Navigating the complexities of wealth requires expert guidance. Wealth management services offer a holistic approach to financial well-being, encompassing investment strategies, financial planning, and regulatory compliance. This guide delves into the core components of these services, exploring various models, client profiles, and the ever-evolving technological landscape shaping the industry.

From understanding different investment vehicles and risk tolerance to crafting comprehensive financial and estate plans, we examine the crucial elements that contribute to long-term financial success. We also explore the regulatory framework and the increasing role of technology in enhancing efficiency and client experience. The future of wealth management is dynamic, and this guide provides insights into the trends shaping its evolution.

Defining Wealth Management Services

Wealth management encompasses a comprehensive suite of financial services designed to help individuals and families grow, protect, and preserve their assets. It goes beyond simple investment management, incorporating sophisticated strategies to achieve long-term financial goals. This holistic approach considers various aspects of a client’s financial life, tailoring solutions to their specific needs and risk tolerance.

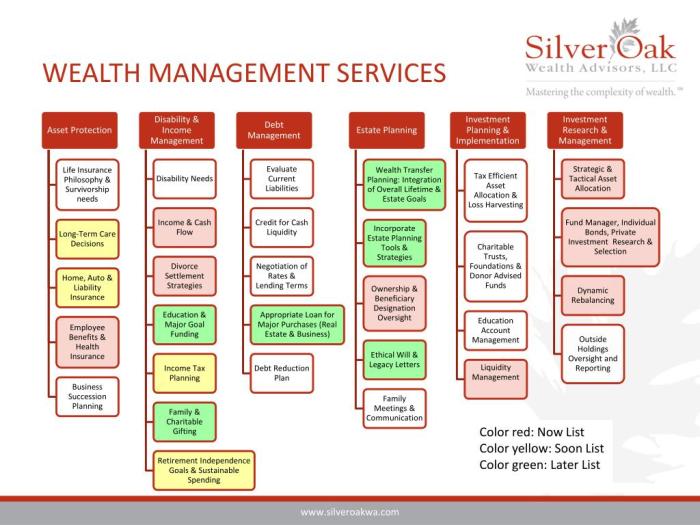

Core Components of Wealth Management Services

Wealth management services typically include financial planning, investment management, tax planning, estate planning, and risk management. Financial planning involves setting financial goals, creating a budget, and developing a strategy to achieve those goals. Investment management focuses on selecting and managing investments to maximize returns while minimizing risk. Tax planning aims to minimize tax liabilities through legal and ethical means. Estate planning involves creating a plan for the distribution of assets after death. Risk management involves identifying and mitigating potential financial risks. These components work together to create a cohesive financial strategy.

Client Types Served by Wealth Management Firms

Wealth management firms cater to a diverse clientele, ranging from high-net-worth individuals (HNWIs) with significant assets to families seeking long-term financial security, and even to individuals nearing retirement who need help managing their assets for a comfortable future. The specific services offered often vary based on the client’s net worth, investment goals, and risk tolerance. For instance, a young professional might focus on retirement planning and investment growth, while a retiree might prioritize income generation and asset preservation. Family offices often manage the complex financial needs of ultra-high-net-worth individuals and families.

Comparison of Wealth Management Service Models

Two primary service models exist: fee-only and commission-based. Fee-only advisors charge a predetermined fee based on assets under management (AUM) or an hourly rate, ensuring transparency and eliminating potential conflicts of interest arising from commissions. Commission-based advisors earn commissions on the products they sell, potentially influencing their recommendations. While commission-based models can offer access to a wider range of products, fee-only models prioritize the client’s best interests by eliminating the incentive to recommend products based on commission rather than suitability. A hybrid model also exists, combining aspects of both.

Wealth Management Service Models Comparison Table

| Service Type | Target Client | Fees | Key Features |

|---|---|---|---|

| Fee-Only | Individuals with various net worths seeking transparent advice | Percentage of AUM, hourly rate, or flat fee | Transparency, fiduciary duty, client-centric advice |

| Commission-Based | Individuals seeking a broad range of product options | Commissions on products sold | Access to various products, potential conflicts of interest |

| Hybrid | Individuals seeking a balance between fee-based and commission-based services | Combination of fees and commissions | Flexibility, potential for both transparency and conflicts of interest depending on the structure |

Investment Strategies in Wealth Management

Effective wealth management hinges on carefully crafted investment strategies designed to align with individual financial goals and risk tolerance. These strategies encompass a range of approaches, from conservative to aggressive, each tailored to meet specific client needs and market conditions. Understanding the nuances of these strategies is crucial for building and preserving wealth over the long term.

Asset Allocation and Diversification

Asset allocation is the cornerstone of any successful investment strategy. It involves determining the proportion of a portfolio invested in different asset classes, such as stocks, bonds, real estate, and alternative investments. Diversification, a closely related concept, spreads investments across various asset classes to mitigate risk. By not placing all eggs in one basket, investors reduce the impact of any single investment performing poorly. A well-diversified portfolio aims to balance risk and return, maximizing potential gains while minimizing potential losses. For example, a portfolio might allocate 60% to stocks for growth, 30% to bonds for stability, and 10% to real estate for diversification and potential inflation hedging.

The Role of Risk Tolerance in Portfolio Construction

Risk tolerance plays a pivotal role in shaping an investment portfolio. It represents an individual’s capacity to withstand potential investment losses. A client with a high risk tolerance might be comfortable investing a larger portion of their portfolio in higher-risk, higher-return assets like growth stocks or emerging market equities. Conversely, a client with a low risk tolerance would likely prefer a more conservative approach, emphasizing lower-risk, lower-return investments such as government bonds or high-yield savings accounts. Determining a client’s risk tolerance involves careful consideration of their financial situation, time horizon, and personal risk preferences. A financial advisor uses this information to construct a portfolio aligned with their comfort level.

Comparison of Investment Vehicles

Several investment vehicles offer distinct risk-return profiles. Stocks represent ownership in a company and offer the potential for high returns but also carry significant risk. Bonds, on the other hand, represent loans to a company or government and generally offer lower returns but less risk. Real estate involves investing in properties and can provide both income and appreciation potential, although it’s often less liquid than stocks or bonds. Each vehicle has its own characteristics and should be considered in the context of the overall portfolio strategy. For instance, stocks are often preferred for long-term growth, bonds for stability and income, and real estate for diversification and potential inflation protection.

Sample Investment Portfolio

Let’s consider a hypothetical client, Sarah, aged 35, with a high risk tolerance and a long-term investment horizon (25 years). Her financial goal is to build wealth for retirement. Given her profile, a suitable portfolio might allocate:

| Asset Class | Allocation | Rationale |

|---|---|---|

| US Equities (Large-Cap) | 35% | Provides exposure to established, large companies with relatively lower volatility. |

| US Equities (Small-Cap) | 15% | Offers higher growth potential but with increased risk compared to large-cap stocks. |

| International Equities | 15% | Diversifies geographic exposure and reduces dependence on the US market. |

| Bonds (Investment Grade) | 20% | Provides stability and income, reducing overall portfolio volatility. |

| Real Estate (REITs) | 10% | Offers diversification and potential inflation hedge through exposure to real estate market. |

| Alternative Investments (Private Equity, etc.) | 5% | Provides potential for higher returns, but with higher risk and illiquidity. |

This allocation reflects Sarah’s high risk tolerance and long time horizon, allowing for a greater allocation to equities for growth. The inclusion of bonds and real estate provides diversification and reduces overall portfolio risk. The small allocation to alternative investments adds potential for higher returns but acknowledges the associated risks. It is crucial to remember that this is a sample portfolio and individual circumstances should always be considered when designing an investment strategy.

Financial Planning within Wealth Management

Financial planning forms the bedrock of effective wealth management. It’s a holistic process that goes beyond simply investing; it considers all aspects of your financial life to create a roadmap for achieving your long-term goals. This involves a detailed assessment of your current financial situation, the identification of your aspirations, and the development of a tailored strategy to bridge the gap. A well-structured financial plan provides clarity, reduces stress, and maximizes your chances of financial success.

Key Elements of a Comprehensive Financial Plan

A comprehensive financial plan typically encompasses several key elements, working together to create a cohesive strategy. These elements are interconnected and influence each other, highlighting the importance of a holistic approach. Ignoring one area can negatively impact the others.

- Financial Goals: Clearly defined short-term and long-term financial objectives, such as retirement, education, or purchasing a home. These goals provide the framework for all subsequent planning decisions.

- Net Worth Assessment: A detailed evaluation of your assets (e.g., investments, real estate, savings) and liabilities (e.g., mortgages, loans, credit card debt). This provides a snapshot of your current financial health.

- Cash Flow Analysis: A meticulous examination of your income and expenses to understand your spending habits and identify areas for potential savings or adjustments. This is crucial for budgeting and achieving financial stability.

- Risk Tolerance Assessment: Determining your comfort level with investment risk, considering your time horizon, financial goals, and personal circumstances. This informs investment strategy selection.

- Investment Strategy: A plan outlining how your assets will be invested to achieve your financial goals, considering your risk tolerance and time horizon. This often includes diversification across different asset classes.

- Retirement Planning: A strategy to ensure you have sufficient funds to maintain your desired lifestyle during retirement. This involves considering factors such as retirement age, expected expenses, and Social Security benefits.

- Estate Planning: A plan to manage the distribution of your assets after your death, including wills, trusts, and power of attorney documents. This ensures your wishes are respected and minimizes potential family conflicts.

- Tax Planning: Strategies to minimize your tax liability through legal and ethical means, maximizing your after-tax returns. This may involve tax-advantaged investments or strategic tax deductions.

Best Practices for Retirement Planning within a Wealth Management Context

Effective retirement planning requires a proactive and multifaceted approach, integrating several best practices to maximize your chances of a comfortable retirement. The earlier you start, the better.

- Start Early: Begin saving and investing for retirement as early as possible to benefit from the power of compounding returns.

- Maximize Retirement Contributions: Contribute the maximum amount allowed to tax-advantaged retirement accounts such as 401(k)s and IRAs to take advantage of tax benefits and employer matching contributions (if applicable).

- Diversify Investments: Spread your retirement investments across different asset classes (stocks, bonds, real estate) to mitigate risk and optimize returns.

- Regularly Review and Adjust: Periodically review your retirement plan to ensure it’s still aligned with your goals and adjust as needed based on market conditions and life changes.

- Consider Longevity Risk: Plan for the possibility of living longer than expected, ensuring you have sufficient funds to cover your expenses throughout your retirement years.

- Seek Professional Advice: Consult with a financial advisor to create a personalized retirement plan that takes into account your individual circumstances and goals.

Estate Planning: A Step-by-Step Guide

Estate planning is the process of preparing for the management and distribution of your assets after your death. A well-defined estate plan ensures your wishes are honored and protects your loved ones from potential legal and financial complications.

- Inventory Assets: Create a comprehensive list of all your assets, including real estate, investments, bank accounts, and personal belongings.

- Create a Will: A will Artikels how your assets will be distributed after your death and designates a guardian for any minor children. Without a will, the state determines the distribution, which may not align with your wishes.

- Establish a Trust (if necessary): Trusts can provide additional control over asset distribution and offer tax advantages. Different types of trusts cater to various needs and objectives.

- Designate Power of Attorney: Appoint someone to manage your financial affairs if you become incapacitated. This ensures your financial needs are met even if you’re unable to handle them yourself.

- Designate Healthcare Power of Attorney: Appoint someone to make healthcare decisions on your behalf if you become unable to do so.

- Review and Update Regularly: Review and update your estate plan periodically to reflect changes in your circumstances, such as marriage, divorce, birth of a child, or significant asset acquisitions.

Tax Planning Strategies in Wealth Management

Tax planning is an integral part of wealth management, aiming to minimize your tax liability through legal and ethical strategies. Effective tax planning can significantly increase your after-tax returns and help you achieve your financial goals more efficiently.

- Tax-Advantaged Investments: Utilize tax-advantaged investment accounts like 401(k)s, IRAs, and 529 plans to reduce your current and future tax burden.

- Tax Loss Harvesting: Strategically selling losing investments to offset capital gains and reduce your tax liability. This requires careful consideration and may involve tax implications.

- Tax Diversification: Distributing assets across different tax-efficient vehicles to optimize your overall tax position.

- Charitable Giving: Making charitable donations can provide tax deductions, reducing your taxable income. This can be particularly beneficial for high-income earners.

- Consult with a Tax Professional: Seek advice from a qualified tax advisor to develop a comprehensive tax strategy tailored to your specific circumstances.

Regulation and Compliance in Wealth Management

The wealth management industry operates within a complex and ever-evolving regulatory landscape designed to protect investors and maintain market integrity. Understanding and adhering to these regulations is paramount for firms and professionals alike, ensuring client trust and avoiding significant legal and financial repercussions. This section will explore the key regulatory aspects, the importance of fiduciary duty, common compliance challenges, and the roles of major regulatory bodies.

The regulatory landscape governing wealth management firms is multifaceted and varies depending on geographical location and the specific services offered. Generally, regulations aim to prevent fraud, conflicts of interest, and the misuse of client assets. These regulations often dictate aspects such as client suitability assessments, investment strategies, record-keeping, and reporting requirements. Firms must comply with numerous laws and regulations, often necessitating specialized compliance departments and ongoing professional development for their employees.

The Importance of Fiduciary Duty in Wealth Management

A fiduciary duty is a legal obligation to act in the best interests of another party. In wealth management, this means advisors must prioritize their clients’ needs above their own. This includes providing unbiased advice, acting with prudence and diligence, and fully disclosing all relevant information. Breaching this duty can lead to significant legal liabilities and reputational damage for the firm and individual advisors. The fiduciary standard requires a higher level of care than a suitability standard, demanding that advisors act in the client’s best interest even if it means foregoing potential personal gains.

Common Compliance Challenges Faced by Wealth Management Professionals

Wealth management professionals face a variety of compliance challenges. These include accurately assessing client risk tolerance and suitability for investments, maintaining accurate and up-to-date client records, preventing insider trading, managing conflicts of interest (such as receiving commissions from product providers), and adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations. Keeping abreast of evolving regulations and best practices is a continuous process, requiring ongoing training and investment in compliance resources. For example, a failure to properly document client risk profiles before recommending investments could expose the firm to significant legal risk if those investments underperform. Similarly, overlooking potential conflicts of interest, such as recommending a higher-commission product without disclosing it, could result in disciplinary action and legal claims.

Key Regulatory Bodies and Their Roles

The regulatory environment for wealth management is overseen by several key bodies, each with specific responsibilities. Understanding their roles is crucial for ensuring compliance.

- Securities and Exchange Commission (SEC): In the United States, the SEC is the primary regulator of securities markets, overseeing broker-dealers, investment advisors, and mutual funds. Their role includes setting standards for investment advice, preventing fraud, and enforcing regulations.

- Financial Industry Regulatory Authority (FINRA): FINRA regulates broker-dealers and exchange markets in the US, focusing on ensuring fair dealing and preventing misconduct. They set standards for licensing, training, and conduct.

- State-level regulators: Many states also have their own regulatory bodies that oversee aspects of wealth management, often focusing on investment advisors and insurance agents. The specific regulations and oversight vary by state.

- The Financial Conduct Authority (FCA): In the United Kingdom, the FCA is the principal regulator of financial services, including wealth management firms. Their responsibilities include protecting consumers and ensuring market integrity.

Technology and Wealth Management

The integration of technology is rapidly transforming the wealth management landscape, impacting every aspect from client acquisition to portfolio management. This evolution is driven by increasing client expectations for personalized service, efficient processes, and access to sophisticated investment tools. The adoption of technological advancements is no longer optional but a necessity for firms seeking to remain competitive and deliver superior value.

Technology’s impact on wealth management is multifaceted, encompassing everything from the rise of automated investment platforms to the sophisticated use of data analytics for personalized portfolio construction and risk management. This shift presents both exciting opportunities and significant challenges for firms navigating this rapidly changing environment.

Robo-Advisors and Fintech Disruption

Robo-advisors, automated investment platforms utilizing algorithms to manage portfolios, have significantly disrupted the traditional wealth management model. These platforms offer low-cost, accessible investment solutions, particularly appealing to younger, digitally native investors. Fintech companies, more broadly, are introducing innovative solutions in areas such as payments, lending, and financial planning, creating increased competition and forcing traditional firms to adapt. For example, the emergence of digital-first platforms has streamlined onboarding processes and provided clients with 24/7 access to their accounts and financial information. This increased accessibility and transparency has broadened the reach of wealth management services to a wider demographic.

Data Analytics in Portfolio Management and Client Servicing

Data analytics plays a crucial role in enhancing portfolio management and client servicing. Sophisticated algorithms analyze vast datasets – encompassing market trends, economic indicators, and individual client profiles – to generate personalized investment strategies, optimize asset allocation, and identify potential risks. For instance, predictive modeling can help forecast market volatility and adjust portfolio holdings accordingly, mitigating potential losses. Furthermore, data analytics empowers firms to deliver hyper-personalized client experiences, tailoring communication, financial advice, and product recommendations based on individual client needs and preferences. This level of personalization enhances client satisfaction and fosters stronger client relationships.

Benefits and Challenges of Technology Integration

Integrating new technologies into existing wealth management processes offers numerous benefits, including improved efficiency, enhanced client experiences, and increased profitability. However, this integration also presents challenges. These include the high initial investment costs associated with new technologies, the need for robust cybersecurity measures to protect sensitive client data, and the need for ongoing training and development to ensure staff can effectively utilize new tools and platforms. Furthermore, regulatory compliance in a rapidly evolving technological landscape poses an ongoing challenge. For example, the implementation of a new CRM system may require significant upfront investment, but it can ultimately streamline client communication and reduce administrative overhead. However, ensuring data security and regulatory compliance within this new system requires careful planning and ongoing monitoring.

Hypothetical Scenario: Technology Enhancing Client Experience and Efficiency

Imagine Sarah, a high-net-worth individual who previously managed her investments with a traditional wealth manager. Her experience was often characterized by lengthy phone calls, infrequent updates, and limited access to her portfolio performance data. Now, Sarah uses a wealth management platform that integrates AI-powered portfolio management, a secure client portal with real-time data visualizations, and personalized financial planning tools. Through the platform’s user-friendly interface, Sarah can easily monitor her portfolio performance, access personalized financial advice, and securely communicate with her advisor. The platform’s AI engine proactively identifies potential risks and opportunities, suggesting adjustments to her portfolio based on her risk tolerance and financial goals. This seamless integration of technology has not only improved Sarah’s experience but also increased the efficiency of her wealth management, allowing her advisor to focus on more strategic planning and relationship building.

Future Trends in Wealth Management

The wealth management landscape is undergoing a rapid transformation, driven by technological advancements, shifting demographics, and evolving client expectations. Understanding these emerging trends is crucial for firms to remain competitive and effectively serve the needs of high-net-worth individuals (HNWIs). This section explores key future trends and their potential impact on wealth management strategies.

The next decade will witness a significant reshaping of the wealth management industry, influenced by several powerful forces. These include the increasing influence of technology, a growing emphasis on personalized service, and the persistent impact of global economic uncertainty. Understanding these factors is paramount for firms seeking to adapt and thrive.

Technological Disruption

Technological advancements are profoundly impacting how wealth management services are delivered and accessed. Artificial intelligence (AI) and machine learning (ML) are automating previously manual processes, enhancing efficiency, and improving the accuracy of investment strategies. Robo-advisors are gaining popularity, offering automated portfolio management at a lower cost than traditional advisors, while sophisticated algorithms analyze vast datasets to identify investment opportunities and manage risk more effectively. Blockchain technology is also emerging as a potential disruptor, offering enhanced security and transparency in transactions. For example, several fintech companies are leveraging AI to personalize financial planning recommendations, creating highly customized strategies based on individual client profiles and risk tolerance.

Evolving Client Needs and Expectations

HNWIs are increasingly demanding a more holistic and personalized approach to wealth management. They expect their advisors to go beyond traditional investment management, providing comprehensive financial planning that encompasses tax optimization, estate planning, philanthropy, and family office services. Transparency and clear communication are also paramount, with clients demanding detailed explanations of investment strategies and fee structures. Furthermore, the younger generation of HNWIs, known for their tech-savviness, expect seamless digital experiences, including mobile access to their accounts and personalized financial dashboards. For instance, the growing popularity of impact investing reflects a shift in client priorities, with many seeking investments that align with their social and environmental values.

Impact of Global Economic Factors

Global economic factors, including geopolitical instability, inflation, and interest rate fluctuations, significantly influence wealth management strategies. The increasing complexity of the global financial landscape requires advisors to develop sophisticated risk management strategies and diversify portfolios across different asset classes and geographies. For example, the recent period of high inflation has led many investors to seek protection in assets such as real estate and commodities, while geopolitical uncertainties have prompted a greater focus on diversification and hedging strategies. Moreover, regulatory changes and tax policies in various jurisdictions also significantly impact investment decisions, necessitating a proactive approach to navigating the regulatory environment.

Anticipated Changes in the Wealth Management Industry (Visual Representation)

Imagine a graph depicting the evolution of the wealth management industry over the next decade. The x-axis represents time (years), and the y-axis represents key industry metrics, such as the adoption rate of AI, the growth of digital channels, the diversification of investment strategies, and the shift towards personalized services. The graph would show a steep upward trend for AI adoption and digital channels, indicating their growing importance. Simultaneously, a gradual but steady increase in portfolio diversification and personalized service would be observed, reflecting the changing needs of HNWIs. The graph might also include a separate line representing regulatory complexity, showing an increase reflecting the evolving regulatory landscape. This visualization would highlight the dynamic and transformative nature of the industry over the next ten years.

Last Word

Ultimately, effective wealth management is a collaborative journey, requiring a deep understanding of individual financial goals and risk appetites. By leveraging sophisticated investment strategies, meticulous financial planning, and adherence to robust regulatory standards, individuals and families can secure their financial futures and build lasting wealth. The ongoing integration of technology further enhances the precision and accessibility of these vital services, paving the way for a more personalized and efficient wealth management experience.

Commonly Asked Questions

What is the difference between a financial advisor and a wealth manager?

Financial advisors typically focus on specific financial products or services, while wealth managers provide a more comprehensive approach, considering all aspects of a client’s financial life.

How much does wealth management cost?

Fees vary widely depending on the services offered, the assets under management, and the firm’s fee structure (e.g., fee-only, commission-based). It’s crucial to discuss fees upfront.

What is a fiduciary duty?

A fiduciary duty is a legal obligation to act in the best interests of the client, prioritizing their needs above the wealth manager’s own.

How often should I meet with my wealth manager?

Meeting frequency depends on individual needs and circumstances, but regular reviews (quarterly or annually) are typically recommended to monitor progress and adjust strategies as needed.