lead to penalties and interest charges. Businesses should ensure all expenses claimed are directly related to their VAT-registered business activities. Maintaining detailed records of all expenses, including invoices and receipts, is essential for justifying input VAT reclaims.

Poor Record Keeping

Maintaining accurate and complete VAT records is vital for compliance. Incomplete or inaccurate records can make it difficult to prepare accurate VAT returns and can lead to investigations and penalties. Businesses should maintain a robust record-keeping system, including digital and physical records, that allows them to easily track all transactions, invoices, and expenses. Regularly backing up records is also essential to prevent data loss.

- Mistake: Incorrect VAT calculation on invoices. Solution: Implement robust accounting software and double-check all calculations.

- Mistake: Failure to register for VAT when exceeding the threshold. Solution: Monitor turnover closely and register promptly upon reaching the threshold.

- Mistake: Incorrect treatment of exempt supplies. Solution: Seek professional advice when unsure about VAT treatment of specific supplies.

- Mistake: Incorrect input VAT reclaims. Solution: Ensure all expenses claimed are directly related to VAT-registered business activities and maintain detailed records.

- Mistake: Poor record keeping. Solution: Implement a robust record-keeping system, including regular backups.

Seeking Professional VAT Advice

Navigating the complexities of Value Added Tax (VAT) can be challenging, even for seasoned business owners. Understanding the intricacies of registration thresholds, record-keeping, and compliance requirements often necessitates seeking expert guidance. This section explores the benefits of professional VAT advice and Artikels how to find the right advisor for your needs.

Circumstances Warranting Professional VAT Advice

Several situations highlight the value of professional VAT advice. Businesses operating across multiple countries face significant complexities in understanding and complying with varying VAT regulations. Similarly, businesses experiencing rapid growth or undergoing significant structural changes (mergers, acquisitions) often require expert assistance to ensure seamless VAT compliance throughout the transition. Businesses involved in complex transactions, such as those involving imports, exports, or specific services with unique VAT implications, also benefit greatly from professional support. Finally, businesses facing VAT audits or disputes need skilled professionals to navigate the process effectively.

Types of Professionals Offering VAT Advice

Accountants and tax advisors are the primary professionals who offer VAT advice. Accountants often incorporate VAT compliance into their broader financial services, providing integrated solutions for businesses. Tax advisors, specializing in tax law and regulations, provide in-depth expertise on VAT-specific issues, often possessing a deeper understanding of intricate VAT legislation and case law. Some larger firms might employ dedicated VAT specialists with expertise in particular sectors or industries.

Benefits of Professional VAT Services for VAT Compliance

Utilizing professional services offers several key advantages. Firstly, professionals possess up-to-date knowledge of constantly evolving VAT regulations, ensuring compliance and minimizing the risk of penalties. Secondly, they streamline the VAT process, freeing up valuable time and resources for business owners to focus on core operations. Thirdly, professionals can proactively identify potential VAT savings and optimization opportunities, maximizing tax efficiency. Finally, their expertise provides a robust defense against potential audits and disputes, minimizing financial and reputational risks.

Checklist of Questions for a Potential VAT Advisor

Choosing the right VAT advisor is crucial. Before engaging their services, consider asking these questions: What is your experience with businesses similar to mine? What is your approach to VAT compliance and planning? Can you provide references from previous clients? What are your fees and payment terms? What is your process for keeping me informed of changes in VAT legislation? How will you communicate with me, and how quickly can I expect a response to my queries? What is your contingency plan in case of a VAT audit or dispute? Do you have professional indemnity insurance?

Conclusion

Mastering VAT compliance is key to the long-term health and prosperity of any business. This guide has provided a framework for understanding the complexities of VAT registration and management. Remember, accurate record-keeping, timely filings, and seeking professional help when needed are essential for avoiding penalties and ensuring financial stability. By implementing the strategies and insights shared here, you can navigate the VAT landscape with confidence and focus your energy on growing your business.

User Queries

What happens if I don’t register for VAT on time?

Late registration can result in significant penalties, including back taxes, interest charges, and potential legal action. The exact penalties vary by country.

Can I register for VAT online?

Many countries offer online VAT registration portals, simplifying the process. However, specific requirements and availability vary by jurisdiction.

How often do I need to file a VAT return?

The frequency of VAT returns depends on your country’s regulations and your business’s turnover. It’s typically monthly, quarterly, or annually.

What if I make a mistake on my VAT return?

Correcting mistakes on a VAT return usually involves filing an amended return. Contact your tax authority for guidance on the process.

Where can I find more information about VAT in my specific country?

Consult your country’s tax authority website for detailed information and specific regulations.