Financial Planning Process Review: Navigating the often-treacherous waters of personal finance requires a sturdy vessel—a well-crafted financial plan. But even the sturdiest ships need regular maintenance, and that’s where a thorough review comes in. This process isn’t just about tweaking numbers; it’s about ensuring your financial trajectory aligns with your evolving life goals, risk tolerance, and, let’s be honest, your dreams of early retirement (or at least a comfortable one!). We’ll explore the crucial steps involved, from gathering data to implementing changes, ensuring your financial future remains smooth sailing.

This comprehensive guide delves into the intricacies of reviewing your financial plan, covering everything from identifying the need for a review to implementing and monitoring the revised plan. We’ll examine both proactive and reactive approaches, highlighting the importance of regular check-ups and addressing common pitfalls. We’ll even equip you with the tools and strategies to effectively communicate with your financial advisor, ensuring you’re both on the same page (and heading in the same direction!).

Defining the Scope of a Financial Planning Process Review

So, you’ve got a financial plan. Fantastic! Think of it as a meticulously crafted roadmap to your financial Everest. But even the most detailed map needs occasional updates, especially when unexpected blizzards (market crashes) or unforeseen shortcuts (inheritance) appear. This section will illuminate the crucial process of reviewing your financial plan, ensuring you’re still on track to conquer your financial peak (or at least a comfortably funded retirement).

Typical Components of a Comprehensive Financial Plan

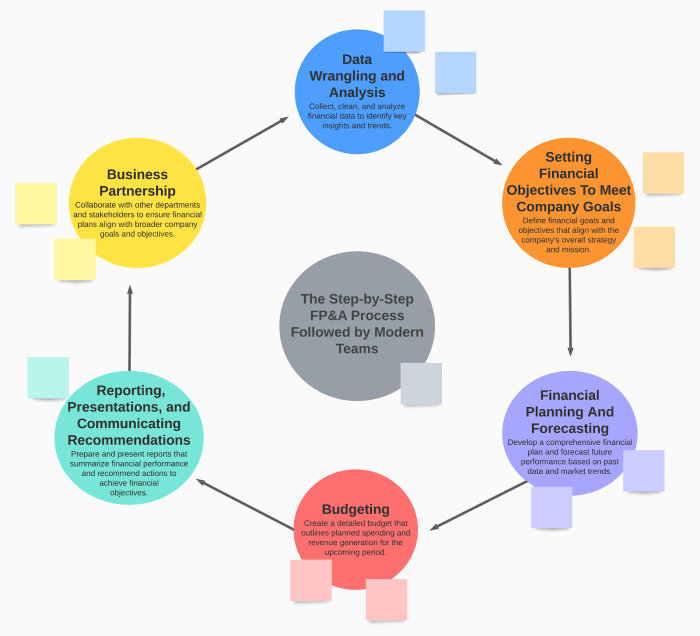

A comprehensive financial plan is more than just a wish list for a Lamborghini. It’s a holistic view of your financial life, encompassing various key areas. These typically include a detailed analysis of your current financial situation (assets, liabilities, income, expenses), retirement planning (pensions, investments, social security), investment strategies (asset allocation, risk tolerance), estate planning (wills, trusts), tax planning, insurance coverage (life, health, disability), and debt management. Think of it as a financial orchestra – each instrument (component) playing its part in harmony to achieve your financial goals. Missing a crucial instrument (or failing to tune it regularly) can lead to a less than harmonious outcome.

Circumstances Necessitating a Financial Planning Process Review

Life, as they say, is what happens when you’re busy making other plans. Significant life events often necessitate a review of your financial plan. These events can be joyous (marriage, birth of a child, inheritance) or challenging (job loss, divorce, unexpected medical expenses). Essentially, any event that substantially alters your income, expenses, assets, liabilities, or risk tolerance should trigger a review. Ignoring these changes is like navigating with a map from the last century – you’re likely to end up somewhere completely unexpected (and potentially undesirable).

Periodic Review Versus Reactive Review

The difference between a periodic and a reactive review is akin to the difference between preventative maintenance and emergency repairs on your car. A *periodic review* is a proactive measure, scheduled at regular intervals (e.g., annually or biennially) to ensure your plan remains aligned with your goals and current circumstances. A *reactive review*, on the other hand, is triggered by a specific event or significant change, necessitating immediate adjustments. While reactive reviews are necessary, a proactive approach minimizes the need for frantic last-minute adjustments.

Examples of Situations Requiring an Immediate Review

Let’s face it, some situations demand immediate attention. A sudden job loss, a major health crisis, or a significant market downturn all require an immediate review to assess the impact on your financial plan and implement necessary adjustments. Similarly, unexpected inheritance or a windfall could also require an immediate review to incorporate the new funds effectively and strategically. Delaying action in these situations can exacerbate the problem and potentially lead to irreversible financial damage. Think of it as a financial emergency room visit – you don’t schedule these, they happen unexpectedly.

Comparison of Proactive vs. Reactive Review Approaches

| Trigger | Frequency | Scope | Benefits |

|---|---|---|---|

| Regular life milestones (e.g., marriage, birth of a child), market fluctuations | Annual or Biannual | Comprehensive review of all aspects of the financial plan | Early identification and mitigation of potential risks, optimization of investment strategy, improved financial well-being |

| Job loss, major illness, divorce, unexpected inheritance | Immediate | Focused review of impacted areas of the financial plan | Swift adaptation to unforeseen circumstances, prevention of financial distress, opportunity to capitalize on new situations |

Data Gathering and Analysis for the Review

Embarking on a financial planning process review is like embarking on a treasure hunt – except the treasure is a clearer understanding of your client’s financial landscape. The first step? Gathering the necessary data. This isn’t just about collecting numbers; it’s about building a comprehensive picture, a financial portrait if you will, that captures the full story of your client’s financial life. Without the right data, your analysis will be as useful as a chocolate teapot.

A Step-by-Step Guide to Data Collection

Collecting client financial data requires a systematic approach, lest you find yourself drowning in a sea of spreadsheets. Think of it as a carefully orchestrated symphony, where each instrument (data point) plays its part to create a harmonious whole (a complete financial picture). Our method involves clear communication, meticulous organization, and a healthy dose of patience (because, let’s face it, some clients are slower to respond than a sloth on tranquilizers).

- Initial Contact and Explanation: Begin by clearly explaining the purpose of the data collection and the types of information needed. Reassure clients about data confidentiality and security.

- Secure Data Transfer: Establish a secure method for clients to submit documents, such as a password-protected online portal or encrypted email.

- Organized Data Request: Provide a checklist of required documents and a clear timeline for submission. This keeps things orderly and prevents unnecessary delays (and avoids the dreaded “Where’s Waldo?” game with missing documents).

- Follow-up and Clarification: Regularly check in with clients to ensure they’re making progress and address any questions or concerns promptly. Remember, a little proactive communication goes a long way.

- Data Verification: Once received, immediately verify the accuracy and completeness of the data, ensuring consistency across different sources.

Verifying Data Accuracy and Completeness

Accuracy is paramount; after all, we’re dealing with someone’s financial future! Verifying data involves more than just a quick glance. It requires a thorough cross-check of all provided information. Imagine it as a detective meticulously examining clues – no detail is too small.

We use a multi-pronged approach to verification. This includes comparing data from multiple sources (like bank statements and tax returns), performing reasonableness checks (making sure numbers align with expectations), and flagging any inconsistencies for further investigation. If a number looks suspiciously off, we don’t just assume it’s a typo; we dig deeper to ensure its accuracy.

Challenges in Obtaining Necessary Information and Solutions, Financial Planning Process Review

Gathering complete and accurate financial data can sometimes feel like herding cats. Clients might be hesitant to share sensitive information, documents may be misplaced, or there might be a lack of clear financial records.

To address these challenges, we build rapport with clients, explaining the importance of complete data for a successful review. We offer flexible data submission methods, and if necessary, we guide clients on organizing their financial records. Patience, persistence, and a good sense of humor are essential tools in this process.

Key Financial Documents Needed

A thorough financial review requires a comprehensive collection of documents. Think of this list as your financial planning toolkit – without these essentials, your review will be incomplete and unreliable.

- Tax Returns (past 3-5 years)

- Investment Statements (brokerage accounts, retirement accounts)

- Bank and Credit Card Statements (past 3-6 months)

- Insurance Policies (life, health, disability, long-term care)

- Estate Planning Documents (wills, trusts)

- Debt Schedules (loans, mortgages)

- Payroll Records (if applicable)

Client Goals and Expectations Questionnaire

Understanding client goals is crucial for tailoring the review to their specific needs. This isn’t about imposing a one-size-fits-all approach; it’s about creating a personalized plan that aligns with their aspirations. This questionnaire acts as a roadmap, guiding both the client and the advisor towards a shared understanding of the review’s objectives.

| Question | Purpose |

|---|---|

| What are your primary financial goals for the next 5-10 years? | Identify short-term and long-term objectives. |

| What are your biggest financial concerns? | Understand areas requiring immediate attention. |

| What are your expectations for this financial planning review? | Set realistic expectations and avoid misunderstandings. |

| What level of risk are you comfortable taking with your investments? | Assess risk tolerance and investment strategies. |

| What is your preferred method of communication? | Ensure efficient and effective communication throughout the review process. |

Evaluating the Current Financial Plan: Financial Planning Process Review

So, the data’s been gathered, the spreadsheets are shimmering, and now comes the fun part: judging the effectiveness of the current financial plan. Think of it as a financial performance review, but instead of a boss, you have a client (hopefully a much nicer one!). This section focuses on a thorough assessment of the existing strategy, ensuring it aligns with the client’s goals and risk appetite. We’ll dissect the investment approach, analyze the asset allocation, and identify any potential shortcomings, all while keeping a lighthearted (but professional!) tone.

Assessing Investment Strategy Effectiveness

Evaluating the effectiveness of an existing investment strategy requires a multi-faceted approach. We start by comparing the portfolio’s actual performance against its benchmark (e.g., the S&P 500 for a broad market index fund). We then analyze the portfolio’s risk-adjusted return using metrics like the Sharpe ratio, which measures risk-adjusted return, and the Sortino ratio, which focuses on downside risk. Significant deviations from the benchmark or suboptimal risk-adjusted returns signal a need for potential adjustments. For instance, if a client’s portfolio significantly underperformed its benchmark over a prolonged period, despite a seemingly appropriate risk profile, a review of the underlying investment strategy (including fund manager performance, expense ratios, and asset class allocation) is warranted. Conversely, consistent outperformance may warrant a review to ensure the client’s risk tolerance remains appropriate for the higher-return strategy.

Evaluating Progress Toward Financial Goals

Measuring progress toward financial goals is crucial. We use a combination of quantitative and qualitative assessments. Quantitatively, we track the client’s net worth, savings rate, and progress toward specific targets (e.g., retirement savings, down payment for a house). Qualitatively, we gauge the client’s satisfaction with their financial situation and their confidence in achieving their goals. Let’s say a client aims to retire in 15 years with $2 million. We can model various scenarios (optimistic, pessimistic, and most likely) to show their current progress and identify any potential shortfalls. If the projections show a shortfall, we can adjust the savings rate, investment strategy, or retirement timeline to bring them back on track.

Comparing Investment Approaches

Different investment approaches are characterized by varying levels of risk and expected return. A conservative approach, suitable for risk-averse clients with shorter time horizons, might focus on low-risk investments like bonds and money market accounts. Conversely, a more aggressive approach, appropriate for risk-tolerant clients with longer time horizons, might include a higher allocation to equities and alternative investments. Consider two clients: one nearing retirement (short time horizon, low risk tolerance) and another just starting their career (long time horizon, high risk tolerance). The first client might benefit from a portfolio heavily weighted towards bonds and fixed income, while the second could allocate a larger portion to stocks and potentially other higher-growth assets. The key is aligning the investment strategy with the individual’s specific circumstances and risk profile.

Analyzing Asset Allocation and Suggesting Adjustments

Asset allocation is the cornerstone of investment strategy. We analyze the client’s current asset allocation (e.g., percentage of stocks, bonds, real estate) and compare it to their target allocation based on their risk profile and financial goals. Significant deviations from the target allocation could indicate a need for rebalancing. For example, if a client’s stock allocation has grown significantly due to market gains, exceeding their target allocation, we might recommend selling some stocks and investing in bonds to bring the portfolio back to its target allocation. This process helps manage risk and maintain the desired level of diversification.

Common Shortcomings in Financial Plans and Their Solutions

Financial plans, even the most meticulously crafted, can fall short. A common issue is the lack of contingency planning for unexpected events (job loss, medical emergencies). Another common area of weakness is failing to account for inflation’s eroding effect on purchasing power. A third frequent problem is insufficient diversification across asset classes, leading to excessive risk. To address these shortcomings, we incorporate contingency planning into the financial plan, regularly adjust goals for inflation, and recommend diversified portfolios across multiple asset classes, potentially including alternative investments like real estate or commodities. This proactive approach helps mitigate potential risks and ensure the plan remains robust even in the face of unforeseen circumstances.

Developing Recommendations and Action Plans

Crafting the perfect financial plan is like baking a delicious cake – you need the right ingredients (data analysis), the proper mixing (evaluation), and finally, the perfect frosting (recommendations). This section details how to transform our insightful findings into actionable steps, ensuring your clients not only understand their financial future but also feel empowered to shape it.

The process of developing personalized recommendations requires a structured approach that moves beyond simply stating the obvious. We need to analyze the client’s risk tolerance, financial goals, and current financial situation to provide tailored advice that resonates and motivates action. This isn’t about throwing numbers at a wall and hoping something sticks; it’s about crafting a roadmap to financial success.

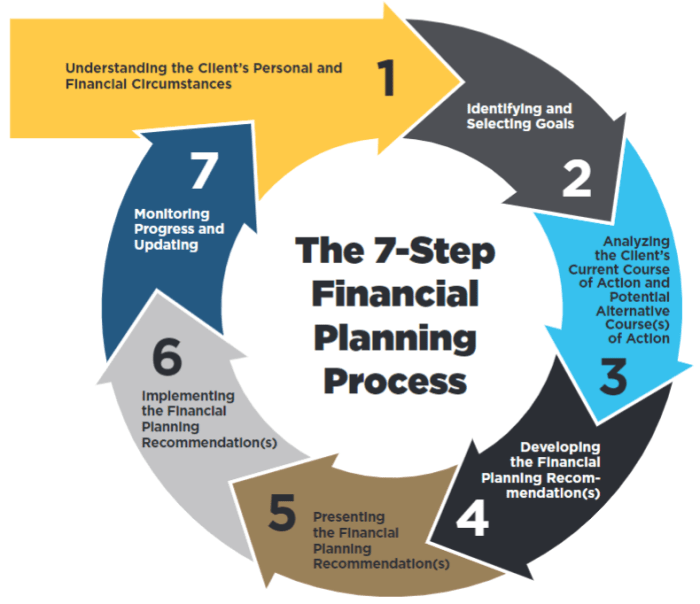

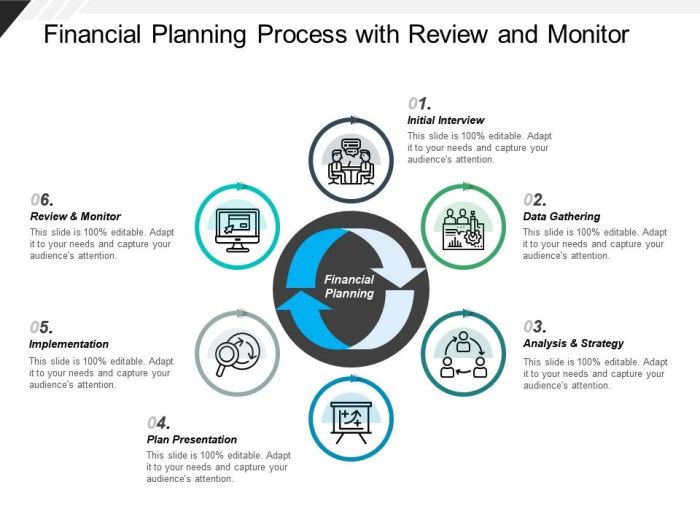

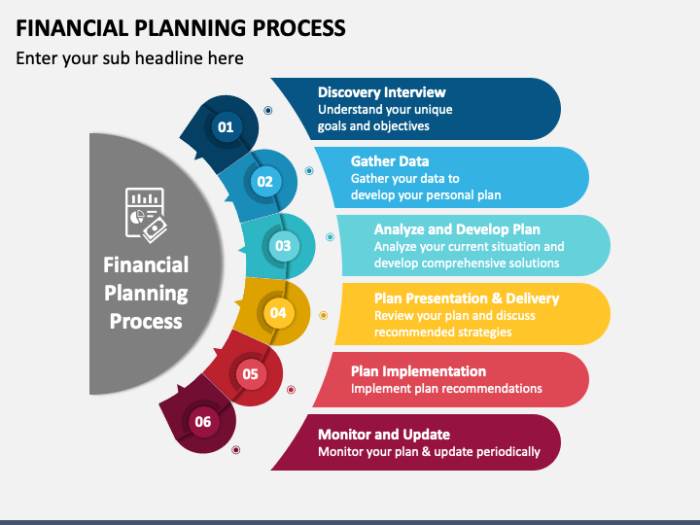

Structured Approach to Formulating Recommendations

Our recommendation process follows a three-pronged approach: identifying key areas for improvement, proposing specific strategies, and prioritizing actions based on impact and feasibility. First, we pinpoint the most impactful areas needing adjustment, whether it’s aggressive debt reduction, diversified investment strategies, or estate planning. Second, we suggest concrete strategies aligned with the client’s goals and risk profile, possibly involving specific investment vehicles, debt consolidation techniques, or tax optimization strategies. Finally, we prioritize these actions, considering both their potential impact and the client’s ability to implement them. This phased approach ensures recommendations are not only effective but also practical and achievable.

Sample Action Plan Template

A well-structured action plan is crucial for successful implementation. The following template provides a clear framework:

| Task | Timeline | Responsible Party | Status | Notes |

|---|---|---|---|---|

| Review and adjust investment portfolio allocation | Within 30 days | Client and Financial Planner | Pending | Consider shifting 15% to lower-risk bonds |

| Establish a monthly debt repayment plan | Within 14 days | Client | In Progress | Utilize the snowball method for faster payoff |

| Consult with an estate planning attorney | Within 60 days | Client | To Do | Explore options for trusts and wills |

Communicating Complex Financial Information

Communicating complex financial information effectively requires avoiding jargon and focusing on the client’s specific goals. We translate complex financial concepts into plain English, using visual aids like charts and graphs to illustrate key points. For example, instead of saying “optimize your asset allocation within a risk-adjusted framework,” we might say, “Let’s make sure your investments are working as hard as possible while minimizing your risk.” The use of analogies and relatable examples further enhances understanding.

Presenting Options and Recommendations

Presenting options involves clearly outlining the potential benefits and drawbacks of each approach, allowing the client to make informed decisions. We utilize scenario planning to showcase the potential outcomes of different choices, making the decision-making process transparent and engaging. For example, we could show them two scenarios: one with aggressive debt reduction and another with a more moderate approach, highlighting the differences in timelines and overall financial outcomes. This visual representation facilitates a better understanding and empowers the client to actively participate in the decision-making process.

Common Financial Planning Adjustments and Their Potential Impacts

Understanding the potential impact of adjustments is key.

- Increased Retirement Contributions: Potential impact: Reduced current disposable income, but significantly increased retirement savings and potential tax benefits.

- Debt Consolidation: Potential impact: Lower monthly payments, but potentially higher overall interest paid if not carefully managed.

- Diversification of Investment Portfolio: Potential impact: Reduced risk, but potentially lower returns in the short term.

- Estate Planning Implementation: Potential impact: Protection of assets for heirs, reduced estate taxes, and peace of mind.

Implementing and Monitoring the Revised Plan

Putting your meticulously crafted financial plan into action is where the real fun begins – or at least, where the real rewards start to materialize. This isn’t about passively watching your investments grow like a particularly well-fertilized money tree; it’s about active management, strategic adjustments, and the satisfying feeling of progress towards your financial goals. Think of it as the exciting, hands-on phase, where theory meets reality (and hopefully, reality is quite generous).

Implementing the agreed-upon recommendations requires a coordinated effort, much like a well-orchestrated symphony (but hopefully with fewer temperamental soloists). It involves a series of steps, from making necessary account changes to setting up automated systems for tracking progress. The key is to ensure a smooth transition, minimizing disruption while maximizing efficiency. We’re aiming for a seamless shift, not a chaotic scramble.

Implementation Process

The implementation process begins with a clear action plan, assigning specific tasks with deadlines and responsibilities. This ensures accountability and prevents tasks from falling through the cracks – a fate worse than a poorly diversified portfolio. Next, we’ll work to put these actions into motion, which might involve opening new accounts, adjusting investment allocations, or even scheduling regular contributions. Finally, we’ll document everything meticulously. This isn’t just about creating a paper trail; it’s about building a robust system for future reference and analysis. Think of it as creating a detailed financial autobiography – only far less boring.

Progress Tracking and Measurement

Tracking progress is crucial; it allows us to celebrate victories (even small ones!) and identify areas needing attention before they become major problems. We’ll use a combination of methods, including regular portfolio reviews, performance reports, and key performance indicators (KPIs) tailored to your specific goals. For example, if your goal is to buy a house in five years, we’ll track your savings progress against that target, ensuring you stay on track. If you’re aiming for early retirement, we’ll monitor your investment growth and adjust your strategy as needed. We’ll be your financial Sherpas, guiding you towards the summit.

Importance of Regular Monitoring and Adjustments

Regular monitoring isn’t just about checking the numbers; it’s about staying agile and adaptable. The financial landscape is constantly shifting, much like a particularly mischievous sand dune. Unexpected events, market fluctuations, and even changes in your personal circumstances can impact your plan. Regular reviews allow us to make timely adjustments, ensuring your plan remains relevant and effective. Think of it as preventative maintenance for your financial well-being – far less expensive than emergency repairs.

Effective Communication Strategies

Keeping you informed and engaged is paramount. We’ll use a variety of communication methods, including regular meetings, email updates, and online portals providing access to your portfolio performance. We’ll explain complex financial concepts in clear, concise language, avoiding jargon that could send you running for the hills. Open communication ensures transparency and fosters a collaborative approach to achieving your financial goals. Consider us your financial translators, deciphering the often cryptic language of the financial world.

Ongoing Plan Maintenance

The process of ongoing plan maintenance is a cyclical journey, not a one-time event.

Regular reviews (at least annually) are essential to ensure the plan remains aligned with your goals.

Adjustments are made based on performance, market conditions, and life changes.

Communication is key to keeping the client informed and engaged throughout the process.

Final Conclusion

Ultimately, a Financial Planning Process Review is not just about numbers and spreadsheets; it’s about securing your future and achieving your financial aspirations. By proactively reviewing and adjusting your plan, you’re taking control of your financial destiny, ensuring it aligns with your evolving life circumstances and goals. So, ditch the financial anxieties and embrace the empowering process of regularly assessing and refining your path to financial well-being. Remember, a little planning can go a long way—especially when it involves potentially more money!

Q&A

What if my financial situation hasn’t changed significantly? Do I still need a review?

Even without major life changes, a periodic review is crucial. Market fluctuations, tax law updates, and even your own evolving goals necessitate regular assessments to ensure your plan remains optimal.

How often should I review my financial plan?

The frequency depends on individual circumstances. Annual reviews are generally recommended, but more frequent reviews might be necessary during periods of significant life changes (marriage, birth, job loss, etc.).

What if I don’t have all the necessary documents for a review?

Don’t panic! Your financial advisor can guide you through the process of obtaining missing documents. It’s better to have an incomplete review than none at all. Start with what you have and work from there.

Can I do a financial plan review myself, or do I need a professional?

While you can certainly review your own plan, a professional advisor offers valuable expertise and an objective perspective, potentially uncovering blind spots you might miss.