Wealth Management Software: Ah, yes, the stuff of dreams (or at least, of very organized spreadsheets). This isn’t your grandpappy’s ledger book; we’re talking sophisticated systems designed to tame the wild beast that is personal finance, or, for the more ambitious, the even wilder beast that is managing other people’s money. From tracking investments to generating reports that would make a tax auditor weep with joy (in a good way, of course), wealth management software promises order in the chaotic world of finance. But is it all sunshine and roses? Let’s delve into the surprisingly hilarious intricacies of this digital money-managing marvel.

This exploration will cover the core functionalities, key features, and the often-overlooked comedic aspects of integrating these systems into the lives of financial advisors and individual investors alike. We’ll examine everything from the thrilling world of data security (because let’s face it, losing someone’s life savings is never funny) to the surprisingly complex task of calculating ROI. Prepare for a journey into the heart of financial technology, where the stakes are high, the software is powerful, and the potential for accidental hilarity is… well, let’s just say it’s significant.

Defining Wealth Management Software

Let’s face it, managing your wealth can be as thrilling as watching paint dry (unless you’re incredibly wealthy, in which case, please send help – and maybe a small loan of a million dollars). Wealth management software aims to inject a much-needed dose of efficiency and (dare we say it?) excitement into the process. Think of it as your personal financial superhero, minus the cape and questionable moral compass.

Wealth management software is a collection of tools designed to help individuals and organizations manage their financial assets effectively. It’s not just about tracking your bank balance (though it certainly does that); it’s about providing a comprehensive overview of your financial life, allowing for strategic planning and informed decision-making. It’s like having a highly organized, data-driven financial advisor always at your fingertips, without the hefty fees (usually).

Core Functionalities of Wealth Management Software

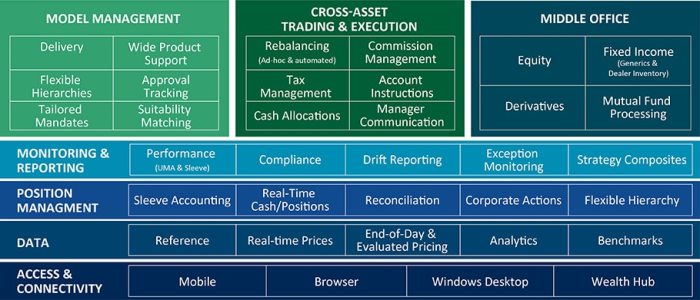

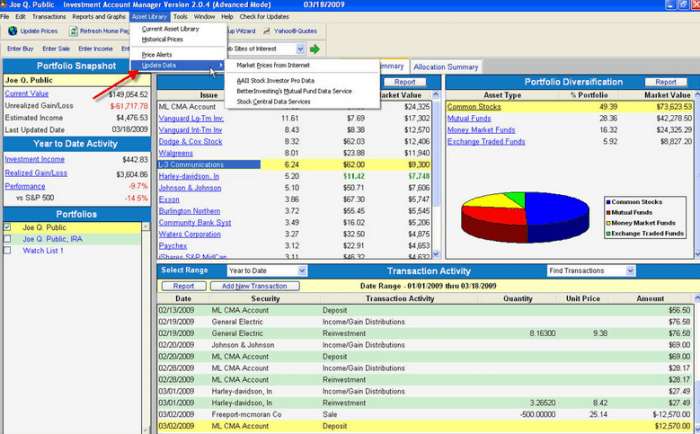

Typical wealth management software offers a robust suite of functionalities, far beyond simply adding up numbers. These include portfolio tracking, performance analysis, financial planning tools (retirement projections, anyone?), tax optimization strategies, and reporting capabilities. Many platforms also integrate with other financial accounts, providing a single, unified view of your assets. Imagine a beautifully organized spreadsheet that updates itself, magically forecasting your future financial empire (or at least a comfortable retirement).

User Types Who Benefit from Wealth Management Software

The benefits of wealth management software extend far beyond the typical Wall Street titan. Financial advisors leverage this technology to streamline their workflow, managing multiple client portfolios efficiently and providing personalized financial advice. Individual investors, from seasoned professionals to those just starting out, use it to gain a clearer picture of their financial health, set goals, and make informed investment decisions. Even family offices find these tools invaluable for managing complex family assets and ensuring a smooth wealth transfer across generations.

Key Features Differentiating Wealth Management Software Solutions

The market is flooded with various wealth management software solutions, each with its own unique strengths and weaknesses. Key differentiators include the level of customization, integration with other financial platforms, reporting capabilities (think dazzling charts and graphs!), the sophistication of the financial planning tools, and the overall user experience (because nobody wants a clunky, frustrating interface). Some platforms cater specifically to high-net-worth individuals, offering advanced features like tax optimization strategies for complex assets. Others focus on ease of use for beginners, providing a simplified, intuitive interface. The choice often depends on individual needs and preferences – just like choosing the perfect pair of socks (although hopefully with less agonizing indecision).

Key Features and Functionality

Choosing the right wealth management software is like picking the perfect pair of shoes – you need something that fits your needs, looks good, and doesn’t pinch your wallet (or your bottom line!). This section delves into the key features and functionality that distinguish top-tier platforms, ensuring you’re equipped to make an informed decision. We’ll explore reporting capabilities, security measures, and even take a peek under the hood of a specific feature’s user interface.

Reporting Capabilities of Leading Wealth Management Software Platforms

Comprehensive reporting is the lifeblood of effective wealth management. It allows advisors to track performance, identify trends, and ultimately, provide clients with clear, concise insights into their financial health. The ability to customize reports is equally crucial, allowing for tailored presentations based on individual client needs and preferences. Let’s compare three leading platforms:

| Platform Name | Reporting Features | Customization Options | Cost (Approximate Annual Subscription) |

|---|---|---|---|

| WealthyWise | Performance summaries, asset allocation reports, tax optimization analysis, client statements, portfolio comparisons. | Extensive customization options, including report templates, branding, and data filtering. Users can create custom dashboards. | $5,000 – $20,000+ |

| MoneyManager Pro | Standard financial statements, portfolio performance graphs, risk assessment reports, cash flow projections. | Moderate customization, allowing for selection of data points and report formats. | $2,000 – $10,000+ |

| FinPlan Genius | Detailed performance reporting, tax implications, retirement planning projections, ESG impact reports. | High degree of customization with drag-and-drop report builders and advanced filtering capabilities. | $7,000 – $25,000+ |

*Note: Costs are estimates and can vary based on the number of users, features, and support level.*

Security Measures in Reputable Wealth Management Software

Security is paramount in wealth management. After all, we’re talking about people’s hard-earned money! Reputable platforms employ a multi-layered approach to safeguard sensitive data. Think of it as Fort Knox meets the digital age.

The typical security measures include robust encryption (both in transit and at rest), multi-factor authentication (MFA) to prevent unauthorized access, regular security audits and penetration testing to identify vulnerabilities, and comprehensive access control mechanisms to limit user permissions based on their roles. Data backups and disaster recovery plans are also critical components, ensuring business continuity in the event of unforeseen circumstances. Compliance with relevant regulations, such as GDPR and CCPA, is a must-have, demonstrating a commitment to data privacy and protection.

Portfolio Rebalancing User Interface Flow, Wealth Management Software

Imagine a smooth, intuitive process for rebalancing a client’s portfolio. Our design prioritizes clarity and efficiency.

The user initiates the rebalancing process from the client’s portfolio overview page. A button clearly labeled “Rebalance Portfolio” triggers a modal window. This window displays the current asset allocation, the target allocation (based on the client’s investment strategy), and the recommended adjustments. The user can review the proposed changes and optionally make manual adjustments before confirming. A progress bar indicates the rebalancing status. Upon completion, the user is notified and redirected to the updated portfolio overview page, where they can view the new asset allocation and performance metrics. Error handling is implemented to gracefully handle any issues during the process, providing informative messages to the user. The entire process is designed to be straightforward and transparent, minimizing user effort and maximizing confidence.

Integration and Data Management

Let’s face it, nobody wants a financial software system that’s as disorganized as a teenager’s bedroom. Effective wealth management hinges on seamless data integration – think of it as the well-oiled engine powering your financial Ferrari, not a sputtering, rusty jalopy. Without it, your data is scattered, incomplete, and ultimately, useless. This section explores the vital role of data integration and management in a robust wealth management system.

Data integration with other crucial financial systems, such as CRM (Customer Relationship Management) and accounting software, is paramount. Imagine trying to manage a client’s portfolio without access to their contact information or transaction history – a recipe for disaster! A truly integrated system allows for a holistic view of the client, streamlining workflows and reducing the risk of errors. This integration not only saves time and money but also elevates the client experience by providing a more personalized and efficient service.

Data Handling Across Formats and Sources

Wealth management software must gracefully handle the diverse formats and sources of financial data. Consider the myriad of formats: CSV files from brokerage accounts, XML feeds from banks, proprietary databases from insurance companies – the list goes on. A robust system will seamlessly import and interpret data from these diverse sources, converting it into a unified, easily accessible format. This often involves sophisticated data mapping and transformation capabilities, ensuring data consistency and accuracy. For example, a system might automatically reconcile transactions from multiple sources, flagging discrepancies for manual review. This prevents the nightmare scenario of conflicting data leading to inaccurate portfolio valuations.

Data Backup and Recovery Best Practices

Data loss is a terrifying prospect for any business, especially one handling sensitive financial information. Implementing robust data backup and recovery strategies is therefore non-negotiable. This should involve regular backups (daily, if not more frequently) to both on-site and off-site locations. A comprehensive disaster recovery plan should also be in place, outlining procedures for restoring data in the event of a system failure or other unforeseen event. Consider using cloud-based backup solutions for enhanced security and redundancy. Regular testing of the backup and recovery procedures is crucial to ensure their effectiveness and identify any potential weaknesses. Think of it as a financial fire drill – better to be prepared than to be caught off guard.

Regulatory Compliance and Security

Navigating the regulatory landscape of wealth management software can feel like traversing a minefield of acronyms and legal jargon – but fear not! With the right software and a dash of due diligence, you can avoid the pitfalls and ensure your clients’ data remains safe and sound (and your business stays out of hot water). This section will delve into the crucial aspects of regulatory compliance and security, ensuring your wealth management software operates smoothly and legally.

Protecting client data is paramount, not just ethically but also legally. Failure to comply with regulations can lead to hefty fines, reputational damage, and a serious dent in client trust. This is where robust security measures become your best friend, a loyal companion on the journey to regulatory compliance.

Key Regulatory Requirements for Wealth Management Software

Wealth management software must adhere to a complex web of regulations, varying by jurisdiction. However, some key players consistently emerge. The General Data Protection Regulation (GDPR) in Europe, for example, mandates stringent data protection standards, granting individuals significant control over their personal information. Similarly, the California Consumer Privacy Act (CCPA) in the United States provides California residents with specific rights regarding their data. Other relevant regulations include the Gramm-Leach-Bliley Act (GLBA) in the US, focusing on financial data privacy, and various anti-money laundering (AML) and know your customer (KYC) regulations globally. Compliance often requires robust data encryption, secure data storage, and transparent data processing practices. Failure to comply can result in significant penalties, highlighting the critical need for proactive measures.

Data Privacy and Security Methods

Maintaining data privacy and security in wealth management software requires a multi-layered approach. Data encryption, both in transit and at rest, is crucial to prevent unauthorized access. This involves using strong encryption algorithms to scramble sensitive data, rendering it unreadable without the correct decryption key. Access control mechanisms, such as role-based access control (RBAC), limit access to sensitive data based on an individual’s role and responsibilities within the organization. Regular security audits and penetration testing identify vulnerabilities and ensure the effectiveness of security measures. Furthermore, robust authentication procedures, including multi-factor authentication (MFA), add an extra layer of security, making it significantly harder for unauthorized individuals to gain access. Finally, employee training programs reinforce the importance of data security best practices and help prevent insider threats.

Potential Security Vulnerabilities and Mitigation Strategies

Ignoring security vulnerabilities is like leaving your front door unlocked – it’s an open invitation for trouble. Here are some common vulnerabilities and their solutions:

- SQL Injection: Malicious code injected into database queries to gain unauthorized access. Mitigation: Parameterized queries and input validation.

- Cross-Site Scripting (XSS): Malicious scripts injected into websites to steal user data. Mitigation: Input sanitization and output encoding.

- Denial-of-Service (DoS) Attacks: Overwhelming a system with traffic to make it unavailable. Mitigation: Load balancing, rate limiting, and distributed denial-of-service (DDoS) mitigation services.

- Phishing Attacks: Tricking users into revealing sensitive information. Mitigation: Security awareness training and multi-factor authentication.

- Insider Threats: Malicious or negligent actions by employees. Mitigation: Access control, background checks, and regular security audits.

Cost and ROI of Wealth Management Software

Investing in wealth management software might seem like a hefty upfront cost, but think of it as an investment in a highly skilled, tireless financial advisor – one that never takes vacations and works 24/7. The true value lies not just in the initial outlay, but in the long-term return on that investment. Let’s delve into the nitty-gritty of calculating just how much richer your firm (and your clients) can become.

Calculating the return on investment (ROI) for wealth management software involves a careful assessment of both expenses and the resulting benefits. This isn’t about throwing darts at a board; it’s a strategic analysis that can significantly influence your bottom line. We’ll explore various pricing models and the factors contributing to a positive ROI.

Pricing Models for Wealth Management Software

Different software providers offer diverse pricing models, each with its own set of pros and cons. Understanding these models is crucial for making an informed decision. The most common models are subscription-based and licensing fees. Subscription models typically involve a recurring monthly or annual fee, often tiered based on the number of users or features. This offers predictability in budgeting but can become more expensive over the long term. Licensing models, on the other hand, involve a one-time purchase fee, but may require additional fees for upgrades, maintenance, and support. This upfront cost can be substantial but could prove more economical in the long run, depending on usage and the software’s lifespan.

Cost-Benefit Analysis of Wealth Management Software

A comprehensive cost-benefit analysis is essential for evaluating the financial implications of implementing wealth management software. This analysis should meticulously consider all associated costs, including the software license or subscription fees, implementation costs (consultants, training), ongoing maintenance and support, and potential integration costs with existing systems. On the benefit side, you need to quantify improvements in efficiency, reduced operational costs (e.g., fewer manual errors, decreased paperwork), increased revenue generation through better client service and improved investment strategies, and enhanced client retention.

For example, imagine a firm processing 100 client portfolios manually, spending an average of 2 hours per portfolio per month on administrative tasks. Implementing software that automates these tasks could reduce the time to 30 minutes per portfolio. This translates to a substantial time saving, freeing up staff for higher-value activities and reducing labor costs. Furthermore, improved accuracy in portfolio management and reporting can minimize compliance risks and potential fines, resulting in significant cost savings.

Calculating ROI: A Simple Example

Let’s illustrate a simplified ROI calculation. Suppose a firm invests $10,000 in wealth management software annually (subscription model). Through automation and improved efficiency, they save $5,000 annually in labor costs and another $3,000 annually by reducing errors and improving investment performance. The net benefit is $8,000 annually ($5,000 + $3,000). The ROI is then calculated as:

ROI = (Net Benefit / Investment Cost) x 100%

ROI = ($8,000 / $10,000) x 100% = 80%

This demonstrates a significant return on investment. However, this is a simplified example. A real-world calculation would require a more detailed cost-benefit analysis considering all aspects of implementation and usage. Remember, the true value often extends beyond simple cost savings to encompass improved client relationships, enhanced regulatory compliance, and the ability to scale the business more effectively.

Future Trends in Wealth Management Software

The world of wealth management is undergoing a thrilling metamorphosis, fueled by technological advancements that promise to revolutionize how we manage, protect, and grow our assets. Forget dusty ledgers and frantic phone calls; the future is sleek, intelligent, and surprisingly witty. Prepare for a whirlwind tour of the exciting innovations shaping the next decade of wealth management software.

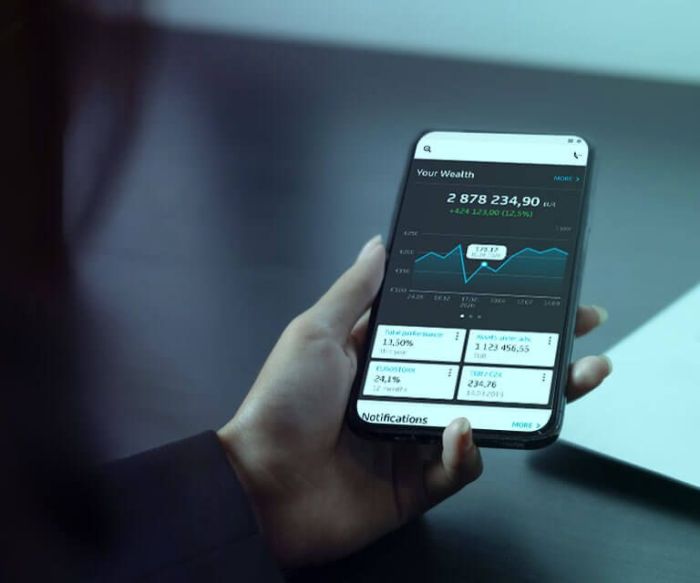

The integration of cutting-edge technologies is not merely an upgrade; it’s a paradigm shift, transforming the very essence of financial advisory. We’re moving beyond simple record-keeping towards a proactive, predictive, and personalized experience for both advisors and clients. This shift promises to enhance efficiency, increase accuracy, and, most importantly, deliver better investment outcomes.

Artificial Intelligence and Machine Learning in Wealth Management

AI and ML are no longer futuristic fantasies; they’re actively reshaping the wealth management landscape. Imagine software that can analyze market trends with superhuman speed, identify potentially lucrative investment opportunities before they even hit the mainstream, and personalize investment strategies with laser-like precision. This is the power of AI and ML in action. For instance, AI-powered robo-advisors are already providing automated portfolio management services to a growing number of investors, offering customized solutions at a fraction of the cost of traditional advisors. Furthermore, machine learning algorithms can analyze vast datasets of client information to identify patterns and predict future financial needs, enabling proactive financial planning and risk management. The result? More efficient portfolio management, reduced human error, and a significantly enhanced client experience. Think of it as having a tireless, hyper-intelligent financial assistant working 24/7.

Blockchain Technology and Enhanced Security

Blockchain technology, the backbone of cryptocurrencies, is poised to revolutionize the security and transparency of wealth management. Its decentralized and immutable nature makes it virtually impervious to fraud and data breaches. Imagine a system where every transaction is recorded on a secure, shared ledger, accessible only to authorized parties. This eliminates the risk of data manipulation and provides unparalleled transparency for both advisors and clients. Furthermore, blockchain can streamline processes like KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, reducing administrative burdens and enhancing regulatory adherence. While still in its early stages of adoption in the wealth management sector, blockchain’s potential to transform the industry is undeniable. Think of it as a fortress of financial security, protecting assets with unbreakable encryption.

Emerging Technologies Shaping the Future of Wealth Management Software

The next 5-10 years will witness a convergence of technologies that will further redefine wealth management. Expect to see the rise of hyper-personalization, driven by advanced analytics and AI, tailoring investment strategies to individual client needs and risk profiles with unprecedented accuracy. The integration of virtual and augmented reality (VR/AR) will provide immersive experiences for clients, allowing them to visualize their financial future and interact with their portfolios in engaging new ways. Imagine walking through a virtual representation of your investment portfolio, or using AR to overlay financial data onto the real world, instantly understanding the performance of your investments. Furthermore, the increasing adoption of cloud-based solutions will enable seamless access to data and services from anywhere in the world, further enhancing efficiency and convenience. This future isn’t science fiction; it’s rapidly becoming reality.

Case Studies

Successful wealth management software implementations aren’t just fairy tales whispered around boardrooms; they’re real-world triumphs, brimming with lessons learned and riches gained (metaphorically speaking, of course – though a healthy ROI is a nice bonus!). Let’s delve into some examples that showcase the power of smart software in the often-chaotic world of finance.

Successful Implementation at “Prosperous Portfolios”

Prosperous Portfolios, a mid-sized wealth management firm, faced a significant challenge: their aging systems were slowing down their operations and hindering their ability to provide top-notch client service. Their advisors spent more time wrestling with spreadsheets than crafting winning investment strategies. After implementing “WealthWise” software, a cloud-based solution, Prosperous Portfolios saw a dramatic shift. The software streamlined their workflow, automating many manual processes such as portfolio rebalancing and reporting. This freed up advisors to focus on building stronger client relationships and acquiring new clients. Furthermore, WealthWise’s robust reporting capabilities allowed for better performance tracking and improved client communication. The implementation wasn’t without its hurdles; initial training required a significant time investment, and some resistance from staff accustomed to the old ways was encountered. However, through comprehensive training and ongoing support, these challenges were overcome.

The key takeaway from Prosperous Portfolios’ experience is that choosing the right software and investing in thorough employee training are crucial for a successful implementation. The resulting increase in efficiency and client satisfaction far outweighs the initial investment of time and resources.

Leveraging Wealth Management Software Across Diverse Organizations

Several organizations have demonstrated the versatility of wealth management software. “Global Investments,” a large multinational firm, used a sophisticated system to manage its global portfolio, enabling real-time monitoring and risk management across multiple markets and asset classes. This enhanced their ability to respond quickly to market fluctuations and optimize investment strategies. In contrast, “Family First Financial,” a smaller, family-owned firm, used a simpler system focused on client relationship management (CRM) and personalized financial planning. This improved their client communication and allowed for more tailored advice. These examples highlight how different organizations can tailor wealth management software to meet their unique needs and scale.

Hypothetical Case Study: “Future Forward Financial”

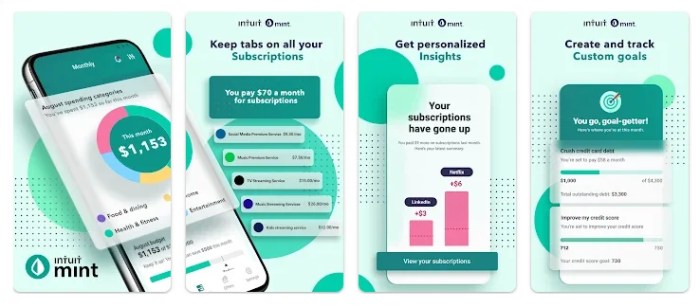

Let’s imagine “Future Forward Financial,” a fictional financial advisory firm specializing in millennial investors. They’re experiencing rapid growth but struggling to keep up with client demands. By adopting “FinTech Fusion,” a cutting-edge wealth management software, Future Forward Financial could achieve several significant benefits. FinTech Fusion’s mobile-first design would cater to their tech-savvy clientele, allowing clients to access their portfolios and communicate with advisors anytime, anywhere. The software’s integrated robo-advisor capabilities could handle routine tasks, freeing up human advisors to focus on more complex financial planning and building stronger relationships. Moreover, FinTech Fusion’s robust analytics tools would provide valuable insights into client behavior and market trends, enabling Future Forward Financial to proactively tailor their services and enhance client retention. The initial investment would be offset by increased efficiency, reduced operational costs, and improved client satisfaction, ultimately leading to substantial growth and a stronger market position.

Final Thoughts

So, there you have it – a whirlwind tour through the world of wealth management software. While the potential for financial gain is certainly alluring (and let’s be honest, who doesn’t love the idea of more money?), the true value lies in the efficiency and security these systems provide. From streamlining workflows to safeguarding sensitive data, the right software can transform the way you manage your finances, turning the often-daunting task into something… dare we say… manageable? While the occasional software glitch might send a shiver down your spine (or induce a fit of laughter depending on your personality), the overall benefits are undeniable. Now, if you’ll excuse me, I have a spreadsheet to conquer.

Questions and Answers

What are the typical costs associated with Wealth Management Software?

Costs vary wildly depending on features, scalability, and vendor. Expect to pay anywhere from a modest monthly subscription to a hefty annual license fee that could fund a small island nation. Do your research!

How easy is it to switch from one wealth management software to another?

Think migrating a flock of particularly stubborn geese. Data migration can be a complex and time-consuming process, requiring careful planning and potentially professional assistance. Don’t underestimate the effort involved.

What happens if my wealth management software experiences a system failure?

This is where robust backup and recovery procedures become your new best friends. Reputable providers will have detailed plans in place, but it’s always wise to ask specific questions about their disaster recovery capabilities.

Can I use Wealth Management Software on my mobile device?

Most modern solutions offer mobile apps or responsive web interfaces, allowing you to monitor your portfolio from practically anywhere (even the beach, though we don’t recommend making major investment decisions while sunbathing).