VAT Registration Requirements Indonesia: Navigating the labyrinthine world of Indonesian VAT can feel like a comedic adventure, a thrilling rollercoaster of paperwork and regulations. This guide aims to be your trusty map, leading you through the twists and turns of registration, ensuring you don’t end up paying more taxes than a sultan’s ransom (though, let’s be honest, Indonesian sultans probably have excellent accountants). We’ll unravel the mysteries of turnover thresholds, document demands, and the peculiar quirks of Indonesian tax law, leaving you with a clearer understanding of how to avoid a tax-induced existential crisis.

This comprehensive guide delves into the intricacies of Indonesian Value Added Tax (VAT), covering everything from understanding the basic principles and applicable rates to the step-by-step registration process. We’ll explore the thresholds that trigger registration, the necessary documentation, and the ongoing obligations of registered taxpayers. We’ll also examine specific industry considerations, offering illustrative examples to clarify potential challenges. Prepare for a journey filled with both enlightenment and, dare we say, a touch of amusement, as we decipher the world of Indonesian VAT.

Understanding Indonesian VAT (Pajak Pertambahan Nilai)

Indonesian VAT, or Pajak Pertambahan Nilai (PPN), is the country’s value-added tax. Think of it as a tax on consumption, subtly woven into the price of almost everything you buy. It’s a crucial part of Indonesia’s revenue stream, funding vital public services like infrastructure projects (so you can finally get that pothole fixed!) and healthcare improvements (because who wants to pay for a hospital bill that rivals the national debt?). Understanding how it works is key to navigating the Indonesian economic landscape, especially if you’re a business owner.

The Purpose and Function of Indonesian VAT

The primary purpose of PPN is to generate revenue for the Indonesian government. This revenue is then used to finance various government programs and initiatives. Beyond simply filling the national coffers, PPN also aims to encourage a fairer distribution of the tax burden, ensuring that consumers contribute their fair share to the upkeep of the nation. It’s a bit like a national piggy bank, but instead of coins, it’s filled with the collective spending power of Indonesia.

Indonesian VAT Rates, VAT Registration Requirements Indonesia

Indonesia currently employs a relatively simple VAT system with two main rates. The standard rate is 11%, applied to the vast majority of goods and services. A reduced rate of 10% exists for certain specified goods and services considered essential or socially beneficial. This difference reflects the government’s efforts to balance revenue generation with social considerations, offering a bit of a tax break for necessities. Imagine it as a tiered system; essential items get a slightly smaller tax burden.

Goods and Services Subject to VAT

Almost all goods and services sold in Indonesia are subject to VAT, unless specifically exempted. This includes a wide range of products, from everyday necessities like groceries and clothing to more luxurious items like cars and jewelry. Services also fall under this umbrella, covering everything from restaurant meals and haircuts to professional consulting and tourism services. Essentially, if you buy it or receive a service for it, chances are it’s VAT-inclusive. It’s a broad net, catching nearly everything in its fiscal embrace.

VAT-Exempt Goods and Services

While the vast majority of goods and services are subject to VAT, some are exempted. These exemptions are often targeted towards essential goods and services, aiming to ease the financial burden on low-income individuals and families. Examples include certain basic foodstuffs, healthcare services, and educational services. These exemptions are carefully selected and regularly reviewed to ensure they align with the government’s social and economic objectives. Think of it as a strategic tax relief program aimed at the most vulnerable. This carefully curated list helps to ensure that essential needs remain affordable for all.

Threshold for VAT Registration

So, you’re thinking about starting a business in Indonesia? Fantastic! But before you start raking in the rupiah, let’s talk about something slightly less glamorous: Value Added Tax (VAT) registration. Think of it as the price of admission to the big leagues of Indonesian commerce – a slightly less exciting party than you might have imagined, but crucial nonetheless. Failing to register when required can lead to some serious headaches (and potentially hefty fines). Let’s delve into the nitty-gritty.

The annual turnover threshold that triggers VAT registration in Indonesia is currently set at IDR 4.8 billion (approximately USD 320,000 as of October 26, 2023, but this is subject to change, so always check the official Directorate General of Taxes website for the most up-to-date information). This means if your business’s annual turnover surpasses this magical number, you’re officially required to register for VAT. Don’t even *think* about hiding your extra sales; the taxman has eyes everywhere (or at least, a very efficient digital system).

Implications of Exceeding the Turnover Threshold

Exceeding the IDR 4.8 billion turnover threshold means you’re now responsible for collecting and remitting VAT to the Indonesian government. This involves a whole new level of paperwork, accounting complexities, and the ever-present worry of getting your calculations perfectly right (because, let’s face it, even a small mistake can snowball into a significant problem). You’ll need to issue VAT invoices to your customers, file regular VAT returns, and, of course, pay your VAT liabilities on time. Failure to comply can result in penalties, ranging from fines to legal action. It’s not a game you want to play.

Determining Annual Turnover

Determining your annual turnover might sound straightforward, but it can be trickier than it seems. It’s generally understood as the total value of your sales, including all goods and services provided during the fiscal year. However, it’s crucial to carefully review the official guidelines provided by the Directorate General of Taxes (DGT) to ensure accurate calculation. Think of it like baking a cake: you need the right ingredients and measurements to avoid a disaster. Incorrect calculation can lead to unnecessary penalties. For example, discounts and returns need to be carefully accounted for, as they affect your final turnover figure.

Situations with Different Thresholds

While the standard threshold is IDR 4.8 billion, there might be situations where this changes. Specific industries or business types might have different thresholds set by the government. For instance, businesses involved in certain sectors considered to have a significant impact on the economy might be required to register for VAT even if their turnover is below the standard threshold. It’s best to consult the DGT’s official website or a qualified tax advisor to ensure compliance with the specific regulations applicable to your business. Think of it as a specialized cake recipe – some cakes require special ingredients and techniques.

Registration Process

Embarking on the thrilling journey of Indonesian VAT registration? Buckle up, because while it might sound daunting, it’s less a rollercoaster and more a gentle, slightly bureaucratic, scenic train ride. This section will guide you through the process, ensuring a smooth and (relatively) painless registration. Think of it as a well-organized filing system, not a chaotic junk drawer.

The Indonesian VAT registration process involves several steps, requiring the careful preparation of documents and a dash of online prowess (don’t worry, it’s easier than it sounds!). The entire process aims to ensure compliance with Indonesian tax laws, allowing businesses to legally operate and, of course, contribute to the nation’s economic growth. So, let’s get down to the nitty-gritty.

Steps Involved in VAT Registration

The registration process, while not overly complicated, does require attention to detail. Think of it like assembling IKEA furniture – follow the instructions carefully, and you’ll be rewarded with a functional (and tax-compliant) structure. The process generally involves submitting an application, providing necessary documentation, and waiting for official approval. It’s a bit like applying for a driver’s license; you need to meet the requirements and pass the (paperwork) test.

Required Documents for VAT Registration

Gathering the right documents is crucial. Imagine trying to bake a cake without flour – it’s just not going to happen. Similarly, incomplete documentation will delay your registration. So, take your time, double-check everything, and ensure all information is accurate and up-to-date. This will significantly reduce the chances of encountering any setbacks during the application process. Think of it as a pre-flight checklist for your tax journey.

| Document | Format | Submission Method | Notes |

|---|---|---|---|

| Application Form (Formulir Pendaftaran PKP) | Digital or Hard Copy | Online or In-Person | Downloadable from the DJP website. |

| Business Registration Certificate (SIUP or TDP) | Original and Copy | Online or In-Person | Depending on your business type. |

| Identity Card (KTP) of the Business Owner | Original and Copy | Online or In-Person | For sole proprietorships. |

| Company’s Articles of Association (Akta Pendirian Perusahaan) | Original and Copy | Online or In-Person | For companies. |

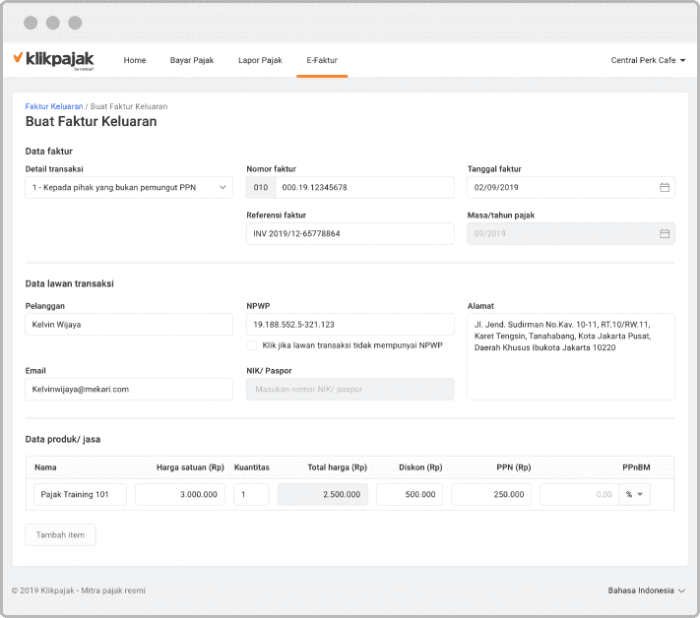

Online Registration Process

Indonesia’s Directorate General of Taxes (DJP) offers an online registration portal. This allows for a more efficient and convenient registration experience, eliminating the need for physical visits (unless otherwise specified). This online system, much like online banking, provides a secure and streamlined process. However, it’s always recommended to check the official DJP website for the most up-to-date instructions and any potential updates.

Timeline for Processing VAT Registration Applications

The processing time for VAT registration applications can vary. Think of it as waiting for a pizza delivery – sometimes it’s fast, sometimes there are unexpected delays. Factors such as the completeness of the submitted documents and the current workload of the tax office can influence the processing time. While there’s no guaranteed timeframe, aiming for a realistic expectation is crucial. Keeping track of your application’s status through the online portal is recommended.

Maintaining VAT Registration

So, you’ve bravely navigated the treacherous waters of Indonesian VAT registration. Congratulations! But the adventure doesn’t end there. Think of it like owning a pet parrot – initially exciting, but requiring consistent care and attention (and maybe a little less screaming). Maintaining your VAT registration involves ongoing responsibilities, and neglecting them can lead to some seriously feathered friends (of the tax inspector variety) paying you a visit.

Maintaining your VAT registration in Indonesia isn’t just about avoiding fines; it’s about ensuring your business remains compliant, operates smoothly, and doesn’t accidentally become a case study in “how *not* to handle Indonesian taxes.” This section will Artikel your ongoing obligations, offering a blend of information and, dare we say, a touch of levity to make the process slightly less daunting.

Obligations of a Registered VAT Taxpayer

Registered VAT taxpayers in Indonesia have several ongoing obligations. These include accurately recording all taxable transactions, issuing valid VAT invoices, and, most importantly, filing timely and accurate VAT returns. Failure to meet these obligations can result in penalties ranging from fines to, in extreme cases, the revocation of your VAT registration. Think of it as a contract with the taxman – break it, and you pay the price. The price, of course, being considerably more than a late library book fee.

Requirements for Filing VAT Returns

Filing VAT returns in Indonesia is a recurring event, typically monthly or quarterly depending on your turnover. These returns detail your taxable sales, purchases, and the resulting VAT payable or refundable. Accuracy is paramount; submitting incorrect information can lead to penalties and audits. Imagine a meticulous accountant meticulously examining every transaction – and they’re not known for their sense of humor. The Indonesian tax authorities require detailed documentation to support your claims, so keep those receipts!

Penalties for Non-Compliance with VAT Regulations

Non-compliance with Indonesian VAT regulations can be costly. Penalties can include substantial fines, interest charges on unpaid VAT, and even legal action. The severity of the penalty often depends on the nature and extent of the non-compliance. While the exact amounts vary, the potential financial consequences can be significant enough to make you reconsider any shortcuts. Remember, honesty is always the best policy, even when dealing with taxes.

Methods for Accurate VAT Record-Keeping

Maintaining accurate VAT records is crucial for smooth compliance. This involves using a reliable accounting system, meticulously recording all transactions, and storing supporting documentation (invoices, receipts, etc.) securely. Consider using accounting software designed for Indonesian tax regulations. It’s an investment that can save you significant time, stress, and potential penalties down the line. Think of it as an insurance policy against a tax-related headache.

Steps for Filing a VAT Return

Preparing and submitting your VAT return involves several steps. Accuracy and timeliness are key to avoiding penalties.

The precise steps might vary slightly depending on your chosen filing method (online portal versus paper filing), but the general process usually involves:

- Gathering all necessary documentation: invoices, receipts, and other supporting documents.

- Calculating your VAT payable or refundable based on your sales and purchases.

- Completing the official VAT return form accurately and completely.

- Submitting the return through the designated online portal or by mail, adhering to the deadlines.

- Keeping a copy of the submitted return for your records.

Specific Industry Considerations

Navigating the world of Indonesian VAT can feel like a thrilling jungle expedition – full of unexpected twists and turns. But fear not, intrepid entrepreneur! This section will illuminate some specific industry considerations, ensuring your VAT journey is more Indiana Jones and less Jurassic Park.

Understanding the nuances of VAT registration varies wildly depending on your business type and operations. Let’s delve into some key areas where the rules get particularly interesting.

E-commerce VAT Registration Requirements

E-commerce in Indonesia is booming, a digital marketplace buzzing with activity. For online businesses, VAT registration hinges on exceeding the standard turnover threshold. However, the complexity arises from determining the location of the sale and the application of applicable tax rates. For instance, a business selling digital products to Indonesian consumers will likely need to register for VAT, regardless of its physical location, once it surpasses the threshold. Conversely, a business selling physical goods to international customers might have different VAT obligations depending on the destination country’s regulations. The key is to carefully track sales and ensure compliance with all relevant Indonesian tax laws, consulting with a tax professional if needed to navigate this complex terrain.

VAT Implications for Import/Export Activities

Importing and exporting goods adds another layer to the VAT adventure. Import VAT is levied on the value of imported goods, payable upon customs clearance. This means businesses importing goods for resale or use in their operations must factor import VAT into their pricing and budgeting. Exporting goods, on the other hand, can sometimes involve VAT refunds, depending on the specific circumstances and proof of export. This process, however, often requires meticulous documentation and adherence to strict procedures. Imagine it as a treasure hunt – the reward is a VAT refund, but the clues are hidden within a mountain of paperwork. Thorough record-keeping is essential for successful navigation.

VAT Registration for Small and Large Businesses

The VAT registration threshold applies equally to both small and large businesses. However, the administrative burden differs significantly. Small businesses may find it simpler to manage their VAT obligations with basic accounting software and potentially less frequent tax filings. Larger businesses, on the other hand, usually require sophisticated accounting systems and dedicated personnel to handle the complexity of VAT compliance, potentially involving multiple branches or subsidiaries. Think of it as scaling a mountain – a small business might take a winding path, while a large business might prefer a well-established, albeit longer, route.

Special Considerations for Foreign Companies Operating in Indonesia

Foreign companies operating in Indonesia face a unique set of challenges when it comes to VAT. They must adhere to all Indonesian VAT regulations, regardless of their home country’s tax laws. This often involves establishing a permanent establishment in Indonesia, which may trigger VAT registration obligations. Furthermore, understanding the intricacies of transfer pricing and other international tax regulations is crucial to avoid penalties. It’s like navigating a foreign language – you need a skilled translator (tax advisor) to ensure smooth communication and avoid misunderstandings. Careful planning and expert advice are paramount.

Illustrative Examples

Let’s spice things up with some real-world scenarios to illustrate the often-hilarious (and sometimes terrifying) world of Indonesian VAT registration. Prepare for a rollercoaster of paperwork and potential tax deductions!

These examples will delve into the unique challenges faced by different types of businesses navigating the Indonesian VAT landscape. Buckle up, it’s going to be a wild ride.

Scenario 1: A Small Business Exceeding the Threshold

Imagine Budi, a charming entrepreneur who sells handcrafted batik scarves online. His business, “Budi’s Batik Bonanza,” has been booming. He initially started small, well below the VAT registration threshold. However, his sales have recently skyrocketed, pushing him over the magical number. Budi now needs to register for VAT.

To register, Budi must gather his business registration documents (SIUP/TDP), his tax identification number (NPWP), and his bank account details. He then submits these documents to the local tax office (Kantor Pelayanan Pajak). The process involves filling out various forms, a task Budi finds mildly infuriating but ultimately manageable.

Budi’s main challenge is understanding the intricacies of VAT calculations and reporting. He’s a batik whiz, not a tax accountant. He might need to hire a consultant or utilize online resources to ensure compliance. The potential penalties for incorrect reporting are enough to make him reconsider his career choice (just kidding… mostly).

Scenario 2: An E-commerce Business

Meet Rani, the queen of online retail. Her e-commerce empire, “Rani’s Retail Revolution,” sells everything from quirky phone cases to artisanal jams. Being an online business presents unique VAT registration challenges.

Rani must not only register for VAT in Indonesia but also ensure compliance with regulations concerning online transactions. This includes properly documenting sales, handling digital invoices, and managing the complexities of cross-border transactions if she sells to international customers. The sheer volume of transactions can make accurate VAT reporting a logistical nightmare.

Rani’s biggest challenge is keeping up with the ever-changing digital tax landscape. New regulations and technological updates necessitate constant vigilance. Investing in reliable accounting software is crucial for her to stay ahead of the curve and avoid the wrath of the taxman.

Scenario 3: A Foreign Company

Now, let’s meet Mr. Smith, the representative of “Global Gadgets,” a multinational corporation based in the UK. Global Gadgets wants to establish a presence in Indonesia and needs to navigate the complexities of VAT registration as a foreign entity.

Mr. Smith faces significant hurdles. He needs to understand Indonesian tax laws, appoint a tax representative in Indonesia, and comply with specific requirements for foreign companies. The language barrier and cultural differences can add another layer of complexity to the registration process.

Mr. Smith’s primary challenge lies in the unfamiliar regulatory environment. He might need to hire a local tax consultant with expertise in international taxation to ensure seamless compliance. The cost of compliance can be substantial, but neglecting it could result in far more expensive penalties down the line. He might also need to consider setting up a local Indonesian entity, adding another layer to the already complex process.

Final Conclusion: VAT Registration Requirements Indonesia

So, there you have it – a whirlwind tour of VAT registration in Indonesia. While the process might seem daunting at first glance (like trying to assemble IKEA furniture blindfolded), with careful planning and a healthy dose of humor, you can conquer the complexities of Indonesian tax law. Remember, understanding your obligations is key to avoiding the dreaded taxman’s wrath. And if all else fails, invest in a really good accountant. They’re worth their weight in gold (or, perhaps, in Rupiah).

FAQ Compilation

What happens if I exceed the VAT registration threshold accidentally?

Don’t panic! Register immediately. Retroactive penalties are possible, but prompt registration demonstrates good faith and might mitigate penalties.

Can I register for VAT before reaching the threshold?

Yes, you can. While not mandatory, proactive registration can simplify future tax obligations.

What are the common penalties for late VAT filing?

Expect fines, interest charges, and potentially even legal action. Punctuality is your friend in the world of Indonesian tax.

Where can I find the most up-to-date information on VAT regulations?

Consult the official website of the Indonesian tax authority (DJP) for the latest updates and regulations. This is your bible, my friend.