VAT Registration Indonesia: Navigating the labyrinth of Indonesian Value Added Tax can feel like trying to assemble IKEA furniture blindfolded, but fear not! This guide unravels the mysteries of registration, ensuring your business avoids the wrath of the taxman (and potential fines that could fund a small island nation). We’ll equip you with the knowledge to conquer the complexities of Indonesian VAT, transforming a daunting task into a surprisingly manageable—dare we say, even enjoyable?—experience. Prepare for a journey filled with insightful explanations, practical tips, and maybe even a chuckle or two along the way.

From understanding the eligibility criteria and gathering the necessary documentation to mastering the online registration process and fulfilling post-registration obligations, this comprehensive guide will serve as your trusty compass through the Indonesian VAT system. We’ll cover everything from calculating VAT accurately to handling penalties for non-compliance, ensuring you’re well-prepared to navigate the regulatory landscape with confidence. So buckle up, because this is going to be a wild ride!

Understanding Indonesian VAT Registration Requirements

Navigating the world of Indonesian VAT can feel like trying to assemble IKEA furniture without the instructions – challenging, potentially frustrating, but ultimately rewarding (mostly rewarding, let’s be honest). This guide aims to shed light on the often-murky waters of Indonesian VAT registration, making the process less like a tax-induced nightmare and more like a mildly amusing bureaucratic adventure.

Criteria for Mandatory VAT Registration in Indonesia

In Indonesia, VAT registration isn’t a suggestion; it’s a requirement for businesses that meet specific turnover thresholds. Think of it as a VIP pass to the world of VAT – you don’t *want* to be in the VIP section, but you *have* to be if you’ve reached the requisite level. These thresholds are determined annually and vary depending on the type of business and location. Failing to register when you’re required to can lead to penalties that are far less amusing than this guide. Essentially, if your business exceeds the annual turnover limit set by the Indonesian government, you’re officially part of the VAT club, whether you like it or not.

Types of Businesses Subject to VAT Registration

A wide variety of businesses fall under the VAT registration umbrella. This isn’t limited to just massive corporations; smaller businesses also need to register once they cross the annual turnover threshold. Examples include retailers, wholesalers, service providers (think restaurants, spas, even your friendly neighborhood dog walker, if they hit the threshold!), importers, and exporters. Essentially, if your business involves selling goods or services and your turnover surpasses the limit, you’re in. It’s less about the *type* of business and more about the *amount* of business you’re doing.

Step-by-Step Guide to VAT Registration

The registration process, while bureaucratic, is relatively straightforward (relatively being the operative word). First, gather all the necessary documentation. This includes your business registration certificate, identity documents, and potentially other supporting documents depending on your specific business structure. Next, submit your application online through the official tax office website. You’ll need to complete the required forms accurately, providing all the necessary information. Once submitted, the tax office will review your application and issue a VAT registration number if approved. Finally, keep your registration number safe and sound – you’ll need it for all future VAT-related activities. Consider it your official membership card to the (somewhat less-than-thrilling) VAT club.

Indonesian VAT Rates for Different Goods and Services

The VAT rate in Indonesia is generally 11%, but there are exceptions for certain goods and services. Some items might have a lower rate, while others might be exempt entirely. Understanding these nuances is crucial for accurate tax calculation. It’s like a complex board game, but with higher stakes (and fewer dice).

| Company Type | Turnover Threshold (IDR) | Registration Deadline | Penalties for Non-Compliance |

|---|---|---|---|

| Small Business | 4.8 Billion | Within 3 months of exceeding threshold | Fines and potential legal action |

| Medium Business | 48 Billion | Within 3 months of exceeding threshold | Fines and potential legal action |

| Large Business | More than 48 Billion | Upon establishment | Significant fines and legal repercussions |

| Specific Sectors (e.g., Certain Services) | Varies depending on regulation | Varies depending on regulation | Varies depending on regulation |

Required Documentation for VAT Registration

Navigating the world of Indonesian VAT registration can feel like trekking through a dense jungle – exciting, potentially rewarding, but definitely requiring the right gear. And that gear, my friends, comes in the form of meticulously prepared documentation. Failure to provide the correct paperwork can lead to delays, rejections, and the dreaded bureaucratic tango. So, let’s ensure you’re armed with the proper paperwork to conquer this administrative Everest!

Preparing the necessary documents for your VAT registration application is crucial. Think of it as assembling the perfect Indonesian tax-compliant puzzle – each piece is essential, and missing even one can leave you with a frustratingly incomplete picture. Let’s delve into the specifics, ensuring you’re ready to submit a flawlessly organized application.

Business Registration Certificate (SIUP/TDP/Izin Usaha)

This document proves your business’s legal existence. It’s the cornerstone of your application, the foundational rock upon which your VAT registration rests. Without it, your application is essentially a ship without a sail. The specific requirements vary slightly depending on your business type (sole proprietorship, partnership, limited company, etc.), so double-check with the relevant authorities to ensure you have the correct version. A correctly formatted certificate will clearly display your company name, registration number, address, and date of issuance. Imagine it as your business’s official birth certificate – it’s that important.

Taxpayer Identification Number (NPWP)

This is your personal or business tax identification number, your unique identifier in the Indonesian tax system. It’s akin to your social security number, but for taxes. You absolutely, positively need this. Obtaining an NPWP before applying for VAT registration is a non-negotiable prerequisite. A correctly formatted NPWP will include your name (for individuals) or company name (for businesses), your tax identification number, and the issuing authority’s stamp and signature. Missing this is like trying to build a house without a foundation.

Proof of Business Address

This could be a copy of your rental agreement, utility bills (electricity, water, etc.), or official business address documentation. This proves your business’s physical location, allowing the tax authorities to verify your address and contact you effectively. A correctly formatted proof of address will clearly display your business’s name and address, the date of issuance, and the provider’s logo or stamp. It should be a recent document (within the last 3 months is ideal). Think of this as your business’s address confirmation – crucial for effective communication.

Financial Statements (If Applicable)

Depending on your business’s size and turnover, you might need to submit financial statements. This could include balance sheets, profit and loss statements, or cash flow statements. These documents provide insights into your business’s financial health and help the authorities assess your eligibility for VAT registration. A correctly formatted financial statement will follow generally accepted accounting principles (GAAP) and include clear dates, account balances, and supporting documentation. These are your business’s financial report card, showcasing its performance.

Checklist for VAT Registration Documents

Before submitting your application, use this checklist to ensure you haven’t missed a crucial piece of the puzzle:

| Document | Checked |

|---|---|

| Business Registration Certificate (SIUP/TDP/Izin Usaha) | |

| Taxpayer Identification Number (NPWP) | |

| Proof of Business Address | |

| Financial Statements (If Applicable) |

Online VAT Registration Process in Indonesia

Embarking on the journey of Indonesian VAT registration might seem like navigating a jungle teeming with paperwork and bureaucratic beasts, but fear not! The online portal, while potentially perplexing at first glance, is designed to streamline the process (at least, that’s the theory). With a bit of patience and a dash of strategic caffeine, you’ll conquer this digital Everest. This section will equip you with the knowledge to traverse the online registration landscape with the grace of a seasoned Indonesian tax professional (or at least, someone who hasn’t completely lost their mind).

The Indonesian online portal for VAT registration is the digital gateway to the world of Indonesian tax compliance. Think of it as a finely-tuned (sometimes) machine, designed to process your application with the efficiency of a well-oiled bureaucracy (again, sometimes). While the user interface might not win any design awards, its functionality, once understood, can be surprisingly effective. Let’s dive into the specifics.

Steps for Completing the Online VAT Registration Application

The online application process is a multi-step affair, each step requiring careful attention to detail. Missing even a comma can lead to delays, so precision is key. Imagine it as a high-stakes game of digital Jenga – one wrong move, and your application could come tumbling down. But don’t worry, we’ll guide you through it.

- Account Creation: First, you’ll need to create an account on the official Directorate General of Taxes (DGT) website. This involves providing basic information, much like creating any other online account. Think of it as your digital passport to the world of Indonesian tax compliance. Ensure accuracy; incorrect information can cause significant headaches down the line.

- Business Information Input: Once logged in, you’ll be prompted to provide comprehensive details about your business. This includes your business registration number (NIB), business type, address, and other relevant information. Think of this as your business’s online resume – make it shine! Double-check everything before proceeding; accuracy is paramount.

- Financial Information Submission: Prepare to input financial details related to your business’s projected turnover. This is where you’ll demonstrate your business’s financial prowess (or at least, its potential). Accurate projections are crucial here; overestimating or underestimating can impact your VAT obligations.

- Document Upload: This step involves uploading scanned copies of all the necessary documents. Ensure the quality is high enough for clear readability; blurry documents are a recipe for rejection. Think of this as your digital filing cabinet – keep it organized and accessible.

- Application Submission and Review: Once you’ve completed all the previous steps, submit your application. The DGT will review your application, which may take some time. Patience is a virtue; the wait might feel like an eternity, but the reward is worth it.

Best Practices for Navigating the Online Portal

Navigating the online portal effectively requires a strategic approach. Think of it as a treasure hunt, where the treasure is your VAT registration. Here are some tips to ensure a smoother experience.

- Prepare all necessary documents beforehand. This will save you time and frustration. Having everything ready will streamline the process considerably.

- Use a reliable internet connection. A slow or unstable connection can lead to delays and errors. A stable connection is your best friend in this digital quest.

- Double-check all information before submitting. Accuracy is paramount; errors can cause significant delays. Take your time; haste makes waste.

- Keep a record of your application details. This will be helpful if you need to refer back to your application later. A well-organized record is a lifesaver.

- Contact the DGT directly if you encounter any problems. They are there to help; don’t hesitate to reach out if you need assistance. Their support is a valuable resource.

Post-Registration Obligations for VAT-Registered Businesses

Ah, the sweet taste of VAT registration! You’ve conquered the paperwork mountain, scaled the bureaucratic Everest, and now you’re officially a VAT-registered business in Indonesia. Congratulations! But the adventure doesn’t end there. Think of it like this: you’ve just gotten your driver’s license; now you need to learn how to actually drive, and, more importantly, follow the rules of the road. Failure to do so can lead to…well, let’s just say it won’t be pretty.

The post-registration phase is all about maintaining your good standing with the Indonesian tax authorities. This involves diligently filing your VAT returns, accurately calculating your VAT payable, and paying your dues on time. Sound daunting? Don’t worry, we’ll break it down into manageable chunks, making the process less terrifying than a tax audit conducted by a particularly grumpy tax inspector.

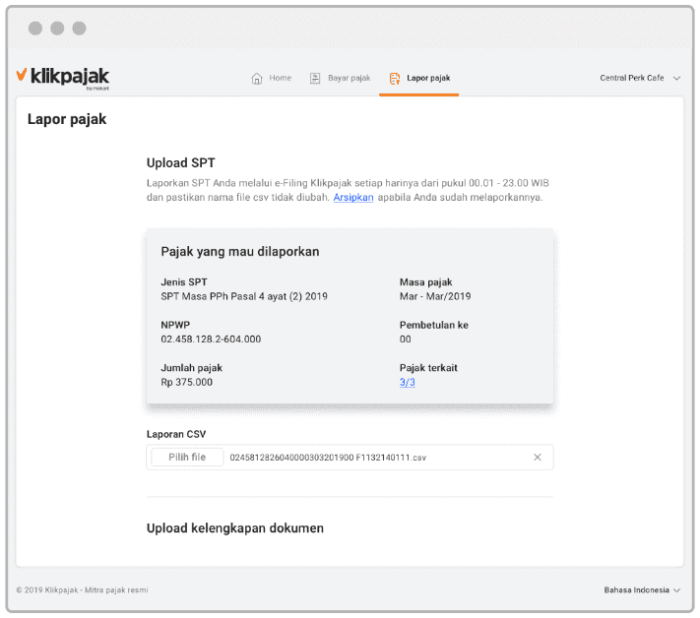

VAT Return Filing Procedures

Filing your VAT returns is the cornerstone of your post-registration obligations. It’s where you report your taxable sales, deductible input VAT, and ultimately, the VAT you owe (or are due a refund!). Failure to file on time can lead to penalties, which are never fun. Think of it as a monthly check-in with the tax authorities; a friendly reminder that you’re a responsible taxpayer. The frequency of filing depends on your business turnover; more sales usually mean more frequent filings. The process itself is largely electronic, using the official Directorate General of Taxes (DGT) online system. This system is…well, let’s just say it has its quirks, but navigating it is crucial for smooth sailing. Familiarize yourself with the online portal, and don’t hesitate to seek assistance if needed. Remember, a little bit of preparation can save you a lot of headaches later on.

VAT Payment Methods

Once you’ve diligently calculated your VAT liability (or refund!), it’s time to pay up (or receive your money!). The Indonesian government offers several convenient methods for making VAT payments, ensuring that you have options to suit your business’s needs. These might include online banking transfers, direct debits, or even visits to designated banks. Choosing the method that best suits your cash flow management and technological comfort level is key. Remember, late payments attract penalties – think of it as an extra charge for forgetting your anniversary, but instead of flowers, you’re paying fines. Sticking to the payment schedule is vital for maintaining your VAT registration.

Timeline of Key Deadlines and Responsibilities

Let’s get organized! Understanding the key deadlines is crucial for avoiding penalties and keeping your tax affairs in order. This requires careful planning and a reliable system for tracking your VAT obligations. Here’s a simplified timeline; remember to check the official DGT website for the most up-to-date information as deadlines can sometimes change.

| Month | Activity | Deadline (Example – Adjust to Current Regulations) |

|---|---|---|

| Month 1 | Record all taxable sales and purchases. | End of month |

| Month 2 | Prepare VAT return. | 15th of the following month |

| Month 2 | Submit VAT return electronically. | 20th of the following month |

| Month 2 | Make VAT payment. | 25th of the following month |

Remember, this is a simplified example. The exact deadlines and procedures can vary depending on your specific circumstances. Always consult the official DGT guidelines and seek professional advice if needed. Procrastination is the thief of time (and potentially, your money!).

Penalties for Non-Compliance with VAT Regulations

Let’s face it, nobody enjoys dealing with taxes. But in Indonesia, ignoring your VAT obligations isn’t just a bad idea; it’s a financially perilous adventure that could leave your business shipwrecked faster than you can say “Pajak Pertambahan Nilai.” This section will illuminate the potential consequences of failing to comply with Indonesian VAT regulations, painting a clear picture of the penalties you could face. Think of it as a financial horror story – one you definitely want to avoid.

The Indonesian tax authorities (DJP) take VAT compliance seriously. They wield a variety of tools to ensure businesses pay their fair share, and these tools aren’t exactly fluffy bunnies. Late filing, underpayment, or complete disregard for VAT rules can lead to a cascade of unpleasant repercussions, ranging from hefty fines to legal battles that could drain your resources and leave you feeling utterly deflated.

Late Filing or Non-Payment Penalties

Late submission of VAT returns incurs penalties, calculated as a percentage of the unpaid tax. The exact percentage varies depending on the duration of the delay. For example, a delay of a few days might attract a smaller penalty compared to a delay of several months. Additionally, failure to pay the VAT due, regardless of whether the return was filed on time, will result in additional penalties, often including daily interest charges. Imagine this: Your late payment is accumulating interest like a snowball rolling down a hill – except this snowball is made of your hard-earned rupiah.

Legal Consequences of Non-Compliance

Non-compliance can lead to a range of legal actions. The DJP might initiate an audit, which could unearth further discrepancies and lead to even higher penalties. In severe cases, legal proceedings could be initiated, resulting in court appearances, potential fines far exceeding the original VAT due, and even criminal charges. Think of it as a tax-themed courtroom drama, and you definitely don’t want to be the star.

Severity of Penalties for Different Violations

The severity of penalties is directly proportional to the seriousness of the violation. Simply forgetting to file your return will result in a different penalty than intentionally underreporting your VAT liability. Intentional evasion, for instance, carries significantly harsher penalties, including potential imprisonment. It’s a bit like a speeding ticket versus reckless driving – the consequences are dramatically different.

Financial Implications: A Hypothetical Example

Let’s say “Toko Bahagia” (Happy Shop), a small business, owes 100 million rupiah in VAT but fails to file their return for three months. They might face a penalty of, say, 2% of the unpaid tax per month of delay, plus daily interest. This could quickly add up to several million rupiah in penalties, not to mention the potential legal fees. In this scenario, the cost of non-compliance far outweighs the original tax liability. This hypothetical scenario illustrates the escalating financial implications of procrastination and non-compliance. The longer you wait, the more expensive it gets.

Seeking Professional Assistance for VAT Registration

Navigating the labyrinthine world of Indonesian VAT registration can feel like attempting to assemble IKEA furniture without the instructions (and maybe a few crucial pieces missing). While a DIY approach might seem appealing to the adventurous soul, seeking professional assistance offers significant advantages, transforming a potential headache into a relatively smooth process. Think of it as hiring a sherpa to guide you up Mount VAT – far less likely to result in a tumble down the side of a fiscal cliff.

The benefits of enlisting professional help are numerous and substantial, ranging from saving you valuable time and reducing stress to ensuring compliance and minimizing the risk of costly errors. Professionals possess the intricate knowledge of Indonesian tax laws, regulations, and procedures, allowing them to handle the complexities with efficiency and accuracy. This expertise translates directly into a reduced risk of penalties and audits, saving you both money and the agony of bureaucratic back-and-forth.

Types of Professional Assistance

Tax consultants and accountants both offer assistance with VAT registration, but their services differ in scope and depth. Tax consultants typically specialize in tax-related matters, offering focused expertise on VAT registration and related tax obligations. They are your go-to experts for navigating the intricacies of tax laws and ensuring compliance. Accountants, on the other hand, provide a broader range of financial services, including VAT registration, but their expertise may be less specialized. Choosing between the two depends on your specific needs and the complexity of your business. For straightforward registrations, an accountant might suffice. For businesses with complex structures or international implications, a tax consultant is often the preferred choice.

Questions to Ask Potential Service Providers, VAT Registration Indonesia

Before committing to a professional, it’s crucial to ask pertinent questions to ensure they’re the right fit for your business. These questions should be viewed not as interrogations, but rather as crucial steps in finding the perfect VAT registration partner.

- What is your experience with VAT registration in Indonesia?

- What is your fee structure, and what services are included in that fee?

- What is your estimated timeline for completing the registration process?

- What is your process for handling potential issues or complications that may arise during the registration?

- Can you provide references from previous clients?

- What is your level of proficiency in English (or other relevant languages)?

- What is your policy on communication and updates throughout the registration process?

Sample Contract for VAT Registration Assistance

A well-structured contract protects both you and the service provider. This sample contract provides a framework; it should be adapted to your specific circumstances and reviewed by legal counsel if necessary.

| Clause | Details |

|---|---|

| Parties Involved | [Your Business Name and Details] and [Service Provider Name and Details] |

| Services Provided | Complete VAT registration in Indonesia, including all necessary documentation and submission. |

| Fees | [State fee structure clearly, including any potential additional costs] |

| Timeline | [State expected start and completion dates] |

| Confidentiality | Both parties agree to maintain confidentiality regarding shared information. |

| Termination | Conditions for termination by either party. |

| Dispute Resolution | Method for resolving disputes (e.g., mediation, arbitration). |

| Governing Law | Indonesian Law |

| Signatures | Spaces for signatures of both parties. |

Illustrative Examples of VAT Calculations

Navigating the world of Indonesian VAT can feel like a jungle trek, but fear not! With a little understanding, you’ll be calculating VAT like a pro (or at least, like someone who’s avoided a hefty fine). Let’s demystify the process with some clear examples. Remember, the Indonesian standard VAT rate is currently 11%, but always check for updates as rates can change.

The following examples illustrate VAT calculations in different scenarios, including both VAT-inclusive and VAT-exclusive pricing, and touch upon the complexities of import and export VAT. We’ll keep it simple and avoid any accounting acrobatics that would make even a seasoned CPA break a sweat.

VAT Calculation: Domestic Sales (Exclusive)

Let’s say a small business sells handcrafted batik shirts. One shirt costs Rp 100,000 (excluding VAT). To calculate the VAT, we simply multiply the price by the VAT rate:

VAT = Rp 100,000 x 11% = Rp 11,000

The total price, including VAT, is therefore:

Total Price = Rp 100,000 + Rp 11,000 = Rp 111,000

VAT Calculation: Domestic Sales (Inclusive)

Now, imagine a customer sees a price tag of Rp 111,000 for a different batik shirt (VAT inclusive). To determine the original price and the VAT amount, we need to work backward:

Original Price = Rp 111,000 / 1.11 = Rp 100,000

The VAT amount is then:

VAT = Rp 111,000 – Rp 100,000 = Rp 11,000

VAT Calculation: Import

Importing goods adds another layer. Let’s say a business imports a shipment of high-quality batik fabric worth Rp 500,000 (excluding VAT and import duties). Assuming a simplified scenario with only VAT applicable, the VAT calculation remains the same:

VAT = Rp 500,000 x 11% = Rp 55,000

The total cost, including VAT, would be Rp 555,000. In reality, import duties and other taxes would significantly increase the final cost, making this a simplified example for illustrative purposes. It’s crucial to consult with customs authorities for accurate import tax calculations.

| Scenario | Input Value (Rp) | Calculation | Result (Rp) |

|---|---|---|---|

| Domestic Sales (Exclusive) | 100,000 (Excl. VAT) | 100,000 x 11% + 100,000 | 111,000 (Incl. VAT) |

| Domestic Sales (Inclusive) | 111,000 (Incl. VAT) | 111,000 / 1.11 – 111,000 | 11,000 (VAT Amount) |

| Import (Simplified Example) | 500,000 (Excl. VAT & Duties) | 500,000 x 11% + 500,000 | 555,000 (Incl. VAT, Excl. Duties) |

Wrap-Up

Successfully registering for VAT in Indonesia is a significant step towards ensuring your business operates legally and efficiently within the country. While the process might initially seem daunting, with the right guidance and understanding, it can be streamlined and even relatively painless. Remember, proper preparation is key, and seeking professional assistance when needed is a sign of smart business strategy, not weakness. So breathe easy, knowing you’ve armed yourself with the knowledge to conquer Indonesian VAT. Now go forth and prosper (legally, of course!).

Query Resolution: VAT Registration Indonesia

What happens if I miss the VAT registration deadline?

Expect penalties, my friend! The exact amount depends on the severity of the delay and the Indonesian tax authorities’ mood that day. Let’s just say it’s not pretty.

Can I register for VAT if my business is a sole proprietorship?

It depends on your turnover. Check the Indonesian tax regulations for the specific thresholds. If you’re over the limit, registration is mandatory; otherwise, you might be able to avoid the VAT rollercoaster (for now).

What if I make a mistake on my VAT return?

Don’t panic! Amendments are usually possible, but it’s best to be as accurate as possible from the start. Seeking professional help can prevent such headaches.

Are there any exemptions from VAT registration?

Yes, certain types of businesses and goods/services may be exempt. Thoroughly review the official Indonesian tax regulations to determine your eligibility for any exemptions.