Navigating the complexities of personal finance can be daunting, and this is where wealth management firms step in. These specialized firms offer a range of services designed to help individuals and families grow, protect, and manage their assets. From sophisticated investment strategies to comprehensive financial planning, wealth management firms provide tailored solutions to meet diverse financial goals, ultimately aiming to secure a client’s financial future.

The industry encompasses a wide spectrum of firms, each with unique approaches and specializations. Understanding the different types of firms, their service offerings, and regulatory landscapes is crucial for both potential clients seeking financial guidance and professionals aiming to succeed in this dynamic sector. This overview delves into the core aspects of wealth management, exploring its intricacies and future trajectory.

Defining Wealth Management Firms

Wealth management firms provide comprehensive financial planning and investment management services to high-net-worth individuals and families. These services extend beyond simple investment advice, encompassing a holistic approach to managing an individual’s or family’s financial well-being, including estate planning, tax optimization, and philanthropic endeavors. The target clientele typically possesses significant assets requiring sophisticated management strategies.

Wealth management firms offer a wide array of services tailored to the specific needs of their clients. These services often include investment portfolio construction and management, financial planning, tax planning and preparation, estate planning, retirement planning, insurance planning, and charitable giving strategies. The complexity and scope of these services vary considerably depending on the firm’s size, specialization, and the client’s individual circumstances.

Types of Wealth Management Firms

The wealth management industry encompasses a diverse range of firms, categorized by size, specialization, and client base. Understanding these distinctions helps clarify the varying approaches to service delivery and client engagement.

- Boutique Firms: These smaller firms typically focus on a niche market or specialized clientele, offering personalized attention and bespoke services. They may specialize in a particular asset class, such as private equity or real estate, or cater to a specific demographic, such as entrepreneurs or family offices. Their business model relies on building strong, long-term relationships with a limited number of high-net-worth clients.

- Large Financial Institutions: Major banks and investment firms often have substantial wealth management divisions offering a broader range of services to a wider client base. They leverage their size and resources to provide comprehensive solutions, but may sacrifice the personalized touch offered by smaller firms. Their business model focuses on economies of scale and a wider range of service offerings.

- Independent Registered Investment Advisors (RIAs): RIAs are fiduciaries, meaning they are legally obligated to act in their clients’ best interests. They are not tied to any specific financial institution, offering independence and objectivity in their advice. Their business model is based on transparent fee structures and a client-centric approach.

Business Models of Wealth Management Firms

Different wealth management firms employ distinct business models, reflecting their size, specialization, and target market. These models often impact the fees charged, the level of service provided, and the overall client experience.

- Fee-Only Model: Firms operating under this model charge clients a fee based on assets under management (AUM) or hourly rates, eliminating potential conflicts of interest associated with commission-based compensation. This model prioritizes transparency and alignment of interests with the client.

- Fee-Based Model: This model combines fee-based and commission-based compensation. Clients may pay a fee for financial planning services while also paying commissions on certain transactions. This approach can offer a blend of fee-based transparency and access to a broader range of investment products.

- Commission-Based Model: This traditional model compensates advisors based on the commissions earned from the sale of financial products. While this model can be lucrative for advisors, it can create potential conflicts of interest, as advisors may be incentivized to recommend products that generate higher commissions rather than those that are best suited for the client’s needs.

Services Offered by Wealth Management Firms

Wealth management firms provide a comprehensive suite of services designed to help individuals and families achieve their financial goals. These services go beyond simple investment management, encompassing various aspects of financial planning and tailored strategies to meet specific needs and risk tolerances. The scope of services offered can vary depending on the firm’s size and specialization, but generally includes a core set of offerings.

Financial Planning Services

Financial planning is a cornerstone of wealth management, providing a roadmap for achieving long-term financial objectives. This involves a thorough assessment of the client’s current financial situation, goals, and risk tolerance, followed by the development of a personalized plan. Key components of financial planning often include retirement planning and estate planning.

Retirement planning focuses on ensuring clients have sufficient funds to maintain their desired lifestyle during retirement. This involves projecting future income needs, analyzing current savings and investments, and recommending strategies to bridge any potential shortfall. Strategies might include increasing contributions to retirement accounts, adjusting investment portfolios to achieve higher returns, or exploring alternative income sources. For example, a firm might help a client nearing retirement determine how much they can safely withdraw annually from their savings while still preserving capital for future needs.

Estate planning, on the other hand, focuses on the management and distribution of assets after death. This includes creating or updating wills, trusts, and other legal documents to ensure assets are distributed according to the client’s wishes. It also addresses minimizing estate taxes and ensuring a smooth transition of assets to heirs. A wealth management firm might assist in establishing a trust to protect assets for minor children or to manage assets for individuals with special needs.

Investment Management Strategies

Wealth management firms employ various investment management strategies to help clients grow and preserve their wealth. These strategies broadly fall into two categories: active and passive.

Active investment management involves actively selecting individual securities or asset classes based on market analysis and predictions. This approach seeks to outperform market benchmarks by identifying undervalued assets or anticipating market trends. Active managers constantly monitor investments, adjust portfolios based on changing market conditions, and aim to generate alpha (returns exceeding the market benchmark). For example, an active manager might invest heavily in a particular sector anticipating strong growth, while reducing exposure to others deemed less promising.

Passive investment management, conversely, focuses on tracking a specific market index, such as the S&P 500. This approach aims to replicate the performance of the index by investing in the same assets in the same proportions. Passive strategies generally involve lower fees than active management and are considered less risky. Index funds and exchange-traded funds (ETFs) are common examples of passive investment vehicles. A client might choose a passive strategy for long-term growth, aiming to match the overall market return with lower management costs.

Services Offered by Wealth Management Firms

| Service | Description | Target Client | Example |

|---|---|---|---|

| Financial Planning | Developing a comprehensive plan to achieve financial goals. | Individuals and families at all life stages. | Creating a retirement plan to ensure sufficient income in later years. |

| Investment Management | Managing investments to achieve growth and preserve capital. | High-net-worth individuals and institutions. | Managing a diversified portfolio of stocks, bonds, and other assets. |

| Estate Planning | Planning for the distribution of assets after death. | Individuals with significant assets. | Creating a will and trust to ensure assets are distributed according to wishes. |

| Tax Planning | Minimizing tax liabilities through strategic planning. | High-income earners and business owners. | Utilizing tax-advantaged investment accounts and strategies. |

Client Acquisition and Relationship Management

Successfully attracting and retaining high-net-worth individuals (HNWIs) requires a sophisticated approach that blends strategic marketing, personalized service, and a deep understanding of their unique financial needs. Building lasting relationships is paramount for long-term growth and sustainable success in wealth management.

Effective client acquisition and relationship management are the cornerstones of a thriving wealth management firm. These strategies, when implemented effectively, lead to increased client retention, positive referrals, and ultimately, enhanced profitability.

Strategies for Attracting High-Net-Worth Individuals

Attracting high-net-worth individuals necessitates a targeted approach that emphasizes exclusivity, discretion, and demonstrable expertise. Simply advertising widely is insufficient; instead, a multi-pronged strategy is crucial.

- Networking and Referrals: Cultivating relationships with key individuals in relevant industries (e.g., legal, accounting, real estate) can generate valuable referrals. These trusted connections often lead to introductions to HNWIs seeking sophisticated wealth management solutions.

- Targeted Marketing Campaigns: Digital marketing strategies, such as LinkedIn advertising and targeted email campaigns, can reach potential clients with specific demographics and financial profiles. These campaigns should highlight the firm’s unique value proposition and expertise.

- Industry Events and Sponsorships: Participating in high-profile industry events and sponsoring relevant causes demonstrates thought leadership and builds brand recognition within the target demographic. This approach cultivates an image of exclusivity and prestige.

- Content Marketing: Creating high-quality content, such as white papers, webinars, and blog posts, establishes the firm as a thought leader and provides valuable insights to potential clients. This approach fosters trust and credibility.

Client Onboarding Process

A seamless and efficient onboarding process is critical for setting the stage for a positive and lasting client relationship. A well-defined process minimizes friction and ensures a smooth transition.

- Initial Consultation and Needs Assessment: The process begins with a thorough understanding of the client’s financial goals, risk tolerance, and investment objectives. This involves open communication and active listening.

- Documentation and Compliance: All necessary paperwork, including KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance documentation, must be completed accurately and efficiently. This ensures regulatory compliance and safeguards the client’s assets.

- Investment Strategy Development: Based on the needs assessment, a tailored investment strategy is developed and presented to the client. This includes a clear explanation of the investment approach and expected returns.

- Account Setup and Funding: The client’s accounts are set up, and the necessary funds are transferred. Regular communication updates the client on the progress of account setup.

- Ongoing Communication and Review: Regular communication and periodic reviews ensure the client’s investment strategy remains aligned with their evolving goals and market conditions.

Building and Maintaining Long-Term Client Relationships

Long-term client relationships are essential for sustainable growth. Building trust and providing exceptional service are key components.

“Client retention is not merely a metric; it’s a testament to the quality of service and the strength of the client-advisor relationship.”

- Personalized Service: Providing customized solutions and attentive service demonstrates a commitment to the client’s unique needs. Regular check-ins and proactive communication are essential.

- Proactive Communication: Keeping clients informed about market trends and their portfolio performance builds trust and strengthens the relationship. Regular reporting and personalized updates are crucial.

- Conflict Resolution: Addressing client concerns promptly and effectively is essential for maintaining trust. A clear and transparent process for resolving disputes is necessary.

- Value-Added Services: Offering additional services, such as financial planning, tax advice, or estate planning, demonstrates a commitment to the client’s overall financial well-being.

Regulatory Compliance and Ethical Considerations

Navigating the complex landscape of wealth management necessitates a robust understanding of regulatory compliance and ethical considerations. Firms must adhere to a stringent framework of rules and regulations to protect client assets and maintain the integrity of the industry. Simultaneously, ethical conduct underpins the trust and confidence clients place in their advisors.

The intersection of legal obligations and ethical principles forms the bedrock of a successful and reputable wealth management firm. Failure to comply with regulations can lead to significant financial penalties, reputational damage, and even legal action. Conversely, ethical lapses can erode client trust, damaging long-term relationships and harming the firm’s overall standing.

Key Regulatory Requirements and Compliance Standards

Wealth management firms are subject to a wide array of regulations, varying depending on their location and the specific services offered. These regulations are designed to protect investors from fraud, mismanagement, and unethical practices. Key areas of regulatory focus include securities laws, anti-money laundering (AML) regulations, and data privacy laws. For instance, in the United States, the Securities and Exchange Commission (SEC) oversees investment advisors, requiring registration, adherence to fiduciary duty, and regular reporting. Similarly, AML regulations, like the Bank Secrecy Act, aim to prevent the use of the financial system for illicit activities. These regulations often require robust Know Your Customer (KYC) procedures and suspicious activity reporting. Data privacy laws, such as GDPR in Europe and CCPA in California, dictate how client information is collected, stored, and used, emphasizing the need for secure data handling practices.

Ethical Considerations and Potential Conflicts of Interest

Ethical considerations are paramount in wealth management. Conflicts of interest are a significant concern, arising when a firm or advisor’s personal interests potentially clash with those of their clients. For example, recommending a specific investment product that generates a higher commission for the firm, rather than one that is most suitable for the client’s needs, represents a clear conflict. Maintaining transparency and disclosing all potential conflicts is crucial. Ethical wealth managers prioritize client interests above their own, fostering trust and building strong, long-term relationships. Independent oversight and robust internal compliance programs are essential in mitigating these potential conflicts.

Transparency and Disclosure in Building Client Trust

Transparency and full disclosure are cornerstones of building and maintaining client trust. Clients need to understand the fees they are paying, the investment strategies being employed, and any potential risks involved. Regular and clear communication is vital. This includes providing comprehensive reports, explaining investment decisions, and promptly addressing client inquiries. Open and honest communication about potential conflicts of interest, even minor ones, demonstrates a commitment to ethical conduct and strengthens the client-advisor relationship. A firm’s commitment to transparency extends beyond individual interactions; it should also be evident in its marketing materials and overall business practices. For example, clearly stating the firm’s investment philosophy, fee structure, and any affiliations with other financial institutions contributes to building a reputation of integrity and trustworthiness.

Technology and Innovation in Wealth Management

The wealth management industry is undergoing a significant transformation driven by technological advancements. These innovations are not merely enhancing efficiency; they are fundamentally reshaping how firms interact with clients, manage assets, and navigate regulatory complexities. The adoption of technology is crucial for firms seeking to remain competitive and deliver superior client experiences in today’s dynamic market.

Technology plays a multifaceted role in boosting efficiency and improving client service within wealth management firms. Automation streamlines administrative tasks, freeing up advisors to focus on higher-value activities like financial planning and client relationship building. Improved data management and analytics provide deeper insights into client portfolios and market trends, enabling more informed decision-making. Enhanced communication tools foster stronger client relationships and facilitate more personalized service. Finally, robust cybersecurity measures protect sensitive client data and maintain the firm’s reputation.

Innovative Technologies in Wealth Management

Several innovative technologies are transforming how wealth management firms operate. These tools allow for greater personalization, efficiency, and improved risk management.

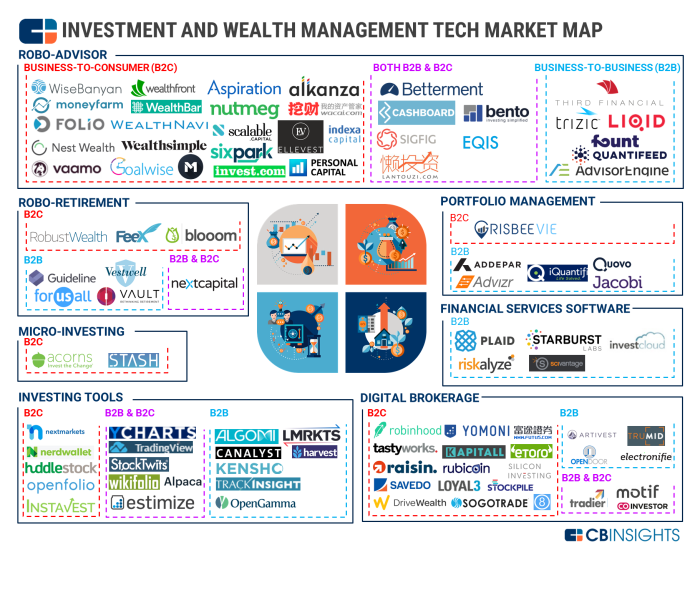

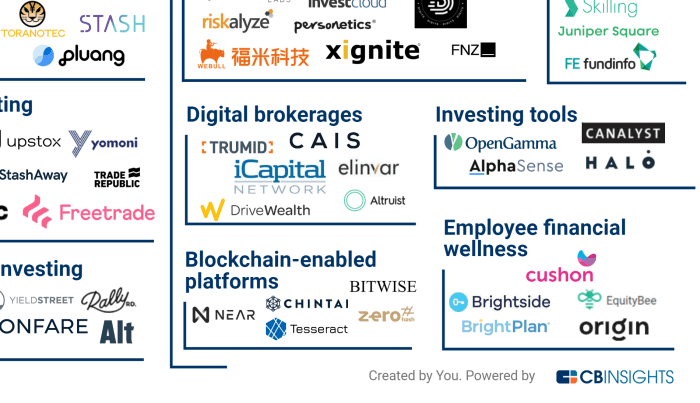

- Robo-advisors: These automated platforms offer algorithm-driven investment advice and portfolio management at a lower cost than traditional advisors. They are particularly well-suited for clients with simpler financial needs and a higher tolerance for risk. Examples include Betterment and Wealthfront, which utilize sophisticated algorithms to construct and manage diversified portfolios based on client risk profiles and investment goals.

- AI-powered tools: Artificial intelligence is being integrated into various aspects of wealth management, from client onboarding and risk assessment to fraud detection and regulatory compliance. AI algorithms can analyze vast datasets to identify patterns and insights that would be impossible for humans to discern, leading to more accurate predictions and better decision-making. For instance, AI can analyze market trends to identify potential investment opportunities or predict market volatility.

- High-Frequency Trading (HFT) Platforms: While not directly client-facing, HFT platforms allow firms to execute trades at incredibly high speeds, maximizing returns and minimizing slippage. This requires sophisticated algorithms and advanced technology infrastructure. The speed and efficiency of HFT can provide a competitive edge in dynamic markets.

- Blockchain Technology: Blockchain offers potential applications in enhancing security and transparency in wealth management. It can streamline processes like KYC/AML compliance and improve the efficiency of cross-border transactions. While still in its early stages of adoption, its potential for secure and transparent record-keeping is significant.

Data Analytics and Machine Learning in Wealth Management

Data analytics and machine learning are revolutionizing the wealth management landscape by providing firms with unprecedented insights into client behavior, market trends, and risk factors. These technologies enable more personalized investment strategies, improved risk management, and enhanced client service.

Data analytics allows firms to segment clients based on their financial goals, risk tolerance, and investment preferences, enabling the creation of customized investment portfolios and financial plans. Machine learning algorithms can analyze historical market data to identify patterns and predict future trends, informing investment decisions and risk management strategies. For example, machine learning can be used to predict market volatility or identify potential investment opportunities based on various factors, including economic indicators and company performance. This allows for more proactive portfolio adjustments and improved risk management. Furthermore, predictive analytics can be used to anticipate client needs and proactively offer relevant financial products and services, enhancing client satisfaction and loyalty.

The Future of Wealth Management

The wealth management industry stands at a crossroads, navigating a complex landscape of technological disruption, evolving client expectations, and shifting macroeconomic conditions. The firms that thrive will be those that proactively adapt to these changes, embracing innovation while maintaining a steadfast commitment to ethical practices and regulatory compliance. This section explores the key trends and challenges shaping the future of wealth management.

Several significant factors are reshaping the industry’s trajectory. The increasing prevalence of technology, the growing importance of sustainable and responsible investing, and the impact of global economic uncertainty are all forcing wealth management firms to rethink their strategies and operations.

Emerging Trends and Challenges

The wealth management industry faces numerous challenges, including heightened regulatory scrutiny, increasing competition from fintech companies, and the need to attract and retain top talent. Simultaneously, several significant trends are emerging, including the rise of robo-advisors, the growing demand for personalized financial planning, and the increasing focus on environmental, social, and governance (ESG) investing. These trends necessitate a fundamental shift in how wealth management firms operate, demanding both technological advancements and a re-evaluation of core business models. For example, the rise of robo-advisors, while initially seen as a threat, is now increasingly viewed as a complementary tool that can enhance efficiency and broaden market reach. Many established firms are integrating robo-advisory platforms into their existing services to cater to a wider range of clients and automate certain aspects of portfolio management.

Adapting to Changing Market Conditions and Client Expectations

Wealth management firms are responding to changing market conditions and client expectations in a variety of ways. Many are investing heavily in technology to improve their efficiency, enhance their client experience, and offer more personalized services. For instance, the adoption of artificial intelligence (AI) and machine learning (ML) is allowing firms to better analyze market data, personalize investment strategies, and provide more proactive client support. Furthermore, firms are increasingly focusing on building stronger client relationships by offering holistic financial planning services that extend beyond traditional investment management. This includes incorporating tax planning, estate planning, and retirement planning into their service offerings to provide clients with a more comprehensive and integrated approach to wealth management. The shift towards a more holistic approach reflects a growing client demand for personalized, comprehensive financial advice.

Impact of Macroeconomic Factors

Macroeconomic factors, such as interest rate fluctuations, inflation, and geopolitical events, have a significant impact on the wealth management industry. For example, rising interest rates can affect the performance of fixed-income investments, while inflation can erode the purchasing power of assets. Geopolitical instability can create market volatility and uncertainty, impacting investment strategies and client portfolios. Wealth management firms must be adept at navigating these macroeconomic headwinds by developing robust risk management strategies, diversifying client portfolios, and providing clients with timely and relevant market insights. The 2008 financial crisis serves as a stark reminder of the potential impact of macroeconomic events, highlighting the importance of proactive risk management and the need for firms to maintain sufficient liquidity and capital reserves. Firms that successfully adapt to these challenges will be well-positioned to thrive in the long term.

Illustrative Case Studies

This section presents two case studies illustrating both the successes and challenges within wealth management. The first showcases a successful wealth management strategy, highlighting the positive outcomes achieved through careful planning and execution. The second case study examines a firm’s challenges and the solutions implemented to overcome them, emphasizing the importance of adaptability and proactive problem-solving in this dynamic field.

Successful Wealth Management Strategy Implementation: The Miller Family Portfolio

The Miller family, a high-net-worth family with $5 million in assets, approached our firm seeking a long-term investment strategy focused on wealth preservation and growth for their children’s education and future retirement. Their current portfolio was heavily concentrated in individual stocks, resulting in significant volatility. We implemented a diversified portfolio strategy incorporating a mix of equities, fixed-income securities, alternative investments (real estate and private equity), and tax-efficient strategies. The allocation was tailored to their risk tolerance, time horizon, and financial goals. Over a five-year period, the portfolio consistently outperformed the benchmark indices, achieving an average annual return of 8%, significantly exceeding their initial expectations of 5%. This was largely attributed to the strategic diversification and the proactive rebalancing of the portfolio in response to market fluctuations.

The Miller family case study demonstrates the power of a well-diversified, strategically managed portfolio in achieving superior long-term returns while mitigating risk.

Careful asset allocation, tailored to individual client needs and risk profiles, is crucial for achieving optimal investment outcomes.

Overcoming Challenges in Wealth Management: Data Security and Client Retention

A mid-sized wealth management firm, “Prosperous Investments,” faced significant challenges related to data security and client retention. A surge in cyber threats necessitated immediate improvements to their security infrastructure, while increasing competition in the market led to concerns about client attrition. To address data security concerns, Prosperous Investments invested heavily in advanced cybersecurity measures, including multi-factor authentication, regular security audits, and employee training programs. Simultaneously, they implemented a comprehensive client relationship management (CRM) system to enhance client communication, personalize services, and proactively identify and address potential concerns. This proactive approach, coupled with enhanced client engagement strategies, including regular financial planning reviews and personalized investment advice, led to improved client satisfaction and a significant reduction in client churn.

Investing in robust cybersecurity measures is paramount for protecting client data and maintaining the firm’s reputation.

Proactive client relationship management and personalized services are essential for fostering client loyalty and mitigating client attrition.

Epilogue

In conclusion, the wealth management industry plays a vital role in guiding individuals and families toward financial security and prosperity. The ongoing evolution of technology, coupled with evolving regulatory landscapes and shifting client expectations, continues to shape the industry’s future. By embracing innovation and maintaining a strong ethical compass, wealth management firms are well-positioned to navigate these challenges and continue providing invaluable services to their clientele for years to come.

Top FAQs

What is the difference between a wealth manager and a financial advisor?

While both provide financial advice, wealth managers typically work with high-net-worth individuals, offering more comprehensive services including estate planning and tax optimization, whereas financial advisors may cater to a broader client base with a focus on specific areas like retirement planning.

How are wealth management fees structured?

Fees vary widely depending on the firm and services offered. Common structures include asset-based fees (a percentage of assets under management), hourly fees, and performance-based fees (a percentage of investment gains).

How do I choose a wealth management firm?

Consider factors like the firm’s experience, specialization, fee structure, investment philosophy, and client testimonials. A thorough due diligence process and a comfortable rapport with the advisor are crucial.

What is fiduciary duty in wealth management?

A fiduciary duty means the wealth manager is legally obligated to act in the best interests of their clients, prioritizing their needs above their own.