Wealth Management Strategies Review: Embark on a hilarious yet insightful journey into the often-serious world of financial planning! We’ll dissect the complexities of building wealth, from shrewd investments to the surprisingly entertaining aspects of tax planning. Prepare for a rollercoaster ride of financial wisdom and witty observations – your portfolio (and your sense of humor) will thank you.

This comprehensive review explores various wealth management strategies, catering to diverse financial situations and risk appetites. We’ll navigate the treacherous waters of investment vehicles, uncover the secrets to effective risk management, and even delve into the surprisingly engaging world of estate planning. Think of it as a financial self-help book, but funnier. Much funnier.

Defining Wealth Management Strategies

Ah, wealth management strategies – the stuff of dreams (and spreadsheets!). It’s not just about piling up cash like Scrooge McDuck; it’s a sophisticated dance of investment, risk mitigation, and long-term planning, all orchestrated to achieve your financial goals. Think of it as a finely-tuned engine, powering your financial future towards a comfortable retirement, a dream home, or perhaps a private island (we don’t judge).

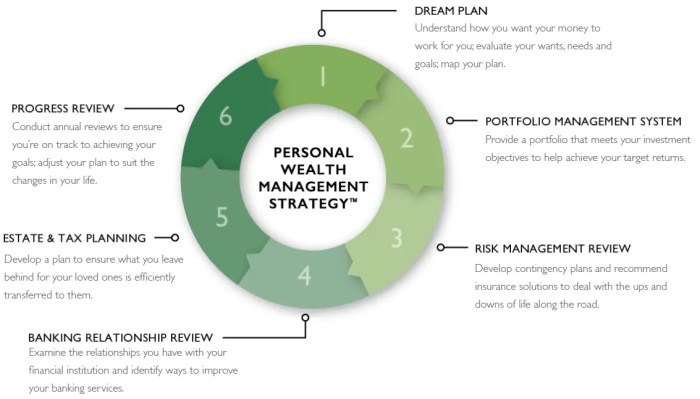

Wealth management strategies encompass a holistic approach to managing your financial resources. This includes, but is certainly not limited to, shrewd investment strategies to grow your wealth, proactive risk management to protect it from unforeseen circumstances, meticulous tax planning to minimize your tax burden (because who doesn’t love a good tax break?), and thoughtful estate planning to ensure your legacy is handled with grace and efficiency, avoiding any potentially awkward family squabbles over your prized collection of rubber ducks.

Types of Wealth Management Strategies

The right strategy isn’t a one-size-fits-all affair. It depends heavily on your unique financial situation, risk tolerance, and, of course, your dreams. A young professional starting out will have very different needs than a seasoned executive nearing retirement. For example, a young professional with a high risk tolerance and a long time horizon might lean towards aggressive growth strategies, while someone closer to retirement might prioritize capital preservation and income generation.

Considerations for Selecting Wealth Management Strategies

Choosing the right strategy involves careful consideration of several key factors. Firstly, defining your financial goals is paramount. Are you saving for a down payment on a house? Planning for your children’s education? Or perhaps aiming for early retirement on a tropical beach? Knowing your goals allows you to tailor a strategy that aligns perfectly with your ambitions. Next, assessing your risk tolerance is crucial. Are you a thrill-seeker, comfortable with potentially higher returns alongside higher risk, or do you prefer a more conservative approach with steadier, albeit potentially lower, returns? Finally, understanding your time horizon is essential. The longer you have until you need the money, the more risk you can generally afford to take. For instance, a young investor with a 30-year time horizon can potentially weather market downturns more easily than someone nearing retirement who needs their funds within the next five years. A diverse portfolio is often recommended, diversifying across asset classes to spread risk and potentially enhance returns. This might include stocks, bonds, real estate, and other alternative investments. Remember, it’s always wise to seek professional advice from a qualified financial advisor to help navigate this complex landscape. They can help you develop a personalized strategy tailored to your unique circumstances and aspirations.

Investment Strategies within Wealth Management

Investing your hard-earned cash wisely is a bit like choosing a superhero for your financial future – you want one with the right powers for the job! Different investment vehicles offer distinct risk-reward profiles, and understanding these nuances is crucial for building a portfolio that aligns with your financial goals and risk tolerance. Let’s dive into the exciting (and sometimes slightly terrifying) world of investment strategies.

Selecting the right investment vehicles is a delicate balancing act, much like juggling chainsaws (don’t try this at home!). It’s about understanding the potential for growth versus the potential for, shall we say, a less-than-stellar outcome. Each vehicle carries its own set of risks and rewards, and the ideal mix depends heavily on your individual circumstances and appetite for adventure (or lack thereof).

Comparison of Investment Vehicles

Stocks, bonds, mutual funds, real estate, and alternative investments each present unique opportunities and challenges. Stocks, representing ownership in a company, offer potentially high returns but also carry significant volatility. Bonds, essentially loans to governments or corporations, generally offer lower returns but are considered less risky. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, offering diversification benefits. Real estate, a tangible asset, can provide both income and appreciation potential but requires significant capital and can be illiquid. Finally, alternative investments, such as hedge funds or private equity, often target high returns but usually come with higher risks and less transparency.

Sample Portfolio Allocation Strategies

Designing a portfolio is like building a delicious financial cake – you need the right ingredients in the right proportions. The ideal mix depends entirely on your appetite for risk. Below are examples of asset allocations for different investor profiles. Remember, these are just examples, and individual circumstances may require a different approach.

| Investor Profile | Stocks | Bonds | Real Estate | Alternative Investments |

|---|---|---|---|---|

| Conservative | 20% | 70% | 10% | 0% |

| Moderate | 50% | 30% | 10% | 10% |

| Aggressive | 70% | 10% | 10% | 10% |

The conservative investor prioritizes capital preservation, hence the heavy weighting in bonds. The moderate investor seeks a balance between risk and return, while the aggressive investor is willing to take on more risk for potentially higher rewards. It’s crucial to remember that past performance is not indicative of future results – even the most seasoned financial superhero can’t predict the future with complete accuracy!

Diversification and Risk Management Best Practices

Diversification is your financial safety net, a bit like having multiple parachutes on a particularly daring skydiving adventure. Spreading investments across different asset classes reduces the impact of any single investment’s underperformance. Risk management involves identifying and mitigating potential threats to your portfolio. This might include setting stop-loss orders on individual stocks or using hedging strategies to protect against market downturns. Remember, a well-diversified portfolio is not a guarantee against losses, but it significantly reduces the likelihood of catastrophic events.

“Don’t put all your eggs in one basket” – A timeless piece of financial wisdom that holds true regardless of market conditions.

Risk Management in Wealth Management: Wealth Management Strategies Review

Navigating the world of finance is like navigating a particularly treacherous pirate ship – thrilling, potentially lucrative, and prone to unexpected squalls. Risk management, therefore, isn’t just a good idea; it’s the sturdy mast that keeps your financial vessel afloat. Ignoring it is akin to sailing without a map, relying solely on the whims of Neptune (who, let’s face it, has a rather capricious sense of humor).

Effective risk management in wealth management involves understanding and mitigating potential threats to your financial well-being. This isn’t about avoiding risk altogether – a little calculated risk is the spice of life (and investment!) – but rather about strategically minimizing the chances of a catastrophic shipwreck.

Common Financial Risks

Market volatility, inflation, and interest rate fluctuations are the financial equivalent of those pesky sea monsters that lurk beneath the waves, ready to snatch your treasure (or at least a significant portion of it). Market volatility refers to the unpredictable swings in the value of investments. Imagine a roller coaster – exhilarating at times, terrifying at others. Inflation, on the other hand, is the slow but steady erosion of your purchasing power; it’s like a persistent leak in your financial hull, slowly letting your wealth drain away. Interest rate changes, meanwhile, can impact everything from mortgages to savings accounts, acting as unpredictable currents that can either push you forward or drag you under. Understanding these risks is the first step towards navigating them successfully.

Risk Mitigation Techniques

Fortunately, there are several techniques to mitigate these financial risks, allowing you to steer clear of the most dangerous waters. Hedging, for instance, involves taking a position that offsets potential losses from another investment. Think of it as having a backup plan – if one venture fails, the other can potentially cushion the blow. Diversification is another crucial strategy, spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the impact of any single investment’s underperformance. This is akin to having multiple cargo holds on your ship; if one gets damaged, the others can still carry the load. Insurance, finally, provides a safety net against unforeseen events, like a sturdy life raft in case of a shipwreck. It won’t prevent the storm, but it will help you survive.

Risk Tolerance and Investment Strategies

The optimal approach to risk management depends significantly on individual circumstances and preferences. Below is a table illustrating different risk tolerance levels and their corresponding investment strategies. Remember, this is just a guideline; consulting a financial advisor is crucial for personalized advice.

| Risk Tolerance | Investment Strategy | Asset Allocation | Potential Return/Risk |

|---|---|---|---|

| Conservative | Focus on capital preservation; low-risk investments | High percentage in bonds, low percentage in stocks | Low return, low risk |

| Moderate | Balance between growth and preservation; diversified portfolio | Balanced mix of stocks and bonds | Moderate return, moderate risk |

| Aggressive | Prioritize growth potential; higher-risk investments | High percentage in stocks, potentially including alternative investments | High return, high risk |

| Speculative | High-risk, high-reward investments; often focused on short-term gains | High percentage in volatile assets like options or cryptocurrencies | Potentially very high return, extremely high risk |

Tax Planning and Wealth Management

Let’s face it, nobody loves taxes. But understanding how tax laws interact with your investments is crucial for building – and *keeping* – wealth. Ignoring taxes is like trying to fill a bucket with holes; you’ll never quite reach your financial goals. Proper tax planning isn’t just about minimizing your tax bill; it’s about maximizing your long-term returns.

Tax laws significantly impact investment returns and wealth accumulation by directly affecting the amount of money you get to keep after paying taxes. High tax rates can dramatically reduce the overall growth of your investments, while smart tax planning can help you retain a larger portion of your hard-earned gains. Think of it as a financial game of whack-a-mole: the government is trying to get its share, and you’re trying to strategically avoid its mallet. The more you understand the rules, the better you’ll play.

Tax-Efficient Investment Strategies

Tax-efficient investing involves choosing investments that minimize your tax liability. This can involve utilizing strategies that defer or reduce taxes on capital gains, dividends, and interest income. For example, investing in tax-advantaged accounts like 401(k)s and IRAs allows for tax-deferred growth, meaning you only pay taxes when you withdraw the money in retirement. This allows your investments to compound tax-free for years, significantly boosting your overall returns. Another example is the strategic use of tax-loss harvesting, where you sell losing investments to offset capital gains, reducing your overall tax burden. Imagine it as a financial accounting magic trick: poof! Your tax bill is smaller.

Tax Planning Techniques

Effective tax planning is not a one-size-fits-all approach; it requires a personalized strategy based on your individual financial situation, risk tolerance, and investment goals. Consider gifting assets to reduce your estate tax liability. This can involve setting up trusts or making annual gifts within the gift tax exclusion limits. This strategy, while complex, can significantly benefit long-term wealth preservation. Another effective technique is to utilize tax deductions and credits. This can involve contributing to a charity or claiming deductions for eligible expenses. These strategies directly reduce your taxable income, increasing your disposable income and leaving you with more money to invest.

Tax Diversification and Long-Term Wealth Growth

Tax diversification, often overlooked, is the strategic allocation of assets across different tax classifications to minimize overall tax exposure. It’s about balancing your investments across taxable and tax-advantaged accounts. Think of it as spreading your risk, not just in terms of market fluctuations, but also in terms of your tax bill. For instance, you might have a mix of investments in a traditional IRA (tax-deferred) and a Roth IRA (tax-free withdrawals), a taxable brokerage account, and perhaps even a 529 plan for education savings. This balanced approach can significantly reduce your overall tax liability over the long term, ensuring a greater portion of your investment gains are retained. The long-term impact is substantial; a consistently lower tax burden allows for greater compound growth, leading to a significantly larger nest egg in the long run.

Estate Planning and Wealth Transfer

Leaving your legacy isn’t just about leaving behind a pile of cash (though that’s nice, too!). It’s about ensuring your hard-earned wealth is distributed according to your wishes, minimizing taxes, and making the process as smooth as possible for your loved ones. Otherwise, you risk your meticulously crafted financial empire crumbling like a poorly-built sandcastle at high tide. Let’s avoid that, shall we?

Estate planning is the art of strategically managing your assets to achieve these goals. It’s about more than just writing a will; it’s a comprehensive plan that considers your unique circumstances, family dynamics, and long-term objectives. Think of it as a well-orchestrated symphony of financial instruments, all working together to ensure a harmonious transfer of wealth.

Estate Planning Tools: Wills, Trusts, and Powers of Attorney

A will is the foundational document of estate planning. It dictates how your assets will be distributed after your death. While seemingly straightforward, a well-drafted will considers various scenarios, including the guardianship of minor children and the distribution of assets in case of simultaneous deaths. Failing to have a will can lead to lengthy legal battles and unpredictable outcomes – a scenario that’s definitely less fun than a family reunion.

Trusts offer a more sophisticated approach to wealth management. They allow you to hold assets for the benefit of others, while managing potential tax implications and protecting assets from creditors or unforeseen circumstances. Different types of trusts, such as revocable and irrevocable trusts, offer various levels of control and tax benefits. Think of a trust as a highly-trained financial butler, meticulously managing your assets according to your instructions, even after you’ve hung up your metaphorical hat.

A power of attorney designates someone to manage your financial and legal affairs if you become incapacitated. This is crucial for ensuring your affairs are handled responsibly and efficiently, should you be unable to do so yourself. Choosing the right person for this role is paramount; you want someone you trust implicitly, with strong financial acumen and a head for detail. Think of it as a financial safety net, catching you should you stumble.

Minimizing Estate Taxes and Ensuring Smooth Wealth Transfer

Estate taxes can significantly reduce the amount your heirs inherit. Strategies for minimizing these taxes include gifting assets during your lifetime, utilizing charitable donations, and structuring your estate in a tax-efficient manner. Careful planning, often involving professional advice, can help you navigate the complex world of estate taxation and ensure your heirs receive the maximum possible benefit from your hard work. Let’s face it, the tax man is persistent; outsmarting him requires careful strategy and precision.

Another crucial aspect is ensuring a smooth wealth transfer. This involves clear communication with your heirs, well-defined distribution plans, and potentially the establishment of a family council to guide future generations in managing the inherited wealth. A poorly planned transfer can lead to family discord and even legal disputes, undermining the very legacy you sought to create. Think of it as passing the baton in a relay race – a smooth transition is essential for success.

Creating a Comprehensive Estate Plan: A Step-by-Step Guide

First, you’ll need to take stock of your assets. This includes everything from bank accounts and real estate to investments and personal belongings. A detailed inventory is essential for accurate planning. Consider creating a spreadsheet or working with a financial advisor to organize this information effectively. This is the foundation upon which your entire plan will be built.

Next, identify your beneficiaries. Who will inherit your assets? Consider various scenarios, including potential changes in family dynamics or unexpected circumstances. Documenting these details clearly will prevent future confusion and potential disputes. This step is critical for ensuring your wishes are carried out.

Third, choose your estate planning tools. This might involve drafting a will, establishing a trust, or designating a power of attorney. The choice of tools will depend on your individual circumstances, family structure, and financial goals. This requires careful consideration and often involves seeking professional advice.

Finally, regularly review and update your estate plan. Life is unpredictable, and your circumstances may change over time. Regular review ensures your plan remains relevant and effective. It’s not a “set it and forget it” type of situation.

Retirement Planning as a Wealth Management Strategy

Retirement: the golden years, the time to finally relax and enjoy the fruits of your labor… or, if you haven’t planned properly, the time to find out if ramen noodles really *do* taste better with ketchup. Proper retirement planning is not just about avoiding a future of instant noodles; it’s a crucial component of a robust wealth management strategy, ensuring financial security and peace of mind during your post-career years. It’s about securing your future so you can spend your retirement sipping margaritas on a beach, not stressing over dwindling savings.

Retirement planning isn’t some mystical art; it’s a blend of smart saving, strategic investing, and a dash of responsible spending. This involves understanding the various vehicles available for saving and the nuances of how they impact your overall financial picture. It also requires a realistic assessment of your spending habits and your projected income needs during retirement, which is often a longer timeframe than most people anticipate.

Retirement Savings Vehicles

Choosing the right retirement savings vehicle is like picking the perfect pair of shoes for a marathon: you need something comfortable, supportive, and appropriate for the distance. Several options exist, each with its own set of advantages and disadvantages. 401(k)s, offered through employers, often come with matching contributions – essentially free money – making them a fantastic starting point. IRAs (Individual Retirement Accounts), on the other hand, offer more flexibility and control, with variations like traditional and Roth IRAs catering to different tax situations. Annuities provide a guaranteed stream of income, acting as a safety net for those seeking predictable payouts in retirement. The ideal combination often involves a mix of these options, carefully tailored to individual circumstances.

Strategies for Maximizing Retirement Savings and Managing Retirement Income

Maximizing your retirement savings involves a multifaceted approach, blending consistent contributions with strategic investment choices. Consider regularly increasing your contributions as your income grows, even if it’s just a small percentage. This principle of consistent, incremental growth allows for compounding, a powerful tool that significantly amplifies your savings over time. Think of it as the snowball effect – the bigger the snowball, the faster it grows. Regarding retirement income management, diversification is key. Don’t put all your eggs in one basket (unless that basket is filled with gold coins, in which case, congratulations!). A well-diversified portfolio across various asset classes helps mitigate risk and ensures a smoother ride through potential market fluctuations.

Factors to Consider When Determining Retirement Savings Goals

Determining your retirement savings goals requires careful consideration of several factors. Failing to adequately plan for these can lead to significant financial shortfalls later. It’s essential to be realistic and proactive in your approach.

- Desired Lifestyle: Will you be content with a modest lifestyle or do you envision a lavish retirement filled with exotic travels and fine dining? Your desired lifestyle directly impacts your savings needs.

- Expected Lifespan: While nobody has a crystal ball, understanding your family history and overall health can provide insights into your likely lifespan, informing the length of time your savings need to support you.

- Healthcare Costs: Medical expenses can significantly impact retirement budgets. Factor in potential costs for insurance premiums, medications, and long-term care.

- Inflation: The insidious creep of inflation can erode the purchasing power of your savings over time. Your retirement plan should account for this gradual decrease in value.

- Current Savings and Investments: A realistic assessment of your current financial standing is crucial. This forms the foundation upon which you build your retirement plan.

- Social Security Benefits: Understand the projected amount of Social Security benefits you’re likely to receive. This will contribute to your overall retirement income stream.

- Tax Implications: The tax implications of different retirement accounts (401(k), IRA, etc.) should be carefully considered, as they can significantly impact your after-tax income in retirement.

Illustrative Case Studies of Wealth Management Strategies

Understanding wealth management strategies is best illustrated through real-world examples. Let’s examine the approaches taken by individuals with vastly different financial situations, highlighting the tailored strategies employed to achieve their respective goals. We’ll explore both a high-net-worth individual leveraging sophisticated techniques and a middle-income individual utilizing more basic, yet equally effective, methods.

High-Net-Worth Individual: The Art Collector’s Portfolio, Wealth Management Strategies Review

Bartholomew “Bart” Butterfield, a renowned art collector with a net worth exceeding $50 million, sought to preserve and grow his wealth while minimizing tax liabilities and ensuring a smooth transfer of assets to his heirs. His portfolio consisted primarily of valuable artwork, real estate holdings (including a charming chateau in the Loire Valley), and significant equity investments in various tech startups. His primary goals were capital preservation, tax optimization, and generational wealth transfer.

Bart’s wealth management strategy involved a multifaceted approach. He employed a team of experts including a financial advisor, tax attorney, and estate planner. His advisor diversified his investments beyond art, allocating a portion to low-risk bonds and hedge funds to balance the volatility inherent in his art collection. His tax attorney implemented sophisticated tax-sheltering strategies, such as utilizing charitable donations of artwork to reduce capital gains taxes. His estate planner structured trusts and other vehicles to minimize estate taxes and ensure a seamless transfer of assets to his children. Regular portfolio rebalancing, taking advantage of tax-loss harvesting, and proactive risk management through insurance policies were also key components of his strategy.

Middle-Income Individual: The Teacher’s Steady Path

Ms. Eleanor Vance, a high school teacher with a comfortable middle-class income, aimed to secure a comfortable retirement and ensure her children’s college education. Her financial situation included a modest savings account, a paid-off home, and a retirement plan through her employer. Her primary goals were retirement savings and college funding.

Eleanor’s wealth management strategy focused on disciplined saving and investing. She maximized her contributions to her employer-sponsored retirement plan, taking advantage of any matching contributions offered. She also opened a 529 college savings plan for her children, contributing regularly to build a fund for their future education. Her strategy was less about sophisticated financial instruments and more about consistent, disciplined savings and smart investment choices, primarily through low-cost index funds. Regular budgeting and debt management were also crucial components of her approach.

Comparison of Strategies

The key difference between Bart and Eleanor’s approaches lies in the complexity and scale of their strategies. Bart’s high net worth allowed for sophisticated tax planning, diversified investments across multiple asset classes, and the engagement of a specialized team of financial professionals. Eleanor’s strategy, while simpler, was equally effective in achieving her goals, relying on disciplined saving, strategic investing in low-cost funds, and careful financial planning. Both strategies demonstrate the importance of tailored approaches to wealth management, emphasizing that effective strategies are not solely defined by complexity but by their alignment with individual circumstances and goals. The ultimate outcome for both individuals was successful wealth management, albeit through different avenues.

The Role of Financial Advisors in Wealth Management

Navigating the complex world of wealth management can feel like trying to assemble IKEA furniture without the instructions – frustrating, potentially damaging, and possibly resulting in a wobbly end product. That’s where the financial advisor steps in, acting as your personal wealth management sherpa, guiding you through the treacherous terrain of investments, taxes, and estate planning. They are the difference between a beautifully crafted financial future and a pile of expensive, mismatched assets.

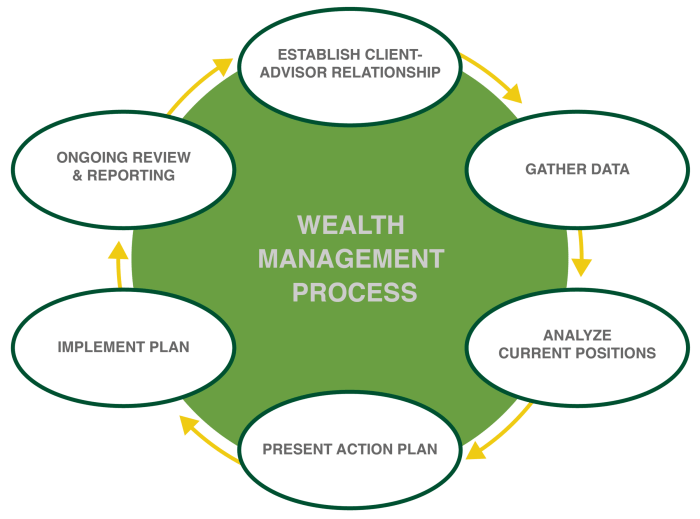

Financial advisors wear many hats, each crucial to a successful wealth management strategy. Their responsibilities extend far beyond simply recommending stocks and bonds; they act as financial strategists, coaches, and even, at times, therapists, helping clients navigate the emotional aspects of managing their wealth.

Financial Advisor Roles and Responsibilities

Financial advisors offer a range of services tailored to individual client needs and risk tolerances. These services often include comprehensive financial planning, investment management, tax planning strategies, retirement planning, and estate planning. Some advisors specialize in specific areas, such as retirement planning for high-net-worth individuals or investment management for institutional clients. A key responsibility is to act as a fiduciary, meaning they are legally obligated to act in the best interests of their clients. This trust is paramount, given the sensitive nature of the information shared.

Selecting a Qualified and Reputable Financial Advisor

Choosing the right financial advisor is akin to selecting a surgeon for a delicate operation – you wouldn’t choose someone based solely on a charming bedside manner. Due diligence is essential. Look for advisors with appropriate certifications (such as a Certified Financial Planner or Chartered Financial Analyst designation), a proven track record, and a strong reputation. Checking with regulatory bodies like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) can help verify their credentials and identify any disciplinary actions. A thorough background check is not optional; it’s a necessity. Consider seeking referrals from trusted sources, like family members or other professionals.

Key Questions to Ask a Prospective Financial Advisor

Before entrusting your financial well-being to an advisor, a frank and thorough interview is crucial. This is your chance to assess their expertise, compatibility, and commitment to your goals. Understanding their fee structure, investment philosophy, and client communication practices is vital. Asking about their experience with clients facing similar financial situations, their approach to risk management, and their process for regular reviews ensures alignment and transparency. Consider asking about their success rate in achieving similar client goals and requesting references to speak with previous clients. Don’t be shy; this is your money, and you deserve clear answers.

Summary

So, there you have it – a whirlwind tour of wealth management strategies, proving that financial planning doesn’t have to be a snooze-fest. From the thrill of smart investing to the (slightly less thrilling) realities of tax season, we’ve covered the gamut. Remember, building wealth is a marathon, not a sprint (unless you’re incredibly lucky, in which case, please share your secrets!). Now go forth and prosper… or at least, try not to lose everything.

Commonly Asked Questions

What’s the difference between a 401(k) and an IRA?

A 401(k) is employer-sponsored, often with matching contributions, while an IRA is self-directed and offers different contribution limits and tax advantages. Think of it like this: a 401(k) is your company’s team effort, while an IRA is your solo act.

How much should I save for retirement?

The magic number varies wildly based on lifestyle, expected longevity, and risk tolerance. But a good rule of thumb is to aim for enough to maintain your current lifestyle without relying solely on Social Security. It’s better to overestimate than to end up sipping lukewarm tea on a park bench.

What if I’m not good with numbers?

Don’t worry, you’re not alone! That’s what financial advisors are for. They can help you navigate the complexities of wealth management, making it less of a math problem and more of a collaborative adventure.