Navigating the complex world of wealth management can feel daunting. This review delves into the intricacies of choosing a firm, analyzing their services, and understanding the crucial factors contributing to successful financial planning. We’ll explore fee structures, investment strategies, client service, and regulatory compliance, providing a framework for making informed decisions about your financial future.

From understanding different investment philosophies to recognizing potential red flags in client service, this guide aims to empower you with the knowledge needed to select a wealth management firm that aligns with your individual needs and goals. We will dissect various aspects, including the use of technology and its impact on the overall experience, ensuring a balanced perspective on both traditional and innovative approaches.

Defining Wealth Management Services

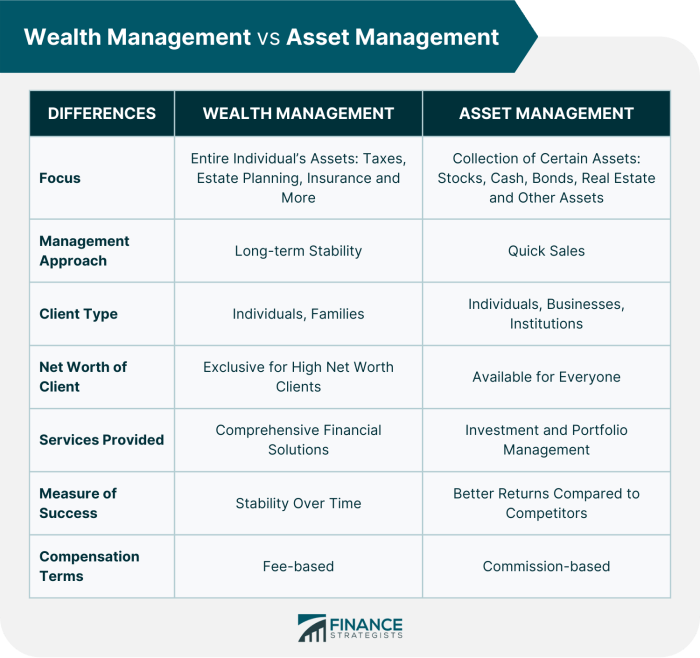

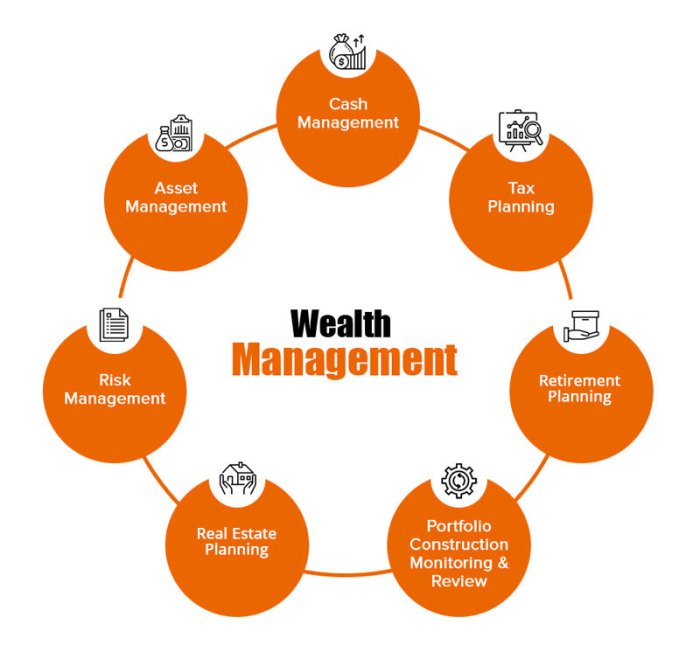

Wealth management encompasses a comprehensive suite of financial services designed to help individuals and families grow, protect, and preserve their assets. It goes beyond simple investment advice, incorporating strategic planning across multiple financial areas to achieve long-term financial goals. This holistic approach ensures a coordinated strategy, maximizing efficiency and minimizing potential risks.

Wealth management services aim to provide a personalized approach to financial well-being, tailoring strategies to individual circumstances, risk tolerance, and aspirations. The services offered are multifaceted and interconnected, working in synergy to create a robust financial plan.

Types of Wealth Management Services

The specific services offered vary depending on the client’s needs and the firm’s specialization. However, core services typically include financial planning, investment management, tax planning, and estate planning. Sophisticated clients may also access services like philanthropic advising and family office services.

Client Profiles and Service Customization

Wealth management firms cater to a range of client profiles, each with unique needs and objectives. High-net-worth individuals (HNWIs) often require more complex strategies involving sophisticated investment vehicles, tax optimization techniques, and international asset management. Families, on the other hand, may prioritize legacy planning, education funding, and wealth transfer strategies across generations. Smaller portfolios may benefit from a more streamlined approach, focusing on fundamental financial planning and basic investment management.

Characteristics of Reputable Wealth Management Firms

Choosing a reputable wealth management firm is crucial for long-term financial success. Several key characteristics distinguish reputable firms from less trustworthy ones. Transparency in fees and investment strategies is paramount. Reputable firms maintain robust regulatory compliance, adhering to strict ethical standards and industry best practices. A strong track record, demonstrated expertise, and a commitment to client education are further hallmarks of a reliable firm. Furthermore, a well-defined process for client onboarding, regular performance reviews, and proactive communication are indicative of a firm that prioritizes client needs and fosters long-term relationships. Finally, the availability of diverse and specialized expertise within the firm is an important indicator of a firm’s ability to handle complex financial situations.

Review Criteria and Methodology

This section details the rigorous criteria and methodology employed in evaluating wealth management firms. Our comprehensive assessment considers several key factors to provide a balanced and insightful review, enabling readers to make informed decisions about their financial future. The evaluation process prioritizes transparency and objectivity, using a combination of quantitative and qualitative data to paint a complete picture of each firm’s strengths and weaknesses.

Our review process involves a structured analysis across multiple dimensions, weighted to reflect their relative importance in providing exceptional wealth management services. The scoring system is designed to highlight areas of excellence and identify potential areas for improvement, facilitating a clear comparison between different firms.

Evaluation Rubric: Key Criteria for Wealth Management Firms

The following table Artikels the key criteria used to evaluate wealth management firms. Each criterion is assigned a weighted score based on its significance in overall client satisfaction and financial success. Scores are derived from a combination of publicly available data, client surveys, and independent research.

| Criterion | Weighting | Quantitative Data Points | Qualitative Data Points |

|---|---|---|---|

| Fee Structure | 20% | Average annual fees, expense ratios, transaction costs, hidden fees | Transparency of fee disclosure, competitive pricing compared to industry benchmarks, value for money provided |

| Investment Philosophy | 25% | Investment returns (alpha and beta), portfolio volatility, Sharpe ratio, risk-adjusted returns | Clarity of investment strategy, alignment with client risk tolerance, diversification approach, long-term performance track record, ethical considerations |

| Client Service | 25% | Client satisfaction surveys, response times to inquiries, client retention rate | Accessibility of advisors, responsiveness, personalized service, proactive communication, overall client experience |

| Regulatory Compliance | 30% | Number of regulatory infractions, disciplinary actions, adherence to fiduciary duty standards | Robustness of internal controls, commitment to ethical practices, transparency in reporting, client protection measures |

Quantitative Data Points Examples

Quantitative data provides measurable insights into a firm’s performance. For example, analyzing the Sharpe ratio, a measure of risk-adjusted return, helps assess the efficiency of a firm’s investment strategy. A higher Sharpe ratio indicates better risk-adjusted returns. Similarly, examining average annual fees allows for a direct comparison of pricing across firms. Lower expense ratios and transparent fee structures are generally favored. Analyzing client retention rates provides insights into client satisfaction and loyalty. High retention rates suggest strong client relationships and effective service delivery.

Qualitative Data Points Examples

Qualitative data offers a deeper understanding of client experience and the firm’s operational practices. Client testimonials and feedback from surveys provide valuable insights into the quality of client service. The clarity and transparency of the firm’s investment philosophy, as communicated to clients, are also crucial aspects. An in-depth review of the firm’s ethical practices and adherence to regulatory compliance is essential, examining any disciplinary actions or regulatory infractions. The overall client experience, including the accessibility and responsiveness of advisors, is also a key qualitative factor.

Fee Structures and Transparency

Understanding the fee structure is crucial when selecting a wealth management firm. Different firms employ various approaches, each with its own advantages and disadvantages. Transparency in how these fees are calculated and disclosed is equally vital for building and maintaining client trust.

Choosing a wealth management firm often involves navigating a complex landscape of fees. A clear understanding of these structures and the firm’s commitment to transparency is paramount for informed decision-making. This section will compare common fee structures and emphasize the significance of upfront and ongoing fee disclosure.

Comparison of Fee Structures

Wealth management firms typically employ one or a combination of three main fee structures: fees based on a percentage of assets under management (AUM), hourly fees, and performance-based fees. AUM fees are the most common, representing a percentage of the total value of the client’s investments managed by the firm. This percentage can vary significantly depending on the firm, the client’s assets, and the services provided. Hourly fees are often used for specific services like financial planning or tax advice, providing a clear cost per unit of service. Performance-based fees, on the other hand, are tied directly to the investment performance, rewarding the firm based on the gains achieved for the client. However, these often involve a hurdle rate, meaning the firm only receives a percentage of profits exceeding a pre-defined benchmark.

Importance of Fee Transparency

Transparency in fee disclosure is essential for building and maintaining trust between wealth management firms and their clients. Clients need a clear and concise understanding of all fees involved, including any potential hidden costs, before engaging the services. Open communication regarding fee structures fosters a positive relationship built on mutual understanding and accountability. Lack of transparency, conversely, can lead to client dissatisfaction, mistrust, and potentially legal issues. Firms that prioritize transparent fee disclosure are often viewed as more credible and trustworthy, attracting and retaining clients who value open communication.

Potential Hidden Fees

It is important to be aware of potential hidden fees that may not be immediately apparent in the initial fee schedule. These can significantly impact the overall cost of wealth management services.

- Administrative Fees: These charges cover administrative tasks, such as account maintenance, statement preparation, and other operational expenses.

- Custodian Fees: These fees are charged by the custodian bank that holds the client’s assets.

- Transaction Fees: These are incurred when buying or selling securities, and can vary depending on the type of transaction and the brokerage used.

- Research Fees: Some firms charge fees for the research and analysis conducted to support investment decisions.

- Advisory Fees (separate from AUM): Some firms charge separate advisory fees in addition to AUM fees, especially for complex financial planning.

Investment Strategies and Performance

Choosing a wealth management firm hinges significantly on understanding their investment approach and track record. A firm’s investment philosophy, coupled with its historical performance, provides crucial insights into its capabilities and suitability for your financial goals. This section explores common investment strategies and how to assess their effectiveness.

Investment strategies employed by wealth management firms can broadly be categorized as active or passive. Active management involves actively selecting and trading individual securities to outperform market benchmarks. Passive management, conversely, aims to mirror a specific market index, minimizing trading costs and relying on market efficiency. Diversification, a cornerstone of risk management, spreads investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of poor performance in any single area. Sophisticated risk management strategies, such as hedging and options trading, are also commonly employed to mitigate potential losses.

Active and Passive Investment Management Strategies

Active management strategies seek to generate returns exceeding market benchmarks through skillful stock picking, market timing, or sector rotation. These strategies often involve higher fees due to the greater research and trading activity. Passive management, on the other hand, utilizes index funds or exchange-traded funds (ETFs) that track a specific market index (e.g., the S&P 500). This approach is generally associated with lower fees and aims to match the market’s overall return. The choice between active and passive management depends on factors such as investor risk tolerance, time horizon, and investment objectives.

Diversification Techniques and Risk Management Approaches

Effective diversification reduces portfolio volatility by spreading investments across various asset classes and geographic regions. A well-diversified portfolio might include a mix of domestic and international stocks, bonds with varying maturities, and alternative investments like real estate or commodities. Risk management strategies are crucial in protecting capital. These strategies can include hedging (using derivatives to offset potential losses), stop-loss orders (automatic sell orders triggered when prices fall below a certain level), and stress testing (simulating market downturns to assess portfolio resilience).

Evaluating Past Performance of Wealth Management Firms

Evaluating a wealth management firm’s past performance requires a nuanced approach. Simply looking at raw returns can be misleading. It’s essential to compare the firm’s returns to relevant market benchmarks (e.g., the S&P 500 for a stock-heavy portfolio) over various time periods (e.g., 3, 5, and 10 years). Risk-adjusted returns, such as the Sharpe ratio (measuring risk-adjusted return relative to a risk-free asset) or the Sortino ratio (focusing on downside risk), provide a more comprehensive assessment of performance. Consistency of returns over different market cycles is another key factor to consider.

Visual Representation of Portfolio Performance Data

A line graph effectively illustrates portfolio performance over time. The horizontal axis represents time (e.g., monthly or yearly intervals), and the vertical axis represents the portfolio’s value or return. Each data point on the graph represents the portfolio’s value or return at a specific point in time. A separate line could represent the performance of a relevant market benchmark (e.g., the S&P 500) for comparison. For example, a graph might show the portfolio’s value increasing steadily over five years, outperforming the benchmark index in most periods but slightly underperforming during a specific market downturn. The graph’s legend would clearly identify the portfolio’s performance line and the benchmark line. This visual representation facilitates a clear understanding of the portfolio’s growth trajectory and its relative performance against a market index.

Client Service and Communication

Exceptional client service is paramount in wealth management, forming the bedrock of trust and long-term relationships. It goes beyond simply executing transactions; it’s about building a genuine partnership based on understanding individual needs and proactively addressing concerns. Effective communication is the cornerstone of this service, ensuring clients feel heard, informed, and valued throughout their financial journey.

Client service in wealth management necessitates a personalized approach. This involves taking the time to thoroughly understand each client’s unique financial situation, goals, and risk tolerance. Responsiveness is crucial; inquiries should be answered promptly and comprehensively, with clear explanations of complex financial concepts. Proactive communication, such as regular portfolio reviews and market updates tailored to individual circumstances, demonstrates commitment and fosters confidence.

Key Elements of Excellent Client Service

Excellent client service in wealth management involves several key elements. A dedicated point of contact ensures consistent communication and personalized attention. Regular meetings, either in person or virtually, allow for in-depth discussions of financial progress and adjustments to investment strategies as needed. Clear, concise communication, avoiding jargon and technical complexities, is essential to ensure client understanding. Furthermore, readily accessible resources, such as online portals providing real-time account access and reporting, enhance transparency and convenience. Finally, a commitment to ongoing education and support helps clients make informed decisions and feel confident in their financial future.

Red Flags Indicating Poor Client Service or Unethical Practices

Several warning signs can indicate potential problems. Unresponsiveness to client inquiries or delays in providing requested information are major red flags. A lack of personalized attention, with communication feeling generic or impersonal, suggests a lack of genuine care for individual needs. High-pressure sales tactics or the recommendation of unsuitable investments based on commissions rather than client suitability should raise serious concerns. Omission of important information or obfuscation of fees also point towards unethical practices. Finally, a lack of transparency regarding investment strategies and performance, coupled with difficulty accessing account information, is highly problematic.

Positive Client Interaction Scenario

Imagine a client, Sarah, meeting with her wealth manager, David, for a quarterly review. David begins by reviewing Sarah’s portfolio performance, explaining both gains and losses in clear, non-technical terms. He then proactively discusses recent market trends and their potential impact on Sarah’s investments, offering tailored recommendations for adjustments based on her risk tolerance and long-term goals. He answers all of Sarah’s questions patiently and thoroughly, providing additional resources for further research. The entire interaction is characterized by open communication, mutual respect, and a genuine partnership approach.

Negative Client Interaction Scenario

In contrast, consider another client, Mark, who attempts to contact his wealth manager, John, repeatedly regarding a significant market downturn affecting his investments. John fails to return Mark’s calls or emails for several weeks. When they finally connect, John provides a brief, dismissive explanation of the market conditions, offering no personalized advice or support. He fails to address Mark’s concerns adequately, leaving him feeling frustrated and ignored. This interaction highlights a significant lack of responsiveness and personalized attention, severely damaging the client-advisor relationship.

Regulatory Compliance and Risk Management

Regulatory compliance and robust risk management are cornerstones of a reputable wealth management firm. These elements directly impact the safety and growth of client assets, and a firm’s commitment to these areas is a critical factor in assessing its overall trustworthiness. Failure to adhere to regulations can lead to significant financial penalties, reputational damage, and even legal action, ultimately eroding client confidence. Conversely, a strong risk management framework demonstrates a proactive approach to safeguarding client investments and building long-term relationships.

The importance of regulatory compliance for wealth management firms cannot be overstated. These firms handle significant amounts of client money and are subject to a complex web of regulations designed to protect investors from fraud, mismanagement, and unethical practices. Non-compliance can result in severe consequences, including hefty fines imposed by regulatory bodies like the Securities and Exchange Commission (SEC) in the US or the Financial Conduct Authority (FCA) in the UK. Beyond financial penalties, non-compliance can lead to loss of licenses, damage to the firm’s reputation, and significant erosion of client trust, ultimately impacting the firm’s viability. For example, the 2008 financial crisis highlighted the devastating consequences of inadequate risk management and regulatory oversight within the financial industry.

Risk Management Strategies

Wealth management firms employ various risk management strategies to mitigate potential losses and protect client assets. These strategies typically encompass a multifaceted approach that includes diversification of investments, thorough due diligence on investment opportunities, stress testing of portfolios to assess their resilience under various market conditions, and robust internal controls to prevent fraud and operational errors. Regular monitoring of market trends and economic indicators allows for proactive adjustments to investment strategies, minimizing potential negative impacts. Furthermore, employing independent third-party audits provides an external assessment of the firm’s risk management procedures and compliance with regulatory standards. A robust risk management framework is not merely a compliance requirement; it is an integral part of providing clients with the security and confidence they expect.

Regulatory Compliance Checklist

Prior to engaging a wealth management firm, it’s crucial to verify their adherence to relevant regulations. A comprehensive checklist should include the following aspects:

The following checklist provides key aspects to consider when evaluating a wealth management firm’s regulatory compliance:

- Verification of registration and licensing with the appropriate regulatory bodies (e.g., SEC, FINRA, FCA).

- Review of the firm’s compliance policies and procedures, ensuring they are up-to-date and effectively implemented.

- Assessment of the firm’s approach to anti-money laundering (AML) and know your customer (KYC) compliance.

- Examination of the firm’s conflict of interest policies and procedures to ensure client interests are prioritized.

- Inquiry into the firm’s disciplinary history and any regulatory actions taken against it.

- Review of the firm’s cybersecurity protocols and data protection measures to safeguard client information.

- Confirmation that the firm maintains adequate professional liability insurance.

Technology and Innovation in Wealth Management

The wealth management industry is undergoing a significant transformation driven by rapid technological advancements. These innovations are reshaping how firms deliver services, manage assets, and interact with clients, leading to increased efficiency, improved client experiences, and the emergence of new business models. This section explores the key technological trends impacting the sector and analyzes their implications.

Emerging technologies are profoundly impacting the delivery and accessibility of wealth management services. The integration of sophisticated software and data analytics is streamlining processes and enhancing decision-making capabilities for both advisors and clients.

Robo-Advisors and AI-Powered Tools

Robo-advisors, utilizing algorithms and automated processes, offer portfolio management services at a lower cost than traditional advisors. AI-powered tools augment human advisors’ capabilities, providing insights from vast datasets to personalize investment strategies and enhance risk management. For example, AI can analyze market trends, identify potential investment opportunities, and flag potential risks more efficiently than human analysts alone, leading to better-informed decisions and potentially higher returns. The use of AI also extends to client communication and service, with chatbots providing instant support and answering routine inquiries. However, the reliance on algorithms raises concerns about transparency and the potential for biases embedded within the systems. Furthermore, the lack of human interaction can be detrimental for clients requiring personalized financial planning beyond basic portfolio management.

Digital Platforms and Client Portals

Secure and user-friendly digital platforms are revolutionizing client engagement. These platforms provide clients with 24/7 access to their accounts, investment performance data, and financial planning tools. Clients can easily monitor their portfolios, make transactions, and communicate with their advisors through secure messaging systems. This increased transparency and accessibility empowers clients to take a more active role in managing their finances. For instance, a well-designed client portal allows clients to easily track their progress toward financial goals, view personalized reports, and access educational resources. This contrasts with the traditional approach where information exchange was primarily limited to scheduled meetings or phone calls. However, ensuring robust cybersecurity measures and maintaining data privacy are crucial considerations in the development and implementation of these digital platforms.

Traditional vs. Technology-Driven Wealth Management

Traditional wealth management relies heavily on human advisors providing personalized service and bespoke investment strategies. This approach often involves higher fees but offers a more personalized touch and access to a wider range of services. Technology-driven solutions, on the other hand, leverage automation and algorithms to provide efficient and cost-effective services, particularly suitable for clients with simpler financial needs. The advantages of traditional methods include personalized advice and relationship building, while technology-driven solutions offer scalability, lower costs, and increased accessibility. The optimal approach often involves a hybrid model, combining the strengths of both traditional and technology-driven methods. For example, a wealth management firm might use robo-advisors for basic portfolio management while reserving human advisors for complex financial planning and high-net-worth clients.

Technology’s Impact on Client Experience and Efficiency

Technology significantly enhances the client experience by providing greater transparency, accessibility, and personalization. Real-time portfolio tracking, personalized financial reports, and secure communication channels improve client engagement and satisfaction. For instance, automated email alerts notifying clients of significant market events or portfolio changes ensure they are always informed. Simultaneously, technology streamlines operational processes, automating tasks such as trade execution, account reconciliation, and regulatory reporting, freeing up human advisors to focus on higher-value activities such as financial planning and client relationship management. This improved efficiency translates into cost savings and allows firms to serve a larger client base. Examples include automated client onboarding processes, reducing administrative overhead and accelerating the time to first investment.

Final Summary

Ultimately, selecting a wealth management firm is a deeply personal decision. This review has provided a structured approach to evaluating different firms, focusing on key criteria such as fees, investment strategies, client service, and regulatory compliance. By considering the factors discussed and asking the right questions, you can confidently choose a partner to guide you toward achieving your long-term financial objectives. Remember, a strong relationship built on trust and transparency is paramount in this crucial aspect of your life.

FAQ Overview

What is the average fee charged by wealth management firms?

Fees vary significantly depending on the firm, services offered, and assets under management. They can range from a percentage of assets under management to hourly rates or performance-based fees. It’s crucial to get a clear and detailed fee schedule before engaging a firm.

How often should I review my wealth management plan?

Ideally, your wealth management plan should be reviewed annually, or more frequently if there are significant life changes (marriage, birth of a child, inheritance, etc.) or market fluctuations impacting your portfolio.

What are the signs of a fraudulent wealth management firm?

Red flags include unrealistic promises of high returns, high-pressure sales tactics, lack of transparency regarding fees, and unregistered or poorly regulated firms. Always verify the firm’s credentials and legitimacy before entrusting them with your finances.