Securing venture capital funding can be a transformative event for a startup, catapulting it from nascent idea to thriving enterprise. This guide navigates the intricate process, demystifying the complexities of attracting and securing investment. From crafting a compelling pitch deck to navigating the intricacies of legal agreements, we provide a comprehensive overview of the venture capital landscape.

We’ll explore the various stages of funding, from seed rounds to later-stage investments, examining the key metrics venture capitalists (VCs) consider and offering practical advice on building strong investor relationships. This guide equips entrepreneurs with the knowledge and strategies necessary to successfully navigate the demanding yet rewarding journey of seeking venture capital.

Understanding Venture Capital

Venture capital (VC) is a critical source of funding for high-growth startups. It bridges the gap between initial seed funding and later-stage investments, providing the capital necessary for expansion, product development, and market penetration. Understanding the intricacies of VC funding is crucial for entrepreneurs seeking to secure this valuable resource.

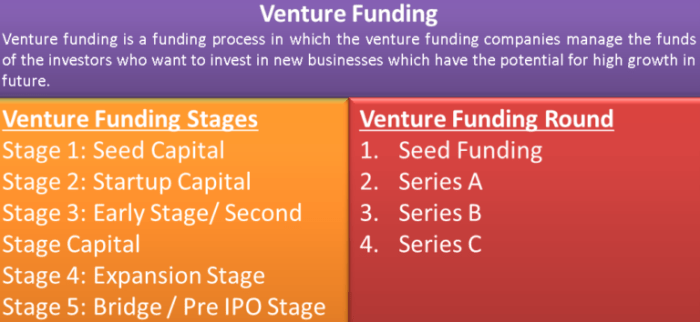

Stages of Venture Capital Funding

Venture capital funding typically unfolds in several distinct stages, each characterized by different investment amounts, company milestones, and investor expectations. Seed funding provides initial capital for product development and market validation. Subsequent rounds, such as Series A, B, C, and beyond, provide increasingly larger sums to fuel growth and scale operations. Each stage requires demonstrating progress and achieving specific milestones to attract further investment. Seed funding focuses on proving the concept, Series A on market traction, and later stages on scaling and profitability.

The Venture Capital Investment Process

The VC investment process is highly competitive and rigorous. It begins with initial contact, often through networking or online platforms. This is followed by due diligence, where the VC firm meticulously investigates the company’s business model, team, market opportunity, and financial projections. Pitch decks and detailed business plans are crucial during this phase. Successful due diligence leads to term sheet negotiations, outlining the investment terms, valuation, and investor rights. Finally, the funding is disbursed after legal agreements are finalized. The entire process can take several months, even a year or more, depending on the complexity of the deal and the company’s stage of development.

Examples of Successful Venture-Backed Companies

Numerous companies have successfully navigated the VC funding landscape. Airbnb, for example, secured significant funding throughout its growth trajectory, starting with seed funding and progressing through multiple Series rounds before its eventual IPO. Similarly, Uber’s journey involved substantial VC investments at various stages, enabling its rapid expansion and global dominance in the ride-hailing market. These examples highlight the importance of securing strategic VC partnerships at the right time to achieve ambitious growth targets.

Types of Venture Capital Firms

The venture capital landscape encompasses various types of firms, each with its own investment focus and strategies. Traditional venture capital firms focus on high-growth potential startups across various sectors. Corporate venture capital (CVC) arms of larger corporations invest in startups that align with their strategic objectives. Angel investors, typically high-net-worth individuals, provide early-stage funding often before VC involvement. Each type brings unique perspectives and resources to the table, offering entrepreneurs a range of options depending on their needs and goals.

Key Metrics Considered by Venture Capitalists

Venture capitalists rely on a range of key metrics to evaluate investment opportunities. These metrics provide insights into a company’s financial health, growth potential, and market positioning.

| Metric | Description | Importance | Example |

|---|---|---|---|

| Revenue Growth | Rate of increase in revenue over time | High growth indicates strong market demand and execution | 50% year-over-year growth |

| Customer Acquisition Cost (CAC) | Cost of acquiring a new customer | Low CAC indicates efficient marketing and sales strategies | $50 per customer |

| Customer Lifetime Value (CLTV) | Total revenue generated by a customer over their relationship with the company | High CLTV relative to CAC is crucial for profitability | $500 per customer |

| Burn Rate | Rate at which a company is spending cash | Sustainable burn rate is essential for long-term viability | $100,000 per month |

Preparing a Funding Proposal

Securing venture capital requires a meticulously crafted funding proposal that showcases your business’s potential for significant returns. This proposal isn’t just a document; it’s a persuasive narrative demonstrating why your venture is a worthy investment. A well-structured proposal will clearly articulate your business model, market opportunity, and financial projections, ultimately convincing investors of your team’s ability to execute your vision.

Sample Executive Summary for a Venture Capital Funding Proposal

An executive summary is your proposal’s first impression. It should be concise, compelling, and highlight the key aspects of your business. It’s a snapshot of your entire proposal, designed to grab the investor’s attention and entice them to read further. Consider this example:

“GreenThumb Technologies seeks $2 million in Series A funding to scale its innovative hydroponic farming technology. Our proprietary system increases crop yields by 40% while reducing water consumption by 70%, addressing the growing demand for sustainable food production. We project $10 million in revenue within three years, based on secured partnerships with major grocery chains. Our experienced team has a proven track record in agriculture and technology, positioning us for rapid market penetration and significant returns for investors.”

Key Components of a Business Plan for Attracting VC Investment

A comprehensive business plan is the cornerstone of your funding proposal. It provides investors with a detailed understanding of your business, its market, and its financial projections. Key components include a detailed market analysis demonstrating market size and opportunity, a clear description of your product or service, a competitive analysis highlighting your competitive advantage, a strong management team section showcasing relevant experience, a realistic financial model, and a well-defined exit strategy outlining how investors will realize a return on their investment.

Best Practices for Crafting a Compelling Pitch Deck

A pitch deck serves as a visual representation of your business plan, designed to engage investors during presentations. It should be concise, visually appealing, and tell a compelling story. Best practices include using high-quality visuals, focusing on key data points, limiting text on each slide, practicing your delivery, and incorporating strong storytelling techniques to make your presentation memorable. A typical deck would include slides on the problem, solution, market opportunity, business model, team, traction, financials, and ask.

Essential Financial Projections Needed in a Funding Proposal

Accurate and realistic financial projections are crucial for securing VC funding. Investors want to see a clear path to profitability and a strong return on their investment. Essential projections include projected revenue, expenses, profitability (gross margin, operating margin, net income), cash flow statements (demonstrating cash inflows and outflows), and key financial ratios (such as customer acquisition cost and lifetime value). Consider using sensitivity analysis to show the impact of different scenarios on your financial projections. For example, projecting revenue under optimistic, base-case, and pessimistic scenarios would demonstrate a thorough understanding of potential risks and opportunities.

Step-by-Step Guide to Preparing a Complete Funding Application Package

Preparing a complete funding application is a multi-step process. First, conduct thorough market research and develop a robust business plan. Next, craft a compelling executive summary and pitch deck. Then, prepare detailed financial projections, including balance sheets, income statements, and cash flow projections. Finally, assemble all documents into a professional package, ensuring consistency and clarity throughout. This package should include the executive summary, business plan, pitch deck, financial projections, and any supporting documents such as letters of intent or patents. Remember to proofread meticulously for any errors.

Finding and Approaching Investors

Securing venture capital funding requires a strategic approach to identifying, connecting with, and persuading potential investors. This section Artikels effective strategies for navigating this crucial phase of the fundraising process, from initial research to crafting a compelling outreach message.

Successfully securing venture capital hinges on effectively identifying and engaging with the right investors. This involves a combination of diligent research, strategic networking, and persuasive communication. A well-defined process can significantly improve your chances of securing funding.

Identifying Potential Venture Capital Investors

Identifying suitable VC firms requires a multifaceted approach. You should begin by defining your ideal investor profile, considering factors such as their investment focus, stage of investment, average investment size, and past portfolio companies. This targeted approach maximizes your efficiency and increases the likelihood of a positive response. Next, leverage online databases and industry resources to compile a list of firms aligning with your criteria. Finally, consider attending industry events and conferences to network directly with potential investors.

Resources for Finding and Researching VC Firms

Several valuable resources facilitate the identification and research of venture capital firms. Online databases such as Crunchbase and PitchBook offer comprehensive information on VC firms, including their investment history, portfolio companies, and investment preferences. Industry publications like Forbes, TechCrunch, and the Wall Street Journal frequently publish articles and rankings of top VC firms. Furthermore, professional networking platforms like LinkedIn can be used to connect with investors and learn about their activities. Finally, leveraging your existing network and seeking introductions from industry contacts can prove invaluable.

Networking and Building Relationships with Investors

Networking is a cornerstone of successful venture capital fundraising. Attending industry conferences, workshops, and networking events provides opportunities to meet investors in person and establish initial connections. Actively participating in these events, engaging in meaningful conversations, and following up afterward are crucial. Online platforms like LinkedIn also offer opportunities for networking; carefully crafted messages demonstrating genuine interest and highlighting relevant experience can facilitate connections. Remember, building relationships takes time and effort; consistent engagement and genuine interest are key to fostering long-term connections with potential investors.

Crafting a Compelling Initial Outreach Email

Your initial email to a VC firm is your first impression. It needs to be concise, compelling, and demonstrate a thorough understanding of the firm’s investment focus. Begin by personalizing the email, addressing the investor by name and referencing a specific aspect of their investment strategy that aligns with your company. Clearly and concisely summarize your company, its value proposition, and the funding request. Include a compelling call to action, such as requesting a brief introductory call. Maintain a professional and enthusiastic tone, showcasing your passion and confidence in your venture. Proofread carefully to ensure a polished and error-free message. A well-crafted email can significantly influence a VC’s decision to engage further.

Approaching Potential Investors: A Flowchart

The following flowchart illustrates the sequential steps involved in approaching potential investors:

[Imagine a flowchart here. It would begin with “Identify Target Investors,” branching to “Research Investors,” then “Network and Build Relationships,” followed by “Craft Outreach Email,” leading to “Send Email and Follow Up.” A “No” branch from “Send Email and Follow Up” would loop back to “Network and Build Relationships,” while a “Yes” branch would lead to “Schedule Meeting/Pitch Deck Presentation.” A final branch would emerge from “Schedule Meeting/Pitch Deck Presentation” leading to “Funding Secured” or “Seek Alternative Funding.”]

Negotiating Terms and Closing the Deal

Securing venture capital funding is a significant milestone for any startup, but the negotiation process leading to a final agreement is equally crucial. This section delves into the intricacies of negotiating terms and conditions, ensuring a mutually beneficial partnership between the startup and the investor. Understanding the key elements and potential pitfalls is essential for a successful outcome.

Common Terms and Conditions in Venture Capital Investment Agreements

Venture capital investment agreements are complex legal documents outlining the terms of the investment. Key terms typically include valuation, equity stake, liquidation preferences, anti-dilution protection, board representation, and investor rights. Valuation determines the company’s worth, influencing the price per share and the investor’s equity stake. Liquidation preferences prioritize certain investors in the event of a sale or liquidation, often providing a return of their investment before other shareholders. Anti-dilution protection safeguards investors from the dilution of their equity stake if the company issues additional shares at a lower price in subsequent funding rounds. Board representation grants investors a seat on the company’s board of directors, providing oversight and influence on strategic decisions. Investor rights often include information rights, protective provisions, and participation rights in future funding rounds.

Comparison of Convertible Notes and Preferred Stock

Two common investment structures are convertible notes and preferred stock. Convertible notes are debt instruments that convert into equity at a future date, typically upon a subsequent financing round. They offer a simpler, faster investment process compared to preferred stock, but often come with a higher interest rate and a discount on the conversion price. Preferred stock represents ownership in the company, offering more control and protection for investors compared to convertible notes. However, the process of issuing preferred stock is more complex and time-consuming. The choice between these structures depends on the stage of the startup, the investor’s risk tolerance, and the negotiation dynamics. For instance, a seed-stage startup might opt for convertible notes to secure early-stage funding, while a later-stage company with a clear path to profitability might favor preferred stock.

The Due Diligence Process

Due diligence is a crucial step in the investment process for both the startup and the investor. For the startup, this involves preparing comprehensive financial statements, demonstrating a strong business plan, and showcasing a capable management team. The investor conducts a thorough review of the startup’s financials, legal documents, market analysis, and intellectual property. The goal for the startup is to demonstrate the viability and potential of their business, while the investor seeks to identify any potential risks or liabilities. A thorough due diligence process minimizes risk for both parties and strengthens the foundation for a successful partnership. For example, a comprehensive review of financial statements by the investor might uncover inconsistencies that could impact the investment decision. Similarly, the startup’s presentation of a robust intellectual property portfolio could enhance investor confidence.

Negotiation Points and Strategies

Negotiation is an integral part of the process. Common negotiation points include valuation, equity stake, liquidation preferences, and board representation. Startups aim to secure a higher valuation and maintain greater control, while investors seek a favorable return on investment and sufficient protection. Effective negotiation strategies involve thorough preparation, understanding the other party’s needs, and being prepared to compromise. For instance, a startup might offer a higher equity stake in exchange for a more favorable liquidation preference. Conversely, an investor might negotiate for a larger board representation in exchange for a lower valuation. The successful negotiation requires a balance of assertiveness and flexibility.

Key Legal Considerations in a Venture Capital Deal

- Valuation and Equity: Ensuring a fair valuation and appropriate equity stake for both parties.

- Liquidation Preferences: Defining the order and priority of capital distribution in the event of a liquidation.

- Anti-dilution Protection: Protecting investors from dilution of their equity in subsequent funding rounds.

- Board Representation and Control: Determining the composition and powers of the board of directors.

- Protective Provisions: Including provisions that safeguard the interests of investors in certain circumstances.

- Intellectual Property Rights: Clearly defining the ownership and usage rights of intellectual property.

- Confidentiality and Non-Disclosure: Protecting confidential information shared during the negotiation and investment process.

- Governing Law and Dispute Resolution: Specifying the governing law and mechanisms for resolving disputes.

Post-Funding Management

Securing venture capital is a significant milestone for any startup, but it’s only the beginning of a new, demanding phase. Post-funding management focuses on effectively utilizing the investment to achieve ambitious growth targets while maintaining a strong relationship with investors. This requires meticulous planning, transparent communication, and a relentless focus on execution.

The ongoing responsibilities of a startup after securing funding are multifaceted and demanding. Success hinges on effectively balancing rapid growth with the need for responsible financial management and consistent communication with investors. This period requires a shift in focus from securing funding to delivering on the promises made in the funding proposal and demonstrating a clear path to profitability or a successful exit strategy.

Regular Reporting and Communication with Investors

Maintaining open and consistent communication with investors is crucial for fostering trust and ensuring continued support. This typically involves regular reporting, typically monthly or quarterly, that details key performance indicators (KPIs), financial statements, and progress toward milestones Artikeld in the business plan. These reports should be concise, clear, and easily understandable, highlighting both successes and challenges. Regular board meetings also provide a forum for in-depth discussions and strategic guidance. Proactive communication, including promptly addressing any concerns or deviations from the plan, is key to building a strong investor relationship.

Strategies for Managing Investor Relationships

Effective investor relationship management involves more than just sending reports. It requires building genuine partnerships based on trust and mutual respect. This can be achieved through:

- Transparency: Openly sharing both positive and negative developments, providing context and demonstrating a proactive approach to problem-solving.

- Regular Updates: Providing frequent, concise updates on progress, even outside of formal reporting cycles, to keep investors informed and engaged.

- Accessibility: Maintaining open lines of communication and being readily available to answer investor questions and concerns.

- Strategic Alignment: Demonstrating a shared vision and actively seeking investor input on strategic decisions.

- Celebrating Successes: Acknowledging milestones achieved and sharing successes to reinforce the positive momentum and build confidence.

For example, a company might share a positive customer acquisition report in a quick email to investors, while reserving a detailed analysis for the quarterly report. This approach keeps investors informed without overwhelming them with information.

Challenges Faced by Startups Post-Funding and Their Solutions

Startups often face unexpected challenges after securing funding. These can include:

- Scaling Challenges: Rapid growth can strain resources and processes, requiring careful planning and execution to avoid operational bottlenecks.

- Hiring and Team Management: Building a strong team and effectively managing rapid growth requires careful recruitment and talent retention strategies.

- Maintaining Focus: The influx of capital can sometimes lead to a loss of focus on core business objectives. Staying disciplined and adhering to the initial plan is crucial.

- Investor Expectations: Meeting investor expectations for growth and return on investment requires consistent execution and a strong understanding of investor goals.

Overcoming these challenges requires proactive planning, effective resource allocation, and a strong leadership team capable of adapting to changing circumstances. For instance, a startup might implement a robust CRM system to manage customer relationships during a period of rapid growth or engage an experienced HR consultant to assist with scaling the team.

Maintaining Strong Investor Relationships While Focusing on Business Growth

Balancing investor relations with business growth requires a strategic approach. Prioritizing open communication, regular reporting, and seeking investor feedback helps ensure alignment between investor expectations and business objectives. By demonstrating consistent progress towards key milestones and proactively addressing any challenges, startups can build strong, lasting relationships with investors while driving business growth. This approach fosters trust and ensures continued support as the company navigates the complexities of scaling and achieving its long-term goals. A successful example is a startup that consistently exceeded its quarterly revenue targets, thereby building confidence among investors and attracting further investment rounds.

Illustrative Examples of Successful Funding

Securing venture capital funding is a significant milestone for any startup. Understanding the journeys of successful companies can offer valuable insights into effective strategies and approaches. The following case studies illustrate diverse paths to securing funding and achieving post-funding growth. Each example highlights the unique business model, funding specifics, and key factors contributing to their success.

Airbnb’s Funding Journey

Airbnb’s success story is a testament to the power of a disruptive business model and a strong team.

- Business Model: Airbnb disrupted the hospitality industry by offering a peer-to-peer platform connecting travelers with individuals willing to rent out their homes or spare rooms. This model offered a cost-effective and unique travel experience compared to traditional hotels.

- Funding Rounds: Airbnb secured significant funding through multiple rounds, including Series A, B, C, and later rounds. These rounds involved substantial investments from prominent venture capital firms like Sequoia Capital and Andreessen Horowitz, accumulating billions in funding over time.

- Post-Funding Performance: Following its funding rounds, Airbnb experienced explosive growth, expanding globally and becoming a household name. It successfully navigated challenges like regulatory hurdles and competition, ultimately achieving a highly successful IPO.

- Key Factors for Success: Airbnb’s success stemmed from its innovative business model, strong network effects, exceptional team execution, and the ability to secure significant funding from top-tier investors who recognized its potential.

Stripe’s Capital Acquisition

Stripe, a payment processing platform, exemplifies how a company with a strong technical foundation and clear market opportunity can attract significant venture capital.

- Business Model: Stripe provides a developer-friendly API for businesses to integrate seamless online payment processing into their applications. This streamlined approach significantly simplified the complexities of online payments for developers.

- Funding Rounds: Stripe secured substantial funding through multiple rounds, attracting investments from prominent venture capital firms like Sequoia Capital and Andreessen Horowitz. The company maintained a high valuation throughout its funding journey.

- Post-Funding Performance: After securing funding, Stripe rapidly expanded its user base, becoming a critical infrastructure component for numerous businesses globally. Its consistent growth and profitability established its position as a leader in the payment processing sector.

- Key Factors for Success: Stripe’s success can be attributed to its superior technology, strong engineering team, focus on developer experience, and its ability to secure funding from investors who recognized its potential to disrupt the payments industry.

Spotify’s Funding and Growth

Spotify’s journey demonstrates how a company addressing a significant market need with a compelling user experience can attract substantial venture capital investment.

- Business Model: Spotify revolutionized the music industry by offering a subscription-based streaming service providing on-demand access to a vast music library. This model provided a legal and convenient alternative to piracy.

- Funding Rounds: Spotify secured substantial funding through various rounds, attracting investments from venture capital firms and other investors. These investments fueled its expansion into new markets and its development of innovative features.

- Post-Funding Performance: Following its funding rounds, Spotify achieved significant user growth, expanding globally and becoming a dominant force in the music streaming industry. While facing challenges related to licensing and competition, Spotify’s strong user base and brand recognition contributed to its success.

- Key Factors for Success: Spotify’s success was driven by its compelling user experience, vast music library, effective marketing, and its ability to secure funding to support its expansion and technological advancements.

Wrap-Up

Successfully navigating the venture capital landscape requires a blend of strategic planning, compelling communication, and a deep understanding of the investment process. This guide has provided a framework for approaching venture capital funding, from initial preparation to post-funding management. By understanding the key considerations, potential pitfalls, and best practices Artikeld here, entrepreneurs can significantly increase their chances of securing the funding needed to propel their ventures forward. Remember, securing funding is only the beginning; building a successful, sustainable business remains the ultimate goal.

FAQ Guide

What is the difference between Seed funding and Series A funding?

Seed funding is typically the initial investment, often used for product development and initial market entry. Series A funding is a larger investment round, usually occurring after some traction has been achieved, used for scaling operations and expanding market reach.

How long does the typical VC investment process take?

The process can vary, but generally takes several months, involving initial outreach, due diligence, negotiations, and closing the deal.

What is a convertible note?

A convertible note is a short-term debt instrument that converts into equity at a future date, often used in early-stage funding rounds to expedite the investment process.

What is due diligence?

Due diligence is the investigative process undertaken by investors to verify the information provided by the startup, assessing its financial health, business model, and management team.